The global healthcare contract research organization market size was valued at USD 52.19 billion in 2023 and is anticipated to reach around USD 104.60 billion by 2033, growing at a CAGR of 7.2% from 2024 to 2033.

.webp)

Increasing investment in R&D programs, preference for outsourcing activities due to time & cost constraints, and patent expiration of blockbuster drugs are key factors anticipated to drive the market in the coming years. Contract research organization (CRO) collaborations offer advanced services, and thus pharmaceutical and biopharmaceutical companies mostly prefer assigning projects to CROs, facilitating market growth.

Increasing pressure on drug developers pertaining to clinical data management, regulatory environments, and stringent safety standards are expected to drive demand for contract research organizations within a healthcare sector. Healthcare and pharmaceutical companies are outsourcing the production of medicines and their clinical trials. With increasing clinical trial privatization, there is a surge in outsourcing to developing countries. Many healthcare contract research organizations (CRO) are enhancing their global research network to provide better customer services. For instance, in February 2023, MMS, a CRO specializing in data, announced a collaboration with the Institute for Advanced Clinical Trials (I-ACT) to expedite advancement of critical therapeutics such as medications, vaccines, and medical devices specifically tailored for pediatric use. As part of its commitment, MMS is sponsoring I-ACT's Spin Challenge, a unique initiative to generate funds to propel and hasten clinical trials focused on children's healthcare.

The outbreak of the COVID-19 pandemic has significantly hampered the growth of the healthcare CRO industry. Factors such as a shortage of patients and temporary closure of clinical trial operating sites have negatively impacted the market. However, this crisis created a need for virtual trials, thereby leveraging usage of digital technology & software solutions. Increasing adoption of machine learning-based platforms, artificial intelligence, and innovative trial designs has helped the industry mitigate the pandemic’s negative impact, thereby witnessing a revenue rebound.

However, 2020 to 2022 was a challenging period for international business, reflecting escalating geopolitical tensions, tighter monetary policy, high inflation, ongoing pandemic, and looming recessions. The global supply chain witnessed significant risks of bifurcation in 2022 as the Ukraine-Russia conflict became a new geopolitical fault line and China-U.S. tensions remained high. Hence, the market has witnessed comparatively sluggish growth from 2020 to 2022.

Pharmaceutical industry also witnessed a backlash across its annual growth due to high inflation and decreasing FDA approval in 2022 and 2023. Pharmaceutical and biopharmaceutical companies tend to outsource the development process of New Molecular Entities (NME). However, a considerable decline in the rate of NME approvals was witnessed in 2022. This also implies that a decline in NME approvals shall directly decrease a commercial scale production agreement for larger contact researchers and manufacturers. In recent years, COVID-19 vaccination drives have allowed societies and economies to reopen and function normally during the pandemic. However, increasing inflation has brought uncertainty to the continuing global recovery in 2023. In 2022, the U.S. FDA approved nearly half of the most innovative drugs than it did in 2021. The drop in these NMEs, both biologics and small molecules, was majorly due to rising global inflation, which the outbreak of the geopolitical war has further triggered. For instance, an article published by Springer Nature Limited stated that the new drug approvals in the U.S. were down in 2022 by about 25% - to the lowest level since 2016.

| Report Attribute | Details |

| Market Size in 2024 | USD 55.95 Billion |

| Market Size by 2033 | USD 104.60 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.2% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Service, Type, Application, End-use Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | QVIA, LabCorp, Charles River Laboratories, WuXiAppTec, Syneos Health, Parexel International, PPD, ICON Plc, Medpace Holdings, SGS, PSI CRO AG, Axcent Advanced Analytics, BIO Agile Therapeutics, Firma Clinical Research, Acculab Life Sciences |

The U.S. healthcare contract research organization (CRO) Market is valued at USD 13.95 Billion in 2023 and is projected to reach a value of USD 27.44 Billion by 2033 at a CAGR (Compound Annual Growth Rate) of 7.0% between 2024 and 2033.

-Market-Size-.webp)

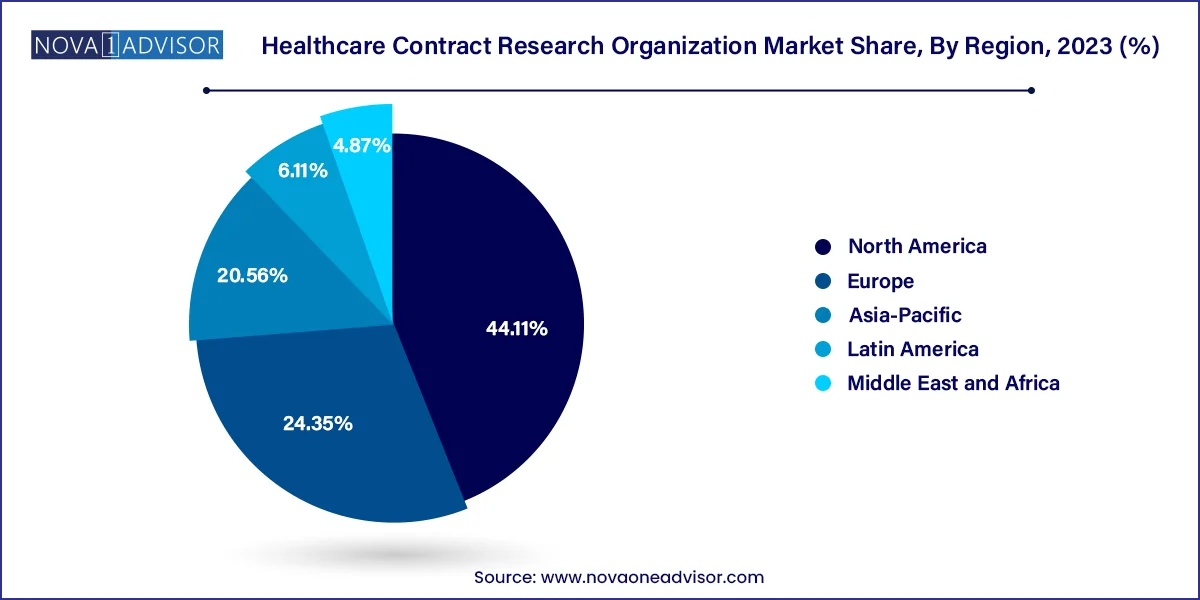

North America was the largest healthcare contract research organization market in 2023 and accounted 44.11% revenue share. The presence of several top biopharmaceutical and biosimilar companies along with the presence of several CROs has collectively contributed towards the market growth. According to the Pharmaceutical Research and Manufacturers Association (PhRMA), US conducts more than half of the research & development activities in the pharmaceutical field and also holds intellectual rights of a significant amount of new medicines. Thus, the rapidly growing investments in the research and development by the top pharmaceutical companies are expected to significantly drive the growth of the North America contract research organization market in the forthcoming years.

Asia Pacific was the second most dominant healthcare contract research organization market in 2023. This is attributable to the rising prevalence of chronic diseases, easy recruitment and retention of patients, and strict adherence to the regulatory standards. Moreover, the presence of several top contract research organizations in the region that offers high quality services at a low cost has fueled the growth of the Asia Pacific healthcare contract research organization market. The availability of cheap labor and experienced research professionals at affordable costs is further fueling the market growth.

Clinical services segment accounted for the largest revenue share of 75.45% in 2023. This growth is owing to a rising number of biologics, recent epidemic events leading to demand for new treatments, need for personalized medicines and orphan drugs, and the demand for advanced technologies. Factors such as technological evolution, globalization of clinical trials, and demand for a contract research organization to conduct clinical trials are further projected to drive growth. Outsourcing of Phase III clinical trials to healthcare contract research organizations generated the highest revenue in 2023 due to fact that they are one of the most expensive stages of a clinical trial; approximately 90.0% of the expenses occurring during the clinical development of a drug stem from this phase.

Preclinical studies segment is projected to witness a rapid growth of 8.6% during the forecast period. An increase in the number of preclinical trials globally and an increasing need to curb R&D expenses are expected to contribute to a growing demand for quality preclinical CRO services, thereby contributing to market growth. Moreover, an increasing pipeline of novel therapeutics has further supported a lucrative growth of preclinical services. For instance, the World Health Organization (WHO) in June 2022 reported that around 217 antibacterial drugs are in the preclinical stage of development as of September 2021. This also indicates that a huge proportion of an antibacterial drugs under preclinical development have been outsourced to contract research organizations for an efficient and timely development process. Such factors are anticipated to boost segment’s growth across the forecast period.

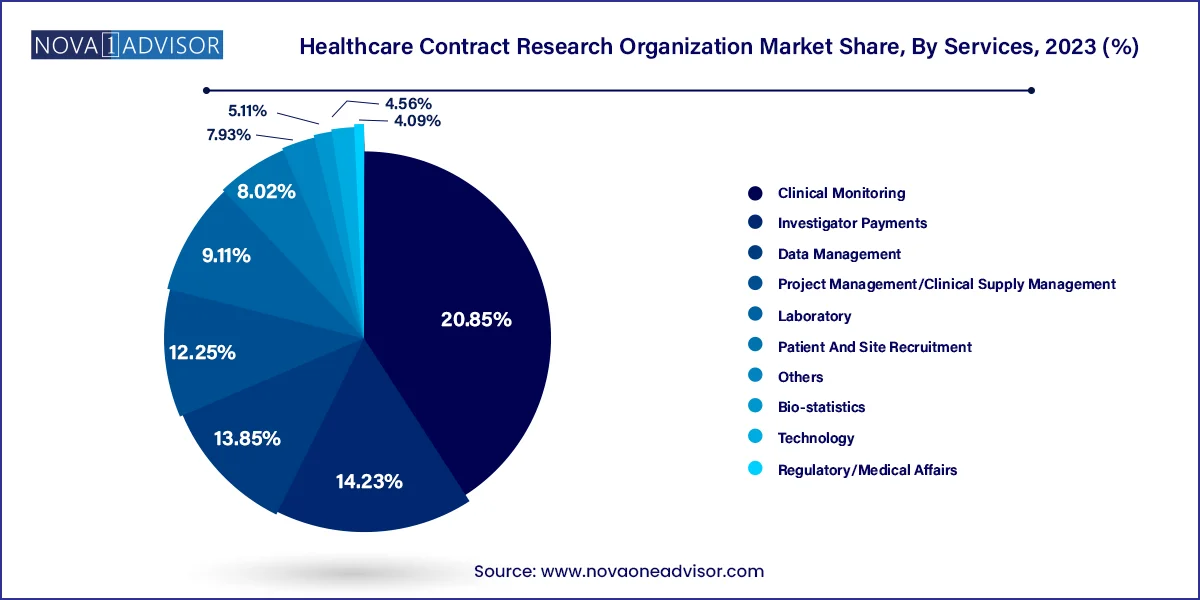

Clinical monitoring segment dominated the market for healthcare contract research organizations and accounted for the largest revenue share of 20.85% in 2023. This may be attributed to increasing number of clinical trials & the need to monitor those studies that are creating more demand for these services. Clinical research has been outsourced to CROs over the past decade due to various reasons, such as cost-effectiveness and technical expertise. Introduction of smart analytics along with real-time data acquisition devices is estimated to improve clinical monitoring data in a healthcare sector. Real-time data acquisition related to drug safety and toxicity enables early identification of trial errors and enables timely rectifications such as trial re-design or termination, thereby propelling segment growth. Moreover, several IT services and consulting companies are entering a field of clinical research through innovation across clinical monitoring platforms. For instance, in June 2023, ICON plc launched the most recent update of its Digital Platform. This advanced platform facilitates a smooth incorporation of ICON's site, patient, and sponsor services, ensuring a streamlined delivery of standardized data.

Regulatory/medical affairs segment is anticipated to witness the fastest growth rate of 11.1% in healthcare CRO market over a forecast period. Outsourcing for regulatory affairs is expanding rapidly due to increase in R&D activities, clinical trial applications, product registration, and drug pipelines. Increasing demand to obtain approval for new products, maintain compliance, and do more with less is projected to support segment's growth. Also, CROs offering regulatory services are focusing on expansion strategies to boost their market presence. For instance, in September 2022 PharmaLex GMBH, a leading provider of regulatory services worldwide, announced an opening of a new office in China, Beijing providing their clients access to a team of pharmaceutical and biopharmaceutical products-related regulatory experts in the region.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Healthcare Contract Research Organization market.

By Type

By Services

By Application

By End-use

By Region