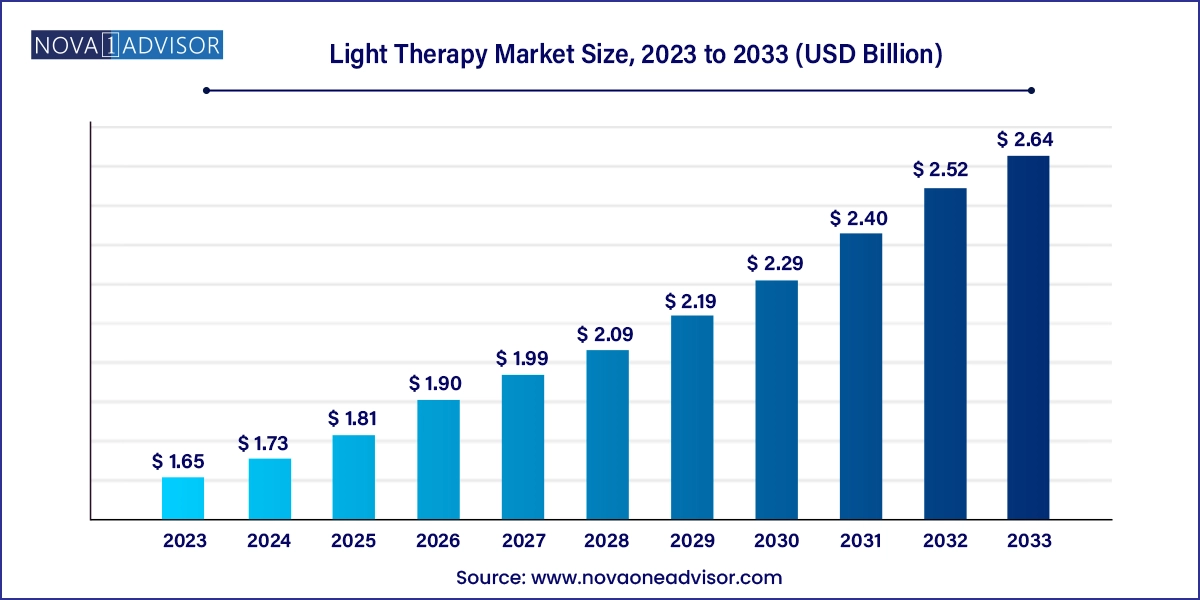

The global light therapy market size was exhibited at USD 1.65 billion in 2023 and is projected to hit around USD 2.64 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.73 Billion |

| Market Size by 2033 | USD 2.64 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.8% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application, Light Type, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Koninklijke Philips N.V.; Beurer GmbH; BioPhotas; Northern Light Technologies; Lumie; Verilux, Inc.; Zepter International; The Daylight Company; Zerigo Health; Naturebright |

According to estimates published by WHO in 2018, skin diseases affected approximately 900 million of the population globally. The increasing adoption of non-invasive treatments and the increasing prevalence of skin diseases are the drivers for the market. Moreover, the market players are involved in various strategic initiatives such as product launches, which are fostering the industry’s growth.

For instance, in June 2023, BioPhotas, Inc. announced a partnership with Ulta Beauty. This partnership is expected to meet the skincare need of customers across the U.S. in 55 different locations with the help of the Celluma PRO and Celluma ELITE models. These models are FDA-cleared to treat various conditions such as acne, wrinkles, and joint pains.

The COVID-19 pandemic had a moderate impact on the light therapy market due to stringent lockdowns, disrupted supply chains, and strain on hospitals, which led to reduced production and availability of light therapy devices. This was compounded by the decreased demand for these products due to lockdowns, consumer spending cuts, and the avoidance of hospitals and clinics for non-emergency reasons. The economic slowdown caused by the pandemic also contributed to a decline in consumer spending. However, the rise in online retail and e-commerce had a positive impact on the market.

The growing incidence of skin-related diseases, depressive disorders such as winter blues, and seasonal affective disorder, along with rapid technological advancements in healthcare, are driving the growth of the market. Clinical depression is a common mental health condition characterized by persistent feelings of sadness and a loss of interest in activities. It also causes physical symptoms such as fatigue, changes in appetite and sleep disorder, and lack of focus.

Depression is caused by a combination of genetic, biological, environmental, and psychological factors. As per the estimates of WHO in 2021, depression affected approximately 264 million people globally. According to the International Labor Organization, around 50% of the youth population was affected by depressive disorders due to COVID-19 and the lockdown, which in turn, increased the demand for light therapy devices.

In addition, increasing awareness amongst consumers regarding the benefits of light therapy devices is expected to further propel the market growth. Moreover, home-held devices are further propelling the demand for light therapy devices due to their properties such as portability, wireless communication, and dosage regulation.

Based on products, the market is segmented into lightbox, floor and desk lamps, hand-held devices for skin treatment, light visors, light therapy lamps, and dawn simulators. In 2023, the hand-held devices segment dominated the market with a revenue share of 26.7% and is expected to expand at the highest CAGR of over 5.3% during the forecast period. The segment is gaining popularity due to the product’s wide range of properties such as portability, efficient technology, and user-friendliness. They are used for skin treatment and utilize technologies such as ultrasonic waves and microcurrents to improve the appearance of the skin.

The light visor segment is expected to progress at a CAGR of 4.9% over the forecast period, which is attributed to the increase in the number of aircraft travelers that has led to various conditions, including insomnia, eye fatigue, and jet lag. This is due to changes in time zones and sleep patterns. It is portable and user-friendly that could be worn on the head. It regulates melatonin hormones and improves the circadian rhythms of the body.

Based on applications, the market is segmented into psoriasis, vitiligo, eczema, sleeping disorder, and SAD/Winter blues. The sleeping disorder segment held the largest market share of 23.4% in 2023. There are various conditions related to sleep disorders such as insomnia, hypersomnia, and sleep-disordered breathing. The aforesaid conditions are attributed to unhealthy lifestyles such as smoking, alcohol consumption, and more screen time.

The SAD/winter blues segment is expected to witness the fastest CAGR of 5.3% during the forecast period. This is attributed to more screen time and unhealthy lifestyles such as a lack of physical activities, an unhealthy diet, and staying indoors for longer periods during winter.

Based on light type, the market is segmented into blue light, red light, and white light. The blue light segment dominated the market in terms of a revenue share of 42.8% in 2023 and is also expected to witness the fastest CAGR of 5.1% over the forecast period. Blue light therapy is used to treat various conditions such as acne, skin disorder, depression, and seasonal affective disorder. The treatment session depending on the condition and treatment area varies from 15 minutes to 90 minutes.

According to the AAD association, 9,500 people in the U.S. are diagnosed with skin cancer on a daily basis and approximately 1 million people in the U.S. are suffering from melanoma. Studies suggest that blue light therapy is effective in treating melanoma, which is expected to drive the market demand for blue light therapy devices.

Based on end-use, the market is segmented into dermatology clinics and home healthcare. The home healthcare segment dominated the market with the highest revenue share of 54.7% in 2023. Increasing consumer awareness and technological advancements such as remote patient monitoring are driving the market. Dermatology clinics are expected to witness a significant CAGR over the forecast period, which is attributed to an increase in various healthcare expenditures post-pandemic.

Dermatology clinics are specialized in treating various skin-related conditions such as acne, eczema, psoriasis, and vitiligo. As per estimates by WHO, skin diseases affect almost 900 million people, which is expected to drive the market for dermatology clinics. Moreover, increasing adoption of non-invasive treatments, and technological advancements such as the use of laser technology are expected to drive market growth over the forecast period.

North America dominated with the highest revenue share of 36.3% in 2023, owing to rising cases of SAD/Winter blues symptoms and psoriasis condition. Light therapy involves exposing the skin to ultraviolet light from artificial sources under medical supervision. UVB and UVA light, or a combination of both, are used to reduce inflammation, slow down skin cell growth, and improve symptoms. As per estimates by the Canadian Dermatology Association, approximately 1 million people have psoriasis condition, which is increasing the market for the devices.

The Asia Pacific region is expected to expand with the fastest CAGR of 5.6%, due to an increase in awareness about the benefits of light therapy, and increased investments in telemedicine. In addition, the increasing adoption of light therapy devices in hospitals, clinics, and the home care segment is also driving growth. The market is expected to continue growing in the coming years, driven by the increasing prevalence of sleep disorders, and the rising adoption of light therapy devices in the treatment of skin conditions such as acne, psoriasis, and eczema.

Europe is expected to have a CAGR of 4.6% over the forecast period; this is attributed to the prevalence of various skin conditions such as psoriasis, acne, and vitiligo in the region. Moreover, increasing cases of SAD and winter blues in the region are further driving the demand. The market is driven by increasing awareness about the benefits of light therapy in treating seasonal affective disorder (SAD) and other mood disorders. Additionally, the rising adoption of light therapy devices in the homecare segment and the growing number of people suffering from SAD and other mood disorders are also driving the market growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global light therapy market

Product

Application

Light Type

End-use

Regional