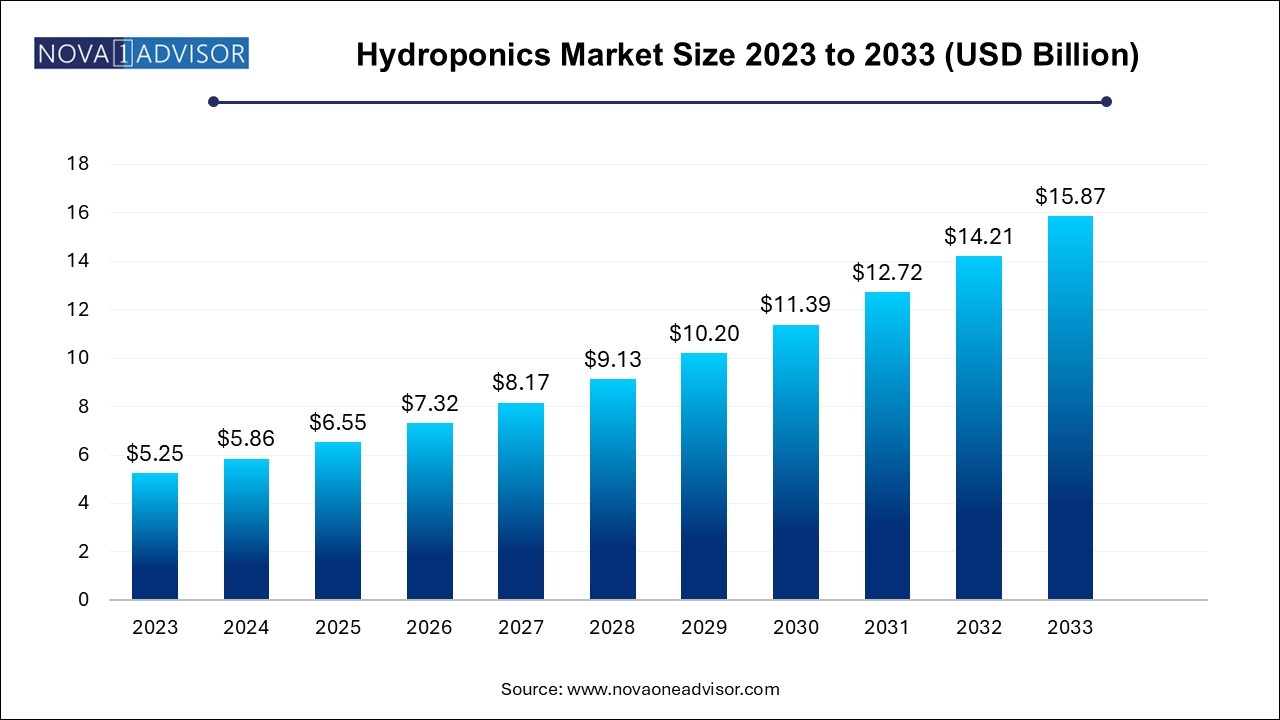

The global hydroponics market size was exhibited at USD 5.25 billion in 2023 and is projected to hit around USD 15.87 billion by 2033, growing at a CAGR of 11.7% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 5.86 Billion |

| Market Size by 2033 | USD 15.87 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 11.7% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Crop Type, Crop Area, and Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, South America, MEA |

| Key Companies Profiled | AeroFarms; AmHydro; Argus Control Systems Limited; Emirates Hydroponics Farms; Freight Farms, Inc.; BrightFarms.; Heliospectra; Signify Holding; Nutrifresh India; UrbanKisaan |

The rapid growth in this sector is linked to the expanding utilization of hydroponic systems in the indoor cultivation of vegetables. Additionally, the increasing acceptance of alternative farming approaches for growing cannabis is experiencing a swift surge. This trend is propelled by the legalization of marijuana in various countries, including Canada, the Czech Republic, South Africa, and others. A growing awareness among consumers about the adverse effects of pesticides and artificial ripening agents on health is anticipated to fuel the demand for hydroponics. This is because hydroponic cultivation eliminates the necessity for such products, resulting in the production of nutritionally superior vegetables. Moreover, the low installation costs and operational simplicity of these systems are poised to further stimulate their adoption throughout the forecast period.

Hydroponic agriculture is a technique for cultivating plants without traditional soil, replacing it with a mineral solution strategically placed around the plant roots. In this method, plant roots are immersed in a chemical solution regularly monitored to uphold the correct chemical composition for optimal growth. Consequently, the hydroponic approach mitigates the risk of diseases caused by soil organisms. Furthermore, plants cultivated hydroponically yield greater outputs compared to their soil-grown counterparts due to precise control over nutrient levels.

The escalating global population is generating a heightened demand for food. As per the Food and Agriculture Organization (FAO) of the United Nations (UN), the world's population is projected to reach 9.1 billion by 2050, necessitating a corresponding increase in food production ranging from 25% to 70%. This surge is expected to propel the need for alternative farming technologies capable of delivering high yields within shorter timeframes. Particularly in regions like the Asia Pacific and Europe, where arable land and water resources are becoming increasingly scarce, there is a noticeable uptick in the adoption of alternative high-yield farming technologies, contributing to anticipated market growth.

Progress in climate control, nutrient farming techniques, sensing technologies, and related areas is anticipated to impact market expansion positively throughout the forecast period. Providers of hydroponics farming solutions present consumers with diverse tools for monitoring and overseeing their crops, including an array of sensors, web platforms, software, and mobile applications. One notable example is SmartBee Technology, Inc., which offers farmers real-time control through offerings such as irrigation controls, water and nutrient sensors, environmental sensors, and dedicated software.

The market is poised for growth due to several key factors, including a consistently increasing global population, limited availability of cultivable land, government incentives, and a rising demand for fresh, high-quality food. Notably, approximately 80% of the world's population resides in urban areas, as reported by the World Health Organization (WHO) and the Population Council. The scarcity of land in urban settings has spurred the adoption of innovative solutions like hydroponics. This method empowers growers to optimize various spaces for cultivating crops, whether it be indoors using layered systems, in multi-story buildings, on stacked racks, or within warehouses.

Hydroponic systems allow growing plants in nutrients and water without using soil as a base. Hydroponic systems are a combination of several technologies and include a specific set of system models. These systems enable growers to obtain higher yields with each harvest and eliminate the need for pesticides and herbicides as compared to traditional cultivation methods. Exotic vegetables, cabbage, peas, and salad vegetables grow well using hydroponics. Moreover, factors such as the easy availability of online education material and tutorials regarding the maintenance of these systems and huge discounts are creating vast demand for these systems among consumers. Crops such as tomatoes, exotic vegetables, cabbage, peas, and salad vegetables require proper care and continuous maintenance.

Based on type, the market is segmented into aggregate systems and liquid systems. The aggregate systems segment accounted for the largest revenue share of 52.5% in 2023, This preference is attributed to the user-friendly nature of aggregate systems, where inert and solid media like peat, rock wool, vermiculite, sand, sawdust, perlite, or coconut coir support plant growth. The utilization of key technologies such as drip systems, ebb and flow systems, and wick systems further underscores the segment's prominence.

The liquid systems segment is anticipated to record the most rapid compound annual growth rate (CAGR) of 14.2% in the forecast period from 2024-2033. This is attributed to the growing preference for closed-system cultivation among cultivators. Deepwater culture and Nutrient Film Technique (NFT) systems are increasingly being employed for cultivating leafy vegetables like lettuce. Liquid systems, devoid of a solid medium, submerge plant roots directly in the nutrient solution, simplifying the cultivation process. Additionally, by delivering nutrients directly to the plant roots, liquid systems accelerate growth, resulting in maximum yields. Despite soilless farming methods reducing the risk of soil-borne diseases, the recirculation of nutrient solutions in closed systems increases the potential dispersal of pathogens.

Based on crops type, the market is segmented into tomatoes, lettuce, peppers, cucumbers, herbs, and others. The tomatoes segment accounted for the largest revenue share of 44.2% in 2023. Tomatoes hold the position as the most extensively cultivated hydroponic crop worldwide, primarily due to their rapid cultivation rate and significantly lower water requirements compared to conventionally farmed tomatoes. Indoor farmers typically employ growing materials such as rock wool, perlite, or coconut coir for hydroponic tomato cultivation. Projections indicate that by 2030, the hydroponic method is expected to witness substantial tomato cultivation in the Europe and Asia Pacific regions.

The lettuce segment is estimated to register the fastest CAGR of 15.4% over the forecast period from 2024-2033. Green and red leaf lettuce is the largest hydroponically grown vegetable among indoor farmers owing to its raw consumption in relatively large quantities. The hydroponic cultivation of lettuce is rising in North America due to its rising demand from households and fast-food chains across the region.

The above 50,000 sq. ft. crop area segment is anticipated to contribute significantly to the global market's revenue. Larger crop areas offer farmers greater flexibility for cultivating multiple high-quality products. Moreover, the ability to install multiple hydroponic systems under one roof enhances productivity, while the deployment of advanced machinery and equipment increases operational efficiency and overall profitability. Additionally, the adoption of hydroponic systems in large farms contributes to water conservation, as these systems minimize water wastage compared to traditional soil-based farming practices. This scalability and efficiency make hydroponics an attractive choice for enhancing agricultural practices in sizable farming operations.

Asia Pacific dominated the hydroponics market and accounted for the largest revenue share of 35.6% in 2023, owing to the substantial adoption of hydroponics in China, Australia, South Korea, and other such countries. The market in China and India is expected to escalate significantly over the forecast period due to emerging urban hydroponic farms.

North America holds a high potential for growth on account of numerous companies located in the region and the growing adoption of alternative farming techniques in urban areas. Some of the prominent market players in North America include AeroFarms (U.S.), AMHYDRO (U.S.), Argus Control Systems Limited (Canada), and LumiGrow (U.S.). Europe is expected to register the fastest CAGR of 13.6% over the forecast period from 2024-2033, as hydroponic systems offer an innovative solution by enabling efficient and controlled cultivation in indoor environments, mitigating the limitations associated with traditional farming. The presence of developed economies, including France, Germany, Italy, Spain, and the Netherlands, contributes to the robust growth of hydroponics, as these nations possess the necessary infrastructure and resources to invest in advanced agricultural technologies. Additionally, the expanding embrace of genetically modified crop technology further augments the appeal of hydroponics, providing a conducive environment for controlled cultivation practices and contributing to the anticipated accelerated growth of the market in Europe.

Canada Hydroponics Market

The hydroponics market in Canada is expected to account for a significant revenue share in the North America hydroponics market. Government initiatives and support programs aimed at promoting agricultural innovation and entrepreneurship further contribute to the expansion of the hydroponics industry in Cannada.

U.K. Hydroponics Market

The hydroponics market in the U.K. is expected to account for a significant revenue share in the Europe hydroponics market. Hydroponics in the UK has gained significant traction in recent years, driven by the increasing demand for sustainable agriculture practices and the desire for locally grown produce.

Germany Hydroponics Market

The hydroponics market in Germany is expected to account for a significant revenue share in the Europe hydroponics market. Hydroponics in Germany has experienced steady growth in recent years, propelled by several factors including increasing consumer demand for locally grown, sustainable produce and advancements in agricultural technology.

France Hydroponics Market

The hydroponics market in France is expected to account for a significant revenue share in the Europe hydroponics market. The France hydroponics industry encompasses a diverse range of applications, from large-scale commercial hydroponic farms to smaller urban and vertical farming operations. This method of soilless cultivation offers numerous advantages including higher crop yields, efficient water usage, and the ability to grow crops in urban environments with limited space.

China Hydroponics Market

The hydroponics market in China is expected to account for a significant revenue share in the Asia Pacific hydroponics market. Hydroponics in China has witnessed significant growth and adoption in recent years, driven by factors such as increasing urbanization, rising demand for high-quality produce, and the need for sustainable agricultural practices.

India Hydroponics Market

The hydroponics market in India is expected to account for a significant revenue share in the Asia Pacific hydroponics market. As India continues to modernize its agriculture sector and address challenges such as food security and environmental sustainability, hydroponics is expected to play an increasingly important role in the country's food production landscape.

Malaysia Hydroponics Market

The hydroponics market in Malaysia is expected to account for a significant revenue share in the Asia Pacific hydroponics market. Government support and investment in agricultural technology and innovation further contribute to the growth of the hydroponics industry in Malaysia.

Japan Hydroponics Market

The hydroponics market in Japan is expected to account for a significant revenue share in the Asia Pacific hydroponics market. Japan continues to prioritize sustainability and innovation in agriculture, the hydroponics sector is expected to further expand, supported by government initiatives promoting urban farming and research and development in agricultural technology.

South Africa Hydroponics Market

The hydroponics market in South Africa is expected to account for a significant revenue share in the Middle East & Africa hydroponics market. Hydroponics offers several advantages in the South African context, including higher crop yields, efficient water usage, and year-round production regardless of seasonal variations.

Middle East & Africa Hydroponics Market

The hydroponics market in the Middle East & Africa is expected to witness noticeable growth in the coming years. Small-scale farmers and entrepreneurs are increasingly turning to hydroponic farming as a viable alternative to traditional agriculture, offering opportunities for food security, income generation, and job creation.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global hydroponics market

Type

Crop Type

Crop Area

Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Hydroponics Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Market Size and Growth Prospects (USD Billion)

3.3. Industry Value Chain Analysis

3.4. Market Dynamics

3.4.1. Market Drivers Analysis

3.4.2. Market Restraints Analysis

3.4.3. Industry Opportunities

3.4.4. Industry Challenges

3.5. Hydroponics Market Analysis Tools

3.5.1. Porter’s Analysis

3.5.1.1. Bargaining power of the suppliers

3.5.1.2. Bargaining power of the buyers

3.5.1.3. Threats of substitution

3.5.1.4. Threats from new entrants

3.5.1.5. Competitive rivalry

3.5.2. PESTEL Analysis

3.5.2.1. Political landscape

3.5.2.2. Economic and Social landscape

3.5.2.3. Technological landscape

3.5.2.4. Environmental landscape

3.5.2.5. Legal landscape

Chapter 4. Hydroponics Market: Type Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Hydroponics Market: Type Movement Analysis, USD Million, 2024 & 2033

4.3. Aggregate Systems

4.3.1. Aggregate Systems Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.3.2. EBB & Flow Systems Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.3.2.1. EBB & Flow Systems Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.3.3. Drip Systems Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.3.3.1. Drip Systems Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.3.4. Wick Systems Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.3.4.1. Wick Systems Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.4. Liquid Systems

4.4.1. Liquid Systems Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.4.2. Deep Water Culture Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.4.2.1. Deep Water Culture Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.4.3. Nutrient Film Technique (NFT) Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.4.3.1. Nutrient Film Technique (NFT) Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.4.4. Aeroponics Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.4.4.1. Drip Systems Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

Chapter 5. Hydroponics Market: Crop Type Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Hydroponics Market: Crop Type Movement Analysis, USD Million, 2024 & 2033

5.3. Tomatoes

5.3.1. Tomatoes Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

5.4. Lettuce

5.4.1. Lettuce Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

5.5. Peppers

5.5.1. Peppers Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

5.6. Cucumbers

5.6.1. Cucumbers Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

5.7. Herbs

1.1.1. Herbs Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

5.8. Others

5.8.1. Others Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

Chapter 6. Hydroponics Market: Crop Area Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Hydroponics Market: Crop Area Movement Analysis, USD Million, 2024 & 2033

6.2.1. Upto 1000 sq.ft.

6.2.1.1. Upto 1000 sq.ft. Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

6.2.2. 1000-50000 sq.ft.

6.2.2.1. 1000-50000 sq.ft. Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

6.2.3. Above 50000 sq.ft

6.2.3.1. Above 50000 sq.ft Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

Chapter 7. Hydroponics Market: Regional Estimates & Trend Analysis

7.1. Hydroponics Market Share, By Region, 2024 & 2033 USD Million

7.2. North America

7.2.1. North America Hydroponics Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.2.2. Hydroponics Market Estimates and Forecasts, by Type, 2021 - 2033 (USD Million)

7.2.3. Hydroponics Market Estimates and Forecasts, by Crop Type, 2021 - 2033 (USD Million)

7.2.4. Hydroponics Market Estimates and Forecasts, by Crop Area, 2021 - 2033 (USD Million)

7.2.5. U.S.

7.2.5.1. U.S. Hydroponics Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.2.5.2. U.S. Hydroponics Market Estimates and Forecasts, by Type, 2021 - 2033 (USD Million)

7.2.5.3. U.S. Hydroponics Market Estimates and Forecasts, by Crop Type, 2021 - 2033 (USD Million)

7.2.5.4. U.S. Hydroponics Market Estimates and Forecasts, by Crop Area, 2021 - 2033 (USD Million)

7.2.6. Canada

7.2.6.1. Canada Hydroponics Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.2.6.2. Canada Hydroponics Market Estimates and Forecasts, by Type, 2021 - 2033 (USD Million)

7.2.6.3. Canada Hydroponics Market Estimates and Forecasts, by Crop Type, 2021 - 2033 (USD Million)

7.2.6.4. Canada Hydroponics Market Estimates and Forecasts, by Crop Area, 2021 - 2033 (USD Million)

7.2.7. Mexico

7.2.7.1. Mexico Hydroponics Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.2.7.2. Mexico Hydroponics Market Estimates and Forecasts, by Type, 2021 - 2033 (USD Million)

7.2.7.3. Mexico Hydroponics Market Estimates and Forecasts, by Crop Type, 2021 - 2033 (USD Million)

7.2.7.4. Mexico Hydroponics Market Estimates and Forecasts, by Crop Area, 2021 - 2033 (USD Million)

7.3. Europe

7.3.1. Europe Hydroponics Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.3.2. Europe Hydroponics Market Estimates and Forecasts, by Type, 2021 - 2033 (USD Million)

7.3.3. Europe Hydroponics Market Estimates and Forecasts, by Crop Type, 2021 - 2033 (USD Million)

7.3.4. Europe Hydroponics Market Estimates and Forecasts, by Crop Area, 2021 - 2033 (USD Million)

7.3.5. U.K.

7.3.5.1. U.K. Hydroponics Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.3.5.2. U.K. Hydroponics Market Estimates and Forecasts, by Type, 2021 - 2033 (USD Million)

7.3.5.3. U.K. Hydroponics Market Estimates and Forecasts, by Crop Type, 2021 - 2033 (USD Million)

7.3.5.4. U.K. Hydroponics Market Estimates and Forecasts, by Crop Area, 2021 - 2033 (USD Million)

7.3.6. Germany

7.3.6.1. Germany Hydroponics Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.3.6.2. Germany Hydroponics Market Estimates and Forecasts, by Type, 2021 - 2033 (USD Million)

7.3.7. Germany Hydroponics Market Estimates and Forecasts, by Crop Type, 2021 - 2033 (USD Million)

7.3.7.1. Germany Hydroponics Market Estimates and Forecasts, by Crop Area, 2021 - 2033 (USD Million)

7.3.8. France

7.3.8.1. France Hydroponics Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.3.8.2. France Hydroponics Market Estimates and Forecasts, by Type, 2021 - 2033 (USD Million)

7.3.8.3. France Hydroponics Market Estimates and Forecasts, by Crop Type, 2021 - 2033 (USD Million)

7.3.8.4. France Hydroponics Market Estimates and Forecasts, by Crop Area, 2021 - 2033 (USD Million)

7.4. Asia Pacific

7.4.1. Asia Pacific Hydroponics Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.4.2. Asia Pacific Hydroponics Market Estimates and Forecasts, by Type, 2021 - 2033 (USD Million)

7.4.3. Asia Pacific Hydroponics Market Estimates and Forecasts, by Crop Type, 2021 - 2033 (USD Million)

7.4.4. Asia Pacific Hydroponics Market Estimates and Forecasts, by Crop Area, 2021 - 2033 (USD Million)

7.4.5. China

7.4.5.1. China Hydroponics Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.4.5.2. China Hydroponics Market Estimates and Forecasts, by Type, 2021 - 2033 (USD Million)

7.4.5.3. China Hydroponics Market Estimates and Forecasts, by Crop Type, 2021 - 2033 (USD Million)

7.4.5.4. China Hydroponics Market Estimates and Forecasts, by Crop Area, 2021 - 2033 (USD Million)

7.4.6. Japan

7.4.6.1. Japan Hydroponics Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.4.6.2. Japan Hydroponics Market Estimates and Forecasts, by Type, 2021 - 2033 (USD Million)

7.4.6.3. Japan Hydroponics Market Estimates and Forecasts, by Crop Type, 2021 - 2033 (USD Million)

7.4.6.4. Japan Hydroponics Market Estimates and Forecasts, by Crop Area, 2021 - 2033 (USD Million)

7.4.7. India

7.4.7.1. India Hydroponics Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.4.7.2. India Hydroponics Market Estimates and Forecasts, by Type, 2021 - 2033 (USD Million)

7.4.7.3. India Hydroponics Market Estimates and Forecasts, by Crop Type, 2021 - 2033 (USD Million)

7.4.7.4. India Hydroponics Market Estimates and Forecasts, by Crop Area, 2021 - 2033 (USD Million)

7.5. South America

7.5.1. South America Hydroponics Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.5.2. Soth America Hydroponics Market Estimates and Forecasts, by Type, 2021 - 2033 (USD Million)

7.5.3. South America Hydroponics Market Estimates and Forecasts, by Crop Type, 2021 - 2033 (USD Million)

7.5.4. South America Hydroponics Market Estimates and Forecasts, by Crop Area, 2021 - 2033 (USD Million)

7.5.5. Brazil

7.5.5.1. Brazil Hydroponics Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.5.5.2. Brazil Hydroponics Market Estimates and Forecasts, by Type, 2021 - 2033 (USD Million)

7.5.5.3. Brazil Hydroponics Market Estimates and Forecasts, by Crop Type, 2021 - 2033 (USD Million)

7.5.5.4. Brazil Hydroponics Market Estimates and Forecasts, by Crop Area, 2021 - 2033 (USD Million)

7.6. Middle East and Africa

7.6.1. Middle East and Africa Hydroponics Market Estimates and Forecasts, 2021 - 2033 (USD Million)

7.6.2. Middle East & Africa Hydroponics Market Estimates and Forecasts, by Type, 2021 - 2033 (USD Million)

7.6.3. Middle East & Africa Hydroponics Market Estimates and Forecasts, by Crop Type, 2021 - 2033 (USD Million)

7.6.4. Middle East & Africa Hydroponics Market Estimates and Forecasts, by Crop Area, 2021 - 2033 (USD Million)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis by Key Market Participants

8.2. Company Categorization

8.3. Company Market Positioning

8.4. Company Market Share Analysis

8.5. Company Heat Map Analysis

8.6. Strategy Mapping

8.6.1. Expansion

8.6.2. Mergers & Acquisition

8.6.3. Partnerships & Collaborations

8.6.4. New Product Launches

8.6.5. Research And Development

8.7. Company Profiles

8.7.1. AeroFarms

8.7.1.1. Participant’s Overview

8.7.1.2. Financial Performance

8.7.1.3. Product Benchmarking

8.7.1.4. Recent Developments

8.7.2. AmHydro

8.7.2.1. Participant’s Overview

8.7.2.2. Financial Performance

8.7.2.3. Product Benchmarking

8.7.2.4. Recent Developments

8.7.3. Argus Control Systems Limited

8.7.3.1. Participant’s Overview

8.7.3.2. Financial Performance

8.7.3.3. Product Benchmarking

8.7.3.4. Recent Developments

8.7.4. Emirates Hydroponics Farms

8.7.4.1. Participant’s Overview

8.7.4.2. Financial Performance

8.7.4.3. Product Benchmarking

8.7.4.4. Recent Developments

8.7.5. Freight Farms, Inc.

8.7.5.1. Participant’s Overview

8.7.5.2. Financial Performance

8.7.5.3. Product Benchmarking

8.7.5.4. Recent Developments

8.7.6. BrightFarms.

8.7.6.1. Participant’s Overview

8.7.6.2. Financial Performance

8.7.6.3. Product Benchmarking

8.7.6.4. Recent Developments

8.7.7. Heliospectra

8.7.7.1. Participant’s Overview

8.7.7.2. Financial Performance

8.7.7.3. Product Benchmarking

8.7.7.4. Recent Developments

8.7.8. Signify Holding

8.7.8.1. Participant’s Overview

8.7.8.2. Financial Performance

8.7.8.3. Product Benchmarking

8.7.8.4. Recent Developments

8.7.9. Nutrifresh India

8.7.9.1. Participant’s Overview

8.7.9.2. Financial Performance

8.7.9.3. Product Benchmarking

8.7.9.4. Recent Developments

8.7.10. UrbanKisaan

8.7.10.1. Participant’s Overview

8.7.10.2. Financial Performance

8.7.10.3. Product Benchmarking

8.7.10.4. Recent Developments