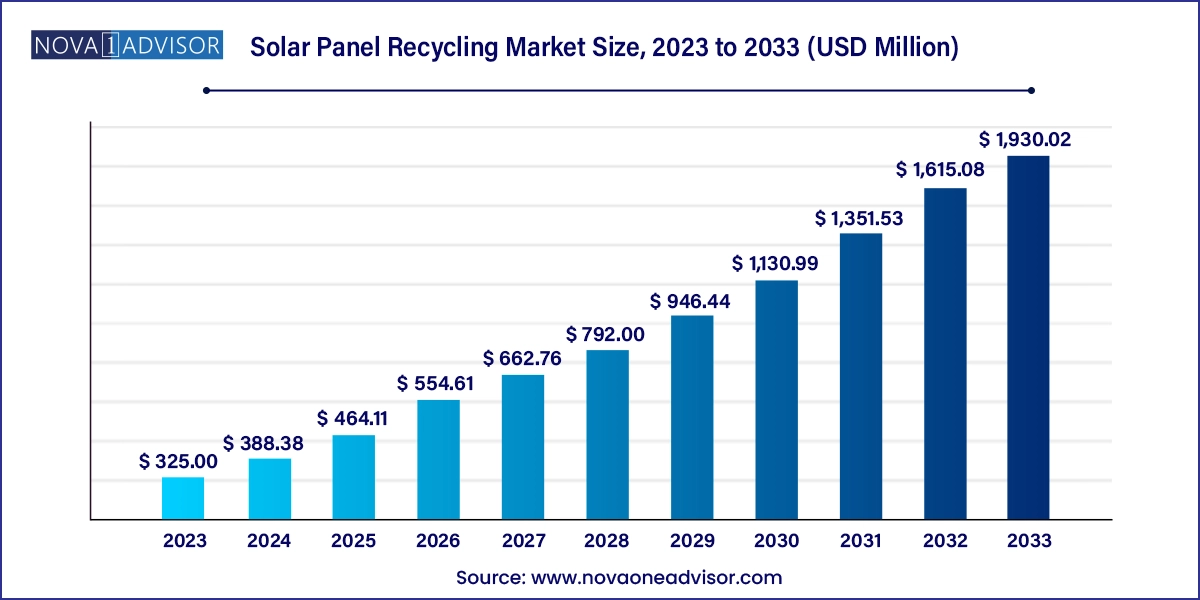

The solar panel recycling market size was exhibited at USD 325.00 million in 2023 and is projected to hit around USD 1,930.02 million by 2033, growing at a CAGR of 19.5% during the forecast period 2024 to 2033. on account of the rising preference for renewable sources of energy tracked by promising environmental standards.

| Report Coverage | Details |

| Market Size in 2024 | USD 388.38 Million |

| Market Size by 2033 | USD 1,930.02 Million |

| Growth Rate From 2024 to 2033 | CAGR of 19.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Process, Product, Shelf life, Regionn |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | The U.S.; Canada; Mexico; The U.K.; Germany; France; China; India; Japan; UAE; Qatar; Brazil |

| Key Companies Profiled | First Solar, Inc.; Echo Environmental, LLC; Silcontel Ltd.; Canadian Solar; Silrec Corp.; SunPower Corp.; Reiling GmbH & Co. KG; Trina Solar; Aurubis; Envaris; SiC Processing GmbH; Yingli Energy Co. Ltd.; Hanwha Group |

Continuous technical advancement with cost efficiency will prompt the adoption of solar panels, which, in turn, will enhance the market outlook. Moreover, growing awareness among customers about the benefits of sustainable sources of energy and subsidies provided by the provincial governments will balance the market scenario. The degradation of the environment coupled with the global energy crisis caused by the conventional energy sources that include nuclear energy and fossil fuels is expected to drive the demand for renewable sources of energy over the projection period.

Transitioning trend towards renewable energy resources owing to its least effect on the environment is likely to enhance the market growth. Furthermore, the declining prices of solar panels are expected to increase the number of installations of solar photovoltaic modules, thereby supporting market growth. The U.S. market is anticipated to witness significant growth over the forecast period due to extensive R&D along with the increasing number of installations of photovoltaic modules. The waste generated at the end of life of the photovoltaic modules is subject to recycle to reuse the ingredients, such as glass and silicon. The demand for solar panels is growing as they are eco-friendly and cost-effective.

In China, the COVID-19 epidemic has paralyzed the demand for power generation, which delayed the growth of the country’s solar panel recycling market. Besides, the country is observing a trend of the addition of low capacities as the manufacturing and construction work is being stopped. Hence, various market players are now considering substitute sourcing to stay in the industry.

The mechanical process accounted for the largest revenue share of more than 59% in 2023 and is likely to expand further at a significant growth rate from 2024 to 2033. However, the laser process segment is estimated to register the fastest CAGR, both in terms of revenue and volume, over the forecast period. The thermal process has a limited acceptance scope but is projected to gain broader adoption during the estimated period owing to a decrease in silicon content in solar panels.

The early loss segment accounted for over USD 102.3 million in 2023. Various government standards and regulations to encourage solar panel recycling and renewable energy projects to preserve ecological balance are expected to foster market growth throughout the forecast years. Major companies in the market are continuously determined towards technical advancements to surge the service quality and efficiency.

The degradation or early weathering of solar panels due to maintenance issues, lack of product standardization, and unfavorable weather conditions is the primary factor contributing to the larger share of the segment in the market. In terms of volume, the normal loss segment is anticipated to witness a significant in the coming years. Since solar panels’ normal shelf life is considered approximately 30 years, they will need to be condensed inactive owing to issues related to maintenance.

The monocrystalline solar panel recycling product type accounted for the largest revenue share of over 55% in 2023. Although monocrystalline panels are costly, they are extensively used on account of high heat tolerance, longer shelf life, and high efficiency. These panels are manufactured with sole crystalline silicon.

Thin film solar panels are projected to appear as the fastest-growing product segment over the projection period owed to active performance and low cost of these panels. Extensive R&D has led to the development of lightweight, low-cost thin film solar modules with properties, such as flexibility and temperature resistance. These kinds of products allow mass manufacture due to their cost efficacy.

Europe accounted for the largest revenue share in 2023. It is estimated to expand further at a significant growth rate from 2024 to 2033 as the region has the maximum number of installed bases of solar farms that would lead to huge numbers of end-of-life solar panels in the upcoming years. The presence of large quantities of end-of-life solar panels is estimated to result in an increase in solar panel waste. Thus, the demand for solar panel recycling is anticipated to rise over the coming years.

In Germany, the market is set to exceed over USD 70.0 million by 2027 owing to technological advancements as well as exhaustive government regulations for waste management. The growing use of solar panels for power generation as an alternative of other non-eco-friendly sources is projected to spur the product demand over the next seven years.

The Asia Pacific is projected to be the fastest-growing regional market from 2024 to 2033. China and Japan are the major revenue generators in the APAC regional market. At present, China accounts for the maximum number of patent filings in solar panel recycling owing to growing investments in research and development of recycling technology.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the solar panel recycling market

Process

Product

Shelf Life

Regional