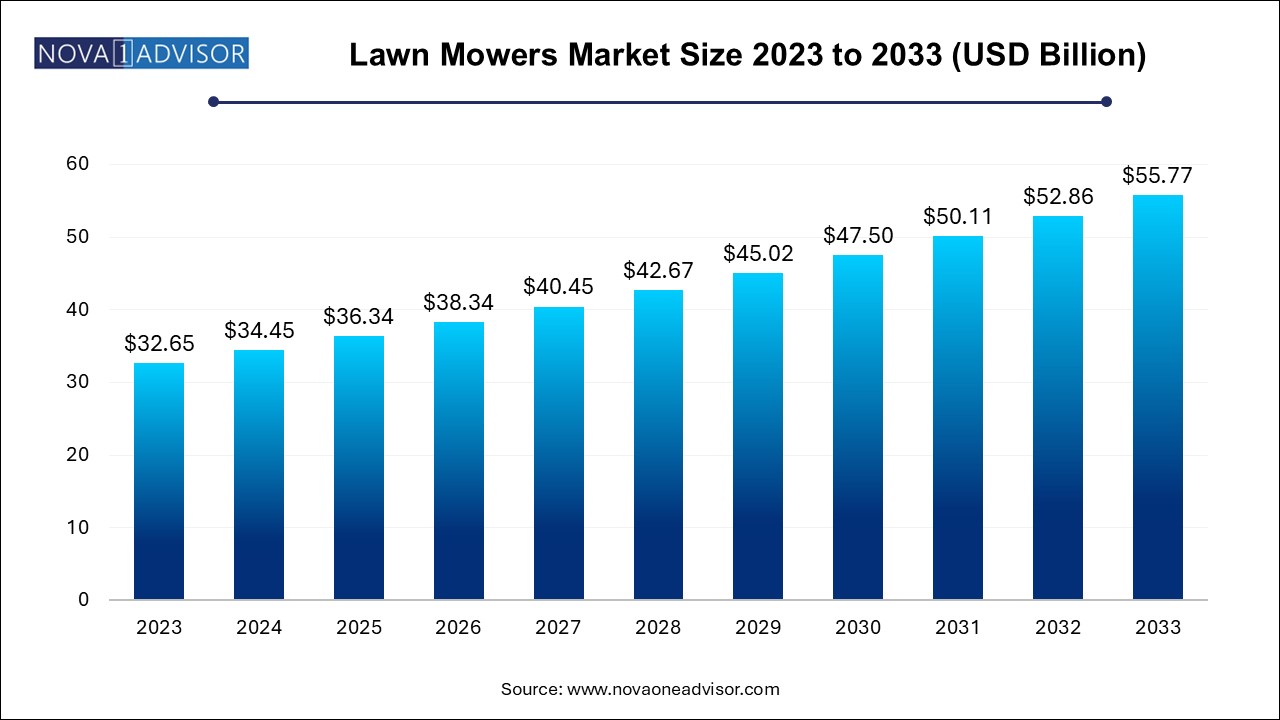

The global lawn mowers market size was exhibited at USD 32.65 billion in 2023 and is projected to hit around USD 55.77 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 34.45 Billion |

| Market Size by 2033 | USD 55.77 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Product Type, Propulsion, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | American Honda Motor Co., Inc. Ariens Company, Briggs Stratton, Deere & Company, Falcon Garden Tools, Fiskars, Husqvarna Group, MTD Products, Robert Bosch GmbH, Robomow Friendly House, The Toro Company |

Increasing awareness of environmental concerns is leading to a demand for eco-friendly, electric, and battery-powered mowers, reducing reliance on traditional gas-powered models. Consumer preferences for low-maintenance, easy-to-use, and durable lawn mowers also play a pivotal role in shaping the market, with manufacturers focusing on developing products that align with these expectations to gain a competitive edge in the industry. Moreover, with work from home, consumers have time to engage in activities like gardening, paving the way for the residential lawn mowers segment growth. In addition to this, households with increased disposable income have also increased consumer spending power, with demand for lawn maintenance activities on a rise.

In China, the demand for lawn mowers is expected to reach above pre-COVID levels in 2023 as the Chinese government pushes for eco-city project developments, subsequently creating avenues for future growth. Further, leisure gardening in China is witnessing a steady rise, projected to favor growth over the next few years. Despite changing consumer preferences or patterns in spending power, aesthetic appeal and eco-awareness for the gardening area within the household is a primary driver for the market.

In 2021, the global market rebounded to pre-COVID levels due to increased demand for battery-powered lawn mowers, notably from North America and Europe. However, ongoing semiconductor shortage concerns, disruption in supply chain activities, rising raw material prices, and a surge in oil prices due to the Russian-Ukraine conflict are expected to slow down the market in 2023. Due to these unfavorable macroeconomic conditions, OEMs and dealers are expected to increase the Average Selling Prices (ASP) of lawn mowers in 2023. These developments are likely to be short-lived and are expected to come down by H2 2023.

Over the next few years, vendor focus will be introducing robotic mowers as the demand for tech-advanced mowers is gaining a foothold with consumers seeking convenience. GPS, Wi-Fi, and other technologies are making inroads in the lawn mowing business and will keep vendors upkeep market growth over the future. Remote-controlled lawn mower is also emerging as a popular choice among consumers in developed regions. In addition to the demand for advanced products, the demand from the affluent middle class taking gardening as a hobby also promotes lawn mowers market growth. The development of government backed or commercial spaces infrastructure projects will also play a crucial part in propelling the demand for lawn mowers in the commercial sector.

The electric-powered lawn mowers segment dominated the market and accounted for the largest revenue share of 29.18% in 2023. This growth is ascribed to ease of use and high torque to weight ratio, enabling these lawn mowers to cut tall grass. The segment captured a sizeable share in 2021 and is anticipated to register a steady CAGR exceeding 5.4% from 2024 to 2033. Furthermore, these lawn mowers are now one of the most often used alternatives among consumers due to innovation and development in battery-powered engines that have boosted their robustness and efficiency.

The robotic mowers segment is projected to surpass 15,937.1 million by 2033, almost 2.2 times the market size in 2023. The massive segment growth is ascribed to consumer inclination towards tech-savvy products that offer convenience and environment-friendly options. Furthermore, the price for robotic products has reached affordable price points increasing their adoption in developed markets over the last few years. Consumers prefer to integrate these mowers with their existing smart home ecosystem, allowing them to control the device remotely using a smartphone-based app.

The residential segment dominated the market and accounted for the largest revenue share of over 59.0% in 2023. Lawn mowers are primarily used in a residential setting for gardening applications, whereas in commercial spaces, for large-scale landscaping applications and lawn maintenance. The demand for lawn mowers in the residential market witnessed an uptick post-2021 and exceeded USD 18 billion in 2023. This healthy demand is ascribed to the proliferation of remote working models worldwide, giving consumers time to engage in leisure activities such as gardening or DIY gardening from their homes. As consumers began to spend more time at home, the demand for products associated with gardening gained traction, a trend that is expected to go on for at least the next two years.

However, because to global shutdown restrictions, projects and associated investment for commercial gardening and landscaping came to a temporary standstill. Orders were put on hold for the specified time due to logistic disruptions, uncertain economic conditions, and reduced budgets. However, with the opening of trade channels, particularly e-commerce channels, and the restarting of infrastructure projects, the industry is anticipated to have a somewhat softer demand over the following few years. The segment is expected to register a CAGR of 5.2% from 2024 to 2033.

North America dominated the lawn mowers market and has the largest revenue share of 35.03% in 2023. Developed markets such as North America and Europe markets with high demand. In 2021, these regional markets held their leading positions in terms of market share, collectively surpassing 60%. Over the last few years, increasing urbanization in Western Europe has made houses smaller, in turn reducing garden size. This trend may become a serious threat to the uptake of lawn mowers in the region. However, the maintenance and development of lawns in commercial buildings will provide some respite to the otherwise challenged lawn mowers industry growth.

In America about 30% of residential houses are known to have kitchen- based gardens, suggesting that gardening is still popular in most parts of the U.S. This trend is projected to support the demand for lawn mower OEMs by increasing sales. In addition to this, more than 70% of the households in the U.S. have a back garden lawn, supporting the application of lawn mowers for maintaining the garden while creating growth avenues for OEMs who offer lawn maintenance equipment. North America is anticipated to register a CAGR of approximately 6.5% over the forecast period, primarily due to an increase in lawn maintenance activities amid the pandemic and an increase in construction activities in 2021.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global lawn mowers market

Product

Product Type

Propulsion

End-use

Regional

Chapter 1. Lawn Mowers Market: Methodology And Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

1.3. List Of Data Sources

Chapter 2. Lawn Mowers Market: Executive Summary

2.1. Market Snapshot

Chapter 3. Lawn Mowers Market: Trends, Variables, And Scope

3.1. Market Segmentation

3.2. Market Size And Growth Prospects, 2021 - 2033

3.3. Value Chain Analysis

3.4. Market Dynamics

3.4.1. Market Driver Analysis

3.4.2. Market Restraint Analysis

3.4.3. Market Opportunity Analysis

3.5. Key Opportunities Prioritized

3.6. Industry Analysis - Porter's Five Forces

3.7. PEST Analysis

3.8. COVID-19 Impact Analysis

Chapter 4. Lawn Mowers Market Product Outlook

4.1. Lawn Mowers Market Share by Product, 2024 & 2033 (USD Million)

4.2. Manual

4.2.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

4.3. Electric

4.3.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

4.4. Petrol

4.4.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

4.5. Robotic

4.5.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

4.6. Others

4.6.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

Chapter 5. Lawn Mowers Market Product Type Outlook

5.1. Lawn Mowers Market Share by Product Type, 2024 & 2033 (USD Million)

5.2. Ride-on Mowers

5.2.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

5.3. Push Mowers

5.3.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

5.4. Robotic Mowers

5.4.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

Chapter 6. Lawn Mowers Market Propulsion Type Outlook

6.1. Lawn Mowers Market Share by Propulsion Type, 2024 & 2033 (USD Million)

6.2. ICE

6.2.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

6.3. Electric

6.3.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

Chapter 7. Lawn Mowers Market End Use Outlook

7.1. Lawn Mowers Market Share by End Use, 2024 & 2033 (USD Million)

7.2. Residential

7.2.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.3. Professional Landscaping Services

7.3.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.4. Golf Courses

7.4.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.5. Government

7.5.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.6. Others

7.6.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

Chapter 8. Lawn Mowers Market: Regional Outlook

8.1. Lawn Mowers Market Share by Region, 2024 & 2033 (USD Million)

8.2. North America

8.2.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.2.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.2.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.2.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.2.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.2.6. U.S.

8.2.6.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.2.6.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.2.6.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.2.6.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.2.6.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.2.7. Canada

8.2.7.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.2.7.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.2.7.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.2.7.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.2.7.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.3. Europe

8.3.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.3.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.3.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.3.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.3.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.3.6. U.K.

8.3.6.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.3.6.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.3.6.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.3.6.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.3.6.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.3.7. Germany

8.3.7.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.3.7.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.3.7.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.3.7.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.3.7.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.3.8. France

8.3.8.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.3.8.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.3.8.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.3.8.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.3.8.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.3.9. Italy

8.3.9.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.3.9.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.3.9.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.3.9.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.3.9.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.3.10. Spain

8.3.10.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.3.10.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.3.10.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.3.10.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.3.10.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.3.11. Netherlands

8.3.11.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.3.11.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.3.11.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.3.11.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.3.11.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.3.12. Denmark

8.3.12.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.3.12.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.3.12.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.3.12.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.3.12.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.3.13. Finland

8.3.13.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.3.13.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.3.13.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.3.13.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.3.13.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.4. Asia Pacific

8.4.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.4.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.4.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.4.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.4.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.4.6. China

8.4.6.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.4.6.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.4.6.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.4.6.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.4.6.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.4.7. India

8.4.7.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.4.7.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.4.7.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.4.7.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.4.7.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.4.8. Japan

8.4.8.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.4.8.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million) (

8.4.8.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.4.8.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.4.8.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.4.9. Australia

8.4.9.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.4.9.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.4.9.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.4.9.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.4.9.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.4.10. South Korea

8.4.10.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.4.10.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.4.10.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.4.10.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.4.10.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.4.11. Singapore

8.4.11.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.4.11.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.4.11.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.4.11.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.4.11.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.5. Latin America

8.5.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.5.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.5.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.5.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.5.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.5.6. Brazil

8.5.6.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.5.6.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.5.6.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.5.6.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.5.6.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.5.7. Mexico

8.5.7.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.5.7.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.5.7.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.5.7.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.5.7.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.5.8. Argentina

8.5.8.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.5.8.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.5.8.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.5.8.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.5.8.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.6. Middle East & Africa

8.6.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.6.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.6.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.6.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.6.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.6.6. U.A.E.

8.6.6.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.6.6.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.6.6.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.6.6.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.6.6.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.6.7. Saudi Arabia

8.6.7.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.6.7.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.6.7.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.6.7.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.6.7.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

8.6.8. South Africa

8.6.8.1. Market Estimates and Forecast, 2021 - 2033 (USD Million)

8.6.8.2. Market Estimates and Forecast by Product, 2021 - 2033 (USD Million)

8.6.8.3. Market Estimates and Forecast by Product Type, 2021 - 2033 (USD Million)

8.6.8.4. Market Estimates and Forecast by Propulsion Type, 2021 - 2033 (USD Million)

8.6.8.5. Market Estimates and Forecast by End Use, 2021 - 2033 (USD Million)

Chapter 9. Competitive Landscape

9.1. Company Categorization

9.2. Company Share Analysis, 2024

9.3. Company Heat Map Analysis, 2024

9.4. Strategy Mapping

9.5. Company Profiles (Overview, Financial Performance, Product Overview, Strategic Initiatives)

9.5.1. American Honda Motor Co., Inc.

9.5.1.1. Company Overview

9.5.1.2. Financial Performance

9.5.1.3. Product Benchmarking

9.5.1.4. Recent Developments

9.5.2. Ariens Company

9.5.2.1. Company Overview

9.5.2.2. Financial Performance

9.5.2.3. Product Benchmarking

9.5.2.4. Recent Developments

9.5.3. Briggs Stratton

9.5.3.1. Company Overview

9.5.3.2. Financial Performance

9.5.3.3. Product Benchmarking

9.5.3.4. Recent Developments

9.5.4. Deere & Company

9.5.4.1. Company Overview

9.5.4.2. Financial Performance

9.5.4.3. Product Benchmarking

9.5.4.4. Recent Developments

9.5.5. Falcon Garden Tools

9.5.5.1. Company Overview

9.5.5.2. Financial Performance

9.5.5.3. Product Benchmarking

9.5.5.4. Recent Developments

9.5.6. Fiskars

9.5.6.1. Company Overview

9.5.6.2. Financial Performance

9.5.6.3. Product Benchmarking

9.5.6.4. Recent Developments

9.5.7. Husqvarna Group

9.5.7.1. Company Overview

9.5.7.2. Financial Performance

9.5.7.3. Product Benchmarking

9.5.7.4. Recent Developments

9.5.8. MTD Products

9.5.8.1. Company Overview

9.5.8.2. Financial Performance

9.5.8.3. Product Benchmarking

9.5.8.4. Recent Developments

9.5.9. Robert Bosch GmbH

9.5.9.1. Company Overview

9.5.9.2. Financial Performance

9.5.9.3. Product Benchmarking

9.5.9.4. Recent Developments

9.5.10. Robomow Friendly House

9.5.10.1. Company Overview

9.5.10.2. Financial Performance

9.5.10.3. Product Benchmarking

9.5.10.4. Recent Developments

9.5.11. The Toro Company

9.5.11.1. Company Overview

9.5.11.2. Financial Performance

9.5.11.3. Product Benchmarking

9.5.11.4. Recent Developments