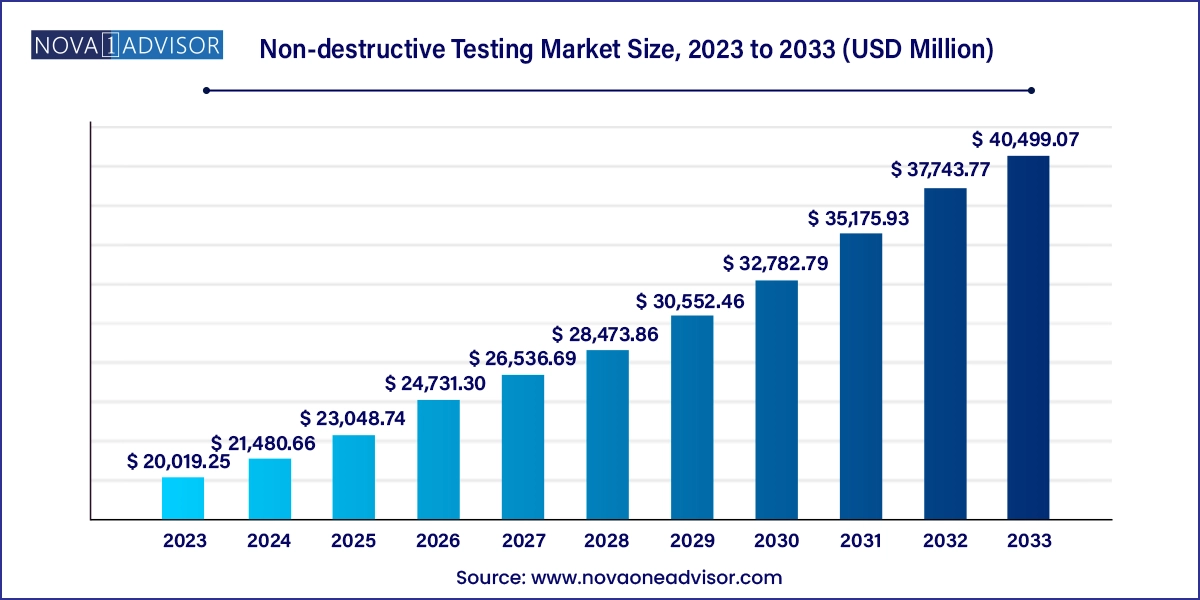

The global non-destructive testing market size was exhibited at USD 20,019.25 million in 2023 and is projected to hit around USD 40,499.07 million by 2033, growing at a CAGR of 7.3% during the forecast period 2024 to 2033.

The Global Non-Destructive Testing (NDT) market has matured into a vital sector supporting safety, compliance, and quality control across critical industries. NDT refers to a wide array of testing techniques used to inspect and evaluate materials, components, or assemblies without altering or damaging the original part. These methods allow organizations to detect internal or surface-level defects, material properties, and performance weaknesses with precision.

From aerospace and power generation to oil & gas and construction, the applications of NDT are expanding in scope, complexity, and criticality. Modern NDT solutions integrate hardware, software, and service expertise to provide actionable data for maintaining structural integrity, minimizing downtime, and extending the lifecycle of assets. NDT helps prevent catastrophic failures, save costs on unnecessary replacements, and ensure compliance with global safety regulations such as ASME, ISO 9712, and API standards.

The demand for NDT has surged with the aging of global infrastructure, expansion of manufacturing operations, and heightened attention to occupational safety and environmental impact. Moreover, digital transformation has made NDT more advanced—incorporating AI, machine learning, robotics, and cloud data storage into traditional inspection workflows.

Industries today are shifting from periodic, manual inspections to continuous, data-driven monitoring. This evolution is creating strong tailwinds for advanced methods such as Phased Array Ultrasonic Testing (PAUT), Time-Of-Flight Diffraction (TOFD), and Digital Radiography (DR), which enable faster, safer, and more accurate results.

Transition to Digitally Enabled NDT

Integration of artificial intelligence, cloud platforms, and big data analytics is revolutionizing how NDT data is captured, stored, analyzed, and reported.

Rise of Robotics and Drones in Remote Inspection

Unmanned aerial and robotic systems are increasingly deployed in hard-to-reach or hazardous inspection areas, improving safety and efficiency.

Growing Preference for Predictive Maintenance

Companies are moving from scheduled maintenance to condition-based monitoring using real-time NDT data and predictive modeling.

Expansion of Advanced Ultrasonic Techniques

Techniques such as PAUT, TOFD, and ACFM are seeing strong adoption in sectors like aerospace and power due to their high precision and depth resolution.

Increased Training and Certification Initiatives

Global standards and qualification frameworks such as ISO 9712 and ASNT SNT-TC-1A are gaining prominence as NDT skills become more specialized.

Miniaturization and Portability of NDT Equipment

Compact, handheld devices with embedded software are replacing bulky traditional setups, especially for in-field inspections.

Integration of Digital Twins in Industrial Inspection

Digital twin models of industrial assets are now integrated with NDT data to simulate and predict structural behavior under stress.

Cross-industry Convergence for Sustainability Compliance

NDT is increasingly part of ESG and environmental audit frameworks, particularly in emissions containment and corrosion monitoring.

| Report Coverage | Details |

| Market Size in 2024 | USD 21,480.66 Million |

| Market Size by 2033 | USD 40,499.07 Million |

| Growth Rate From 2024 to 2033 | CAGR of 7.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Offering, Test Methods, Vertical, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | Previan Technologies, Inc.; Bureau Veritas; Fischer Technology Inc. (Helmut Fischer); MISTRAS Group; Comet Group (YXLON International); MME Group; TWI Ltd.; Nikon Corporation; Olympus Corporation; Sonatest; Acuren; Intertek Group plc; CREAFORM; Vidisco Ltd.; SGS S.A |

One of the most prominent drivers of the global NDT market is the increasing stringency of safety, environmental, and quality assurance regulations. In industries like oil & gas, nuclear power, and aerospace, even minor defects can lead to catastrophic failures posing threats to human life, environmental integrity, and organizational reputation.

To mitigate such risks, international regulatory bodies require frequent inspections using NDT methods that offer detailed, auditable results without damaging the asset. For instance, pipeline operators in North America must comply with PHMSA (Pipeline and Hazardous Materials Safety Administration) regulations mandating rigorous corrosion and weld inspections using ultrasonic and radiographic methods.

Additionally, as products and infrastructure age, regulators mandate more frequent NDT inspections, creating sustained demand. This is especially evident in the aerospace sector, where aircraft undergo scheduled non-destructive evaluations at multiple points throughout their lifecycle.

Despite its long-term cost-saving potential, the NDT market faces adoption barriers due to the high upfront cost of equipment and the scarcity of trained professionals. Techniques such as digital radiography or phased array ultrasonic testing require expensive imaging systems, processing software, and training deterring small and mid-sized enterprises from full-scale adoption.

Moreover, NDT services rely heavily on human expertise. Certification paths are lengthy and require rigorous practical experience. This shortage of certified professionals often leads to bottlenecks in project timelines, particularly in high-growth regions where demand for inspection services is surging.

The cost of setting up in-house inspection teams, purchasing portable units, and complying with international standards makes many organizations rely on outsourced inspection services limiting the scalability of internal quality control programs.

The advancement of Industry 4.0 has created a powerful opportunity for the NDT market to embed itself into automated production lines and predictive maintenance ecosystems. Integration of NDT with manufacturing execution systems (MES), industrial Internet of Things (IIoT) sensors, and digital twins allows continuous asset monitoring, quality control, and proactive fault detection.

For example, in an automotive plant, ultrasonic sensors embedded in the production line can scan welded joints in real time, flagging anomalies that could later result in part failure. Similarly, AI-powered defect recognition can speed up analysis of radiographic images, improving throughput while maintaining accuracy.

This convergence is particularly valuable in industries like power generation and aerospace, where the stakes for undetected flaws are high and inspection cycles must align with tight operational schedules.

Services dominated the market in terms of value contribution, as most organizations especially in high-risk sectors prefer outsourcing NDT tasks to certified third-party providers. Inspection services are the backbone of the segment, offering periodic or one-time inspection of industrial assets using various NDT techniques. The increasing requirement for asset health reporting, certification audits, and regulatory compliance further boosts demand for skilled inspection services.

Training and support services are the fastest-growing, driven by the global shortage of certified NDT professionals. With standards such as ISO 9712 and ASNT requiring ongoing qualification, companies are investing in workforce upskilling through digital simulations, online modules, and practical workshops. In addition, support services for software updates, calibration, and device maintenance are rising as digital systems become widespread.

Traditional methods such as ultrasonic and radiographic testing still dominate, accounting for a major share of global inspection protocols. Ultrasonic testing (UT) is widely used for weld inspection and thickness measurement, while radiographic testing (RT) is favored for identifying internal flaws in castings and pipes. These methods are mature, highly validated, and standardized.

Phased Array Ultrasonic Testing (PAUT) is the fastest-growing among advanced techniques due to its precision, speed, and data richness. PAUT allows operators to steer ultrasonic beams at different angles, covering large areas in a single scan. Its applications in aerospace, wind turbine blades, and nuclear reactors are expanding rapidly. Additionally, Time-Of-Flight Diffraction (TOFD) and Pulsed Eddy Current (PEC) methods are gaining traction for complex geometry inspections and corrosion mapping.

Oil & gas remains the dominant vertical, encompassing upstream, midstream, and downstream segments. From inspecting offshore platforms and pipelines to checking refinery heat exchangers, NDT is integral to every phase. The need for frequent, code-compliant inspections to prevent leaks, explosions, and environmental disasters ensures sustained demand for NDT across this sector.

Aerospace and defense is the fastest-growing, as advanced NDT techniques are used in aircraft maintenance, engine integrity checks, and composite material inspections. With the expansion of commercial aviation and defense manufacturing programs globally, demand for high-resolution, automated NDT tools is accelerating. In this segment, failure is not an option—NDT is not just a safety tool but a prerequisite for certification.

North America dominates the global NDT market, thanks to a robust industrial base, stringent safety regulations, and early adoption of advanced testing technologies. The U.S. is home to some of the most mature aerospace, power, and oil & gas operations, all of which rely on non-destructive testing for safety assurance and operational efficiency. Regulatory mandates by organizations like OSHA, ASME, and DOT ensure consistent demand for inspection, training, and maintenance services.

Asia Pacific is the fastest-growing region, led by China, India, and Southeast Asian economies undergoing rapid infrastructure and manufacturing expansion. In these regions, construction booms, energy investments, and automotive production are rising exponentially. While traditional NDT methods are still predominant, governments and private players are investing in smart factories and robotics-based inspection. Increasing collaborations between regional manufacturers and global NDT vendors are also driving the adoption of advanced testing systems.

April 2025 – Eddyfi Technologies announced the release of a next-gen ultrasonic scanner with embedded AI defect recognition and automated corrosion mapping, designed for offshore pipeline monitoring.

March 2025 – Olympus Scientific launched a ruggedized phased array ultrasonic testing (PAUT) system with wireless data transmission and enhanced field calibration features.

February 2025 – GE Inspection Technologies unveiled a cloud-native version of its radiographic testing analytics platform, allowing real-time image processing across multiple field teams.

January 2025 – MISTRAS Group partnered with a leading renewable energy firm to develop specialized NDT protocols for inspecting wind turbine blades and offshore substations.

February 2025 – YXLON International introduced a high-speed digital radiography (DR) unit tailored for battery inspections in electric vehicle (EV) manufacturing.

Some of the prominent players in the global non-destructive testing market include:

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global non-destructive testing market

Offering

Test Methods

Vertical

Regional