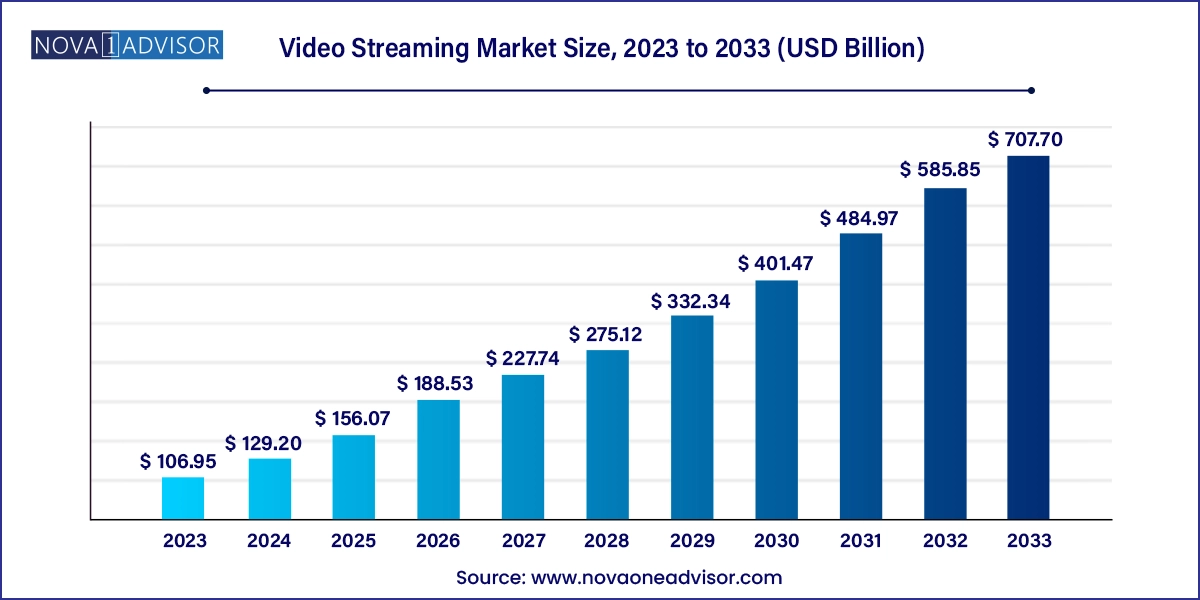

The global video streaming market size was exhibited at USD 106.95 billion in 2023 and is projected to hit around USD 707.70 billion by 2033, growing at a CAGR of 20.8% during the forecast period 2024 to 2033.

The global video streaming market has evolved into a formidable component of the digital economy, driven by advancements in internet infrastructure, increasing penetration of smartphones, and evolving content consumption preferences. This market encompasses all formats of video delivery over the internet, including live broadcasts, on-demand content, and user-generated videos, delivered via platforms ranging from Over-the-Top (OTT) services to Internet Protocol Television (IPTV).

As of 2024, video streaming is no longer limited to entertainment but spans diverse sectors such as education, enterprise communication, fitness, and gaming. With millions of users streaming daily, platforms like Netflix, Amazon Prime Video, YouTube, and Disney+ dominate the consumer space, while enterprise video platforms such as Microsoft Teams and Zoom have transformed workplace collaboration. The surge in remote work and e-learning due to the COVID-19 pandemic has also contributed to long-term behavioral shifts, accelerating the growth of this market.

The proliferation of 5G networks and improvements in data compression technologies have further reduced latency, improved quality (4K and 8K support), and enhanced user experiences. Additionally, emerging technologies like artificial intelligence (AI), machine learning (ML), and blockchain are being integrated to personalize content delivery, optimize bandwidth, and ensure content security.

Estimates suggest that the global video streaming market is poised to surpass a valuation of USD 500 billion by 2034, growing at a double-digit CAGR. This meteoric rise is indicative of a larger shift in consumer behavior, away from traditional cable TV toward a more personalized, on-demand digital experience.

Rise of Original Content and Platform Exclusives: Platforms like Netflix and Amazon Prime Video are heavily investing in original series and films, which serve as unique selling propositions to attract and retain subscribers.

Expansion of Ad-Supported Streaming (AVOD): Free access to high-quality content supported by advertising is gaining momentum, especially in emerging markets with price-sensitive audiences.

Increased Integration with AI and ML: AI is being deployed for personalized content recommendations, intelligent encoding, and audience analytics to boost engagement.

Growing Popularity of Live Streaming: From concerts and sports to influencer-led events, live video is becoming a preferred mode of content delivery on platforms like YouTube Live, Twitch, and Facebook Live.

Cloud-based Infrastructure Adoption: Cloud solutions are being embraced for their scalability, flexibility, and reduced operational costs, enabling smaller players to enter the market.

Multi-platform Accessibility: Consumers increasingly demand content that can be accessed across smart TVs, gaming consoles, mobile phones, and desktop devices seamlessly.

Emergence of Hybrid Monetization Models: Many platforms are blending subscription (SVOD), transactional (TVOD), and ad-supported (AVOD) revenue models to cater to different customer segments.

Localization and Multilingual Content Growth: Platforms are offering content in regional languages with localized subtitles or dubbing to tap into culturally diverse markets.

| Report Coverage | Details |

| Market Size in 2024 | USD 129.20 Billion |

| Market Size by 2033 | USD 707.70 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 20.8% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Streaming Type, Solution, Platform, Service, Revenue Model, Deployment Type, User, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, South America, Middle East & Africa |

| Key Companies Profiled | Akamai Technologies; Amazon Web Services, Inc.; Apple Inc.; Cisco Systems, Inc.; Google LLC; Kaltura, Inc.; Netflix, Inc.; International Business Machine Corporation (IBM Cloud Video); Wowza Media Systems, LLC; Hulu, LLC |

A significant driver behind the growth of the video streaming market is the increasing consumer demand for on-demand entertainment. Unlike traditional cable services, which operate on rigid schedules, video streaming allows viewers to watch content whenever and wherever they want. This flexibility has revolutionized consumer expectations and shifted industry focus toward user-centric, personalized viewing experiences.

The explosion of OTT services such as Disney+, HBO Max, and regional platforms like Hotstar in India and iQIYI in China illustrate this trend. These platforms offer extensive content libraries and original programming, catering to diverse demographics. As more consumers cut the cord with traditional television providers, the convenience and personalization of streaming services are becoming indispensable. Moreover, the proliferation of smart devices and broadband internet has made on-demand streaming accessible even in remote regions.

Despite its growth, the video streaming market faces significant hurdles in content licensing and digital piracy. Acquiring content rights—whether global or regional—can be complex and expensive, often limiting smaller players’ access to high-quality libraries. Furthermore, competition among platforms for exclusive rights has inflated licensing costs, affecting profitability.

Piracy, on the other hand, continues to plague the industry. Despite the availability of affordable subscription models, illegal streaming websites and torrents still attract millions of users. This is exacerbated by limitations in global enforcement and loopholes in digital rights management (DRM) technologies. These issues not only result in revenue losses but also discourage content creators from investing in new projects due to fear of unauthorized distribution.

The global rollout of 5G and advancements in edge computing represent a transformational opportunity for the video streaming market. 5G offers higher data rates, lower latency, and greater network reliability, enabling ultra-high-definition video streaming even in mobile environments. This makes seamless 4K and 8K streaming possible without buffering, greatly enhancing the user experience.

Simultaneously, edge computing allows for content processing closer to the end-user, reducing latency and improving load times. Together, these technologies are set to revolutionize real-time applications such as live sports broadcasting, AR/VR video content, and interactive streaming. Early adopters of 5G and edge infrastructure will likely gain a competitive advantage by offering superior service quality, especially in high-growth urban and suburban markets.

Non-linear video streaming (Video on Demand) dominated the streaming type segment due to the immense popularity of content flexibility and binge-watching culture. With platforms like Netflix, Hulu, and Amazon Prime providing vast libraries of movies, TV shows, documentaries, and original content, users are shifting towards customizable viewing experiences. VOD offers features like download-and-watch later, ad-free content, and multilingual support, making it a preferred choice. Additionally, the affordability of subscription-based models and the expansion of internet access in rural areas continue to fuel the growth of this segment.

Live video streaming is the fastest-growing segment, driven by rising demand for real-time interactions in entertainment, sports, gaming, and corporate events. Platforms such as Twitch, YouTube Live, and Facebook Live have empowered creators and brands to engage audiences directly. In the enterprise domain, live webinars, product launches, and investor meetings conducted via Zoom and Microsoft Teams have become routine. The acceleration of virtual events and digital-first marketing strategies has elevated the relevance of live streaming, which is further enhanced by 5G connectivity and latency improvements.

Over-the-Top (OTT) platforms dominated the solution segment by capturing the largest revenue share, owing to the disruptive business models and global content reach. OTT services offer viewers the autonomy to select and pay for content they want, bypassing traditional distribution channels. Netflix’s success story, which began with mail-order DVDs and evolved into a global entertainment behemoth, exemplifies the power of OTT. These platforms also invest heavily in content analytics, enabling them to tailor content offerings and improve viewer retention.

Internet Protocol TV (IPTV) is experiencing rapid growth, particularly in regions with strong broadband infrastructure like Europe and parts of Asia. IPTV provides a hybrid model offering linear programming with the flexibility of on-demand content. It’s increasingly adopted by telecom operators and ISPs as a value-added service. Innovations in IPTV middleware and integration with smart home ecosystems are helping the segment scale rapidly, especially in urban locales.

Smart TVs dominated the platform segment as they offer built-in apps for popular streaming services and support high-definition content without additional hardware. With brands like Samsung, LG, and Sony embedding proprietary operating systems optimized for streaming, user convenience has skyrocketed. Smart TVs provide synchronized viewing experiences with other devices and voice-assistant compatibility, contributing to their growing adoption in households globally.

Smartphones and tablets are the fastest-growing platforms, mainly due to the increasing consumption of short-form content and mobile-first platforms like TikTok, YouTube, and Instagram Reels. Mobile internet affordability and the convenience of consuming content on the go have made smartphones essential streaming devices. Moreover, the development of mobile-optimized apps and adaptive bitrate streaming ensures a seamless user experience even on lower bandwidths.

Managed services held the dominant position in the services segment due to their role in ensuring high uptime, content delivery optimization, and technical support. Managed service providers offer video encoding, transcoding, analytics, and monitoring solutions, allowing OTT platforms to focus on core competencies. Enterprises also rely on these services to stream townhalls, training modules, and live presentations with minimal IT burden.

Training and support services are growing rapidly, especially as smaller content creators, educational institutions, and SMEs enter the streaming domain. These users often lack in-house capabilities and rely on third-party providers to set up, operate, and troubleshoot video platforms. Demand for these services has surged in the education and healthcare sectors due to telelearning and telemedicine applications.

Subscription-based revenue models dominate the market, with platforms like Netflix, Disney+, and Hulu adopting monthly or yearly plans offering premium content libraries. This model ensures consistent revenue inflow, encourages platform loyalty, and provides a predictable growth path. Users also prefer ad-free experiences and exclusive access to premium shows or early releases.

Advertising-based models are expanding rapidly, driven by the success of AVOD platforms like YouTube, Pluto TV, and Crackle. These models are particularly effective in cost-sensitive markets, where users are unwilling or unable to pay for subscriptions. Brands are also increasingly allocating marketing budgets to digital video ads due to their higher engagement rates and targeting precision.

Cloud deployment dominated the deployment segment, enabling flexibility, cost-efficiency, and real-time scalability. Cloud platforms offer robust CDN (Content Delivery Network) support, uptime guarantees, and auto-scaling capabilities that are critical during high-traffic events. Cloud-native applications also benefit from faster updates and reduced operational overhead.

On-premises deployment is gaining niche traction, especially in sectors requiring stringent security protocols such as defense, education, and government. Institutions managing sensitive content or operating in low-connectivity zones prefer on-prem setups to retain control and ensure data sovereignty.

Consumer users dominate the market with applications spanning real-time entertainment, gaming, and social networking. Platforms like Netflix, Twitch, and YouTube cater to billions of consumers globally, with content formats tailored to individual preferences. Consumer adoption is reinforced by affordable internet plans, smart device proliferation, and cultural shifts toward digital leisure.

The enterprise segment is growing rapidly, especially in training & development and corporate communications. Businesses are increasingly adopting internal video platforms for employee onboarding, knowledge sharing, and leadership communication. The transition to hybrid workplaces has further emphasized the value of reliable video streaming tools in driving employee engagement and productivity.

North America dominates the global video streaming market, driven by mature infrastructure, high disposable incomes, and the presence of market giants like Netflix, Disney+, and Amazon Prime. The U.S. alone contributes significantly to global subscription revenue, bolstered by early adoption of 4K content, smart home devices, and premium OTT services. Furthermore, North American companies are pioneers in developing proprietary content and experimenting with immersive streaming formats such as interactive storytelling and virtual reality.

Asia Pacific is the fastest-growing region, owing to a large and youthful population, rapid urbanization, and rising internet penetration. Countries like India, China, and Indonesia are experiencing exponential growth in video consumption through smartphones. Local players such as Hotstar (India), Tencent Video (China), and Viu (Southeast Asia) are expanding aggressively with regionally relevant content and affordable plans. Government investments in digital infrastructure and the rollout of 5G are expected to further fuel this surge.

Netflix (March 2025) announced plans to expand its gaming platform into Southeast Asia, aiming to capitalize on the region’s mobile gaming and video consumption trends.

Amazon Prime Video (February 2025) revealed its investment in AI-powered dubbing and voice synthesis tools to provide multilingual content at scale.

Disney+ (January 2025) launched an ad-supported tier in European markets to expand user base among price-sensitive audiences.

YouTube (March 2025) began rolling out immersive AR filters for live streamers and creators, boosting interactivity and engagement.

Twitch (April 2025) partnered with Riot Games to offer exclusive live eSports content and rewards, strengthening its hold in the gaming community.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global video streaming market

Streaming Type

Solution

Platform

Service

Revenue Model

Deployment Type

User

Regional