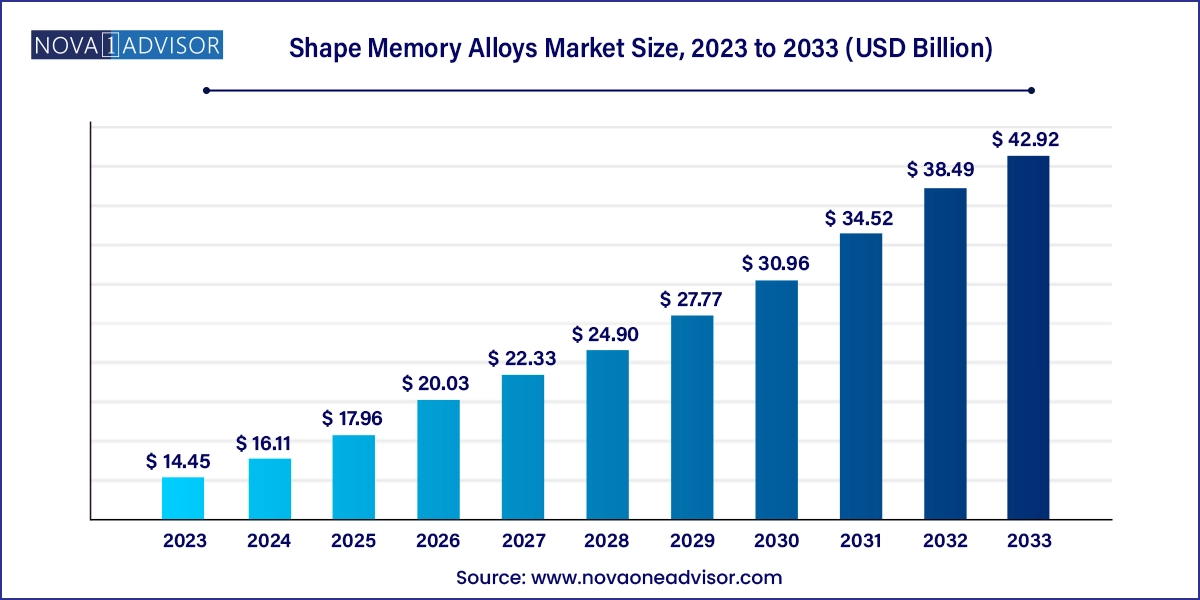

The shape memory alloys market size was exhibited at USD 14.45 billion in 2023 and is projected to hit around USD 42.92 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 16.11 Billion |

| Market Size by 2033 | USD 42.92 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 11.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S., Canada, Mexico, Germany, UK, France, China, India, Japan, Brazil |

| Key Companies Profiled | ATI, Baoji Seabird Metal Material Co., Ltd., Dynalloy, Inc., Fort Wayne Metals Research, Furukawa Electric Co., Ltd., Johnson Matthey, Mishra Dhatu Nigam Limited (MIDHANI), Nippon Seisen Co., Ltd., Nippon Steel Corporation, SAES Group |

Rising investment in healthcare within the biomedical industry is expected to drive the need for shape memory alloys. As per the United Nations, the global population is expected to reach around 9.7 billion by 2050. With such a rapid increase in population, healthcare expenditure is also expected to witness incessant growth. To develop new medical devices, many companies have increased their R&D expenses on novel materials such as nickel-titanium (nitinol) alloys.

Shape-memory alloy (SMA) is a specialized type of alloy capable of being deformed at low temperatures and reverting to its original, pre-deformed shape when subjected to heat.

Nitinol alloys are the most extensively used SMAs, especially in the healthcare sector. Nitinol is extensively utilized in medical components such as catheters, stents, and retrieval baskets owing to its shape memory and biocompatibility. These properties make it ideal for in-body applications as it can easily return to its original shape and is safe for human tissue.

“By product segmentation, nickel-titanium held the largest revenue share of over 88% in 2023.”

Based on product, the market for shape memory alloys is segmented into nickel-titanium alloys (nitinol), copper-based alloys, and others. Increasing investments in R&D to develop advanced nitinol products such as specialty guidewire, wire stents, and micro-coils is driving segment growth. Self-expanding stents made from nitinol are used to treat peripheral vascular diseases.

The copper-based alloys segment is also anticipated to register lucrative growth. This is attributed to the increasing use of copper-based alloys in safety valves, actuators, couplings, and fluid connectors. Copper-based alloys include copper-zinc-aluminum (CuZnAl) and copper-aluminum. CuZnAl is relatively less expensive compared to other materials.

The others segment includes Nickel Manganese Gallium (NiMnGa), Cobalt Nickel Gallium (CoNiGa), and iron-based alloys. They are now being explored due to the limited temperature range and high manufacturing costs. Increasing demand from high-temperature alloys for industrial applications is likely to contribute to the segment’s growth.

“Biomedical accounted for the highest revenue share of over 68% in 2023.”

Biomedical segment’s market share is attributed to the excellent biocompatibility and computer tomography compatibility of SMEs. Rising demand for SMEs in orthodontics, endodontics, orthopedics, and neurosurgery is driving the segment. In addition, increasing healthcare expenditure across the globe will boost segment growth over the forecast period. According to the U.S. Centers for Medicare & Medicaid Services, the National Health Expenditure grew to 4.1% in 2022 from 2021, reaching USD 4.5 trillion. It is expected to grow to 5.6% from 2024 to 2033.

Further, the rising demand for enhanced performance, safety, and comfort in modern vehicles is contributing to the development of advanced actuators, sensors, and microcontrollers. Growing adoption of shape memory effect over conventional actuators, such as pneumatic and hydraulic systems, is driving the segment growth.

The aerospace and defense sector is also one of the key consumers of SMAs. These products are used as sensors, actuators, or structural members. Many government and private institutes have contributed heavily to the research and development of SMAs over the years. For instance, NASA has been working on SMA products for more than a decade on testing infrastructure, new alloys, and modeling tools.

“The U.S. held over 25% revenue share of the global shape memory alloys market.”

The North America shape memory alloys market held a global revenue share of over 35% in 2023. The region has a well-established medical and healthcare industry, resulting in the demand for technologically advanced biomedical equipment. This is one of the factors fueling the growth of SMAs in the region.

U.S. Shape Memory Alloys Market Trends

The shape memory alloys market in the U.S. is driven by increasing healthcare expenditure in the country coupled with growing obesity among the population. According to the latest study by the Centers for Disease Control and Prevention, 4 out of every 10 Americans are obese. Obesity increases the risk of heart attacks and other cardiovascular diseases. SMAs are used extensively in stents to support weakened or narrowed blood vessels.

The shape memory alloys market in Europe is anticipated to register a CAGR of 11% over the forecast period. Europe is a forerunner in green energy and sustainability initiatives to curb carbon and greenhouse gas emissions caused by various industrial activities and electricity generation through conventional sources.

Germany shape memory alloys market is recognized globally for its automotive, manufacturing, and engineering industries. SMAs are used in vehicles to improve their fuel efficiency, reduce their emissions, and increase vehicle safety. Growth in end use industries is thus expected to augment SMA growth in Germany over the coming years.

The shape memory alloys market in the UK is driven by the use of SMAs in smart home technologies and adaptive architectural elements. For instance, SMA actuators can be integrated into window systems and climate control devices to improve energy efficiency. Growing construction spending in the UK construction industry is anticipated to augment market growth.

The shape memory alloys market in Asia Pacific is expected to grow at a CAGR of 11.6% across the forecast period. The region is undergoing significant infrastructural development in railways, roadways, industrial, commercial, and residential sectors. Furthermore, globalization has made the region a lucrative place for investment to aid the development of the economy while catering to a larger population. Asia Pacific also boasts a large aerospace and defense industry, creating novel opportunities for SMAs to be incorporated.

The China shape memory alloys market is fueled by the rapid expansion of the consumer electronics market, owing to the availability of low-cost labor, which is a significant driver for the adoption of SMAs. As one of the world's largest consumer electronics markets, the demand for compact, efficient actuators and sensors is increasing in China.

The shape memory alloys market in India is expected to witness robust growth through the forecast period. This can be attributed to the growing aerospace & defense, automotive, and consumer electronics sectors. Companies are increasingly setting up their factories in the country, owing to governmental initiatives such as Make in India, which attract investments in the country.

Central & South America Shape Memory Alloys Market Trends

The shape memory alloys market in Central & South America is advancing at a promising growth rate, owing to the ongoing development in the electronics and automotive industries. The favorable upturn in economic indicators within the region has notably augmented consumers' purchasing power, consequently exerting a positive influence on the expansion of the shape memory alloys market.

Middle East & Africa Shape Memory Alloys Market Trends

The Middle East & Africa shape memory alloys market is expected to be an emerging market for medical devices over the next couple of years. The flourishing healthcare sector in countries such as Saudi Arabia, Qatar, and other GCC countries will likely boost the use of SMAs in biomedical applications over the forecast period.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the shape memory alloys market

Product

End Use

Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Information Analysis

1.3.2. Market Formulation & Data Visualization

1.3.3. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segmental Outlook

2.3. Competitive Outlook

Chapter 3. Market Variables, Trends, and Scope

3.1. Market Outlook

3.2. Penetration & Growth Prospect Mapping

3.3. Value Chain Analysis

3.3.1. Raw Material Outlook

3.3.2. Distribution Channel Analysis

3.3.3. Vendor Selection Criteria

3.4. Manufacturing and Technology Trends

3.5. Regulatory Framework

3.6. Market Dynamics

3.6.1. Market Driver Analysis

3.6.2. Market Restraint Analysis

3.6.3. Industry Challenges

3.7. Porter’s Five Forces Analysis

3.7.1. Bargaining Power of Suppliers

3.7.2. Bargaining Power of Buyers

3.7.3. Threat of Substitution

3.7.4. Threat of New Entrants

3.7.5. Competitive Rivalry

3.8. PESTLE Analysis

3.8.1. Political

3.8.2. Economic

3.8.3. Social Landscape

3.8.4. Technology

3.8.5. Environmental

3.8.6. Legal

Chapter 4. Shape Memory Alloys Market: Product Estimates & Trend Analysis

4.1. Shape Memory Alloys Market: Product Movement Analysis, 2024 & 2033

4.2. Nickel-Titanium Alloys

4.2.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

4.3. Copper-Based Alloys

4.3.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

4.4. Others

4.4.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

Chapter 5. Shape Memory Alloys Market: End Use Estimates & Trend Analysis

5.1. Shape Memory Alloys Market: End Use Movement Analysis, 2024 & 2033

5.2. Biomedical

5.2.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

5.3. Automotive

5.3.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

5.4. Aerospace & Defense

5.4.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

5.5. Consumer Electronics & Household

5.5.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

5.6. Others

5.6.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

Chapter 6. Shape Memory Alloys Market: Regional Estimates & Trend Analysis

6.1. Regional Analysis, 2024 & 2033

6.2. North America

6.2.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

6.2.2. Market estimates and forecasts, by product, 2021 - 2033 (USD Million)

6.2.3. Market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

6.2.4. U.S.

6.2.4.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

6.2.4.2. Market estimates and forecasts, by product, 2021 - 2033 (USD Million)

6.2.4.3. Market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

6.2.5. Canada

6.2.5.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

6.2.5.2. Market estimates and forecasts, by product, 2021 - 2033 (USD Million)

6.2.5.3. Market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

6.2.6. Mexico

6.2.6.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

6.2.6.2. Market estimates and forecasts, by product, 2021 - 2033 (USD Million)

6.2.6.3. Market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

6.3. Europe

6.3.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

6.3.2. Market estimates and forecasts, by product, 2021 - 2033 (USD Million)

6.3.3. Market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

6.3.4. Germany

6.3.4.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

6.3.4.2. Market estimates and forecasts, by product, 2021 - 2033 (USD Million)

6.3.4.3. Market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

6.3.5. UK

6.3.5.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

6.3.5.2. Market estimates and forecasts, by product, 2021 - 2033 (USD Million)

6.3.5.3. Market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

6.3.6. France

6.3.6.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

6.3.6.2. Market estimates and forecasts, by product, 2021 - 2033 (USD Million)

6.3.6.3. Market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

6.4. Asia Pacific

6.4.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

6.4.2. Market estimates and forecasts, by product, 2021 - 2033 (USD Million)

6.4.3. Market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

6.4.4. China

6.4.4.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

6.4.4.2. Market estimates and forecasts, by product, 2021 - 2033 (USD Million)

6.4.4.3. Market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

6.4.5. India

6.4.5.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

6.4.5.2. Market estimates and forecasts, by product, 2021 - 2033 (USD Million)

6.4.5.3. Market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

6.4.6. Japan

6.4.6.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

6.4.6.2. Market estimates and forecasts, by product, 2021 - 2033 (USD Million)

6.4.6.3. Market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

6.5. Central & South America

6.5.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

6.5.2. Market estimates and forecasts, by product, 2021 - 2033 (USD Million)

6.5.3. Market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

6.6. Middle East & Africa

6.6.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

6.6.2. Market estimates and forecasts, by product, 2021 - 2033 (USD Million)

6.6.3. Market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

Chapter 7. Competitive Landscape

7.1. Recent Developments, By Key Market Participants

7.2. Kraljic Matrix

7.3. Company Market Ranking

7.4. Vendor Landscape

7.4.1. List of Raw Material Suppliers

7.4.2. List of Distributors & Channel Partners

7.5. List of Prospective End Users

7.6. Strategy Mapping

7.7. Company Profiles/Listing

7.7.1. ATI

7.7.1.1. Company Overview

7.7.1.2. Financial Performance

7.7.1.3. Product Benchmarking

7.7.2. SAES Group

7.7.2.1. Company Overview

7.7.2.2. Financial Performance

7.7.2.3. Product Benchmarking

7.7.3. Nippon Steel Corporation

7.7.3.1. Company Overview

7.7.3.2. Financial Performance

7.7.3.3. Product Benchmarking

7.7.4. Furukawa Electric Co., Ltd.

7.7.4.1. Company Overview

7.7.4.2. Financial Performance

7.7.4.3. Product Benchmarking

7.7.5. Johnson Matthey

7.7.5.1. Company Overview

7.7.5.2. Financial Performance

7.7.5.3. Product Benchmarking

7.7.6. Baoji Seabird Metal Material Co., Ltd

7.7.6.1. Company Overview

7.7.6.2. Product Benchmarking

7.7.7. Dynalloy, Inc.

7.7.7.1. Company Overview

7.7.7.2. Product Benchmarking

7.7.8. Fort Wayne Metals Research Products Corp.

7.7.8.1. Company Overview

7.7.8.2. Product Benchmarking

7.7.9. Nippon Seisen Co., Ltd

7.7.9.1. Company Overview

7.7.9.2. Product Benchmarking

7.7.10. Mishra Dhatu Nigam Limited (MIDHANI)

7.7.10.1. Company Overview

7.7.10.2. Product Benchmarking