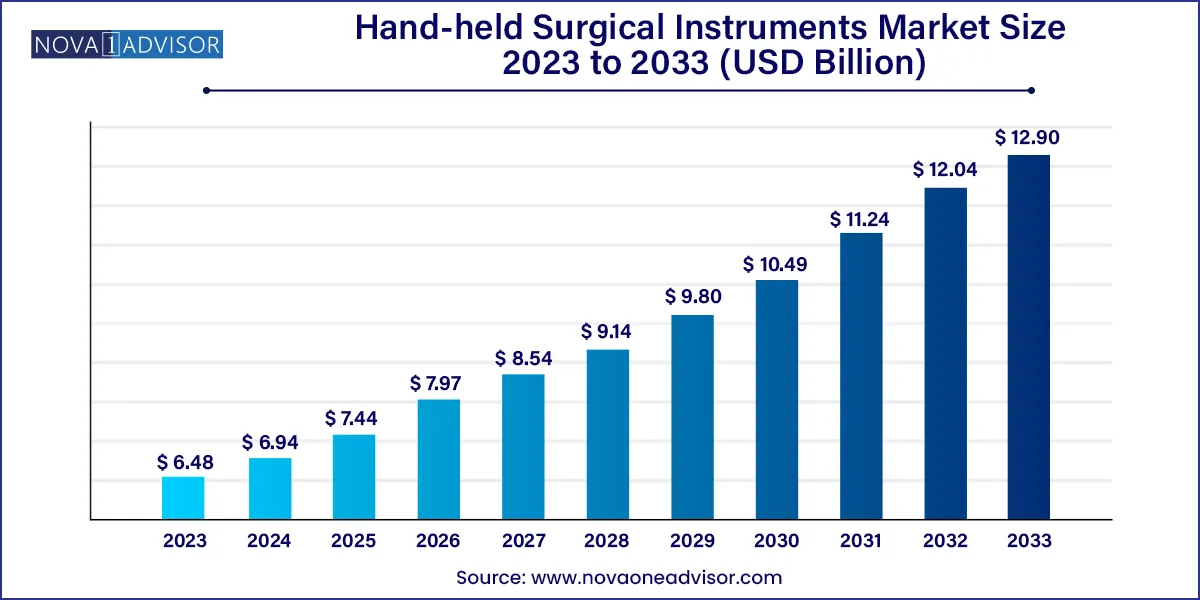

The global hand-held surgical instruments market size was exhibited at USD 6.48 billion in 2023 and is projected to hit around USD 12.90 billion by 2033, growing at a CAGR of 7.13% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 6.94 Billion |

| Market Size by 2033 | USD 12.90 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.13% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | B. Braun Melsungen AG; Integra LifeSciences Corporation; Medtronic; Smith & Nephew; Zimmer Biomet Holdings; Johnson & Johnson Services, Inc.; Becton, Dickinson and Company; CooperSurgical, Inc.; Thompson Surgical Instruments Inc.; Aspen Surgical. |

Rising prevalence of chronic disorders, such as cardiovascular, urological, neurological and infectious diseases are key factors driving the market. In addition, growing geriatric population prone to various diseases is expected to indirectly propel the uptake of these instruments. The COVID-19 pandemic had a significant negative impact on the hand-held surgical instruments market. The lockdowns, restrictions and guidelines led down by government authorities across the globe in order to curb the spread of the COVID-19 virus led to a sudden downfall in the sales of hand-held surgical instruments.

The healthcare guidelines led by the authorities suggested postponement of elective surgical procedures in order to avoid any potential compromise on hospital and intensive care unit capacity and shortages in personal protective equipment. However, with the situation finally being under control in second half of the pandemic, hospitals and other settings started performing surgical procedures in full volume. This has helped the market to recover in 2021. Significant backlogs in surgical procedures and increasing demand for elective surgeries is further expected to surge the demand for hand-held surgical instruments market.

As compared to other chronic disorders, prevalence of heart disorders is increasing worldwide due to lack of physical activities, overweight, smoking, poor nutrition, or family history. Other risk factors for cardiovascular disorders comprise diabetes, hypertension, or hyperlipidemia. According to CDC, about 20.1 million adults aged 20 and older had coronary artery disease in 2020. People aged 60 and above are at a high risk of diseases such as cardiovascular, orthopedic, and neurological diseases. Thus, increase in geriatric population is expected to boost the demand for handheld surgical equipment. In addition, increase in the number of road accidents is one of the high-impact rendering factors leading to increase in the demand for handheld surgical instruments.

Increasing number of surgical procedures along with growing demand for aesthetic surgeries is another driver of the hand-held surgical instruments market. Procedures, such as breast surgery, eyelid, liposuction, nose reshaping, tummy tuck surgeries have been witnessing high demand in over the past few years, which is propelling the uptake of hand-held surgical instruments, thereby driving the market.

Growing innovations in the surgical instruments and increasing adoption of advanced devices by surgeons is also predicted to drive the hand-held surgical instruments market over the forecast period. Surgeons are constantly focusing on using superior quality instruments that would allow them to perform surgeries smoothly and speedily with no compromise on the patient’s health. One such innovative surgical instrument is technologically improved powered screwdriver specially designed for extremely sensitive surgeries. It has sensors incorporated with software that offers intelligence to the surgeon.

The forceps segment held the highest market share in 2023 of 19.6% owing to its increasing usage. The rise in usage is attributable to its advantages, such as; it helps in eliminating the need for holding minute objects with hands and avoid contamination.

However, the retractors segment is expected to experience maximum growth with a CAGR of 9.4% over the forecast periodowing to advancements in retractors for different types of surgeries. For instance, in September 2021, a trauma surgeon invented the TITAN CSR, a unique retractor that combines both ample exposure and speed. The product does not need to be mounted on the table and can be set up in about 6 seconds without losing any functionality.

Orthopedic surgery segment held highest market share of 18.4% in 2023 due to factors such as; high incidence of Musculoskeletal (MSK) ailments and increasing developments in minimally invasive surgeries. According to a research article by WHO published in July 2023, approximately 1.71 billion people have MSK conditions globally. It is the leading cause of disability worldwide, which hampers an individual’s productivity.

The plastic surgery segment is expected to be the fastest growing segment with a CAGR of 7.7% over the forecast period. Factors such as technological advancements in plastic surgery that has made it safer and reduced the recovery time as well as the cost of procedure have led to growing popularity of plastic surgeries. Individuals are now not that reluctant to undergo plastic surgery with fear as they would be before. Moreover, growing disposable income and the rising influence of social media are factors that are further driving the growth of this segment over the forecast period. For instance, according to the American Academy of Facial Plastic and Reconstructive Surgery, an estimated 1.4 million surgical and non-surgical procedures were performed in 2020. This indicated a 40 percent increase even though most countries were hit with the COVID-19 pandemic.

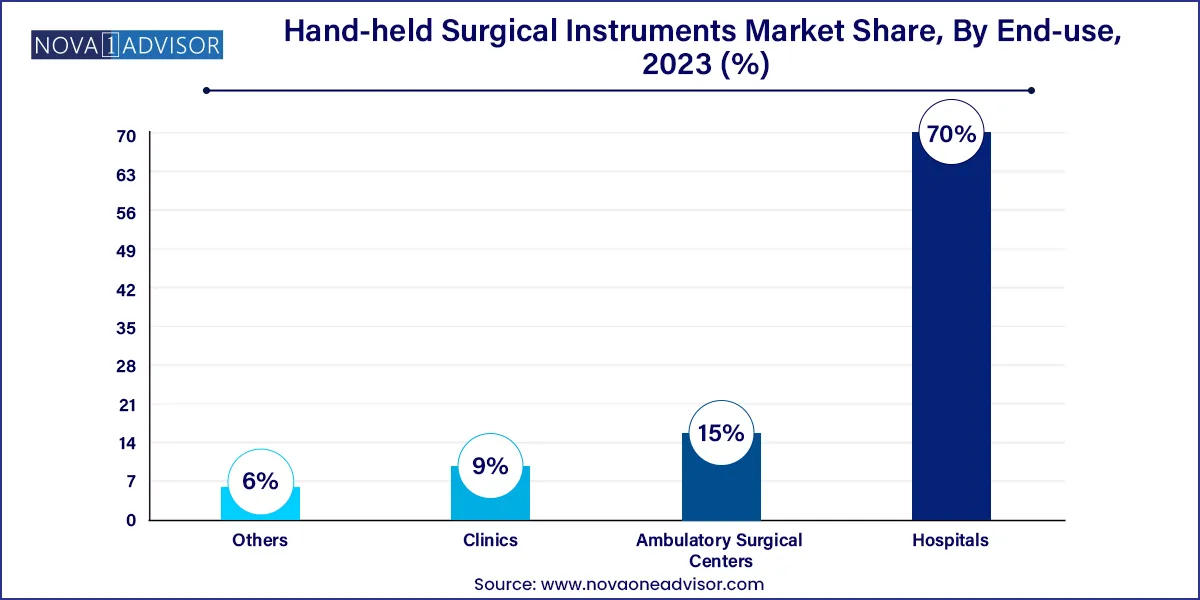

The hospitals segment held for highest revenue share in 2023 of 70.0% owing large number of cases and preventive surgeries being performed in these settings. In addition, availability of all the types of surgical instruments and skilled professionals is expected to fuel the segment growth. Rising number of admissions due to increasing number of chronic disorders is also expected to propel the segment growth over the forecast period. With increase in the number of procedures, such as angioplasty and kidney & liver transplants, and incidence of trauma, the demand for surgical equipment has significantly increased in hospitals.

The ambulatory surgical centers segment is expected to gain maximum growth over the forecast period. This is due to growing popularity of aesthetic or cosmetic surgeries being carried out in ambulatory surgical centers. Moreover, it offers advantages like reduced cost by curtailing the overall patient stay post the procedure. Thus, making it a perfect option for individuals that do not need prolonged hospital stay, thereby fueling the market demand.

The clinics segment is also expected to experience significant growth over the forecast period due to in the number of dental and orthopedic specialty clinics across the globe. Global rise in prevalence of melanoma and skin cancer has led to a latent increase in number of patients visiting dermatology clinics for treatment and care. Moreover, sprains, osteoporosis, cartilage tears, fractures, strains, osteoarthritis, and ankle arthritis are usually treated at orthopedic clinics as they offer expert advice and skill with respect to orthopedics. As orthopedic clinics cater to the needs of patients and provide customized services, they are being preferred over hospitals that usually cater to a wide range of disorders and diseases.

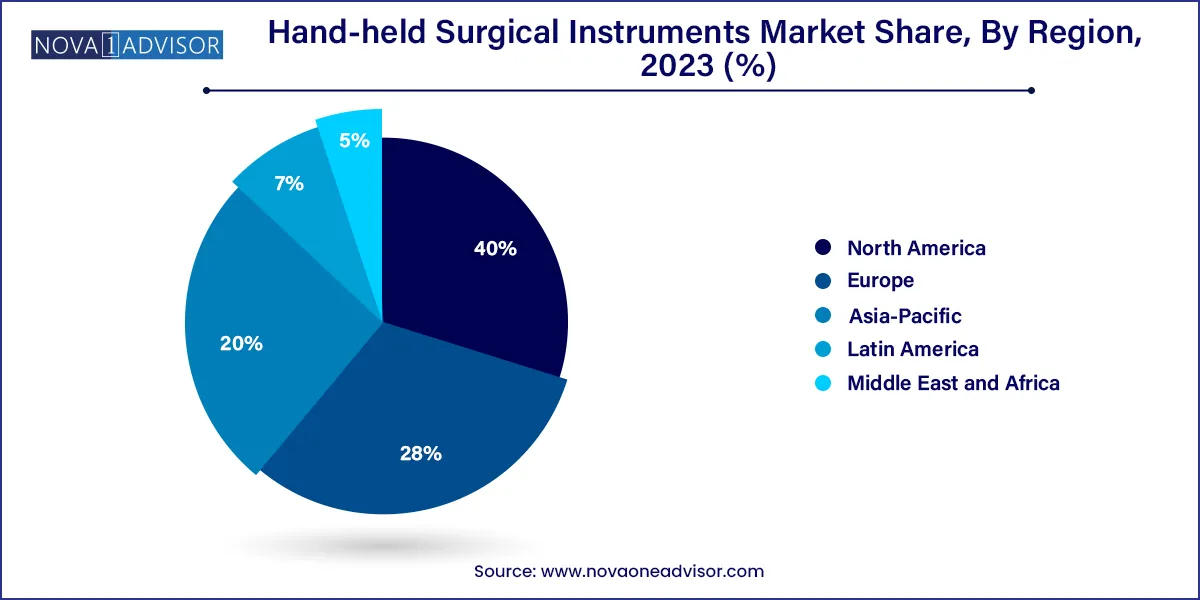

North America dominated the global hand-held surgical instrument market with an overall market share of 40.0% in 2023. Increasing prevalence of neurological, cardiovascular, cancer and autoimmune disorders is the key factor driving the market growth in this region. Some of the common surgeries performed in North America include circumcision, C-section, cataract removal, joint replacement, gallbladder removal, angioplasty, broken bone repair and cardiovascular disorders. According to research article published in the Journal of the American Medical Association, the U.S. had more than 13 million U.S. surgical procedures from the start of 2019 to Jan 30th, 2021.

Europe is expected to capture the second position owing to increasing demand for safe surgical instruments that are used in minimally invasive surgeries. Growing demand for less time consuming and cost-effective medical solutions are also expected to augment the demand for hand-held surgical instruments, thereby driving the market. According to WHO, the European region has the highest burden of non-communicable diseases and is expected to grow at a high rate in the near future.

Asia Pacific is expected to witness lucrative growth owing to growing population, high prevalence of chronic disorders, and increasing spending power of consumers. In addition, growing medical tourism in the developing economies due to lower cost of procedures as compared to other developed countries is driving the growth of the market in the Asia Pacific region. According to the Malaysia Healthcare Travel Council, a coronary artery bypass graft that would cost $92,000 in the United States costs less than $10,000 in India.

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global hand-held surgical instruments market.

Product

Application

End-use

By Region

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.1.1. Product

1.1.2. Application

1.1.3. End-Use

1.1.4. Regional scope

1.1.5. Estimates and forecast timeline

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.3.5.1. Data for primary interviews in North America

1.3.5.2. Data for primary interviews in Europe

1.3.5.3. Data for primary interviews in Asia Pacific

1.3.5.4. Data for primary interviews in Latin America

1.3.5.5. Data for Primary interviews in MEA

1.4. Information or Data Analysis

1.4.1. Data analysis models

1.5. Market Formulation & Validation

1.6. Model Details

1.6.1. Commodity flow analysis (Model 1)

1.6.2. Approach 1: Commodity flow approach

1.6.3. Volume price analysis (Model 2)

1.6.4. Approach 2: Volume price analysis

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

1.9.1. Objective 1

1.9.2. Objective 2

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Product Outlook

2.2.2. Application Outlook

2.2.3. End-use Outlook

2.2.4. Regional Outlook

2.3. Competitive Insights

Chapter 3. Hand-held Surgical Instruments Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Penetration & Growth Prospect Mapping

3.3. Industry Value Chain Analysis

3.3.1. Reimbursement framework

3.4. Market Dynamics

3.4.1. Market driver analysis

3.4.1.1. Increasing prevalence of chronic diseases

3.4.1.2. Increasing geriatric population

3.4.1.3. Rise in the number of road accidents

3.4.1.4. Rise in number of surgical procedures

3.4.2. Market restraint analysis

3.4.2.1. Increase in the number of minimally invasive and non-invasive procedures

3.4.3. Industry challenges

3.5. Hand-held Surgical Instruments Market Analysis Tools

3.5.1. Industry Analysis - Porter’s

3.5.1.1. Supplier power

3.5.1.2. Buyer power

3.5.1.3. Substitution threat

3.5.1.4. Threat of new entrant

3.5.1.5. Competitive rivalry

3.5.2. PESTEL Analysis

3.5.2.1. Political landscape

3.5.2.2. Technological landscape

3.5.2.3. Economic landscape

3.5.3. Major Deals & Strategic Alliances Analysis

3.5.4. Market Entry Strategies

Chapter 4. Hand-held Surgical Instruments Device: Product Estimates & Trend Analysis

4.1. Definitions and Scope

4.1.1. Forceps

4.1.2. Retractors

4.1.3. Dilators

4.1.4. Graspers

4.1.5. Scalpels

4.1.6. Cannulas

4.1.7. Dermatome

4.1.8. Trocars

4.1.9. Others

4.2. Product Market Share, 2024 & 2033

4.3. Segment Dashboard

4.4. Global Hand-held Surgical Instruments Market by Product Outlook

4.5. Market Size & Forecasts and Trend Analyses, 2021 to 2033 for the following

4.5.1. Forceps

4.5.1.1. Market estimates and forecast 2021 - 2033

4.5.2. Retractors

4.5.2.1. Market estimates and forecast, 2021 - 2033

4.5.3. Dilators

4.5.3.1. Market estimates and forecast, 2021 - 2033

4.5.4. Graspers

4.5.4.1. Market estimates and forecast, 2021 - 2033

4.5.5. Scalpels

4.5.5.1. Market estimates and forecast, 2021 - 2033

4.5.6. Cannulas

4.5.6.1. Market estimates and forecast, 2021 - 2033

4.5.7. Dermatomes

4.5.7.1. Market estimates and forecast, 2021 - 2033

4.5.8. Trocars

4.5.8.1. Market estimates and forecast, 2021 - 2033

4.5.9. Others

4.5.9.1. Market estimates and forecast, 2021 - 2033

Chapter 5. Hand-held Surgical Instruments: Application Estimates & Trend Analysis

5.1. Definitions and Scope

5.1.1. Orthopedic Surgery

5.1.2. Cardiology

5.1.3. Ophthalmology

5.1.4. Wound Care

5.1.5. Audiology

5.1.6. Thoracic Surgery

5.1.7. Urology and Gynecology Surgery

5.1.8. Plastic Surgery

5.1.9. Neurosurgery

5.1.10. Others

5.2. Application Market Share, 2024 & 2033

5.3. Segment Dashboard

5.4. Global Hand-held Surgical Instruments Market by Application Outlook

5.5. Market Size & Forecasts and Trend Analyses, 2021 to 2033 for the following

5.5.1. Orthopedic surgery

5.5.1.1. Market estimates and forecast, 2021 - 2033

5.5.2. Cardiology

5.5.2.1. Market estimates and forecast, 2021 - 2033

5.5.3. Ophthalmology

5.5.3.1. Market estimates and forecast, 2021 - 2033

5.5.4. Wound care

5.5.4.1. Market estimates and forecast, 2021 - 2033

5.5.5. Audiology

5.5.5.1. Market estimates and forecast, 2021 - 2033

5.5.6. Thoracic surgery

5.5.6.1. Market estimates and forecast, 2021 - 2033

5.5.7. Urology & Gynecology Surgery

5.5.7.1. Market estimates and forecast, 2021 - 2033

5.5.8. Plastic surgery

5.5.8.1. Market estimates and forecast, 2021 - 2033

5.5.9. Neurosurgery

5.5.9.1. Market estimates and forecast, 2021 - 2033

5.5.10. Others

5.5.10.1. Market estimates and forecast, 2021 - 2033

Chapter 6. End-Use Estimates & Trend Analysis

6.1. Definitions and Scope

6.1.1. Hospitals

6.1.2. Clinics

6.1.3. Ambulatory Surgical Centers

6.1.4. Others

6.2. End-Use Market Share, 2024 & 2033

6.3. Segment Dashboard

6.4. Global Hand-held Surgical Instruments Market by End-Use Outlook

6.5. Market Size & Forecasts and Trend Analyses, 2021 to 2033 for the following

6.5.1. Hospitals

6.5.1.1. Market estimates and forecast, 2021 - 2033

6.5.2. Clinics

6.5.2.1. Market estimates and forecast, 2021 - 2033

6.5.3. Ambulatory Surgical Centers

6.5.3.1. Market estimates and forecast, 2021 - 2033

6.5.4. Others

6.5.4.1. Market estimates and forecast, 2021 - 2033

Chapter 7. Hand-held Surgical Instruments Market: Regional Estimates & Trend Analysis

7.1. Regional market share analysis, 2024 & 2033

7.2. Regional Market Dashboard

7.3. Global Regional Market Snapshot

7.4. Regional Market Share and Leading Players, 2021

7.4.1. North America

7.4.2. Europe

7.4.3. Asia Pacific

7.4.4. Latin America

7.4.5. Middle East and Africa

7.5. SWOT Analysis, by Factor (Political & Legal, Economic and Technological)

7.5.1. North America

7.5.2. Europe

7.5.3. Asia Pacific

7.5.4. Latin America

7.5.5. Middle East and Africa

7.6. Market Size, & Forecasts and Trend Analysis, 2021 to 2033:

7.7. North America

7.7.1. Market estimates and forecast, 2021 - 2033

7.7.2. U.S.

7.7.2.1. Market estimates and forecast, 2021 - 2033

7.7.3. Canada

7.7.3.1. Market estimates and forecast, 2021 - 2033

7.8. Europe

7.8.1. UK

7.8.1.1. Market estimates and forecast, 2021 - 2033

7.8.2. Germany

7.8.2.1. Market estimates and forecast, 2021 - 2033

7.8.3. France

7.8.3.1. Market estimates and forecast, 2021 - 2033

7.8.4. Italy

7.8.4.1. Market estimates and forecast, 2021 - 2033

7.8.5. Spain

7.8.5.1. Market estimates and forecast, 2021 - 2033

7.9. Asia Pacific

7.9.1. Japan

7.9.1.1. Market estimates and forecast, 2021 - 2033

7.9.2. China

7.9.2.1. Market estimates and forecast, 2021 - 2033

7.9.3. India

7.9.3.1. Market estimates and forecast, 2021 - 2033

7.10. Latin America

7.10.1. Brazil

7.10.1.1. Market estimates and forecast, 2021 - 2033

7.10.2. Mexico

7.10.2.1. Market estimates and forecast, 2021 - 2033

7.10.3. Argentina

7.10.3.1. Market estimates and forecast, 2021 - 2033

7.11. MEA

7.11.1. South Africa

7.11.1.1. Market estimates and forecast, 2021 - 2033

7.11.2. Saudi Arabia

7.11.2.1. Market estimates and forecast, 2021 - 2033

7.11.3. UAE

7.11.3.1. Market estimates and forecast, 2021 - 2033

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Company/Competition Categorization

8.2.1. Innovators

8.2.2. Market Leaders

8.2.3. Emerging Players

8.3. Vendor Landscape

8.3.1. List of key distributors and channel partners

8.3.2. Key customers

8.3.3. Key company market share analysis, 2021

8.3.4. Zimmer Biomet Holdings

8.3.4.1. Company overview

8.3.4.2. Financial performance

8.3.4.3. Product benchmarking

8.3.4.4. Strategic initiatives

8.3.5. Integra Lifesciences Corporation

8.3.5.1. Company overview

8.3.5.2. Financial performance

8.3.5.3. Product benchmarking

8.3.5.4. Strategic initiatives

8.3.6. B.Braun Melsungen AG

8.3.6.1. Company overview

8.3.6.2. Financial performance

8.3.6.3. Product benchmarking

8.3.6.4. Strategic initiatives

8.3.7. Medtronic, plc.

8.3.7.1. Company overview

8.3.7.2. Financial performance

8.3.7.3. Product benchmarking

8.3.7.4. Strategic initiatives

8.3.8. Smith & Nephew

8.3.8.1. Company overview

8.3.8.2. Financial performance

8.3.8.3. Product benchmarking

8.3.8.4. Strategic initiatives

8.3.9. Johnson & Johnson Services, Inc.

8.3.9.1. Company overview

8.3.9.2. Financial performance

8.3.9.3. Product benchmarking

8.3.9.4. Strategic initiatives

8.3.10. BD

8.3.10.1. Company overview

8.3.10.2. Financial performance

8.3.10.3. Product benchmarking

8.3.10.4. Strategic initiatives

8.3.11. Humeca BV

8.3.11.1. Company overview

8.3.11.2. Financial performance

8.3.11.3. Product benchmarking

8.3.11.4. Strategic initiatives

8.3.12. CooperSurgical Companies

8.3.12.1. Company overview

8.3.12.2. Financial performance

8.3.12.3. Product benchmarking

8.3.12.4. Strategic initiatives

8.3.13. Aspen Surgical

8.3.13.1. Company overview

8.3.13.2. Financial performance

8.3.13.3. Product benchmarking

8.3.13.4. Strategic initiatives