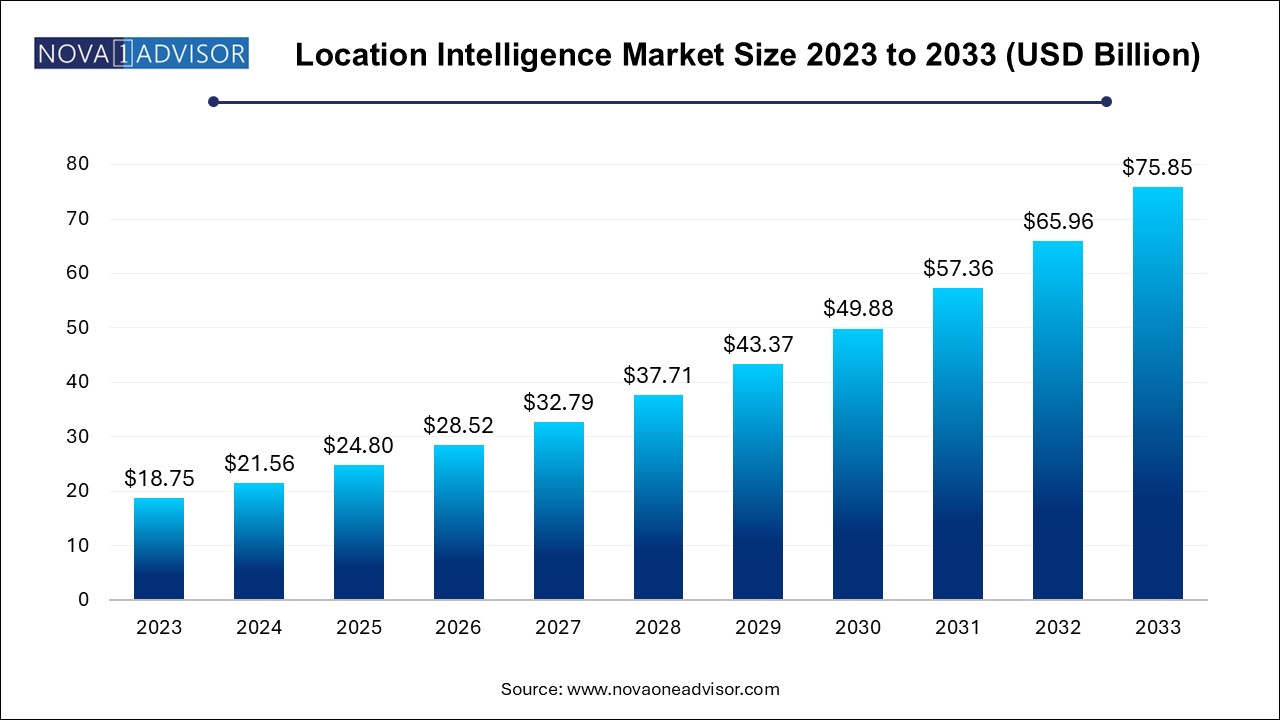

The global location intelligence market size was exhibited at USD 18.75 billion in 2023 and is projected to hit around USD 75.85 billion by 2033, growing at a CAGR of 15.0% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 21.56 Billion |

| Market Size by 2033 | USD 75.85 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 15.0% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Component, Application, Location Type, Deployment, Organization, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Autodesk, Inc.; Bosch Software Innovations GmbH; ESRI; Foursquare.; HERE Technologies; IBM Corporation; LocationIQ; MDA Corp.; Microsoft; Pitney Bowes, Inc.; Qualcomm Technologies, Inc.; Supermap Software Co., Ltd.; Tibco Software, Inc.; Trimble, Inc.; Wireless Logic |

The industry is mainly driven by the growing penetration of smart devices and increasing investments in IoT and network services as it facilitates smarter applications and better network connectivity. The COVID-19 pandemic resulted in the increased adoption of location intelligence solutions to manage the changing business scenario as it helps businesses to analyze, map, and share data in terms of the location of their customers.

In addition, healthcare and government organizations implemented location-based solutions for vaccination drives to carry out successful COVID-19 public health strategies. Furthermore, the growing surge of asset management across industry verticals is expected to boost the demand for location intelligence over the forecast period. Location intelligence is a subpart of the IoT technology that makes businesses identify consumer trends, consumer behavior, and different information about niche markets to deliver better services and products, for better decisions and mitigate the uncertainties in the market.

Further benefits of location intelligence include risk management, predictive analytics, real-time tracking of trends and patterns, and streamlining the operations and services of companies. Moreover, rising digitalization has enabled organizations to collect user information, which is anticipated to spur industry growth further. Enhancing customer experience is one of the significant factors influencing the growing adoption of location intelligence. Increasing investments in infrastructure and the adoption of new technologies have resulted in several business-to-business (B2B) and business-to-consumer (B2C) applications, such as sales & marketing, customer management, and facility management.

The excessive use of mobile applications and enhanced location-sharing capabilities of mobile devices have revolutionized the way services are being delivered to the end-users. Location intelligence and in-store location technology enhance the customer experience by helping them locate the products they need quickly and efficiently. Furthermore, increasing investments in IoT is another crucial factor that has propelled industry growth. IoT is a rapidly growing network of internet-enabled gadgets, which can capture a vast amount of data with moving & fixed sensors. The processing of this captured data in real time is crucial for modern analytics in public or private services. The key driving force behind the adoption of location intelligence software is a growing awareness of the significance that spatial insights provide to business decision-making. Businesses across industries use location intelligence software to achieve a competitive advantage by optimizing operational processes and improving consumer experiences.

Spatial analysis or location intelligence allows placing these data within the critical context of ‘where’ and allows tying this extensive information together. Various industries, such as automotive, transportation & logistics, manufacturing, and healthcare, are discovering the potential uses of location data. Location intelligence offers real-time data processing by helping businesses analyze and identify hidden patterns, relationships, and unique insights that drive better decision-making. Although the industry is anticipated to record steady growth due to the benefits above, lack of awareness, expertise, and other operational challenges and data privacy concerns are expected to challenge growth.

Consumers are hesitant about technologies that could lead to personal information and safety-related risks. This factor also hinders market growth. Thus, manufacturers and service providers must implement appropriate security measures to assure the safety and privacy of a customer’s data. The changing scenario of how businesses are conducted across the globe has urged companies across various industries to adopt the technology. Location technology is one of the significant additions to business operations post-pandemic—the use of location analytics aids enterprises in coping with the uncertainties induced by the pandemic. As a result, the market experienced an elevated demand in 2020 and is expected to grow significantly over the forecast period.

The sales & marketing optimization application segment dominated the global industry in 2023 and accounted for the maximum share of more than 20% of the overall revenue. The segment is expected to continue its dominance from 2024 to 2033. On the basis of applications, the industry has been segmented into asset management, facility management, workforce management, risk management, sales & marketing optimization, remote monitoring, customer management, and others. Location intelligence tools reduce the complexity of the sales and marketing processes by gathering enough relevant data for the marketing campaigns and predicting the outcomes.

Furthermore, location intelligence helps continuously monitor and manage inventory, energy utilization, and temperature in the facility remotely. It can also help the management trace and monitor the workforce in indoor and outdoor environments. Location intelligence enables companies to measure occupancy in rooms, estimate maintenance cycles for assets, monitor activities of employees, and manage staff remotely. Thus, increasing operational efficiency with the help of location intelligence tools is expected to increase the demand for the market.

Based on services, the global industry has been further categorized into consulting, system integration, and others. The system integration category segment dominated the industry and accounted for the maximum share of more than 45% of the overall revenue. The segment growth is driven by the rising need to integrate new data sources with the increasing penetration of IoT and increasing location-based data. System integrators help many industries integrate their assets, business processes, and products with location intelligence to collect information that can be further studied to gather meaningful insights. Moreover, system integrators have expertise in understanding and working with spatial and non-spatial data businesses, open data sources, or commercial data providers.

For instance, Korem company has complete experience in building solutions that integrate data from loads of databases and systems, breaking data warehouses while accelerating the business insights that appear from geospatial solutions. The consulting segment is estimated to grow at a rate of around 16% from 2024 to 2033. This service helps identify and prioritize several business use cases where location intelligence provides significant value. Location intelligence assists in consulting the companies to collect, analyze, and examine relevant information and offer a more precise opinion to other organizations. Various end-use industries take advice to integrate location intelligence tools with their business activities from IoT consulting and location intelligence firms.

The transportation & logistics segment dominated the industry in 2023 and accounted for the largest share of more than 19% of the overall revenue. Location intelligence helps in understanding the distance and drive times between destinations with precise geographic coordinates and the current routable road network, which increased its usage in the transportation & logistics segment. Also, it offers various routes to reach the goal with drive time and real-time traffic analysis. It also provides road blockages and actual daily closures on the site. Location Intelligence solves retail challenges, including store sales predictions, drive time & distance profiling, network optimization & scenario modeling, site selection planning, franchise area evaluation & overlap analysis, sales & market share analysis, market size & demand estimation by location/product, territory optimization & planning, and customer segmentation & profiling.

The retail and consumer goods segment is expected to record the fastest growth rate over the forecast period. The reason for the segment growth is solving retail challenges, including store sales predictions, drive time & distance profiling, network optimization & scenario modeling, site selection planning, franchise area evaluation & overlap analysis, sales & market share analysis, market size & demand estimation by location/product, territory optimization & planning, and customer segmentation & profiling. Location intelligence offers a framework that utilizes site selection techniques, such as sophisticated modeling and the “kicking-the-dirt’ technique. It helps find the right site for a distribution center, store, and service center.

North America dominated the industry in 2023 and accounted for the largest share of more than 33% of the overall revenue. It is expected to grow steadily from 2024 to 2033. The penetration of smartphones in North America was around 80% in 2023 and is steadily increasing. Thus, the regional market is expected to grow at a steady pace. Similarly, the market in Europe is also expected to record healthy growth, driven by rapid business intelligence analytics and geographic information systems technology expansion. Asia Pacific is expected to register the fastest CAGR from 2024 to 2033 owing to the growing number of smartphone users, increasing number of service providers, enhancement of networking technologies, and rise in the popularity of social media.

Europe Location Intelligence Market

The Europe location intelligence market was estimated to occupy a market share nearly of 27% in 2023. The growth of the Europe location intelligence market can be attributed to the increased adoption of digital technology, IoT device popularity, location-based services, and IoT and connected device investment, among others.

U.K. Location Intelligence Market

The U.K. location intelligence market was expected to occupy around 19% of the Europe location intelligence market in 2023. The growth of the location intelligence market in the U.K. can be attributed to factors such as increased strategic initiatives, which have enabled the companies in the country to offer advanced solutions. For instance, January 2023, precisely announced the acquisition Transverse. Following the acquisition of Transerve, Precisely's suite of data integrity software and data also now incorporates additional SaaS location intelligence capabilities, enabling clients to leverage location data and analytics and gain new business insights without specialized knowledge or experience.

Germany Location Intelligence Market

The location intelligence market in Germany was estimated to be valued at USD 0.93 billion in 2023. The growth of the location intelligence market in Germany can be attributed to factors such as increased adoption of digital technologies, rising smartphone penetration, and the increasing popularity of IoT. Moreover, the use of location intelligence utilizes geospatial data, which would help businesses to make better decisions.

France Location Intelligence Market

The France location intelligence market was estimated to hold a market share of around 13% in 2023 in the Europe location intelligence market. The growth of the location intelligence market in France can be attributed to factors such as the increasing affordability of smartphones, the growing availability of high-speed mobile internet, and the rising popularity of mobile apps are driving the growth in the number of smartphone users. Moreover, Infrastructure developments, along with the increasing use of smart devices and connected devices, are contributing factors expected to boost the market for location intelligence.

Asia Pacific Location Intelligence Market

Several businesses and service providers are introducing new products and services to increase their share in developing markets. In the APAC region, governments and municipal corporations are improving their services by analyzing information about asset locations to deliver a better standard of living and ease citizens’ workload. Thus, companies are opting for location intelligence tools for improving asset management to make operations more efficient, which is expected to increase the demand for location intelligence. Therefore, the regional market is expected to grow at the fastest higher CAGR from 2024 to 2033.

China Location Intelligence Market

The China location intelligence market is expected to hold a market share of around 32% in 2023. The growth of the location intelligence market in China can be attributed to high mobile device penetration, growing need for location data for targeted marketing campaigns, increasing adoption of location-based technologies, high demand for better customer service experience, and rising importance of location data in several industries, among others.

Japan Location Intelligence Market

The Japan location intelligence market was estimated to be around USD 0.81 billion in 2023. The growth of the location intelligence market in Japan can be attributed to factors such as rising investment in IT infrastructure development, growing adoption of advanced location intelligence technologies, and increasing urbanization, among others.

India Location Intelligence Market

The India location intelligence market was expected to hold around 18% in 2023. The growth of the location intelligence market in India can be attributed to increasing purchasing power, improving digital infrastructure, increasing adoption of location-based technologies, growing need for real-time data and insights, and improved decision-making capabilities through location insights.

Middle East & Africa Location Intelligence Market

The Middle East & Africa location intelligence market was estimated to hold around 5% of the market share in 2023. The growth of this region in the location intelligence market can be attributed to factors such as rapid urbanization, improving digital infrastructure, expansion activities carried out by several key companies in the market, and advancement in location technologies, among others.

Saudi Arabia Location Intelligence Market

The location intelligence market in Saudi Arabia was expected to have a high growth rate, which can be attributed to factors such as the increasing use of GPS devices, rising usage of location applications, improved organizational need to gain competitive advantage, and growing need for real-time data and insights.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global location intelligence market

Component

Application

Location Type

Deployment

Vertical

Regional