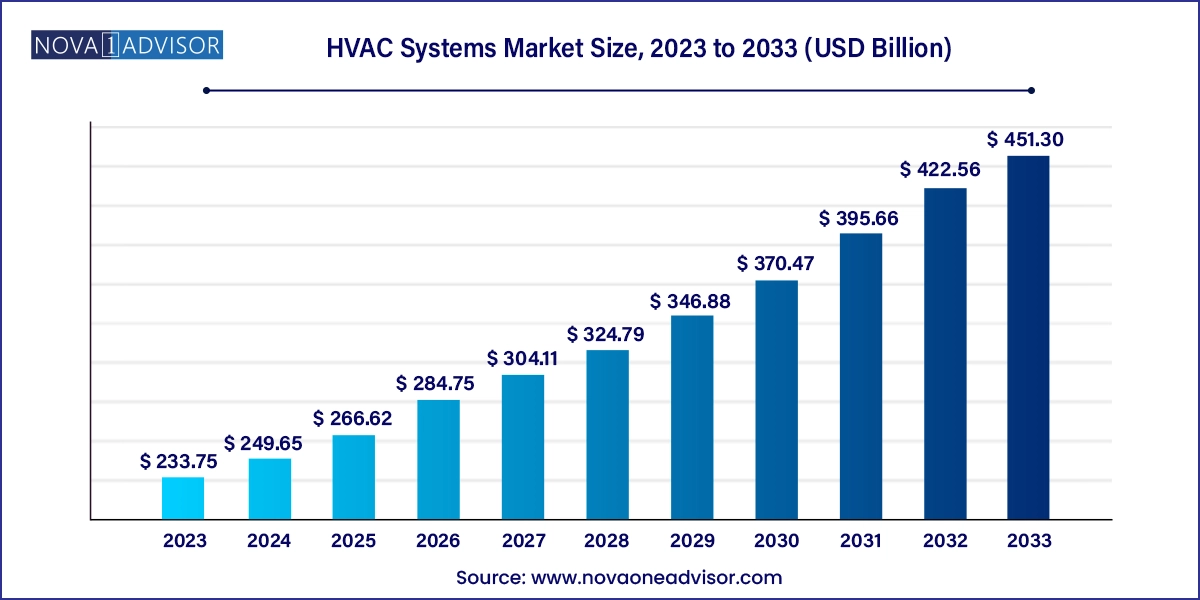

The global HVAC systems market size was exhibited at USD 233.75 billion in 2023 and is projected to hit around USD 451.30 billion by 2033, growing at a CAGR of 6.8% during the forecast period 2024 to 2033.

The Global Heating, Ventilation, and Air Conditioning (HVAC) Systems Market has become a fundamental sector in the global economy, touching nearly every facet of residential, commercial, and industrial infrastructure. HVAC systems are essential for regulating indoor environmental quality—managing temperature, humidity, and air quality. Their significance has grown in tandem with global trends such as urbanization, climate change, health awareness, and the digitization of building infrastructure.

In 2024 and heading into 2025, the market is undergoing a dramatic shift, influenced by the convergence of sustainability goals, government energy mandates, and a growing emphasis on smart, connected solutions. Technologies like variable refrigerant flow (VRF), AI-powered controls, Internet of Things (IoT), and energy recovery systems are now being embedded into modern HVAC systems to enhance operational efficiency and reduce carbon footprints.

A key market movement is the integration of HVAC systems with building automation systems (BAS), allowing facility managers to remotely monitor and optimize energy usage. Moreover, global construction booms—especially in developing economies—are directly translating to increased demand for energy-efficient HVAC solutions. With governments offering tax incentives for green building retrofits, manufacturers are innovating to align with LEED certifications and regional building codes.

The market is highly competitive and fragmented, featuring a blend of global players like Daikin, Carrier, and Johnson Controls, as well as regional specialists in niche products or markets. The market’s long-term trajectory is driven by the push for decarbonization, comfort, air quality, and climate adaptability.

Shift Toward Smart and Connected HVAC Systems: Remote monitoring, predictive maintenance, and AI-driven controls are transforming conventional HVAC systems into intelligent energy solutions.

Rising Adoption of Heat Pumps: As a replacement for traditional fossil-fueled furnaces, heat pumps are gaining popularity due to efficiency and low emissions, especially in Europe and North America.

Integration with Renewable Energy Sources: HVAC systems are being integrated with solar panels, geothermal systems, and wind energy to meet net-zero building targets.

Focus on Indoor Air Quality (IAQ): Demand for air purifiers, ventilators, and high-efficiency filters has surged post-pandemic, especially in schools, hospitals, and offices.

Growing Popularity of VRF (Variable Refrigerant Flow) Systems: VRF allows for precise zoning control, energy efficiency, and reduced operational costs in commercial buildings.

Government Initiatives and Energy Regulations: Energy efficiency mandates such as SEER 2 ratings in the U.S. and EcoDesign standards in Europe are shaping product innovation.

Increase in Modular and Retrofittable Solutions: HVAC systems designed for easy upgrades without full replacement are becoming mainstream, particularly in aging infrastructure.

High Growth of Dehumidifiers and Ventilation in Humid Regions: Demand is rising in tropical climates where moisture control is critical for health and structural integrity.

| Report Coverage | Details |

| Market Size in 2024 | USD 249.65 Billion |

| Market Size by 2033 | USD 451.30 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.8% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Equipment, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | Carrier Corporation; Daikin Industries, Ltd.; Fujitsu; Haier Group; Havells India Ltd.; Hitachi Ltd.; Johnson Controls; LG Electronics; Lennox International Inc.; Mitsubishi Electric Corporation; Rheem Manufacturing Company; SAMSUNG; Trane |

One of the strongest driving forces in the global HVAC market is the increasing pressure to reduce energy consumption and adhere to environmental regulations. HVAC systems typically account for 40–60% of a building’s energy consumption. Governments across the globe are enacting legislation aimed at improving the efficiency of building systems to combat climate change and promote sustainable urban growth.

For example, the U.S. Department of Energy’s SEER 2 (Seasonal Energy Efficiency Ratio) regulation, introduced in 2023 and enforced in 2025, has driven a wave of product redesigns among HVAC manufacturers. In Europe, the EcoDesign directive mandates minimum performance requirements and lifecycle environmental analysis. These mandates have compelled manufacturers to innovate through inverter technology, variable-speed compressors, and smart thermostats to meet compliance.

Despite long-term energy savings, the high initial cost of purchasing and installing HVAC systems remains a significant barrier—especially in residential and small business segments. Installing a central air conditioning system or a geothermal heat pump can require several thousand dollars in upfront investment. Additionally, retrofitting older buildings with modern systems often entails structural modifications, labor costs, and electrical upgrades.

Moreover, advanced features like smart zoning, remote monitoring, and energy recovery ventilation add to upfront costs, making premium HVAC systems out of reach for cost-sensitive customers. Financing options and government subsidies help alleviate this barrier in some markets, but affordability continues to restrict broader adoption in low- and middle-income regions.

The global rise in green building certifications such as LEED (Leadership in Energy and Environmental Design), BREEAM (UK), and NABERS (Australia) has created a significant opportunity for HVAC vendors. As sustainable construction gains momentum, HVAC systems that are energy-efficient, low-emission, and smart-ready are in high demand.

In commercial real estate, green-certified buildings command higher lease rates and valuations. As a result, developers are investing in high-efficiency chillers, air handling units, and smart ventilation systems that improve indoor air quality while minimizing environmental impact. Additionally, retrofitting older buildings to meet energy codes is a vast untapped opportunity. Manufacturers that offer modular HVAC systems designed for phased upgrades or space-constrained environments will find significant growth prospects in this trend.

Air Conditioning systems dominated the equipment segment, reflecting their ubiquitous application in residential, commercial, and industrial environments. Central AC systems, ductless mini-splits, and VRF systems are integral to new construction and building retrofits alike. Especially in regions experiencing record-breaking summer temperatures, cooling systems are not a luxury but a necessity. Additionally, product innovations such as dual inverter compressors, smart thermostats, and IoT-enabled diagnostics are making air conditioning systems more energy-efficient and intelligent, driving repeat purchases and upgrades.

Heat Pumps are the fastest-growing segment, largely due to their dual heating and cooling capabilities and climate-focused adoption across North America and Europe. Unlike traditional systems that burn fossil fuels, electric heat pumps offer clean energy operation with excellent performance in mild to moderate climates. Governments are incentivizing installations with tax credits, such as the U.S. Inflation Reduction Act and EU decarbonization funds. Technological improvements, such as cold-climate heat pumps that work efficiently in sub-zero temperatures, are expanding their applicability and spurring adoption in colder regions like Canada and Scandinavia.

Ventilation fans and dehumidifiers dominate in niche segments, particularly in coastal and humid regions where moisture and air purity control are critical. In schools, public buildings, and hospitals, ventilation systems are now a minimum requirement post-COVID. Similarly, dehumidifiers are seeing high sales in Southeast Asia and the southern U.S., driven by mold prevention concerns and health regulations.

Air purifiers are gaining rapid traction as consumers become more conscious of airborne diseases, allergens, and pollutants. This is particularly evident in regions prone to wildfires (California, Australia) or urban smog (India, China). The availability of portable purifiers and hybrid HVAC-air purifier systems is further expanding this segment. Corporate buyers, such as hotels and coworking spaces, are also integrating purification systems as a brand differentiator and wellness offering.

The residential segment dominated the market as households account for the majority of HVAC system installations globally. From single-family homes to high-rise apartments, climate control is essential for comfort and health. The surge in home renovation activities and rising disposable incomes in emerging economies are key contributors. Moreover, smart home ecosystems like Google Nest and Amazon Alexa are influencing HVAC buying behavior by offering centralized control and energy optimization. Suburban housing growth in countries like India, China, and the U.S. continues to fuel this demand.

The commercial segment is the fastest-growing, supported by new construction in retail, hospitality, education, and healthcare. Commercial HVAC systems require higher performance, zoning, and integration capabilities. Data centers, which demand continuous and precise temperature regulation, are particularly fueling growth in chillers and ventilation systems. Government stimulus packages aimed at upgrading public infrastructure and green building certifications are also pushing commercial buyers toward high-efficiency, low-emission HVAC solutions.

Asia Pacific dominates the HVAC systems market, both in volume and growth. The region’s vast population, rising middle class, and rapid urbanization have made HVAC systems a critical infrastructure component. Countries like China, India, and Japan lead the pack, driven by large-scale residential and commercial projects. Government programs such as India’s “Housing for All” initiative and China’s urban redevelopment plans include HVAC provisioning as standard. Moreover, the region is home to manufacturing powerhouses like Daikin, Midea, and Gree, which drive innovation and affordability in HVAC equipment.

North America is the fastest-growing region, due to the convergence of environmental regulations, aging infrastructure, and demand for energy-efficient retrofits. The U.S. has seen unprecedented heat waves and cold snaps in recent years, pushing homeowners and businesses to upgrade outdated systems. The 2025 implementation of SEER 2 and federal tax incentives under the Inflation Reduction Act are driving consumer and commercial investments in high-efficiency HVAC units. Additionally, U.S. companies like Carrier and Johnson Controls are aggressively rolling out AI-integrated solutions to appeal to both commercial developers and tech-savvy homeowners.

April 2025 – Johnson Controls launched its new “AI Energy Optimizer” system designed to reduce HVAC energy consumption in commercial buildings by up to 30%. This AI-driven control suite integrates weather forecasting, occupancy sensing, and real-time optimization to automatically adjust HVAC loads.

March 2025 – Carrier Global Corporation announced the acquisition of a leading European HVAC controls company, expanding its portfolio in smart building automation and accelerating its energy transition strategy.

February 2025 – Daikin Industries unveiled its new residential VRF system tailored for multi-dwelling units in urban areas. The compact design is compatible with solar battery systems, targeting eco-conscious homeowners in Japan and Southeast Asia.

January 2025 – Lennox International rolled out a subscription-based HVAC service model for residential customers in North America, bundling equipment, maintenance, and smart home integration under a monthly fee.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global HVAC systems market

Equipment

End-use

Region