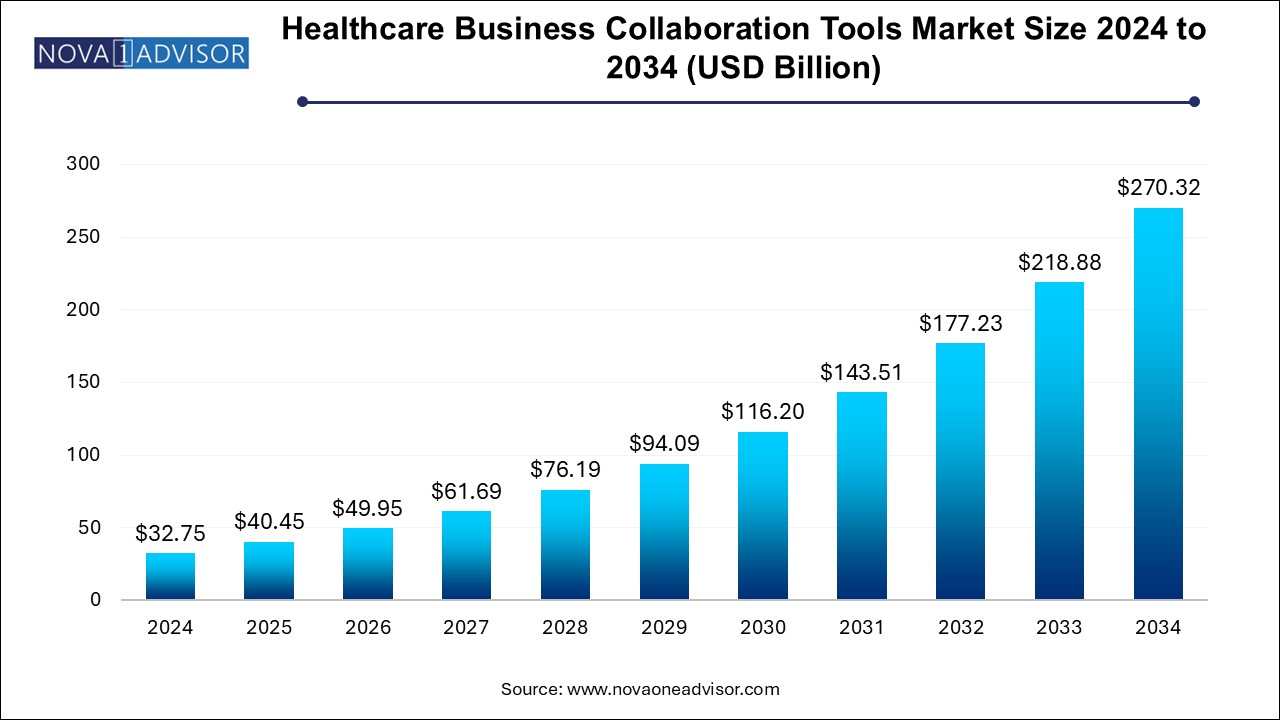

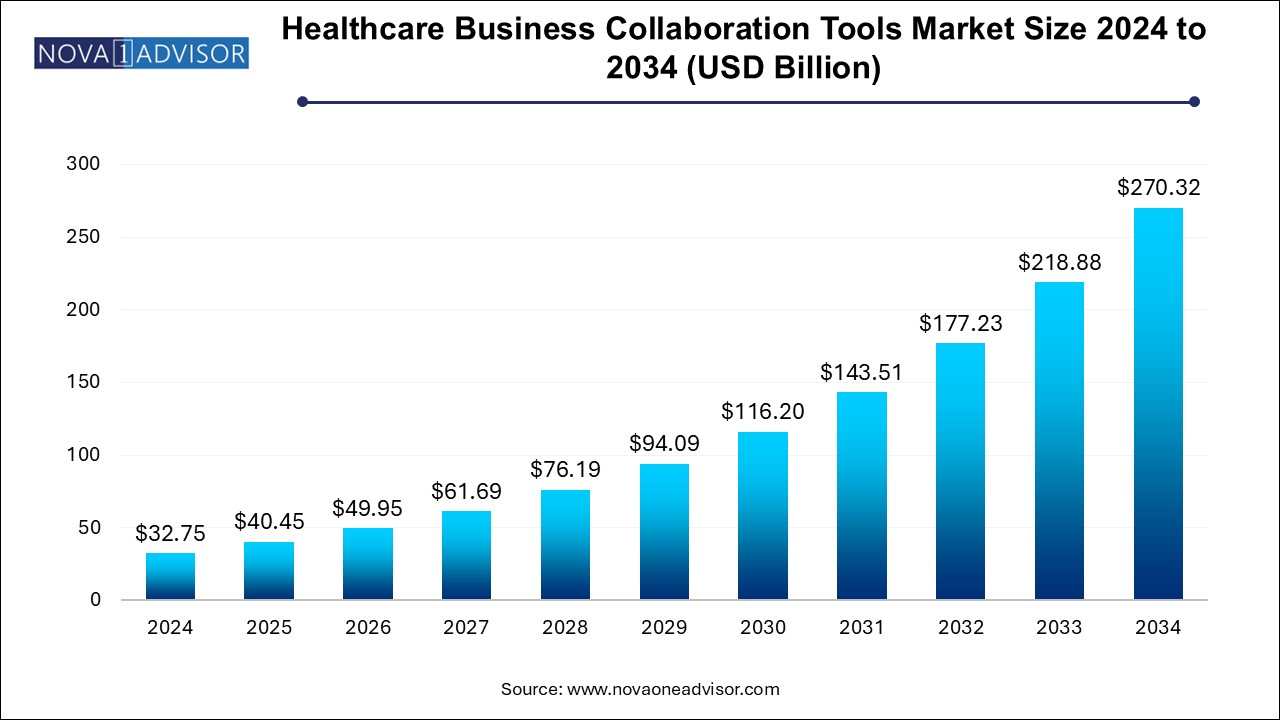

The healthcare business collaboration tools market size was exhibited at USD 32.75 billion in 2024 and is projected to hit around USD 270.32 billion by 2034, growing at a CAGR of 23.5% during the forecast period 2024 to 2034.

- By type, the communication & coordination software segment dominated the market with the largest revenue share in 2024.

- The conferencing software segment in the healthcare business collaboration tools industry is anticipated to witness the fastest growth with a CAGR of 24.8% over the forecast period.

- By deployment, the on-premises segment dominated the market with the largest revenue share in 2024.

- The cloud segment is anticipated to witness the fastest growth rate with a CAGR of 27.9% over the forecast period.

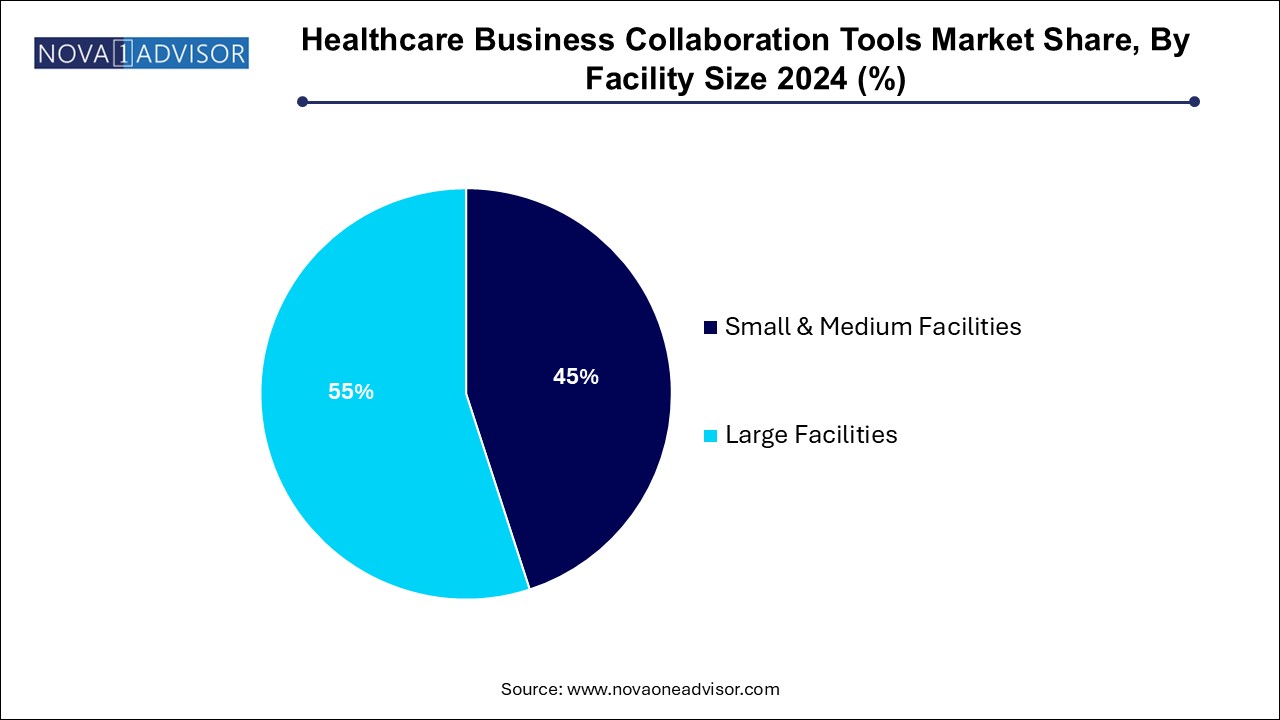

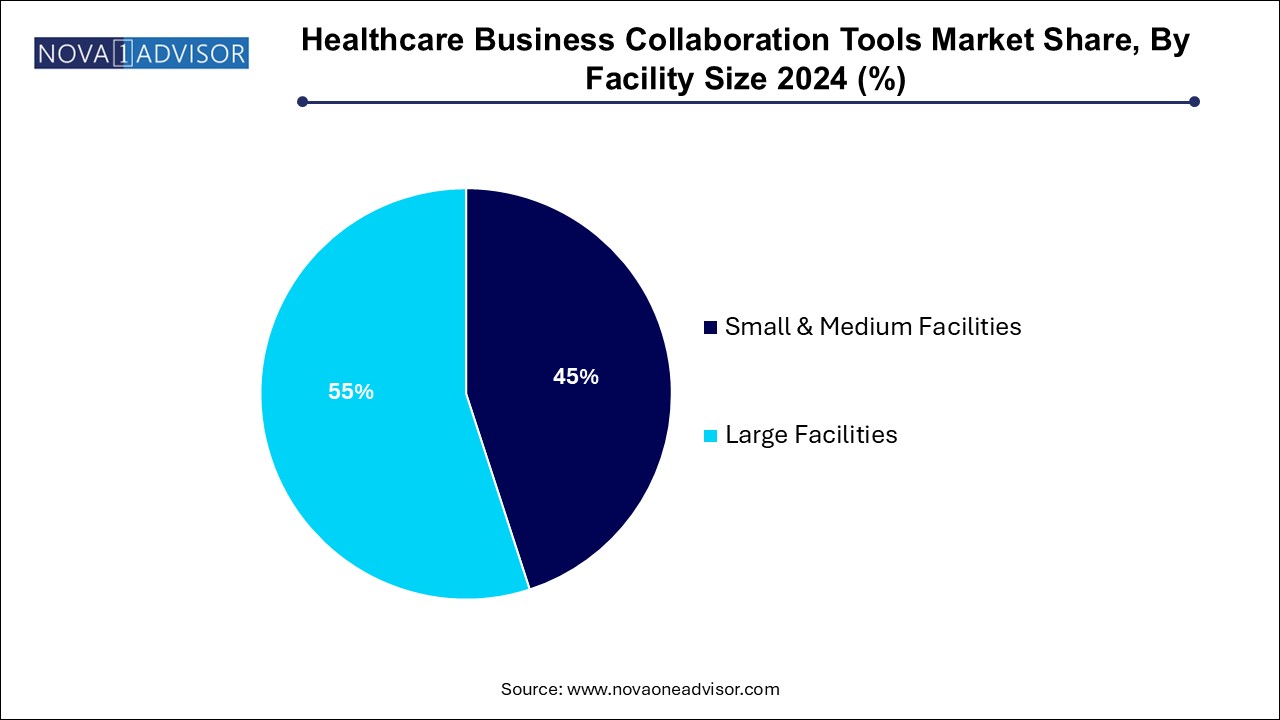

- By facility size, the large facilities segment dominated the market with the largest revenue share of 55.0% in 2024.

- The small & medium facilities segment is anticipated to witness the fastest growth with a CAGR of 23.6% over the forecast period.

- North America healthcare business collaboration tools market is anticipated to register a significant growth rate during the forecast period.

Market Overview

The healthcare business collaboration tools market is rapidly evolving as healthcare providers, payers, pharmaceutical companies, and public health systems adopt digital solutions to streamline communication, enhance coordination, and improve patient outcomes. These tools include a variety of platforms and software designed to facilitate real-time conferencing, asynchronous messaging, shared task management, and clinical coordination across geographically dispersed teams.

Healthcare is uniquely complex, with multidisciplinary teams—including physicians, nurses, administrative staff, pharmacists, and external partners—working under intense regulatory, logistical, and clinical constraints. Effective collaboration is not only critical to the success of patient care but also to operational efficiency, compliance, and cost management. As such, collaboration platforms tailored for healthcare environments are becoming increasingly indispensable.

From secure video conferencing for telehealth consultations to integrated messaging systems embedded within electronic health records (EHRs), these tools are transforming the way care is delivered. Collaboration tools have expanded their role beyond basic communication to include care coordination across transitions, interdisciplinary rounds, emergency response planning, virtual case discussions, and performance reporting.

The pandemic served as a major catalyst for adoption. With remote work mandates, virtual care expansion, and the need for cross-functional pandemic response teams, the demand for secure, HIPAA-compliant collaboration solutions surged. Now, in a post-COVID world, healthcare organizations continue to leverage these tools to support hybrid workforce models, reduce communication silos, and accelerate care delivery pathways.

Technological advancements—particularly in cloud computing, AI-powered workflows, mobile-first applications, and system interoperability—have significantly improved the capabilities and scalability of business collaboration tools. As healthcare organizations worldwide strive to become more agile, connected, and data-driven, the collaboration tools market is expected to see sustained double-digit growth through 2034.

Major Trends in the Market

-

Rise of hybrid care models driving demand for tools that support both in-person and virtual team coordination.

-

Integration of AI and automation for prioritizing messages, summarizing discussions, and assigning follow-up tasks.

-

Growth of mobile-first collaboration tools, enabling real-time communication across clinical teams on-the-go.

-

Adoption of HIPAA and GDPR-compliant platforms, ensuring secure communication and data sharing.

-

Embedding of collaboration tools within EHRs, fostering context-aware communication and eliminating app-switching.

-

Increasing usage of video conferencing platforms for tele-rounding, training, and virtual patient consultations.

-

Surge in multidisciplinary team huddles and virtual command centers, especially in large health systems and public health agencies.

-

Use of analytics dashboards within collaboration tools for tracking team productivity, handoffs, and patient safety metrics.

-

Growing investments in interoperability APIs that allow third-party collaboration tools to integrate seamlessly with core clinical systems.

| Report Coverage |

Details |

| Market Size in 2025 |

USD 40.45 Billion |

| Market Size by 2034 |

USD 270.32 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 23.5% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Type, Deployment, Facility Size, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Microsoft, Google, IBM, FreshBooks, CONTUS TECH, Tvisha Technologies Pvt Ltd., Zoho Corporation Pvt. Ltd., Wrike, Inc., 500apps.com, BrainCert |

Market Driver: Need for Real-Time, Cross-Functional Communication in Complex Healthcare Settings

A primary driver of the healthcare business collaboration tools market is the urgent need for seamless, real-time communication and coordination among diverse healthcare stakeholders. Healthcare delivery involves collaboration between various professionals—primary care physicians, specialists, nurses, pharmacists, administrative teams, and external providers—all of whom must exchange timely and accurate information to ensure effective treatment and continuity of care.

In fast-paced settings like emergency rooms, intensive care units (ICUs), or operating theaters, delays or miscommunications can lead to medical errors, increased costs, and adverse outcomes. Collaboration platforms allow healthcare teams to share updates, patient data, task assignments, and alerts in real time—ensuring transparency, accountability, and rapid response. The digitization of communication also enhances auditability and compliance, which is vital for both operational oversight and regulatory reporting.

Market Restraint: Interoperability and Data Security Challenges

A key restraint in this market is the difficulty of achieving interoperability with existing IT infrastructure—especially legacy EHR systems and departmental applications. Many healthcare organizations operate in IT silos, where systems lack the APIs or standard formats necessary to share information smoothly across platforms. This creates barriers for collaboration tool vendors seeking to integrate their offerings seamlessly.

Moreover, concerns over data security, privacy, and regulatory compliance remain a challenge—particularly given the sensitive nature of patient information. Misconfigured tools, inadequate encryption, and third-party integrations can expose organizations to data breaches and non-compliance with frameworks like HIPAA, HITECH, GDPR, and regional equivalents. These concerns have made many healthcare CIOs cautious, slowing the adoption curve in certain markets or segments.

Market Opportunity: Growth of Cloud-Based and AI-Integrated Collaboration Ecosystems

A significant opportunity lies in the development of scalable, cloud-native collaboration platforms embedded with AI and machine learning capabilities. Cloud deployment offers flexibility, remote access, rapid scaling, and lower capital costs, making it ideal for healthcare organizations navigating workforce decentralization and IT budget constraints.

AI integration can enhance collaboration platforms by automating routine communications, summarizing case discussions, flagging urgent messages, and assisting in decision-making. For example, intelligent chatbots can triage requests, schedule follow-ups, or fetch relevant EHR data on demand. Predictive analytics embedded within collaboration dashboards can alert administrators to care coordination gaps, bottlenecks, or high-risk patients.

Vendors that can offer secure, cloud-based, AI-augmented solutions—with a focus on interoperability and user experience—will be well-positioned to capture the expanding demand from hospitals, clinics, and life science organizations.

By type, the communication & coordination software segment dominated the market with the largest revenue share in 2024. As they provide persistent, asynchronous messaging, task assignment, and structured workflows. These tools are essential in day-to-day healthcare operations, enabling clinicians to manage patient cases, update records, coordinate shift handovers, and communicate care plans across multidisciplinary teams. Platforms like Microsoft Teams (with healthcare modules), Vocera, and TigerConnect exemplify this segment.

These tools offer HIPAA-compliant messaging, role-based access, EHR integration, and user authentication, making them suitable for sensitive healthcare environments. They play a key role in reducing paging errors, improving discharge planning, and minimizing treatment delays.

Conferencing software is the fastest growing segment, especially with the proliferation of telehealth, remote medical education, virtual staff meetings, and cross-site collaboration. Video conferencing tools like Zoom for Healthcare, Cisco Webex, and Doxy.me have gained widespread adoption for virtual consultations, grand rounds, and inter-hospital tumor board discussions. These platforms are now being augmented with whiteboarding, screen sharing, and AI-driven transcription to enhance collaboration across clinical and administrative teams.

By deployment, the on-premises segment dominated the market with the largest revenue share in 2024. Especially those with strict data residency requirements or custom integrations. Some institutions prefer local hosting for sensitive communications tied to critical infrastructure, disaster response, or government programs. These setups are often favored by military, veterans' hospitals, or private payers with internal development capabilities.

The cloud segment is anticipated to witness the fastest growth rate with a CAGR of 27.9% over the forecast period. Offering scalability, low upfront costs, and access from any device or location. Cloud-native tools are particularly attractive for small and medium healthcare facilities, telehealth providers, and integrated delivery networks (IDNs) aiming to unify communication across multiple sites. Cloud platforms also support continuous updates and remote IT management, reducing burden on in-house teams.

By facility size, the large facilities segment dominated the market with the largest revenue share of 55.0% in 2024. As they have complex operational needs that demand robust collaboration platforms. Academic medical centers, multi-specialty hospitals, and integrated health networks manage hundreds of users across departments, requiring tools with granular access control, analytics dashboards, and EHR integration. These facilities are also early adopters of enterprise-grade collaboration suites, often linking them with hospital information systems (HIS), PACS, and scheduling tools.

The small & medium facilities segment is anticipated to witness the fastest growth with a CAGR of 23.6% over the forecast period. As cloud-based, affordable, plug-and-play collaboration solutions become increasingly available. Clinics, urgent care centers, and small practices are embracing tools for shift coordination, patient triage, and front-desk communication. These providers seek intuitive interfaces, mobile access, and minimal IT overhead—offering fertile ground for SaaS vendors targeting simplicity and speed.

North America is the dominant regional market, driven by a high level of digital maturity, strong regulatory frameworks, and widespread adoption of electronic medical records. The U.S. and Canada have rapidly embraced telehealth, virtual care models, and hybrid clinical workforces, all of which demand robust collaboration infrastructure.

Vendors like Microsoft, Salesforce, and Zoom offer healthcare-specific versions of their tools in the region, while HIPAA and HITECH legislation have accelerated the development of secure communication platforms. Moreover, federal programs such as the CMS interoperability mandates and pandemic-era funding have boosted adoption in both private and public health systems.

Asia Pacific is emerging as the fastest growing market, driven by increasing digitization of healthcare, rising healthcare investments, and growing demand for accessible care in remote regions. Countries like India, China, Japan, and Australia are expanding their healthcare IT infrastructure and adopting mobile health apps, patient portals, and cloud-based collaboration tools to support underserved populations.

The region is also home to a growing number of startups and health-tech innovators building multilingual, mobile-first collaboration solutions tailored to regional workflows. Government initiatives aimed at universal health coverage, pandemic response, and hospital infrastructure upgrades are expected to further accelerate collaboration tool deployment across APAC.

- Microsoft

- Google

- IBM

- FreshBooks

- CONTUS TECH

- Tvisha Technologies Pvt Ltd.

- Zoho Corporation Pvt. Ltd.

- Wrike, Inc.

- 500apps.com

- BrainCert

-

March 2025 – Microsoft launched Teams Premium for Healthcare, integrating AI-generated visit summaries, real-time translation, and EHR interoperability for providers.

-

January 2025 – Salesforce announced a strategic partnership with Cerner to bring seamless collaboration between care teams through cloud-hosted patient data and integrated messaging.

-

November 2024 – TigerConnect introduced AI-powered smart messaging features that auto-prioritize urgent clinical messages and summarize team discussions for hospital staff.

-

September 2024 – Zoom for Healthcare released a HIPAA-compliant virtual waiting room solution to support telehealth triage and patient check-ins.

-

July 2024 – Vocera (a Stryker company) expanded its wearable badge ecosystem to integrate directly with EMR alerts and secure messaging platforms for real-time care coordination.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the healthcare business collaboration tools market

By Type

- Conferencing Software

- Communication & Coordination Software

By Deployment

By Facility Size

- Small & Medium Facilities

- Large Facilities

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)