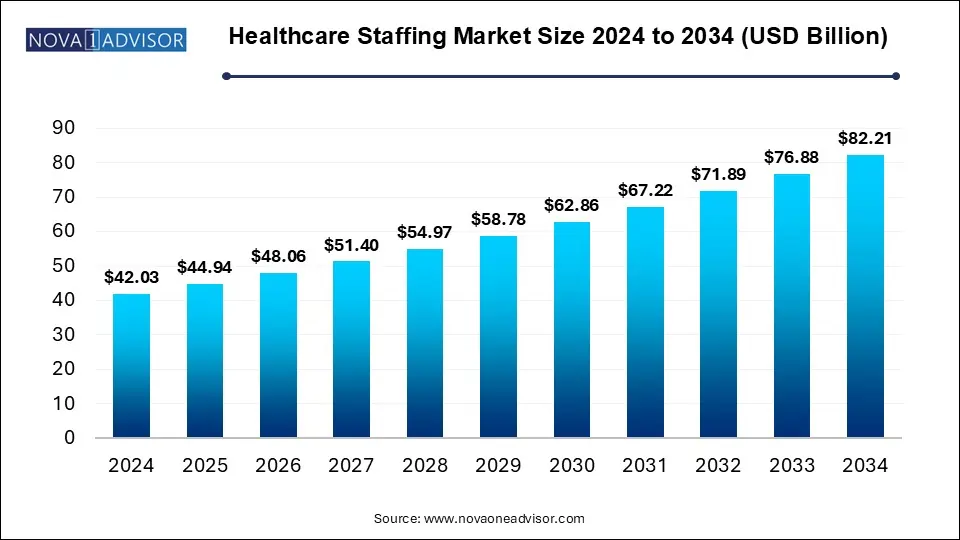

The healthcare staffing market size was estimated at USD 42.03 billion in 2024 and is projected to hit around USD 82.21 billion by 2034, expanding at a CAGR of 6.94% during the forecast period from 2025 to 2034. The rising prevalence of chronic diseases is expected to spur the demand for skilled healthcare staff for the management of patients and providing effective care, significantly fueling market growth during the forecast period.

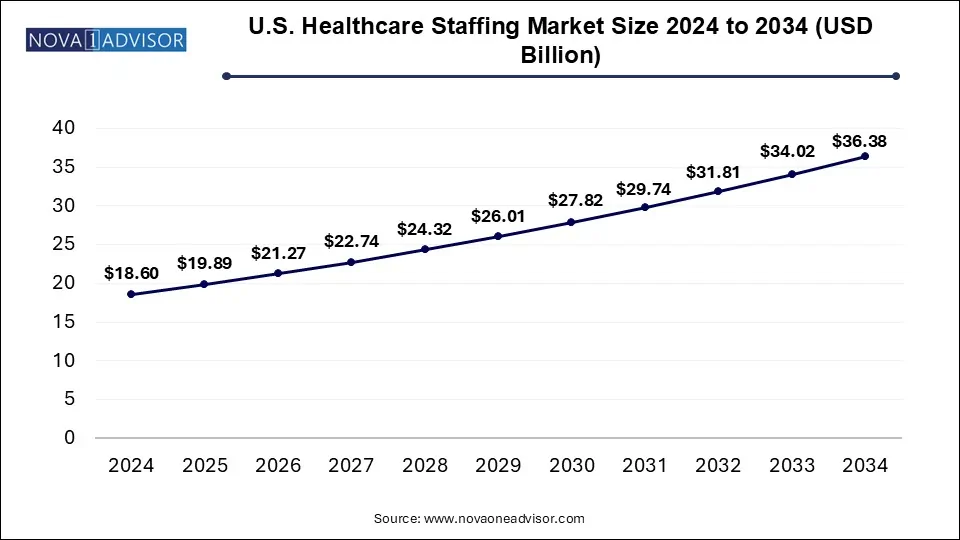

The U.S. Healthcare Staffing Market size was valued at USD 18.6 billion in 2024 and is expected to reach around USD 36.38 billion by 2034, growing at a CAGR of 6.28% from 2025 to 2034.

North America held the dominating share of the global market in 2024. The local presence of key market players, a rise in the geriatric population, the growing prevalence of chronic diseases, and the increasing demand for healthcare staff by hospitals are some of the major factors contributing to the largest share held by this region.

On the other hand, Asia Pacific is expected to grow at the fastest CAGR during the forecast timeline, as demand for a contract workforce rises in the region. The increased demand might be linked to the fact that contract hire does not carry the obligations that are traditionally connected with permanent employees. Additionally, the recruitment process is faster, and recruiters have access to a bigger pool of prospects. All these factors are likely to drive the market in the coming years.

Healthcare staffing involves the process of placing permanent, temporary, and travel healthcare personnel in several medical facilities, such as clinics, hospitals, and others. This market plays an integral role in meeting the evolving demand for a skilled healthcare workforce including nurses, physicians, and other medical staff. Factors such as the rising burden of chronic diseases, the rising presence of healthcare facilities, rising healthcare expenditure, and supportive government regulations are expected to contribute to the overall growth of the healthcare staffing market in the coming years.

The increasing focus on having well-trained healthcare staff is likely to propel the market’s growth. However, numerous countries are facing a shortage of healthcare staff. The gap between the healthcare demand and the supply of nurses and doctors in the healthcare system is widening.

| Report Coverage | Details |

| Market Size in 2025 | USD 44.94 Billion |

| Market Size by 2034 | USD 82.21 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 6.94% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Service Type, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Key Companies Profiled | Envision Healthcare Corporation; AMN Healthcare; CHG Management, Inc; Maxim Healthcare Group; Cross Country Healthcare, Inc.; Aya Healthcare; Trustaff; TeamHealth; Adecco Group; LocumTenens.com |

Opportunity

Rising geriatric population

The increasing aging population around the world is projected to offer lucrative growth opportunities to the healthcare staffing market in the coming years. For instance, according to the article published by the United Nations sexual and reproductive health agency in December 2023, the current elderly population of 153 million (aged 60 and above) is expected to reach a staggering 347 million by 2050. There, the aging population is more susceptible to chronic diseases and infections which often require long-term hospitalization. As a result, the rising adoption of outsourcing healthcare staff is anticipated to increase, propelling the expansion of the market throughout the projected period.

Restraint

Limited healthcare facilities

The limited healthcare facilities are anticipated to projected to hinder the market's growth. The market has observed the limited availability of healthcare facilities, particularly in underdeveloped countries. In addition, the shortage of skilled medical professionals in middle- and lower-income countries may restrict the expansion of the global healthcare staffing market.

In terms of revenue share, the travel nurse segment dominated the market in 2024. The rapid rise of the travel nurse staffing segment can be ascribed to quick service, cost-effectiveness, and a nurse shortage. This scenario is anticipated to continue in the coming years.

On the other hand, locum tenens is expected to witness the fastest growth rate during the forecast period. Employers’ cost-effectiveness and physicians’ demand for locum tenens work are two of the factors driving the market growth. Locum tenens is preferred by hospitals, groups, and clinics during peak seasons and when a permanent physician is on vacation or a sabbatical because it is more cost-effective. In addition, due to the shorter period of the assignment, flexible schedule, travel opportunities, and diversified clinical experience, medical doctors/physicians choose to serve as locum tenens.

On the other hand, the per diem nurse staffing segment is expected to witness the fastest growth rate during the forecast period. Per diem, nurses are paid daily and are hired for short-term assignments through specialized job placement firms or hospital staffing pools. The main reasons nurses choose per diem are the relatively high earnings and work flexibility. Due to spontaneous leaves, vacations, or high acuity, clinics, outpatient facilities, and hospital groups face both last-minute and temporary staffing demands. Per diem shifts can be scheduled through a staffing agency or with a hospital directly. Furthermore, some nurses take per diem jobs as a way to gather work experience in various hospital settings before accepting a permanent post.

The hospital segment accounted for the dominating share in 2024. The segment’s growth is attributed to the rising need for healthcare staff in the hospital. Several governments around the world have set specific norms for standard nurse-to-patient ratios, which hospitals need to maintain. In addition, patient-centric laws and regulations are fueling the number of staff members in hospitals.

On the other hand, the clinics segment is expected to witness a significant share during the forecast period. The growth of the segment is driven by the increasing demand for skilled healthcare professionals in clinics and the increasing number of a large network of clinics, particularly in developing notions.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Anti-Radiation Drugs Market

By Service Type

By End-use

By Regional