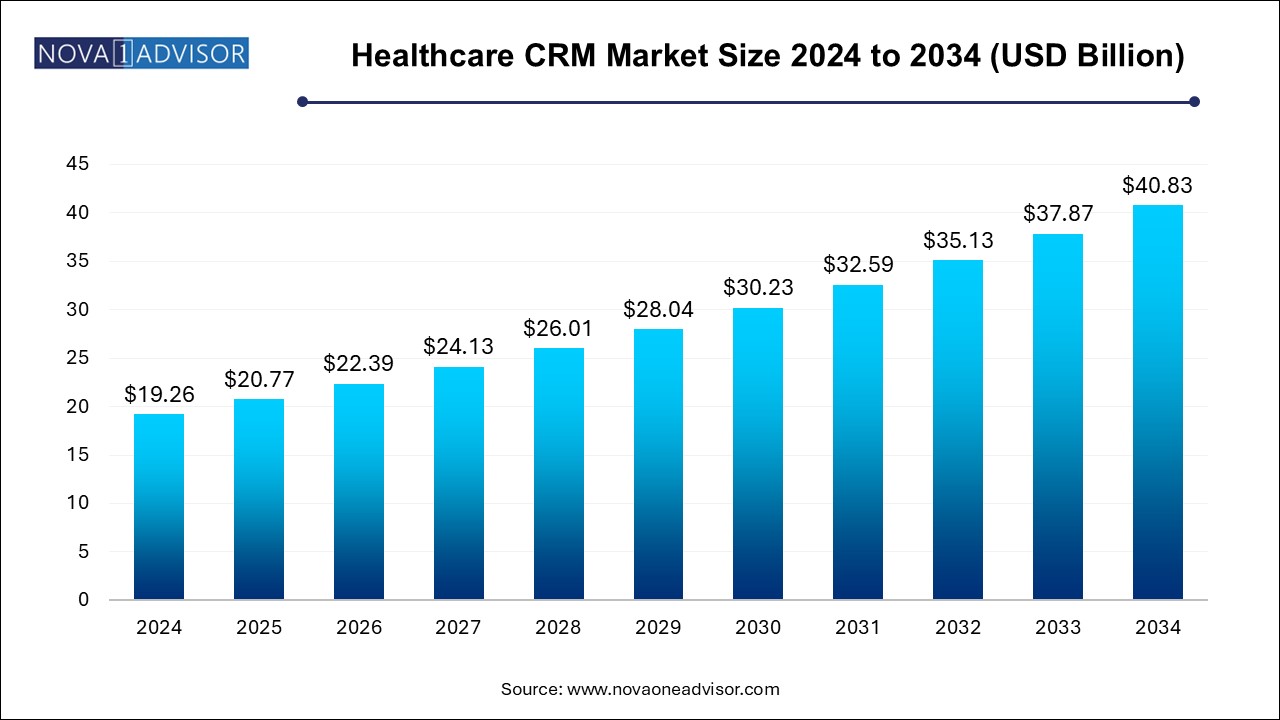

The healthcare CRM market size was exhibited at USD 19.26 billion in 2024 and is projected to hit around USD 40.83 billion by 2034, growing at a CAGR of 7.8% during the forecast period 2025 to 2034.

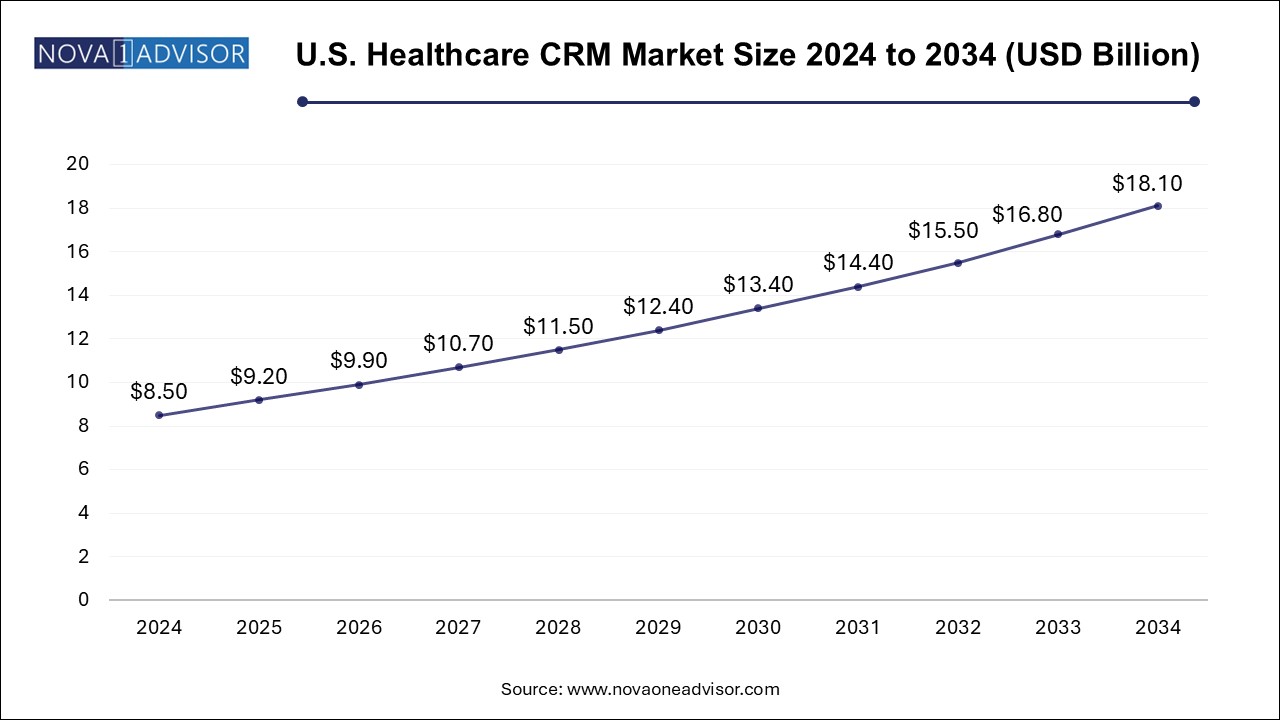

The U.S. healthcare CRM market size is evaluated at USD 8.5 billion in 2024 and is projected to be worth around USD 18.1 billion by 2034, growing at a CAGR of 7.11% from 2025 to 2034.

North America holds the largest market share, led by the United States, where digitization of healthcare is deeply embedded in both public and private sectors. The presence of major CRM vendors, high healthcare IT adoption, favorable reimbursement systems, and patient-centric regulations like the 21st Century Cures Act support regional leadership. U.S.-based hospitals, payers, and pharmaceutical companies have been early adopters of cloud CRM platforms that integrate with EHRs, telemedicine tools, and wearables.

Moreover, North America’s high per capita health expenditure, widespread chronic disease prevalence, and competitive provider landscape create a strong need for advanced patient engagement tools. CRM platforms are being deployed in large health systems like Mayo Clinic and Cleveland Clinic, as well as in retail health and urgent care chains.

Asia Pacific is witnessing the fastest growth, fueled by rapid urbanization, rising healthcare investment, and the emergence of digital health ecosystems. Countries such as China, India, Japan, and South Korea are expanding national health coverage and upgrading health IT infrastructure. CRM platforms are being adopted by private hospital networks, insurance companies, and pharmaceutical firms to improve customer acquisition, loyalty, and operational efficiency.

Additionally, Asia Pacific’s large and diverse patient population offers fertile ground for CRM platforms tailored to specific languages, behaviors, and regulations. The surge in mobile health applications, telemedicine platforms, and AI-driven health startups further amplifies demand. Governments in the region are also promoting health digitization through initiatives like India’s Ayushman Bharat Digital Mission, paving the way for widespread CRM integration.

The Healthcare CRM (Customer Relationship Management) Market has evolved from being a peripheral digital tool to becoming an essential strategic asset for healthcare organizations seeking to deliver personalized, connected, and efficient patient care. At its core, healthcare CRM integrates patient data, communication platforms, analytics engines, and automation tools to enable seamless interaction between providers, payers, life sciences firms, and patients across the healthcare ecosystem. As patient expectations shift towards convenience, personalization, and real-time engagement—mirroring consumer-centric industries—healthcare entities are increasingly adopting CRM systems to streamline operations, enhance engagement, and improve care outcomes.

This market’s expansion is being propelled by a confluence of factors, including the rise of digital health, increased focus on value-based care, the growing importance of patient retention and satisfaction, and a surge in data generation across EHRs, telehealth platforms, and mobile health apps. Healthcare CRM platforms are now offering robust functionalities across marketing automation, patient acquisition, referral tracking, billing support, appointment scheduling, and population health management. Unlike traditional CRMs focused solely on sales, healthcare CRMs are tailored for clinical workflows, regulatory compliance, and multi-stakeholder coordination.

CRM adoption is no longer restricted to large hospital networks; today, even ambulatory care providers, insurance firms, and pharma companies are integrating CRM platforms to manage everything from customer journeys to adverse event reporting. Cloud-based deployments, AI-enhanced analytics, and integration with existing health IT infrastructure have made modern healthcare CRMs highly scalable and adaptable. As the healthcare industry embraces digital transformation at scale, the CRM market is poised to witness robust growth through 2034.

Shift Toward Cloud-Based CRM Models for Scalability and Remote Accessibility

Integration of AI and Predictive Analytics for Patient Behavior Forecasting

Rising Adoption of Omnichannel Communication Tools Across Care Touchpoints

Growing Utilization of CRM in Population Health and Chronic Disease Management

Enhanced Focus on Data Security and HIPAA Compliance in CRM Platforms

Expansion of CRM Applications Beyond Providers to Payers and Pharma Companies

Increased Use of CRM in Telemedicine and Virtual Care Ecosystems

Development of CRM Modules Tailored for Clinical Trials and Life Sciences Workflows

CRM-Enabled Patient Engagement for Preventive Care and Appointment Adherence

Collaborative CRM Platforms Facilitating Physician-Pharma Engagement

| Report Coverage | Details |

| Market Size in 2025 | USD 20.77 Billion |

| Market Size by 2034 | USD 40.83 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 7.8% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Component, Functionality, Deployment Mode, End-use, and Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Microsoft; Cerner Corp. (Oracle); IBM; SAP; Accenture; Zoho Corp.; hc1; LeadSquared; Salesforce; Veeva Systems; Talisma; Alvaria; NICE; Verint Systems Inc.; Creatio; Cured (Acquired by Innovaccer Inc.); Actium Health; Keona Health; MediCRM.ai |

One of the primary forces driving the healthcare CRM market is the increasing emphasis on patient-centric care, a model that prioritizes individualized, coordinated, and proactive healthcare experiences. Unlike traditional care delivery systems that were provider-focused, today’s healthcare models strive to empower patients as active participants in their healthcare journey. This transformation has placed immense pressure on healthcare providers to offer personalized communication, proactive outreach, coordinated follow-ups, and satisfaction-driven services.

CRM platforms provide the digital infrastructure needed to support this transformation. By consolidating fragmented data across patient portals, EHRs, appointment systems, billing modules, and customer service channels, healthcare CRMs enable providers to craft holistic and context-aware engagement strategies. For instance, a CRM can trigger a personalized post-surgery recovery plan, send medication reminders via SMS, or schedule a follow-up teleconsultation—all automatically. These capabilities enhance patient adherence, satisfaction, and ultimately, outcomes, making CRM an indispensable tool for modern care delivery.

Despite the expanding utility of healthcare CRM systems, the market faces a significant constraint in the form of data privacy regulations and interoperability issues. Healthcare data is highly sensitive and regulated under strict standards such as HIPAA in the United States and GDPR in Europe. Ensuring that CRM platforms meet these compliance requirements—especially when integrating with third-party applications, legacy systems, and cloud servers—adds complexity and cost.

Additionally, interoperability remains a critical pain point. Many healthcare organizations operate on siloed IT infrastructures, making it difficult to create a unified patient view. Integrating CRM platforms with disparate EHRs, radiology systems, pharmacy modules, and insurance databases is technically challenging and requires substantial customization. Failure to ensure real-time, bidirectional data flow can limit CRM’s effectiveness and delay ROI realization, especially for smaller or mid-sized healthcare providers.

The most promising opportunity in the healthcare CRM market lies in the emergence of AI-driven platforms that are transforming CRM from a transactional system into an intelligent, predictive engine. By leveraging machine learning algorithms and natural language processing (NLP), AI-enabled CRMs can analyze vast volumes of patient data—including historical records, social determinants of health, and behavioral cues—to anticipate health risks, suggest interventions, and enable proactive care delivery.

For example, a CRM platform equipped with AI can identify patients at high risk of diabetes relapse and automatically enroll them in a digital wellness program. Similarly, predictive analytics can forecast appointment no-shows, enabling automated rescheduling or reminders. Life sciences companies can use AI-enhanced CRM systems to identify clinical trial candidates based on genotype and phenotype data. These use cases not only improve outcomes but also generate significant operational efficiencies, opening up a new dimension of value for CRM vendors and users alike.

Software remains the dominant component in the healthcare CRM market, accounting for the largest share due to the widespread demand for digital platforms that can consolidate patient data and enable omnichannel engagement. CRM software packages are now designed with modular architecture, offering plug-and-play functionalities for marketing, scheduling, revenue cycle management, and care coordination. The ability to customize software based on organizational size, clinical workflows, and patient demographics makes it highly attractive to healthcare providers and payers.

Meanwhile, the services segment is emerging as the fastest-growing, driven by the increasing need for system integration, technical support, training, and analytics consulting. As CRM software becomes more sophisticated and AI-enabled, organizations seek expert guidance to ensure optimal configuration, staff onboarding, and long-term value extraction. Managed CRM services, including third-party data management and campaign execution, are also witnessing increased adoption, especially among smaller providers and specialty clinics.

Based on functionality, is witnessing the fastest growth. Healthcare providers and payers are increasingly investing in targeted campaigns to acquire new patients, promote preventive services, and re-engage inactive ones. CRM platforms with built-in marketing automation tools enable healthcare organizations to run personalized email campaigns, track patient behavior on websites, and segment audiences based on clinical and behavioral data. As healthcare becomes more competitive and consumerized, CRM-led marketing will continue to rise.

Customer service and support functionalities lead the market, reflecting the core purpose of CRM in healthcare—improving communication and relationship management between patients and healthcare entities. These features allow healthcare professionals to manage patient inquiries, track feedback, handle complaints, and deliver timely resolutions. In large hospital networks, CRM tools are used to manage call centers, support portals, and escalation workflows, creating a consistent patient experience.

Cloud-based CRM solutions dominate the healthcare sector due to their scalability, remote access capabilities, and lower upfront cost. These platforms allow multiple users across departments and geographies to access real-time patient data, collaborate on care plans, and launch engagement campaigns without on-site infrastructure. Cloud CRM adoption has surged in post-pandemic scenarios, where virtual consultations and remote team collaboration became essential.

Although on-premise deployment models continue to be used in large academic or legacy hospitals—where data control and customization are critical—their growth is relatively stagnant. As data security and compliance mechanisms in the cloud improve, even traditionally cautious institutions are migrating to web-based CRM models, ensuring this segment maintains its momentum in the coming years.

Healthcare providers, including hospitals, clinics, and physician groups, are the largest end-users of healthcare CRM platforms. These institutions use CRM tools to manage the complete patient journey—from initial inquiry to post-discharge follow-up. Providers utilize CRM for appointment reminders, feedback collection, care plan dissemination, and chronic disease monitoring. With the rise of outpatient care and accountable care organizations (ACOs), CRM platforms are becoming central to care coordination strategies.

The life sciences industry is the fastest-growing end-use segment. Pharmaceutical and biotechnology companies are using CRM to manage interactions with physicians, streamline sales rep workflows, conduct adverse event reporting, and track patient outcomes during clinical trials. As these companies adopt direct-to-consumer models and personalized medicine, CRM tools become vital for managing engagement across multiple stakeholders and regulatory jurisdictions.

Some other players in the AI-powered healthcare CRM market include:

March 2025: Salesforce Health Cloud launched new features focused on patient engagement automation, including integrated appointment bots and AI-driven health insights for chronic care management.

February 2025: Oracle Cerner partnered with a major health insurer in Europe to deploy a cross-CRM platform facilitating real-time claims tracking and policyholder engagement.

January 2025: HubSpot announced a specialized CRM module tailored for small-to-midsize healthcare clinics offering online scheduling, patient journey mapping, and HIPAA-compliant data encryption.

December 2024: Microsoft Cloud for Healthcare added new interoperability layers to its Dynamics 365 CRM, enhancing integration with popular EHRs and enabling seamless patient data flow.

November 2024: Veeva Systems, known for its life sciences CRM, launched a decentralized trial engagement CRM platform, enabling better patient recruitment and monitoring during remote clinical trials.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the healthcare CRM market

By Component

By Functionality

By Deployment Mode

By End-use

By Regional