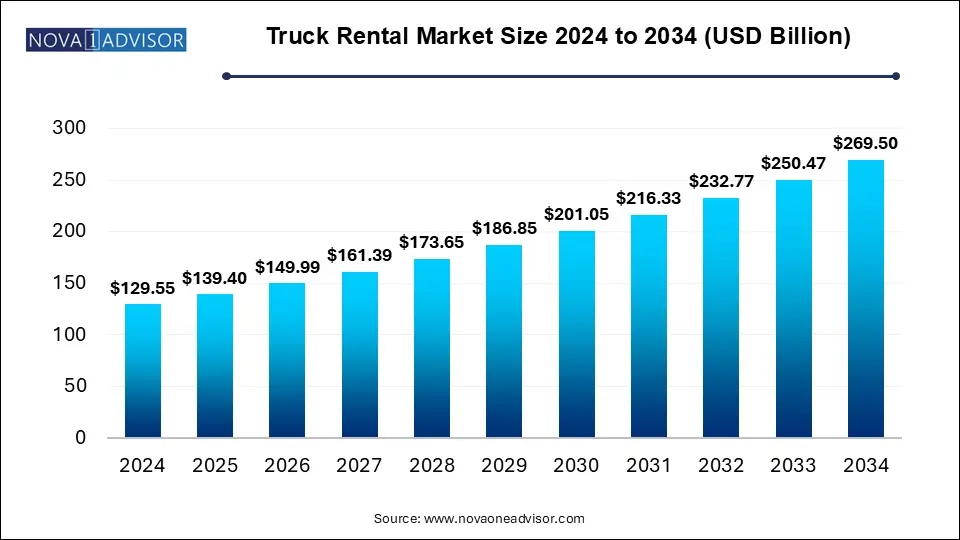

The truck rental market size was exhibited at USD 129.55 billion in 2024 and is projected to hit around USD 269.5 billion by 2034, growing at a CAGR of 7.6% during the forecast period 2025 to 2034.

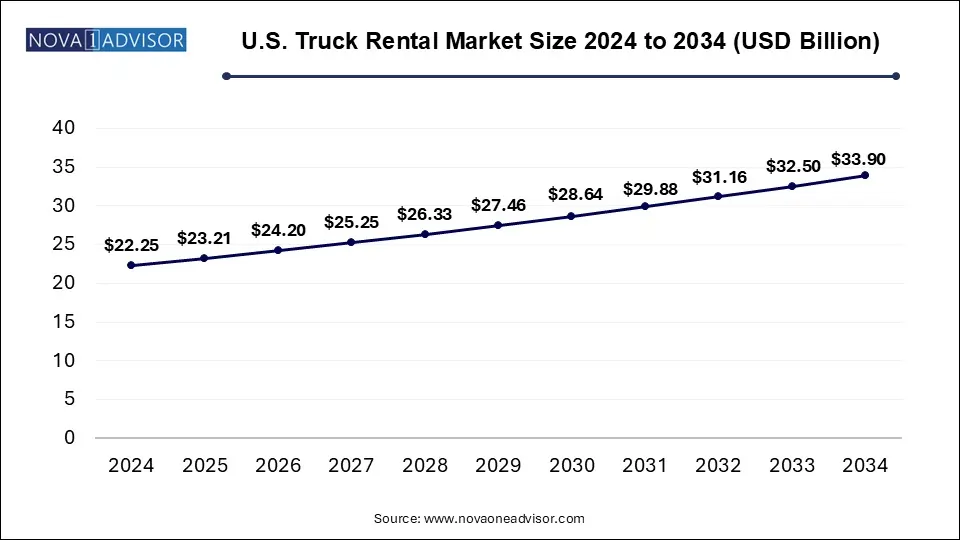

The U.S. truck rental market size was valued at USD 22.25 billion in 2024 and is expected to reach around USD 33.9 billion by 2034, growing at a CAGR of 4.3% from 2025 to 2034.

In 2024, North America held a substantial share of the global truck rental market. The increasing demand for urban deliveries, fueled by the rapid growth of e-commerce and on-demand services, is a key factor driving market expansion. Urban areas across the region are facing rising challenges related to traffic congestion and regulatory restrictions on commercial vehicles. Truck rental services enable businesses to utilize specialized vehicles, including compact trucks and electric models, which are well-suited for city deliveries and compliance with local regulations.

U.S. Truck Rental Market Trends

The U.S. truck rental market is projected to grow at a notable CAGR from 2025 to 2034. The expansion of rental service networks and the diversification of rental offerings are key contributors to this growth. Rental providers are continuously broadening their fleets by incorporating specialized vehicles catering to different industries. Additionally, they are enhancing customer services by offering maintenance, support, and flexible rental options.

Europe Truck Rental Market Trends

The European truck rental market is anticipated to experience significant growth between 2025 and 2034. Strict environmental policies and emission regulations across European nations are shaping market dynamics. Governments are implementing stringent sustainability measures to reduce air pollution and encourage the adoption of cleaner transportation solutions. In response, truck rental companies are upgrading their fleets with low-emission and eco-friendly vehicles to comply with evolving environmental standards.

Asia Pacific Truck Rental Market Trends

In 2024, the Asia Pacific truck rental market accounted for the largest share, representing 40.0% of the global market. The rapidly expanding e-commerce sector is a primary driver of market growth in the region. As online shopping continues to surge, the demand for efficient and scalable last-mile delivery solutions is rising. Truck rental services provide e-commerce businesses with flexible transportation options, allowing them to adjust delivery capacities based on fluctuating demand, particularly during peak shopping periods such as holiday seasons and promotional events.

The truck rental market is experiencing steady growth, driven by increasing demand for flexible and cost-effective transportation solutions across various industries. Businesses and individuals are opting for rental trucks as an alternative to ownership, allowing them to manage logistics needs without the long-term financial commitment of purchasing a fleet.

One of the key drivers of the market is the expansion of the e-commerce industry. The rise in online shopping has intensified the need for efficient last-mile delivery services, leading to a growing demand for short-term truck rentals, particularly in urban areas. Additionally, rental trucks provide scalability for businesses, enabling them to adjust their fleet size based on seasonal demand fluctuations.

The construction and infrastructure sectors also contribute significantly to market growth. Governments and private entities are investing in large-scale projects, requiring transportation for raw materials, machinery, and equipment. Renting trucks offers construction firms a flexible solution to meet temporary project demands without the burden of fleet maintenance and depreciation costs.

| Report Coverage | Details |

| Market Size in 2025 | USD 139.4 Billion |

| Market Size by 2034 | USD 269.5 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 7.6% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Truck, Duration, Propulsion, Service Provider, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Enterprise Holdings, Inc.; The Hertz Corporation.; Penske; Ryder System, Inc.; Avis Rent A Car System, LLC; NationaLease; Daimler Truck AG; United Rentals, Inc.; Bush Truck Leasing; and Kenworth Sales Company |

The light-duty truck segment led the market in 2024, capturing a 70.0% share of global revenue. The growing demand for practical transportation solutions among small businesses and local enterprises has fueled this segment's expansion. Light-duty trucks are especially beneficial for businesses like local delivery services, food vendors, and tradespeople, who need reliable, easy-to-handle vehicles for transporting goods or equipment within a limited geographic area. The affordability and widespread availability of these trucks through rental services enable businesses to operate efficiently without the financial strain of purchasing a vehicle.

The heavy-duty truck segment is expected to witness substantial growth from 2025 to 2034. The increasing complexity of supply chains and the expansion of global trade are driving the demand for heavy-duty trucks in the rental sector. These trucks play a crucial role in transporting large volumes of cargo over long distances. Many logistics companies prefer renting heavy-duty trucks to accommodate peak demand periods, seasonal variations, or specific contractual obligations, contributing to this segment's rising prominence in the truck rental industry.

The short-term rental segment dominated the market in 2024. The rapid expansion of the gig economy and the rise of independent contractors in the logistics and transportation sectors have significantly contributed to the growth of short-term truck rentals. Freelance drivers, moving companies, and on-demand delivery providers often opt for short-term rentals to meet specific job needs. The gig economy’s focus on flexibility and real-time service demand aligns seamlessly with the short-term rental model, driving its continued expansion.

The long-term rental segment is projected to experience substantial growth between 2025 and 2034. The primary factor fueling this trend is the ability to minimize the financial impact of vehicle depreciation. Owning a fleet comes with the risk of asset devaluation, which can negatively affect a company’s financial standing. Long-term rentals shift the depreciation burden to the rental provider, allowing businesses to use trucks as needed without concerns about resale value. This enables companies to focus on their core operations while maintaining an optimized fleet.

The internal combustion engine (ICE) truck segment held the largest market share in 2024. This dominance is attributed to the well-established infrastructure supporting ICE trucks, including widespread refueling stations and maintenance services. The extensive availability of these facilities makes ICE trucks a convenient and reliable choice for businesses that depend on seamless transportation operations. As a result, many companies continue to favor ICE trucks due to the familiarity and accessibility of existing infrastructure.

The electric truck segment is anticipated to experience notable growth from 2025 to 2034. The increasing pace of urbanization and the introduction of low-emission zones in major cities are key drivers of this growth. Many urban areas have implemented restrictions on high-pollution vehicles, making electric trucks a preferred choice for businesses operating within these zones. By offering electric truck rentals, rental companies cater to businesses that must comply with evolving environmental regulations, further accelerating the adoption of electric trucks.

The rental and leasing company segment led the market in 2024. The expansion of customer-focused services and enhanced support options have significantly contributed to this segment’s growth. Many rental and leasing firms now provide value-added services, including 24/7 roadside assistance, comprehensive maintenance plans, and customizable leasing solutions tailored to diverse business needs. These improvements in service quality have made rental and leasing options more attractive to businesses looking for reliable and stress-free transportation solutions.

The OEM captives segment is expected to grow considerably between 2025 and 2034. One of the primary factors driving this segment’s expansion is the availability of customized financing solutions, which offer a more appealing alternative to conventional lenders. OEM captives provide businesses with flexible financing terms, including lower interest rates, tailored lease agreements, and payment schedules that align with specific industry needs. These financing benefits help businesses manage cash flow efficiently while reducing the financial strain of acquiring new vehicles. The increasing demand for cost-effective fleet management solutions is propelling the growth of OEM captive financing in the truck rental sector.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the truck rental market

By Truck

By Duration

By Propulsion

By Service Provider

By Regional