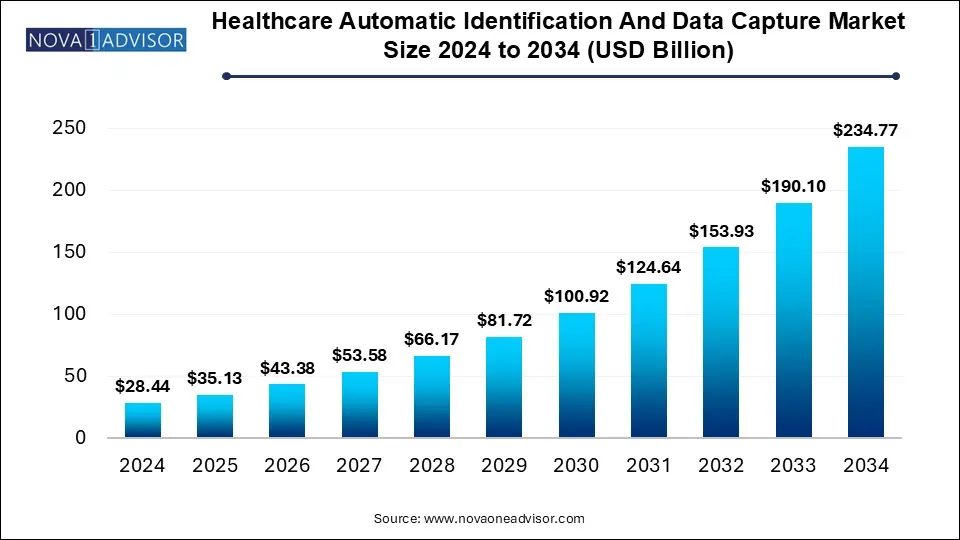

The healthcare automatic identification and data capture market size was exhibited at USD 28.44 billion in 2024 and is projected to hit around USD 234.77 billion by 2034, growing at a CAGR of 23.5% during the forecast period 2025 to 2034.

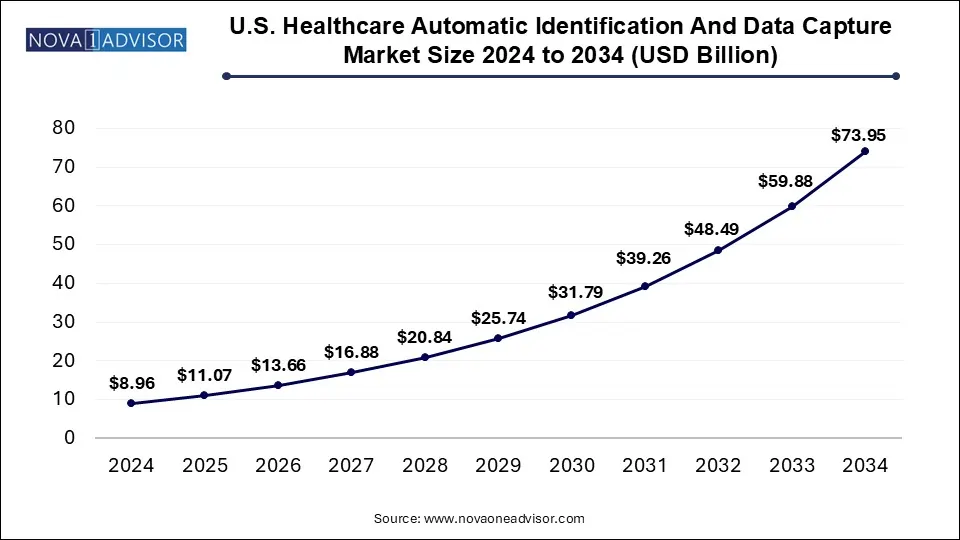

The U.S. healthcare automatic identification and data capture market size was valued at USD 8.96 billion in 2024 and is expected to reach around USD 73.95 billion by 2034, growing at a CAGR of 21.15% from 2025 to 2034.

In 2024, North America led the healthcare automatic identification and data capture market, accounting for the highest revenue share of 42.0%. This dominance is attributed to the widespread adoption of advanced technologies aimed at enhancing patient care, increasing demand for improved healthcare facilities, and substantial healthcare spending. According to CMS, U.S. healthcare expenditure accounted for 17.7% of its GDP in 2019, highlighting the region's strong inclination toward adopting healthcare automatic identification and data capture solutions.

Meanwhile, the Asia Pacific region is expected to witness substantial growth, driven by the rising need for healthcare automation to address the shortage of medical professionals, increasing per capita income, and growing investments in the healthcare sector by leading market players.

Increasing Adoption of Biometric Technology

Growing Demand for RFID and Barcode Technology

Rising Investments in Healthcare Automation

Expansion of Cloud-Based Data Capture Solutions

Emphasis on Patient Safety and Compliance

Growth in Mobile-Based Healthcare Data Capture

Rising Demand in Emerging Markets

Integration of AI and IoT in Healthcare Data Capture

| Report Coverage | Details |

| Market Size in 2025 | USD 35.13 Billion |

| Market Size by 2034 | USD 234.77 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 23.5% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Technology, Application, Component, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Datalogic S.p.A; SICK AG; Honeywell International Inc.; Cognex Corporation; Toshiba TEC Corporation; Bluebird Inc; NXP Semiconductors; SATO Holdings Corporation; The Code Corporation; Jadak - A Novanta Company; Unitech Electronics Co., LTD.; Impinj, Inc.; Denso Wave Europe; Avery Dennison Corporation; TSC Auto ID Technology Co., Ltd. |

In 2024, the biometric segment led the healthcare automatic identification and data capture market, securing the highest revenue share of 41.5%. This growth is primarily driven by government initiatives supporting biometric implementation in healthcare facilities to combat medical identity theft and fraudulent activities. Additionally, the increasing adoption of healthcare IT, growing awareness of biometric benefits, and the rising need for cybersecurity in medical practices are significant factors contributing to this segment’s expansion.

The COVID-19 pandemic has reinforced the need for physical distancing, accelerating the adoption of healthcare automatic identification and data capture technologies. Among these, iris scanning is gaining popularity as an effective method for patient identification in healthcare settings, further fueling market growth.

Medication and pharmaceutical counterfeiting remain a global concern, and RFID technology is emerging as a key anti-counterfeiting solution. The use of RFID in healthcare is expanding rapidly, with applications ranging from patient and staff tracking to monitoring surgical tools and medical inventory in hospitals.

The non-clinical segment dominated the market in 2024, holding the largest revenue share of 75.9%. This can be attributed to the widespread adoption of RFID and barcode technology in areas such as medical staff tracking, asset management, and supply chain operations. Manufacturers are increasingly seeking efficient supply chain solutions for transportation and warehouse management, driving demand for non-clinical applications in the healthcare sector.

Barcoding technology is highly adaptable within healthcare and is used for various clinical applications, including dietary management, blood transfusion verification, medication administration, gamete tracking in fertility treatments, and laboratory specimen identification. These applications are expected to propel the demand for automatic identification and data capture technologies in healthcare.

Furthermore, advancements in technology and the introduction of innovative products are boosting the clinical application of these solutions. For instance, in May 2023, SATO showcased its PJM RFID-based blood management solutions at the ISBT Basel 2024 Congress. PJM RFID technology, recommended by the ISBT for blood banking and transfusion medicine, is expected to drive adoption in the coming years.

The hardware segment held the largest market share, accounting for 45.0% in 2024, largely due to the growing adoption of biometric technology. The increasing demand for hardware components in automatic identification and data capture devices, including scanners, printers, readers, and identification cards, is fueling market growth. Additionally, the rising affordability of RFID solutions and increased adoption of RFID systems due to COVID-19 have further strengthened the hardware segment.

Meanwhile, advancements in technology aimed at enhancing usability and increasing patient acceptance are driving the software segment. Growing initiatives by key industry players are also fueling its expansion. For example, in December 2020, Honeywell acquired Sparta Systems to strengthen its presence in the life sciences and software markets. This acquisition has enhanced Honeywell’s product reach within the life sciences and software segments, further accelerating growth in this sector.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the healthcare automatic identification and data capture market

By Technology

By Component

By Application

By Regional