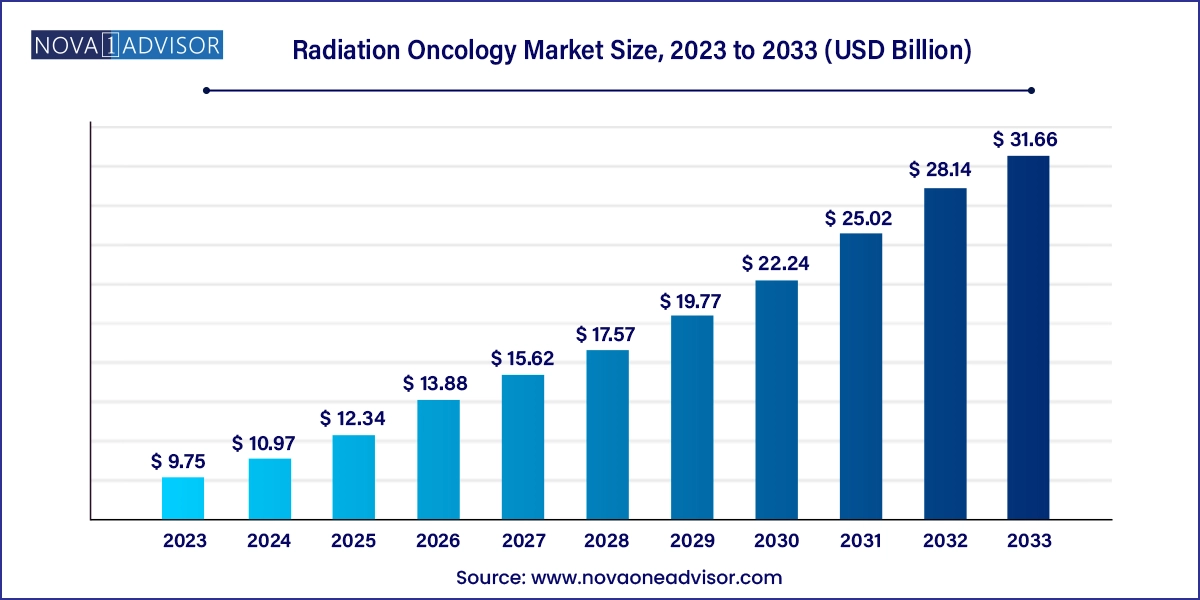

The global radiation oncology market size was exhibited at USD 9.75 billion in 2023 and is projected to hit around USD 31.66 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 10.97 Billion |

| Market Size by 2033 | USD 31.66 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 12.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Technology, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Key Companies Profiled | Varian Medical Systems, Inc.; Elekta AB; Accuray Incorporated; IBA Radiopharma Solutions; BD; Isoray Medical; Mevion Medical Systems, Inc.; Nordion Inc.; NTP Radioisotopes SOC Ltd.; Curium Pharma; Viewray Technologies, Inc. |

Key factors driving the market include technological advancement in radiation therapy equipment, global rise in cancer cases, and increasing adoption of radiation therapy in oncology treatment.

Furthermore, the radiation oncology market is witnessing increased demand for radiotherapy due to the rising global cancer burden. According to WHO, globally, around 19.3 million people were suffering from cancer, and 10 million died from it in 2022. Moreover, WHO in Europe estimated that there were 4.6 million new people diagnosed with various indications of cancer such as prostate, breast, lung, colorectal, and brain and around 2.1 million people across European countries died from the disease in 2020. As per American Cancer Society’s 2022 report, breast cancer is most common occurring condition which accounts for around 3 lakh and 51,400 new cases in U.S. of invasive and non-invasive breast tumor, respectively.

In the dynamic market outlook of the radiation therapy space, key players are making strategic moves to enhance their market presence. In October 2023, Accuray Incorporated gained approval for its Tomo C radiation therapy system in China, opening new avenues for growth in the region. This regulatory milestone reflects Accuray's commitment to expanding its market reach. Similarly, in June 2023, PharmaLogic Holdings Corp. entered into a Master Services Agreement for the development and production of theranostic candidates VMT-01 and VMT-NET. These radiopharmaceuticals, currently in the research and development phase, aim to address the diagnostic and treatment needs of metastatic melanoma and neuroendocrine cancers. This strategic collaboration underscores PharmaLogic's dedication to advancing innovative solutions in the oncology space.

The external beam radiation therapy (EBRT) market, which includes linear accelerators (Linac), and compact advanced radiotherapy systems dominated the overall market with the largest share of 62.41% in 2023 due to increased adoption in treatment of various types of cancers. Furthermore, EBRT products has high ability to kill tumor in the early phases as compared to conventional therapies with less side effects. Moreover, rapid technological advancements and investigation of such technologies on various cancer treatment are increasing demand for LINACs and MR-LINACs, thereby, contributing to the growth of radiation oncology markets. For instance, in December 2022, using Elekta Unity MR-Linac, first ever patient got treated for pancreatic tumor with new advanced radiotherapy motion management.

Linear accelerator (Linac) uses microwave technology like radar to destroy tumor cells by delivering high energy electrons or x-rays near tumor region and spare the surrounding healthy tissue. Introduction of novel linear accelerators contributes to market growth. For instance, in September 2020, Elekta AB announced the launch of the Elekta Harmony linear accelerator, which is the productive Linac for the treatment of cancer by radiotherapy. The launch of the new products may contribute to the market growth by addressing the unmet medical needs.

The IMRT segment accounted for the largest share of the radiation oncology market in 2023, attributable to a substantial demand for treatment and increased availability of technologically advanced intensity-modulated radiotherapy (IMRT) in countries with unmet treatment needs. However, brachytherapy is estimated to be the fastest-growing segment over the forecast period due to the benefits associated with its high adoption rate and minimal risk of side effects.

3D-CRT projects radiation beams in such a way that the beams match the dimensions of tumor and help physicians to know the exact dimensions of tumor, which limits the damage to healthy tissues. It allows delivery of higher dose levels at the tumor site, thereby increasing its effectiveness to shrink and destroy the tumor by using a multi-leaf collimeter (MLC) in a step-and-shoot technique. 3D-CRT is used to treat head & neck, liver cancer, prostate, lung, and brain cancer.

The advancements in brachytherapy provide precise and targeted dose delivery and personalized treatment options to patients. This technology is mostly used for the treatment of prostate cancer. Compared to conventional treatment techniques, its improved efficacy and reduced setup time are likely to drive the worldwide brachytherapy segment. Moreover, supportive reimbursement policies for products related to brachytherapy reduced the treatment cost, thereby encouraging patients to avail treatment. In May 2020, Isoray announced the approval of billing codes for reimbursement of Cesium-131 for the hospital in a DRG setting. Cesium-131 is used in brachytherapy to treat various organ tumors.

The EBRT segment accounted for the largest revenue size of radiation oncology market by in 2023 and is anticipated to maintain its dominance over the forecast period. This can be attributed to the rising global cancer prevalence and increasing adoption of EBRT systems by cancer centers and hospitals. For instance, in September 2021, Unicancer acquired multilple Radixact Systems of Accuray, Inc. with the ClearRT with aim to provide personalized treatment patients in Europe. Unicancer is French hospital network that provide treatment to 530,000 cancer patients annually.

The market for IBRT is anticipated to witness significant growth over the forecast period due to growing prevalence of cancer in developing countries, and increased product penetration. IBRT is mostly used in conjunction with breast cancer surgery. Brachytherapy for breast tumor involves different techniques for placing devices such as interstitial brachytherapy and intracavitary brachytherapy. Most performed technique for breast cancer is intracavitary brachytherapy. According to a study published by National Cancer Institute (NCI) showed that whole breast irradiation, (WBI), and accelerated partial-breast irradiation (APBI) lowers the rate for cancer recurring in the breast cancer patients.IMRT has become the standard treatment for locally advanced head & neck cancer due to its high conformality. Moreover, Gynecologic cancer is mostly treated with the help of various brachytherapy techniques.

North America dominated the overall radiation oncology market in terms of revenue share of 45.52% in 2023, owing to the favorable government initiatives and availability of technologically advanced radiotherapy equipment. Furthermore, active participation of key players to increase their market share in region is fueling the market growth. For instance, in December 2022, MVision AI entered partnership with Medron Medical Systems to distribute AI radiotherapy technology of MVision in Canada. The use of AI technology provides high accuracy, leading to improved patient outcomes.

Asia Pacific is estimated to be the fastest-growing region over the forecast period due to improvements in healthcare infrastructure, increase in patient awareness levels, and high unmet patient needs. In addition, rising cancer burden and funding support to major players in the region are expected to offer lucrative opportunity for segment growth. According to Globocan report 2020, about 9.5 million new cancer cases were diagnosed, and 5.8 million died due to this disease in the Asia region, increasing demand for radiotherapy to manage the impact of cancer in the countries.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global radiation oncology market

Type

Technology

Application

Regional