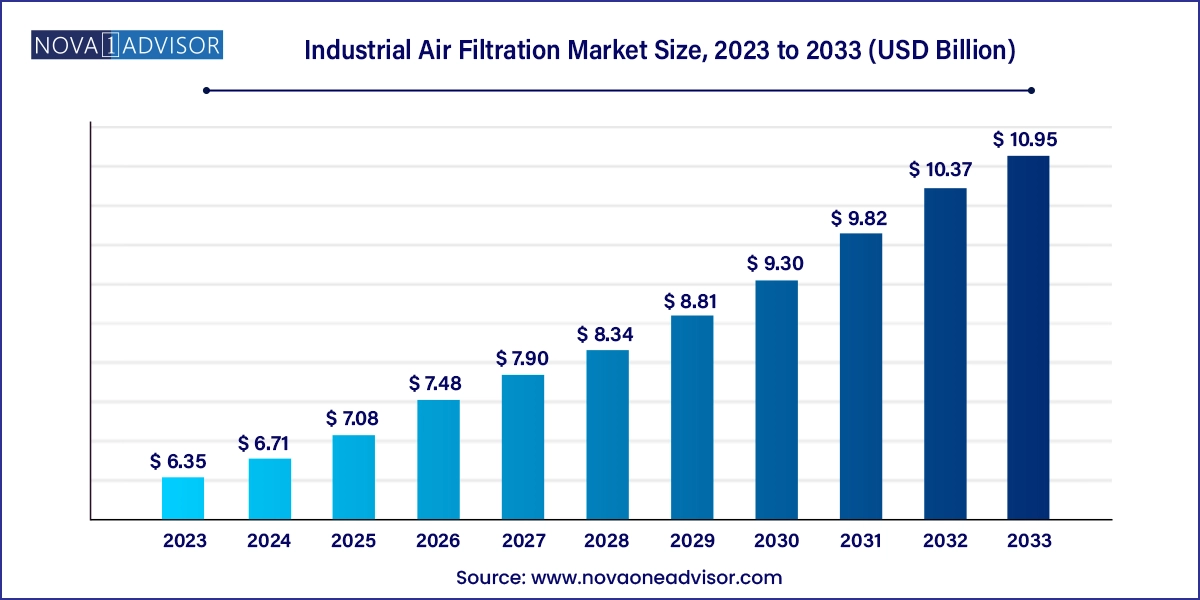

The global industrial air filtration market size was exhibited at USD 6.35 billion in 2023 and is projected to hit around USD 10.95 billion by 2033, growing at a CAGR of 5.6% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 6.71 Billion |

| Market Size by 2033 | USD 10.95 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.6% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, End use, Distribution Channel, MERV rating, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | CMANN+HUMMEL; Donaldson Company Inc.; Honeywell International Inc.; Daikin Industries, Ltd.; Danaher; SPX FLOW, Inc.; Lydall, Inc.; American Air Filter Company, Inc.; Industrial Air Filtration, Inc.; PARKER HANNIFIN CORP; Camfil; K&N Engineering; Freudenberg SE; Testori Spa; Eaton |

This growth can be attributed to factors such as rising industrial activities, growing investments in the manufacturing sectors, favorable regulations, and technological advancements related to industrial air filtration. In addition, the global demand for air filters is augmented by the development and introduction of more stringent regulations and standards for various end use industries and commercial applications. With the rising air pollution, the indoor air quality in residential apartments in major metro cities is declining rapidly, driving the need for air purifiers to maintain the overall air quality for individuals.

The global filter market encompasses air, fluid, and ICE filters, with fluid filters primarily including water and beverage filters. These filters serve various residential, commercial, and industrial purposes. The demand for filters with smart features and energy efficiency has recently surged, a trend expected to continue in the coming years. HEPA filters, known for their superior particle trapping capabilities, are particularly in demand as they can capture over 99% of particles sized between 0.3 and 1.0 microns. Regulatory measures, such as government emissions standards and workplace safety regulations, are anticipated to stimulate market growth further. For instance, the Clean Air Act in the U.S. aims to control air pollution nationally, prompting stricter industrial air filtration regulations due to increased industrial and manufacturing activities.

Modern air filtration systems help reduce operational costs and enhance energy savings while adhering to quality standards. Continuous technological advancements aim to improve the efficiency and effectiveness of industrial air filtration systems, aligning with the rising need for reduced energy consumption across various sectors. Furthermore, growing concerns about environmental health and dwindling raw material resources are expected to drive market expansion in the foreseeable future. The combination of regulatory support and technological innovation positions the filter market for significant growth as industries adapt to evolving environmental standards and consumer preferences for cleaner air solutions.

Dust collection filters dominated the market and accounted for the largest revenue share of 42.0% in 2023 attributed to increasing industrial activities and stringent regulatory requirements for air quality, prompting companies to invest in effective dust collection systems. In addition, the rising awareness of workplace safety and health standards is also pushing industries to adopt advanced filtration technologies. Furthermore, technological innovations to enhance filter efficiency and reduce energy consumption contribute to the demand for dust collection filters, ensuring compliance with environmental regulations.

HEPA filters are expected to grow at a CAGR of 6.9% over the forecast period. HEPA filters extensively remove airborne particles, dust, and other contaminants in various industrial facilities. The use of HEPA filters can ensure highly efficient filtration systems with almost 99.5% capture of particulate pollution in the air. These filters effectively remove 99.97% of air pollutants with particle sizes of 0.3 to 1.0 microns.

The food & beverage segment led the market and accounted for the highest revenue share of 21.3% in 2023 and is likely to continue to dominate the market over the forecast period. This growth is attributed to the presence of stringent regulations about indoor air quality and acceptable concentration of various particles and substances in the air in food & beverage processing, manufacturing, packaging, and storage facilities. The rising awareness regarding airborne contaminants that can pose risks to the safety of food products, as well as humans and pets, is likely to drive the growth of the industrial air filtration market.

The pharmaceutical segment is expected to grow at a CAGR of 7.0% over the forecast period driven by stringent regulatory requirements for air quality and contamination control in pharmaceutical manufacturing, necessitating implementing advanced filtration systems. In addition, the increasing demand for high-quality products and rising healthcare needs compel pharmaceutical companies to invest in effective air filtration solutions to maintain clean environments. Furthermore, advancements in filtration technologies, such as HEPA filters and fume extraction systems, enhance operational efficiency while ensuring compliance with safety standards, further propelling market growth.

The aftermarket segment accounted for the highest revenue share, 78.6%, of the overall market in 2023 and is likely to continue to dominate the market over the forecast period attributed to the high annual sales volume of aftermarket filters for replacement filters at specific intervals. In addition, aftermarket filters are preferred for their lower prices while offering performance characteristics similar to OEM filters. Furthermore, the growing awareness of the importance of regular filter maintenance and replacement to ensure optimal air quality and system efficiency is also a key factor propelling aftermarket sales.

The OEM segment is expected to grow at the fastest CAGR over the forecast period attributed to the increasing vehicle production, particularly in emerging markets, driving demand for high-quality air filters that enhance fuel efficiency and passenger comfort. OEMs prioritize premium products to meet stringent regulatory standards and consumer expectations. Furthermore, strategic partnerships between manufacturers and OEMs facilitate efficient supply chains, ensuring timely delivery of filtration solutions tailored to specific vehicle models, further boosting the OEM segment growth.

Above 17 MERV rating led the market and accounted for the largest revenue share of 36.2% in 2023 attributed to the increased awareness of air quality and health standards. These high-efficiency filters effectively capture smaller particles, including allergens, bacteria, and hazardous pollutants, which is crucial in pharmaceuticals and food processing industries. In addition, stringent regulations mandating improved air quality in workplaces further propel the demand for high-MERV filters. Furthermore, technological advancements also enhance filter performance, making them essential for maintaining compliance and ensuring worker safety.

9 to 12 MERV rating is expected to grow at a CAGR of 6.6% over the forecast period. These filters effectively capture a wide range of airborne particles, including pollen, mold spores, and dust, making them suitable for both residential and commercial applications. In addition, their moderate efficiency ensures improved indoor air quality without excessively restricting airflow, which is crucial for HVAC system performance. Furthermore, their affordability and availability make them attractive for facilities seeking a balance between cost and air quality enhancement, further fueling their demand.

North America industrial air filtration market dominated the global market and accounted for the largest revenue share of 42.2% in 2023 attributed to enhanced awareness regarding the importance of indoor air quality, up-to-date regulations and norms, and growing emphasis on the safety and well-being of employees across the region. Furthermore, rising industrialization and urbanization also lead to greater emissions, necessitating advanced filtration solutions. Moreover, technological innovations also enhance filter efficiency and energy savings while growing awareness of workplace safety, which further propels the adoption of industrial air filtration systems across various sectors.

U.S. Industrial Air Filtration Market Trends

The U.S. industrial air filtration market in the U.S. dominated the North American market and accounted for the largest revenue share in 2023 primarily driven by increasing concerns over air pollution and its health impacts. In addition, stricter regulatory frameworks, such as the Clean Air Act, enforce compliance with air quality standards, prompting industries to adopt advanced filtration systems. Furthermore, the rising awareness of workplace safety and indoor air quality has led businesses to invest in efficient air filtration solutions.

Asia Pacific Industrial Air Filtration Market Trends

Asia Pacific industrial air filtration market is expected to grow at a CAGR of 6.9% over the forecast period, owing to rapid industrialization and urbanization. Global population growth and the increasing need for various consumer goods and products put enormous pressure on the manufacturing industry to meet this demand. This, in turn, leads to strategies and initiatives to increase the industrial output and construct new industrial facilities. Asia Pacific is becoming a hub for the manufacturing sector due to favorable factors such as affordable and cheap labor, a short supply chain, and a lenient regulatory framework.

The industrial air filtration market in China is expected to grow significantly over the forecast period driven by its extensive industrial base and significant pollution challenges. In addition, the government's stringent environmental regulations and emission standards drive demand for advanced filtration systems to reduce particulate matter and volatile organic compounds from industrial sources. Furthermore, rapid urbanization and industrial growth necessitate adopting effective air purification solutions. The increasing public awareness of health issues linked to air quality further fuels the demand for industrial air filtration technologies.

Europe Industrial Air Filtration Market Trends

The growth of Europe industrial air filtration marketis driven by stringent environmental regulations to reduce emissions from industrial operations. In addition, the European Union's commitment to improving air quality and reducing carbon footprints compels industries to invest in advanced filtration technologies. Furthermore, growing public awareness regarding the health impacts of poor air quality encourages businesses to adopt effective air filtration systems. Moreover, the rise in manufacturing activities across various sectors also increases the demand for reliable and efficient air filtration solutions.

The industrial air filtration market in the UK is expected to be driven by regulatory pressures and rising public health awareness influences. Furthermore, growing concerns about indoor air quality in workplaces drive demand for efficient filtration solutions. The UK's focus on sustainability and reducing emissions aligns with adopting innovative filtration technologies, enhancing market growth as industries seek to comply with evolving standards and improve overall air quality.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global industrial air filtration market

Product

End Use

Distribution Channel

MERV Rating

Regional