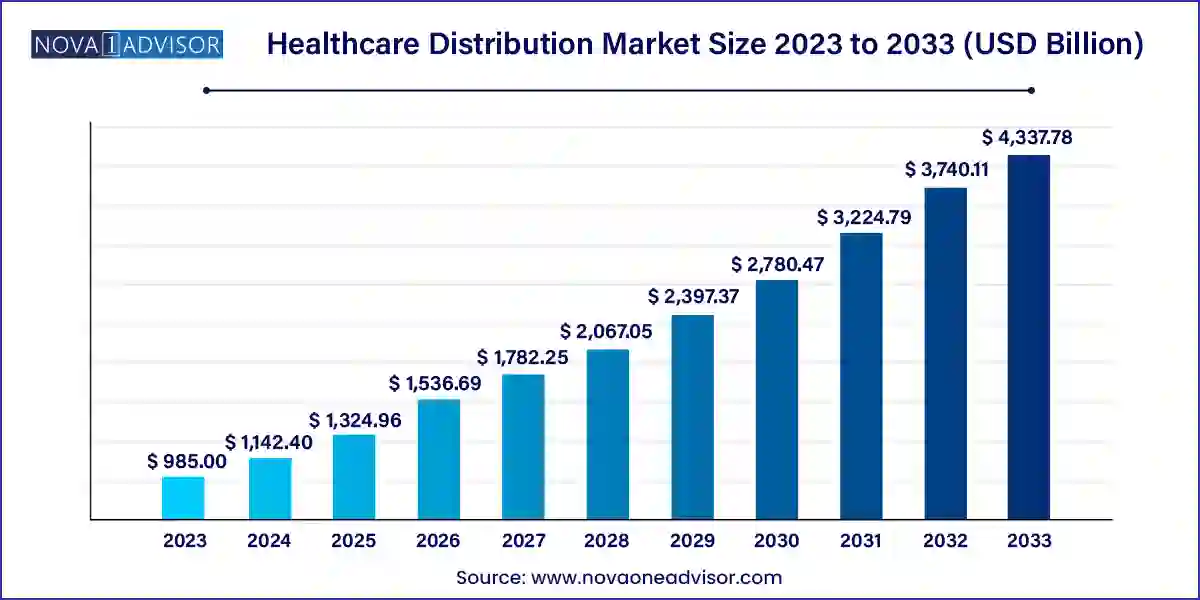

The global healthcare distribution market size was exhibited at USD 985.00 billion in 2023 and is projected to hit around USD 4,337.78 billion by 2033, growing at a CAGR of 15.98% during the forecast period 2024 to 2033.

Innovation in technology can help drive efficacy across the divided supply chains. For instance, drones, mobile phones, and (IoT) Internet of Things will have a transformative consequence by facilitating gathering and reporting of information and improving discernibility across the existing supply chain. This superior understanding of product appeal often results in reduced costs, decreased inefficiency and lessened time to market. Supply chains that take advantage of mobile technology, help quickenconnect by submitting data to several stakeholders. Information on utilization can be conveyed by health workforces in the clinics to the central logistics administration unit to inform replenishing and future procurement. The mobile technology is not only being exploited for communication, but has also been extensively applied in financial businesses across the world. Alliances in healthcare delivery markets and the appearance of new products is expected at unleashing anupsurge of opportunities in the global healthcare distribution market over the forecast timeframe.

Increasing popularity of generic drugs in the developing regions is expected to open up new avenues for the healthcare distribution market. A generic drug is a replica that is the identical as a brand-name drug in strength, safety, dosage, mode of intake, performance, quality, and intended usage. As generics use identical active ingredients and are revealed to work the similar way in the human body, they have the equivalent risks and advantages as their brand-name medications. However, generic drugs are less costly because generic producers don’t have the investment expenses of the creator of a new drug. More generic replicas of successful medications are being retailed worldwide than ever earlier. This requires a robust distribution system across world.

| Report Coverage | Details |

| Market Size in 2024 | USD 1,142.40 Billion |

| Market Size by 2033 | USD 4,337.78 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 15.98% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, End User, Geography |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | Amerisource Bergen Corporation, McKesson Corporation, Medline Industries, Cardinal Health, Inc., PHOENIX Group, Shanghai Pharmaceutical Group Co., Ltd., Henry Schein Inc., Owens & Minor, Inc., Medline Industries, and Rochester Drug Cooperative, Inc.among others. |

In 2020, the pharmaceutical and medical product supply networks struggled on an international scale to keep pace with the quick spread of the corona virus. The interruption in supply chains because to the COVID-19 pandemic had resulted in a fall in the accessibility of healthcare products across the world. The supply of key raw materials was also severely disrupted due to the forced lockdowns and dearth of manpower. Multiple issues including lack of streamlined link among the regional warehouses resulted in disruption of provision of raw materials between regions. The rapid spread of corona virus highlighted the numerous shortcomings of the healthcare supply chains. This has prompted major companies operating in the healthcare distribution business to take necessary steps to remove the bottlenecks and reorganize the distribution network.

The rise of specialty healthcare products is presenting new challenges for the healthcare distribution industry. The companies will have to design new supply chains that can cater to the distribution of specialty medications. The healthcare distribution companies are working on the use of data for improving the existing models and offering more value-added services.

Pharmaceutical segment recorded the prime market share in the global healthcare distribution Market in 2023. The key reason for the hefty share of the pharmaceutical segment is the high production of pharmaceutical products owing to high demand, strong product pipeline of major manufacturers, high investment in research and development for developing effective drugs, initiatives taken by governments for eradicating communicable diseases, and constant launch of new and effective treatments.

The biopharmaceuticals segment is projected grow at the highest CAGR during the forecast period mainly due to increasing awareness regarding use of biologics for the treatment of hitherto untreatable diseases. Other factors responsible for high growth of biopharmaceuticals segment are increasing geriatric population, high prevalence of chronic disorders, and rising cases of cancer worldwide.

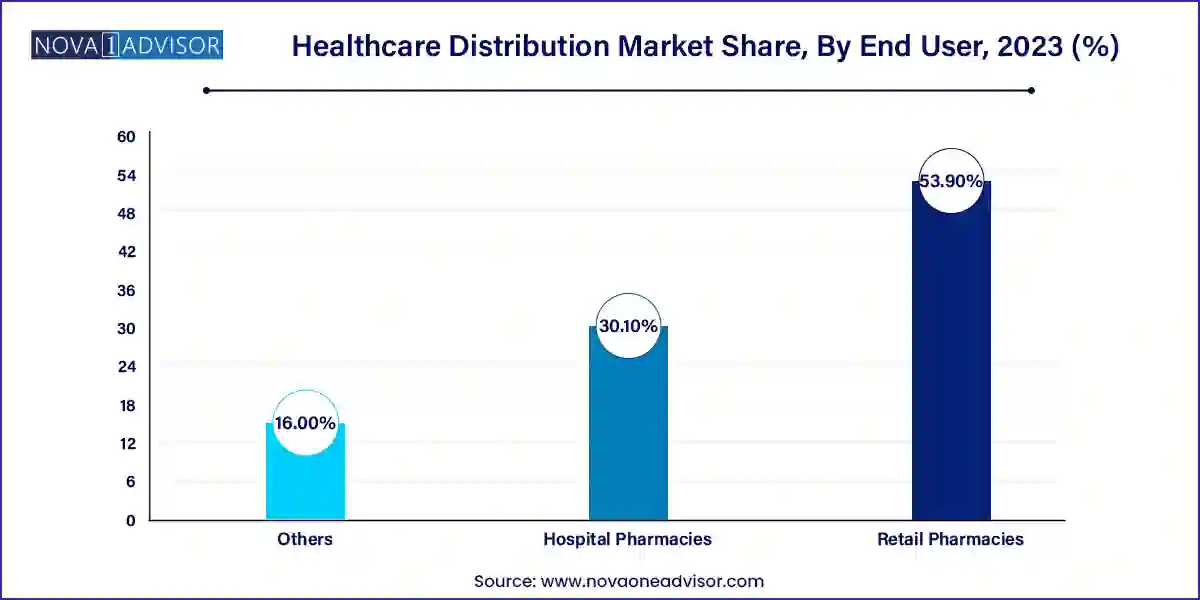

The retail pharmacies are involved inhandling large capacity of prescriptions on a regular basis, which is a key factor supporting the progress of the segment. The retail pharmacies also stock products for multiple disorders ranging from cardiovascular diseases to skin disorders. Moreover, the growing trend of retail pharmacy chains and 24X7 pharmacies is also expected to play an important part in the high revenue share of retail pharmacies. The retail pharmacies accounted for the largest revenue in the end user segment with more than 53.9% share in 2023.

Hospital pharmacies will hold a significant share in the global healthcare distribution market mainly due to the high incidence of lifestyle related disorders requiring long hospital stays. Other end-users include specialty pharmacies which stock drugs and medical devices related to specific medical conditions.

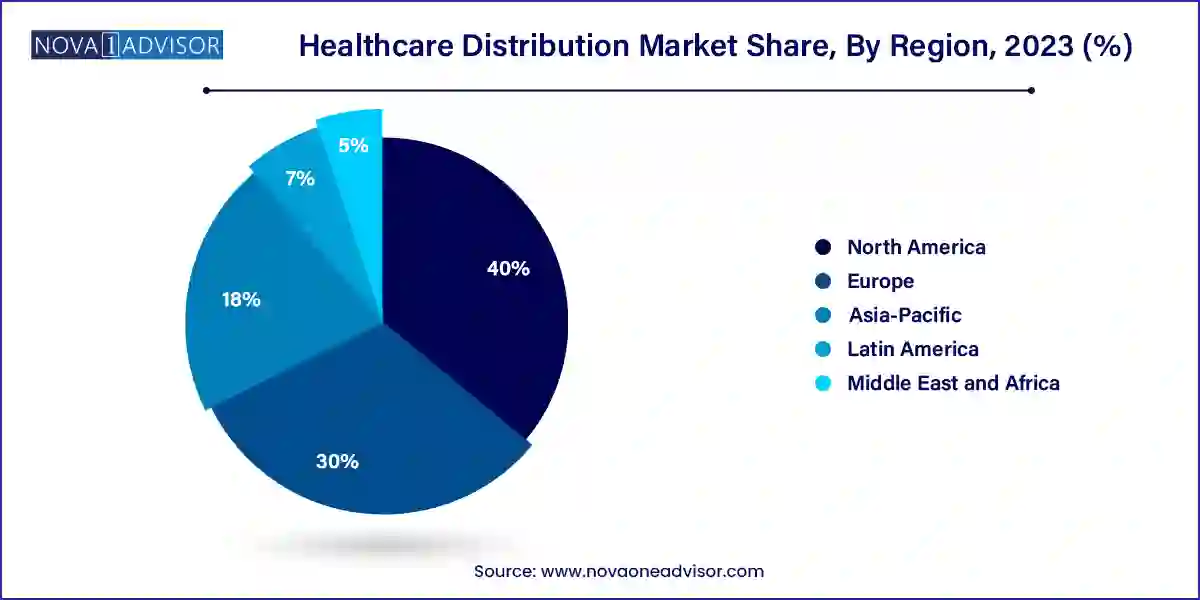

The research report covers key trends and prospects of healthcare distribution products across different geographical regions including North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa. Geographically, healthcare distribution market is conquered by North America owing to high incidence of chronic diseases and presence of sophisticated healthcare distribution framework comprising of distributors and retailers. In 2023, North America dominated the global market with a market share of more than 40.0%.

On the other hand, Asia-Pacific is anticipated to witness the rapid growth rate around 9.3%, on account of increasing healthcare expenditure and growing investment by major manufactures to streamline supply chain.

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global healthcare distribution market.

By Product Type

By End User

By Region