Healthcare Biometrics Market Size and Forecast 2024 to 2033

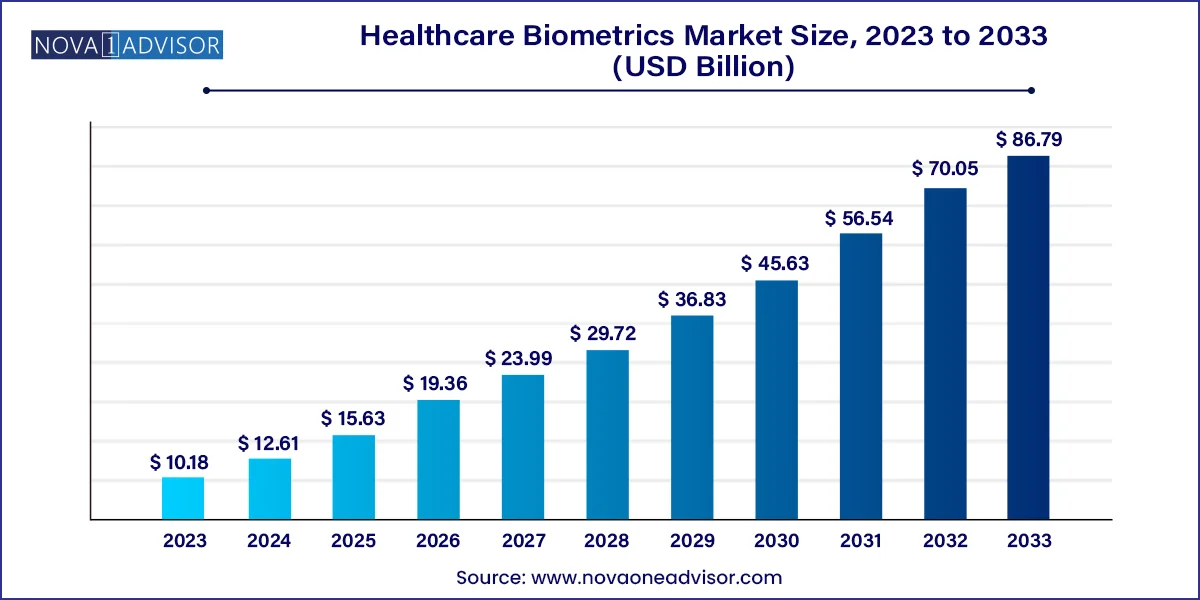

The global healthcare biometrics market size was valued at USD 10.18 billion in 2023 and is anticipated to reach around USD 86.79 billion by 2033, growing at a CAGR of 23.9% from 2024 to 2033.

Healthcare Biometrics Market Key Takeaways

The increased awareness of healthcare frauds, medical identity thefts, and an increase in the initiatives taken by major medical institutes and governments to implement biometrics in healthcare facilities are some of the key factors contributing to the market growth. In addition, the increasing adoption of information technology (IT) solutions in the healthcare sector and the growing demand for cybersecurity and biometric facilities, especially those made for the healthcare sector, contribute to market growth.

An increase in the government initiatives to enhance safety with the help of biometrics has been a major driving factor in this market. In the emergency ward, there is a compulsion of biometrics. Biometrics in hospitals and other medical institutes aid in accurate patient identification and monitoring. Stringent implementation of biometrics will help reduce fraud and data security breaches in the healthcare sector. Furthermore, increases in investment by government and medical institutes to adopt more technologically advanced solutions and biometrics are a few of the driving factors in the growth of this market.

There is an increased demand for contactless identification solutions as they provide safer and more accurate patient identification. Governments and medical institutions are implementing contactless identification, as using fingerprints, palm prints, and hand-key scanners can increase the chances of virus spread due to physical contact. Therefore, there is an increased demand for contactless technologies such as face recognition and iris recognition.

The U.S. healthcare biometrics market size was USD xx billion in 2023, calculated at USD xx billion in 2024 and is expected to reach around USD xx billion by 2033, expanding at a CAGR of 23.9% from 2024 to 2033.

North America dominated the healthcare biometrics market with a market share of 37.06% in 2023. This growth was attributed to the growth in the healthcare sector and increased emphasis of adopting biometric systems by the government to mitigate the rising instances of frauds and security breaches. Due to this, there is an increase in the demand for biometric solutions in the hospital and other medical institutes to enhance the security and safeguard patient data.

.webp)

U.S. Healthcare Biometrics Market Trends

U.S. dominated the market of North America in 2023 with a market share of 83.19%. The market growth was attributed to the increased adoption of biometric systems due to rise in fraudulent activities in the healthcare sector of the country. The market growth is also attributed to the growth in the healthcare sector as new healthcare facilities are adopting stringent security measures in order to safeguard the facility and the patient data. Therefore, these reasons have attributed to the market growth in this country.

Europe Healthcare Biometrics Market Trends

Europe healthcare biometrics market was identified as a lucrative region in this industry as it had a market share of 28.11% in 2023. This growth was resulted due to increase in the number of fraudulent activities in the healthcare sector. Hospitals and medical institutes are now adopting biometric systems in order to securely store accurate record and store patient data, which is used in order to track patient progress and provide accurate medical decisions.

The UK healthcare biometrics market is expected to grow rapidly due to the presence of key medical institutes are rising adoption of biometric systems in order to increase the security of these institute premises and patient data. Government is emphasizing on adoption of biometric systems in order to deal with fraudulent activities and patient data thefts. Therefore, these factors are responsible for the market growth in this country.

Asia Pacific Healthcare Biometrics Market Trends

Asia Pacific held a market share of 23.03% in 2023. This growth is due to the growth in the healthcare sector and increased adoption of biometric systems by medical institutions to avoid frauds. Newly constructed medical facilities are adopting strong biometric systems in order to deal with security breaches and fraudulent activities. Technological advancements and rising disposable income has also resulted in the adoption of more advanced and secure biometric security systems in the region.

China held a substantial market share in healthcare biometrics market due to increase in the fraudulent activities and data breaches in the healthcare sector. Increased emphasis of government on adoption of biometric security systems has resulted in hospitals and medical facilities installing secure biometric systems. This will help the medical institutions in protecting the patient data from data breaches and frauds. Therefore, these factors are responsible for the market growth in this country.

| Report Attribute | Details |

| Market Size in 2024 | USD 12.61 Billion |

| Market Size by 2033 | USD 86.79 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 23.9% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Technology, type, application, end-use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | NEC Corporation, Thales, Fujitsu, HID Global Corporation, IDEMIA, BIO-key International, Aware, Inc., Imprivata, Inc., Suprema, Inc., Hitachi Ltd., Qualcomm Technologies, Inc. |

Technology Insights

The fingerprint recognition segment dominated the market in 2023, with a revenue share of 39.18%. This growth is significant due to the high reliability and accessibility of fingerprint recognition devices, as they are one of the most commonly used biometric systems globally. A fingerprint recognition system provides an accurate and secure collection of fingerprints. Furthermore, growth in the small-scale and healthcare industries has increased demand for these systems.

The iris recognition segment is anticipated to grow at a CAGR of 24.1% over the forecast period. This market growth is attributed to the increased demand for contactless recognition systems. These systems offer secure contactless recognition, aiding in avoiding physical contact that might lead to the spreading of viruses and bacteria. Therefore, hospitals and other medical institutes have increased the use of iris recognition systems.

Type Insights

The single-factor authentication segment dominated the market in 2023 with a share of 64.14% 2023. The market share is significant as single factor authentication is widely used as a recognition system due to its accessibility and reliability. It is easy to set up and is less complicated to understand and use. With growing awareness about biometrics, medical institutes and hospitals in under-developed and developing countries have started to practice person authentications. Single-factor authentication is widely used in such settings due to its availability and ease of setting it up.

The multimodal authentication segment is expected to register the fastest CAGR over the forecast period. This market growth is attributed to multimodal authentication's enhanced security and authentication. Multimodal biometric systems provide robust identity verification, which aids in reducing the risks of medical identity thefts and safeguarding patient data. Multimodal authentication provides multiple-factor authentication, aiding in better security and data collection. These reasons are fueling the market growth of this segment.

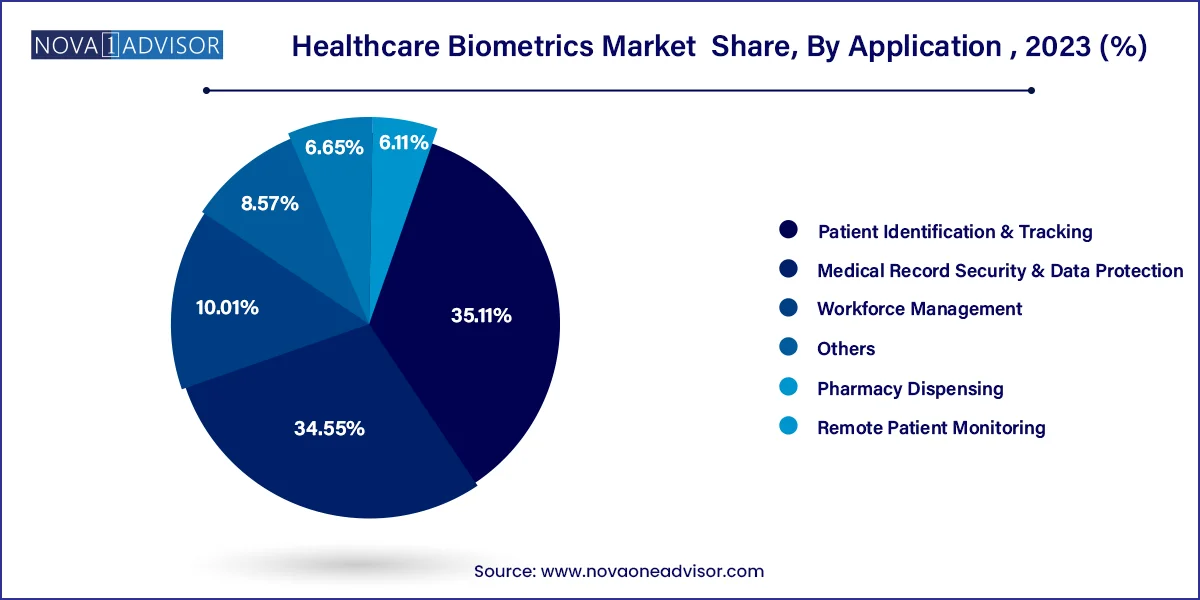

Application Insights

The patient identification & tracking segment dominated the market in 2023 with a share of 35.11% in 2023. The factors responsible for this growth are the growing awareness and implementation of biometric systems in healthcare and other sectors. Biometrics collects accurate and secure patient identification data, which aids in proper tracking and helps in making better medical decisions-furthermore, biometrics aids in avoiding fraud of patient data and security breaches.

The medical record security & data protection segment is anticipated to grow at a CAGR of 25.1% during the forecast period. Growth in the use of biometric systems has aided in safeguarding medical records. Medical records provide essential information to track patient progress and implement accurate medical decisions. Enhanced security of medical records further aids in avoiding fraud and data breaches. Therefore, these factors are responsible for the market growth of this segment.

Some of the major companies in the healthcare biometrics market are NEC Corporation, Thakes, Fujitsu, Biometrics Research Group, Inc., IDEMIA, and more. Companies are focusing on developing products with contactless biometric authentication and improving the security in order to deal with security and data breaches.

Healthcare Biometrics Market Top Key Companies:

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Healthcare Biometrics market.

By Technology

By Type

By Application

By End-use

By Region