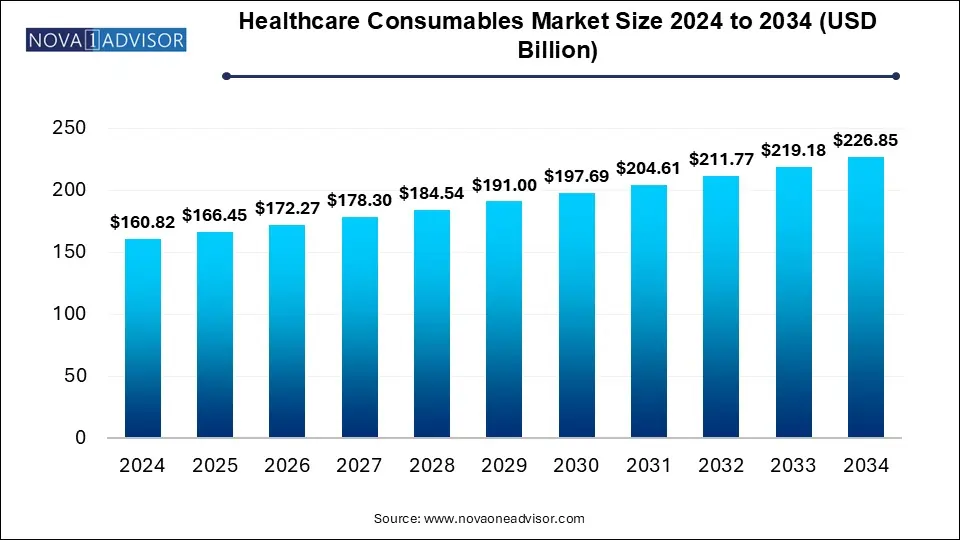

The healthcare consumables market size was exhibited at USD 160.82 billion in 2024 and is projected to hit around USD 226.85 billion by 2034, growing at a CAGR of 3.5% during the forecast period 2025 to 2034.

The U.S. healthcare consumables market size was valued at USD 46.85 billion in 2024 and is expected to reach around USD 57.73 billion by 2034, growing at a CAGR of 2.11% from 2025 to 2034.

In 2024, North America held over 43.0% of the market share, driven by high healthcare spending, growing awareness of minimally invasive procedures, a well-established healthcare infrastructure, and expanding healthcare facilities. Additionally, the increasing number of hospital admissions is fueling market growth. According to CDC data, the U.S. recorded approximately 45 million outpatient surgeries, over 900 million physician visits, and 155 million emergency department visits in 2019.

Meanwhile, the Asia Pacific region is expected to present significant growth opportunities in the coming years. It is projected to experience a substantial rise in its geriatric population. According to WHO, by 2050, nearly 80% of the world's elderly population will reside in low- and middle-income countries. Furthermore, the expanding presence of hospitals, ambulatory services, clinics, and diagnostic laboratories in the region is contributing to market expansion.

The global healthcare consumables market is primarily driven by the increased number of hospitals admissions owing to various reasons like the rising prevalence of chronic diseases, increasing the number of road traffic accidents, and increased adoption of surgical procedures for treatment among the population. Moreover, the rising number of hospital acquired diseases and growing awareness regarding this is boosting the consumption of healthcare consumables. In the year 2020, the demand for healthcare consumables witnessed a rapid surge owing to the rapid spread of the COVID-19 disease across the globe and increased number of hospital admissions. The government in most of the countries encouraged the increased the production of consumable such as face shields, face masks, disposable gloves, and hospital gowns. This resulted in the increased revenue in 2020. The demand for the personal protective equipment increased exponentially across the globe to prevent the COVID-19 infection.

The rising prevalence of various chronic diseases like CVDs, COPD, and diabetes is a significant contributor to the healthcare consumables market growth. According to the International Diabetes Federation, the global diabetic population is estimated to reach at around 552 million by 2030. According to the WHO, diabetes is a major reason for kidney failure, blindness, stroke, and diabetic foot ulcer. This results in prolonged hospital stays. The rising the geriatric population across the globe is expected to drive the growth of the market, as old age people as more prone to various diseases and they need utmost attention and continuous monitoring, which may fuel the demand for the healthcare consumables. According to the WHO, the global geriatric population is anticipated to reach 2 billion by 2050. Moreover, the rising demand for the various invasive and minimally-invasive surgeries for the treatment is positively impacting the growth of the global healthcare consumables market.

| Report Coverage | Details |

| Market Size in 2025 | USD 166.45 Billion |

| Market Size by 2034 | USD 226.85 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 3.5% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Raw Material, End User, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | BD, Thermo Fisher Scientific, Inc., Baxter International, Inc., Avanos Medical, Inc., 3M, Johnson & Johnson, Medtronic, Cardinal Health, Inc., B. Braun Melsungen AG, Boston Scientific Corporation |

In 2024, the sterilization consumables segment accounted for the highest revenue share. This segment includes items such as cotton swabs, test tubes, sterilizer bags, and cotton balls, which are widely used for skin preparation and sterilizing medical instruments. The increasing demand for pre-mixed cotton swabs and cotton balls is further propelling the growth of this segment.

Conversely, hand sanitizers are projected to be the fastest-growing segment during the forecast period. This growth is primarily driven by increasing awareness of infection risks through hand contact. The rising prevalence of bacterial and fungal infections is further accelerating the demand for hand sanitizers. Additionally, growing concerns over hospital-acquired infections are expected to boost their usage in the coming years.

By raw material, the plastic resin segment dominated the market in 2024. This is largely due to the widespread use of plastic resins in manufacturing various healthcare consumables, including syringes, tubes, packaging materials, and medical containers. The affordability, durability, and availability of plastics such as PP, PVC, and polystyrene have significantly contributed to market growth in the healthcare sector.

Meanwhile, the non-woven materials segment is anticipated to witness the highest growth rate during the forecast period. This surge is attributed to the rising awareness of the advantages of non-woven materials in effectively reducing hospital-acquired and surgical infections. Their easy disposal, recyclability, and cost-effectiveness are key factors supporting the expansion of this segment.

The hospital segment accounted for the largest market share, reaching 68.0% in 2024, and is expected to maintain its dominance throughout the forecast period. Hospitals experience a continuous influx of patients, leading to a sustained demand for healthcare consumables. These facilities provide treatment for a wide range of medical conditions, necessitating the daily use of various consumables. Many hospitals also feature specialized departments such as laboratories, imaging centers, and rehabilitation units, each requiring specific medical supplies. Additionally, hospitals serve a diverse patient population with varying health conditions and medical needs, further driving demand for an extensive range of consumables.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the healthcare consumables market

By Product Type

By Raw Materials

By End User

By Regional