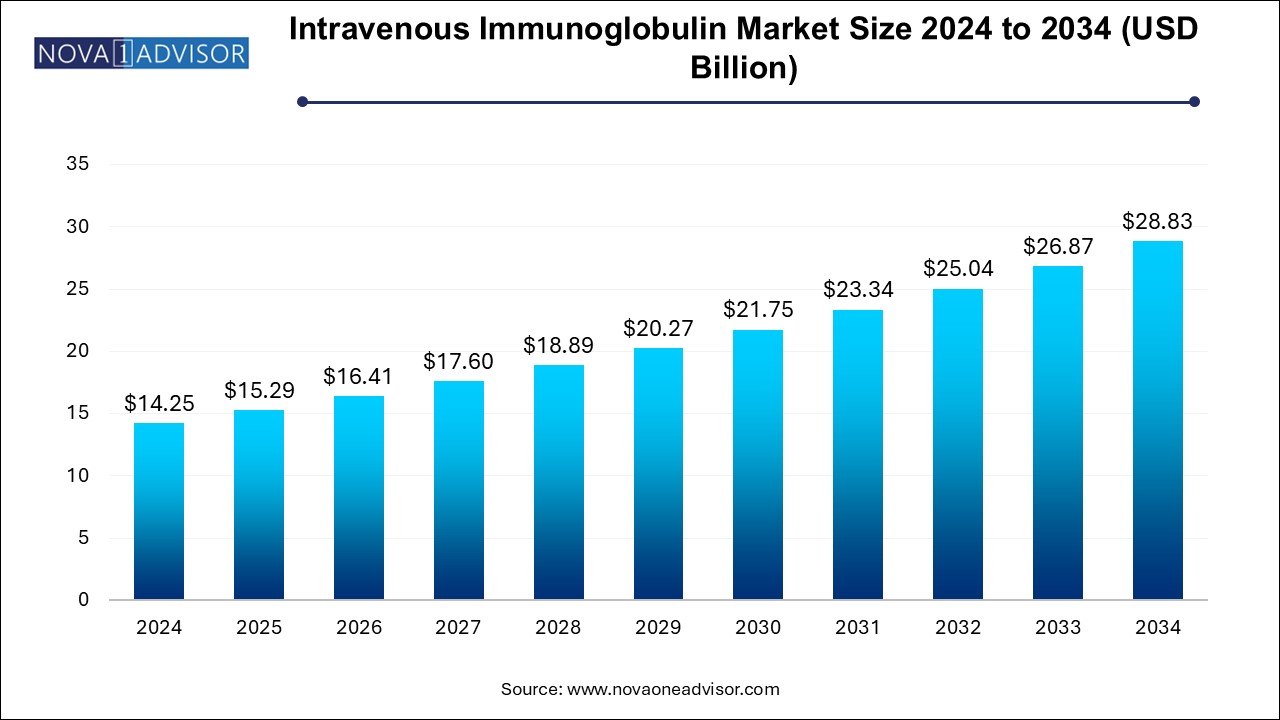

The intravenous immunoglobulin market size was exhibited at USD 14.25 billion in 2024 and is projected to hit around USD 28.83 billion by 2034, growing at a CAGR of 7.3% during the forecast period 2025 to 2034.

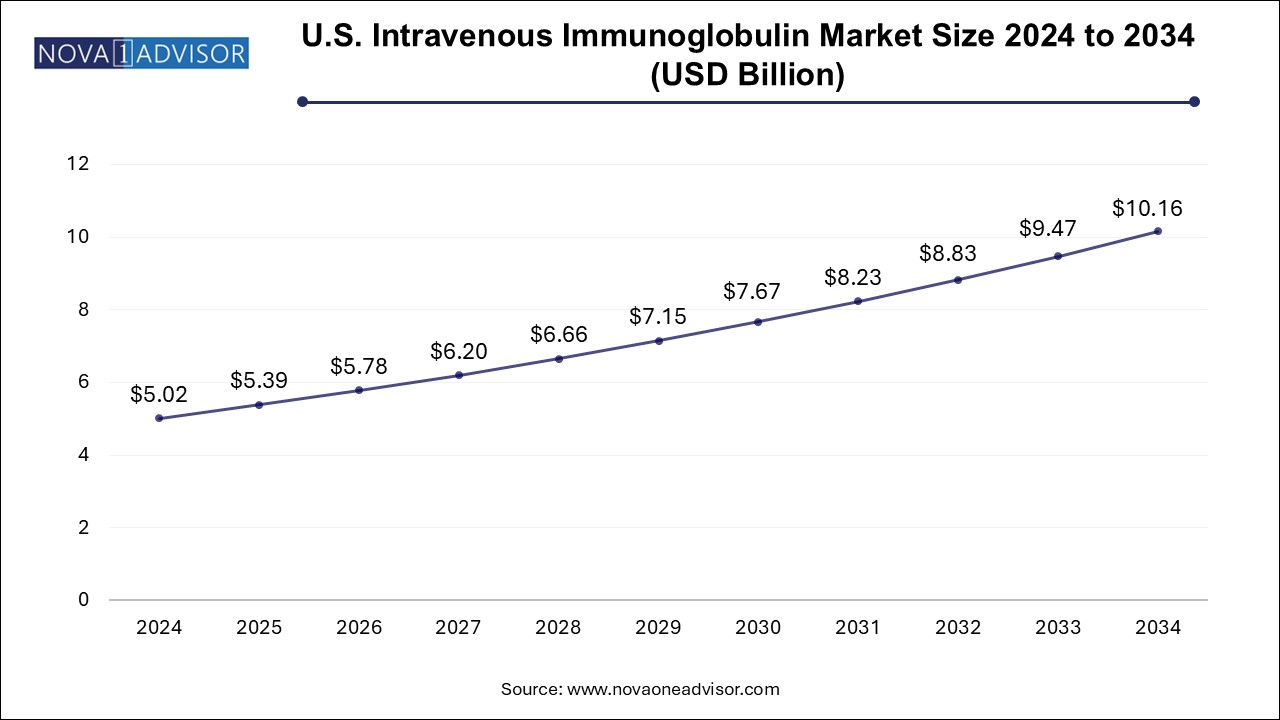

The U.S. intravenous immunoglobulin market size is evaluated at USD 5.02 billion in 2024 and is projected to be worth around USD 10.16 billion by 2034, growing at a CAGR of 6.61% from 2025 to 2034.

North America dominated the Intravenous Immunoglobulin (IVIG) market, with a global share of 47.0% in 2024.This market is witnessing considerable growth, primarily driven by the increasing demand for IVIG therapies in treating a variety of immunodeficiency diseases and related conditions. The increasing usage of IVIG pharmacies also contributes to expanding access to medication across the region.

U.S. Intravenous Immunoglobulin Market Trends

The IVIG market in the U.S. continues to dominate the North American market, holding a share of 80.19% in 2024. The growth in the U.S. IVIG market is largely attributed to the increasing prevalence of immunodeficiency diseases and related health conditions. CIDP, Hypogammaglobulinemia, and autoimmune disorders such as Myasthenia Gravis and ITP are becoming more common, driving the demand for IVIG therapies. In addition, hospital and specialty pharmacies remain key distribution points for IVIG therapies in the U.S., where providers and patients benefit from advanced treatments offered by major suppliers such as Biotest AG, Baxter, and Octapharma AG.

Europe Intravenous Immunoglobulin Market Trends

The intravenous immunoglobulin market in Europe is also experiencing rapid growth, driven by increasing awareness of immunodeficiency diseases and the availability of effective IVIG therapies for conditions like CIDP, Guillain-Barre Syndrome, and Kawasaki disease. Countries like the UK, Germany, and France are witnessing a steady rise in the demand for IVIG products, particularly through hospital pharmacies and specialty pharmacies. The region’s growth is further supported by initiatives from key players like Grifols SA, CSL, and LFB, who are competing to expand their presence in the European market.

The UK intravenous immunoglobulin market is experiencing robust growth in the IVIG market, driven by the rising number of patients diagnosed with conditions such as Chronic Lymphocytic Leukemia, Hypogammaglobulinemia, and Myasthenia Gravis. The demand for IVIG is significantly increasing, with patients relying on hospital pharmacies and specialty pharmacies for treatment. Key players such as Biotest AG and Baxter are at the forefront of providing IVIG therapies, further accelerating market expansion in the UK.

The intravenous immunoglobulin market in Germany is witnessing steady growth in the IVIG market, primarily due to an increasing focus on treating immunodeficiency diseases and related conditions like ITP and Multifocal Motor Neuropathy. Hospital and specialty pharmacies are the primary points of distribution, with increasing partnerships between healthcare providers and major suppliers like Octapharma AG and Grifols SA. These companies are working to meet the growing demand for IVIG therapies and expand their reach in the German market.

France intravenous immunoglobulin market is growing rapidly, fueled by a rising awareness of the effectiveness of IVIG treatments for conditions like Guillain-Barre Syndrome and Kawasaki disease. The French market sees a high demand for IVIG therapies through hospital pharmacies, with significant competition between established international players and local suppliers such as LFB. This competitive landscape is helping to expand access to life-saving therapies for patients across France.

Asia Pacific Intravenous Immunoglobulin Market Trends

The IVIG market in Asia Pacific is expanding rapidly, driven by a significant increase in the incidence of immunodeficiency diseases, particularly in countries such as China, India, Japan, and Australia. The growing need for IVIG therapies to treat conditions such as CIDP, Myasthenia Gravis, and Guillain-Barre Syndrome is evident, with hospital pharmacies and specialty pharmacies being the main distributors. Companies like CSL, China Biologics Products Inc., and Kedrion are working to establish a stronger foothold in the region by increasing the availability of their therapies.

Japan intravenous immunoglobulin market is experiencing significant growth in the IVIG market, driven by an increasing number of patients suffering from Myasthenia Gravis, CIDP, and Multifocal Motor Neuropathy. Hospital pharmacies and specialty pharmacies are the leading distribution channels, ensuring that patients across the country have access to IVIG treatments. International and local companies, including BDI Pharma Inc. and Octapharma AG, are working to meet the growing demand for IVIG in Japan.

The IVIG market in China is witnessing rapid growth, primarily driven by the increasing incidence of immunodeficiency diseases such as Chronic Lymphocytic Leukemia, ITP, and Hypogammaglobulinemia. Urbanization and increased access to healthcare services contribute to the demand for advanced IVIG treatments, primarily distributed through hospitals and specialty pharmacies. Major players like China Biologics Products Inc. and Kedrion are expanding their market presence in China to capitalize on this growth opportunity.

Latin America Intravenous Immunoglobulin Market Trends

The intravenous immunoglobulin (IVIG) market in Latin America is experiencing notable growth, primarily due to rising demand for IVIG therapies to treat conditions such as Kawasaki disease and Myasthenia Gravis. Countries like Brazil are leading this trend, where an increasing number of hospitals and specialty pharmacies focus on delivering advanced treatments for immunodeficiency diseases. The presence of key players such as Grifols SA and Baxter is driving market expansion, helping to ensure wider access to IVIG therapies in the region.

Brazil IVIG market is growing rapidly, fueled by increasing public health concerns regarding diseases such as Chronic Lymphocytic Leukemia, ITP, and Guillain-Barre Syndrome. Hospitals and specialty pharmacies remain the country's key distribution channels for IVIG therapies. The proactive efforts of suppliers like LFB and Biotest AG, coupled with government initiatives, are driving the growth of the IVIG market in Brazil.

Middle East & Africa Intravenous Immunoglobulin Market Trends

The intravenous immunoglobulin market in MEA is experiencing growth, driven by increasing demand for treatments related to conditions such as CIDP, Myasthenia Gravis, and Kawasaki disease. Countries like Saudi Arabia, South Africa, UAE, and Kuwait are witnessing a rise in the prevalence of these conditions, leading to higher demand for IVIG therapies. Hospital pharmacies and specialty pharmacies play a pivotal role in ensuring that patients in the region have access to essential treatments. Major suppliers like BDI Pharma Inc. and Grifols SA are expanding their reach in the MEA region to address this growing demand.

Saudi Arabia intravenous immunoglobulin market is experiencing significant growth, driven by increasing awareness of immunodeficiency diseases and related conditions. With a focus on conditions such as Guillain-Barre Syndrome and Myasthenia Gravis, the demand for IVIG therapies through hospital and specialty pharmacies is on the rise. The Saudi government’s Vision 2030 Health Sector Transformation Program, which includes initiatives to address immunodeficiency diseases, is expected to further support the country's IVIG market growth.

| Report Coverage | Details |

| Market Size in 2025 | USD 15.29 Billion |

| Market Size by 2034 | USD 28.83 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 7.3% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Application, Distribution Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Biotest AG; Baxter; Octapharma AG; LFB; Grifols SA; CSL; China Biologics Products Inc.; Kedrion; BDI Pharma Inc. |

Based on application, the Intravenous Immunoglobulin (IVIG) market has been categorized into immunodeficiency diseases, CIDP, hypogammaglobulinemia, congenital AIDS, chronic lymphocytic leukemia, myasthenia gravis, multifocal motor neuropathy, ITP, Kawasaki disease, Guillain-Barre syndrome, and others. The immunodeficiency diseases segment accounted for the largest revenue share of 19.78% in 2024. The growth of immunodeficiency diseases is driven by the rising incidence of primary and acquired immunodeficiency diseases (PID & AID); treatment with IV antibiotics is often necessary to manage infections. IVIG replacement therapy remains the most effective alternative for treating immunodeficiency diseases, driving steady market growth in the coming years.

The Kawasaki disease segment is expected to exhibit the fastest growth in the market over the forecast period. The rising incidence of Kawasaki disease in children and the growing demand for IVIG treatments are expected to drive market growth. While steroids serve as an alternative to IVIG therapy, they carry more side effects, making IVIG the preferred choice for treating Kawasaki disease. Furthermore, increasing patient awareness and the rising incidence of antibody deficiency diseases are expected to further boost the demand for IVIG therapies, fueling growth in this segment.

Based on distribution channel, the Intravenous Immunoglobulin (IVIG) market has been categorized into hospital pharmacies, specialty pharmacies, and others. The hospital pharmacies segment held the largest revenue share of 58.0% in 2024. The extensive network of hospitals and the wide range of products available through hospital pharmacies have made them a convenient option for patients. Moreover, the increasing incidence of primary immune deficiencies, hepatitis , and other diseases has led to a rise in hospitalizations globally, driving greater patient preference for hospital pharmacies. Hospitals also offer quick reimbursement processes, effective treatment, and comprehensive care, further contributing to the growing trend of patients opting for hospital pharmacies.

Specialty pharmacy is expected to grow considerably over the forecast period. They offer the convenience of at-home treatment, making them an attractive option for many patients. As specialty drugs play a vital and growing role in the pharmacy industry, the number of licensed specialty drugs is increasing rapidly. This expansion is expected to drive significant growth in the specialty pharmacy segment during the forecast period.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the intravenous immunoglobulin market

By Application

By Distribution Channel

By Regional