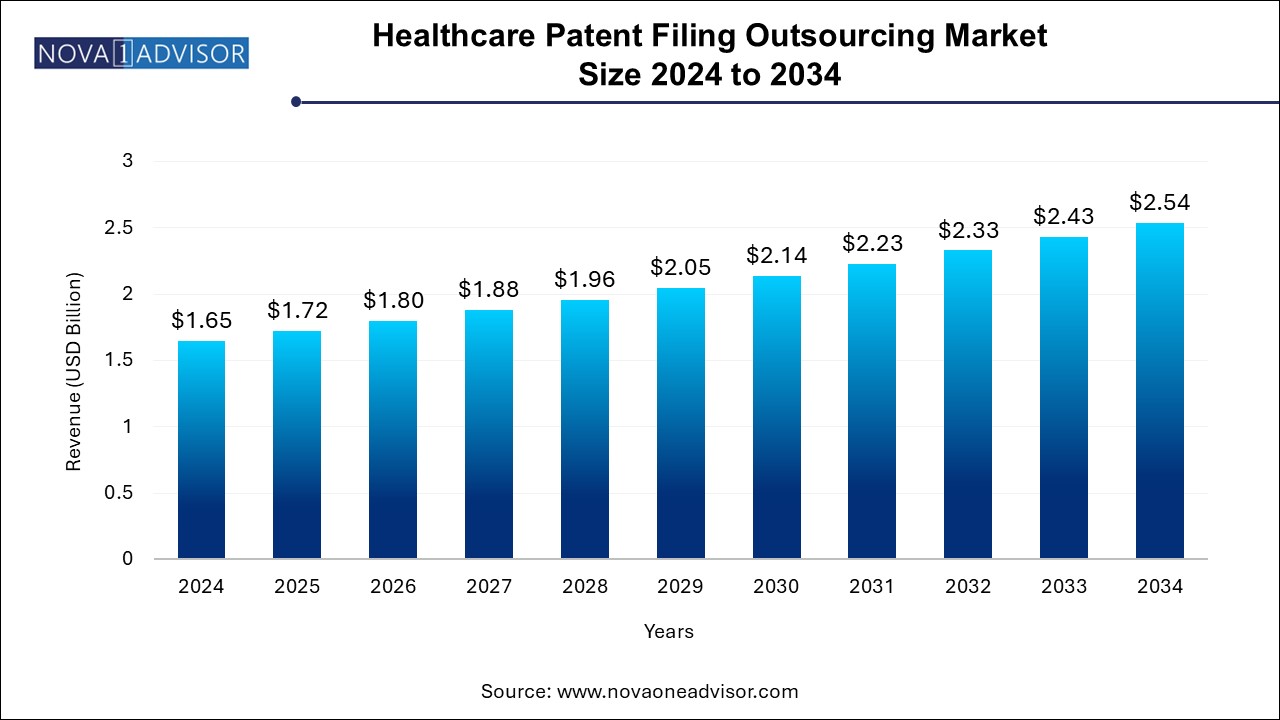

The healthcare patent filing outsourcing market size was exhibited at USD 1.65 billion in 2024 and is projected to hit around USD 2.54 billion by 2034, growing at a CAGR of 4.4% during the forecast period 2024 to 2034. The rising complexity of healthcare innovations and the increasing need for intellectual property protection drive the demand for patent filing outsourcing services.

The healthcare patent filing outsourcing market has experienced significant growth as healthcare companies continue to innovate and develop new technologies. As the industry becomes more competitive and complex, the demand for intellectual property (IP) protection grows. Healthcare companies are increasingly outsourcing patent filing services to specialized firms to streamline their patent application processes, mitigate risks, and reduce costs. The market encompasses a wide array of segments, from medtech and pharmaceuticals to various devices and services, each requiring specialized patent protection strategies.

Outsourcing allows healthcare companies to leverage the expertise of third-party providers to manage patent filings efficiently. These firms assist with navigating the intricate patent laws and regulations across different jurisdictions, thus safeguarding valuable intellectual property. The market is expected to grow at a substantial rate due to technological advancements in the healthcare sector and the increasing emphasis on innovation protection.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.72 Billion |

| Market Size by 2034 | USD 2.54 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 4.4% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Domain, Service, Origin, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | Clarivate; ipMetrix CRJ IPR Services LLP; Patent Outsourcing Limited; Synoptic IP PVT LTD; Dennemeyer Group; POWELL GILBERT; Bristows LLP; HOYNG ROKH MONEGEIER; CARPMAELS & RANSFORD LLP |

Driver: Rising Complexity of Healthcare Innovations

As the healthcare industry sees an influx of new innovations, ranging from pharmaceuticals to medical devices, the complexity of these technologies increases. This has led to a growing demand for specialized patent filing outsourcing services. The intricacy of patenting innovations, especially in cutting-edge areas like AI-powered medical devices and drug delivery systems, requires expertise in managing intellectual property. Patent filing outsourcing companies have the necessary knowledge and resources to handle the complex legal and technical requirements of healthcare-related patents. This trend is driving the demand for outsourcing as healthcare companies look to protect their intellectual property while focusing on their core competencies.

Restraint: Regulatory and Legal Barriers

While outsourcing patent filings can offer significant benefits, the healthcare industry faces regulatory and legal hurdles when filing patents across multiple jurisdictions. Different countries have varying intellectual property laws and requirements, making it difficult for healthcare companies to navigate these complex regulations. These challenges can create delays in patent filings, which may hinder innovation and disrupt business operations. The inconsistency of patent laws and the costs involved in meeting diverse jurisdictional requirements may deter companies from outsourcing patent filing activities. Furthermore, the risk of non-compliance and subsequent legal disputes can result in significant financial and reputational damages for healthcare organizations.

Opportunity: Expansion in Emerging Markets

Emerging markets, especially in Asia and Africa, present significant opportunities for growth in the healthcare patent filing outsourcing market. These regions are witnessing rapid growth in healthcare innovation, fueled by technological advancements and increasing investments in the healthcare sector. As healthcare companies in these regions develop new products, there is a growing need for efficient patent filing processes to protect their intellectual property. By outsourcing patent filing services, companies can gain access to local expertise and navigate the regulatory environment effectively, thereby protecting their innovations. Additionally, the relatively lower costs of outsourcing patent filing in emerging markets offer significant cost-saving opportunities for global healthcare companies.

The pharmaceutical segment dominated the market and accounted for the largest revenue share of 50.4% in 2024. As research and development in the pharmaceutical industry advance, the need for intellectual property protection becomes more critical. Outsourcing patent filings allows pharmaceutical companies to handle the intricate filing processes more efficiently while focusing on the core aspects of their business. Additionally, with the rapid growth in biotechnology and biologics, pharmaceutical companies are increasingly turning to specialized patent filing services to navigate the complex patenting landscape of these products.

The medtech domain sector is the fastest-growing segment, driven by the constant development of new drugs and biologics. This sector, encompassing a wide range of devices and technologies like surgical tools, diagnostic devices, and drug delivery systems, has seen an influx of innovations that require patent protection. The rise of wearable medical devices, which are becoming increasingly popular for monitoring patient health, has significantly contributed to the growth of this segment. Medtech companies are outsourcing patent filing to ensure they can focus on advancing their technologies while safeguarding their intellectual property. The growing demand for personalized and advanced healthcare solutions continues to boost this segment's market share.

The filing and prosecution segment dominated the healthcare patent filing outsourcing market and accounted for the largest revenue share of 51.9% in 2024 , as it involves the critical process of preparing and submitting patent applications. This segment requires specialized legal and technical expertise to ensure patent applications comply with the various legal and regulatory requirements in different regions. Outsourcing this service allows healthcare organizations to streamline the patent application process while reducing the time and resources spent on internal patent management.

The pre-filing segment is expected to experience significant growth during the forecast period. Pre-filing plays a critical role in the patent process, as it involves thorough due diligence before a patent is officially filed. Improper or unprofessional handling of the filing steps can lead to delays and the need for reapplication, which is a time-consuming process for businesses. As a result, there is an increasing demand for professional and competent pre-filing services, highlighting the importance of accuracy and expertise in this phase.

The resident segment dominated the market and accounted for the largest revenue share of 64.0% in 2024. with a large share attributed to patents filed within the same country or region as the applicant. This segment is vital because businesses prefer to work with local outsourcing partners who are familiar with domestic patent laws, regulations, and language requirements. The growth of this segment reflects the preference for local expertise in managing patent filings.

The non-resident segment is expected to grow steadily as global demand for patent protection increases. With the expansion of the healthcare sector across different markets, the need for patent safeguarding in multiple countries has become more critical. By working with local patent outsourcing firms, applicants benefit from expert knowledge of regional regulations, which supports the growth of this segment in the coming years.

North America, particularly the United States, is the fastest-growing market for healthcare patent filing outsourcing. The region has a robust healthcare industry with numerous medical device manufacturers, pharmaceutical companies, and research institutions, all of which require intellectual property protection. The U.S. is home to some of the world’s leading healthcare innovators, and its strong intellectual property laws provide a conducive environment for patent filings. Additionally, the prevalence of established patent law firms offering specialized services further strengthens the region's market dominance.

The Asia-Pacific region dominates the healthcare patent filing outsourcing market. Countries like China, India, and Japan are rapidly advancing in healthcare innovations and are becoming hubs for medical device and pharmaceutical development. These regions are witnessing significant investments in research and development, which necessitate strong intellectual property protection. With relatively lower outsourcing costs and a growing pool of specialized patent filing service providers, Asia-Pacific is expected to experience rapid market expansion in the coming years.

In October 2024: Ginkgo Bioworks partnered with Virica Biotech to enhance AAV gene therapy manufacturing platforms, addressing high production costs.

In August 2024: Lonza Group expanded its AAV vector manufacturing capacity in North America to meet the increasing demand for gene therapies.

In May 2024: Siren Biotechnology formed an alliance with Catalent Inc. to support the development and manufacturing of AAV immuno-gene therapies, with Catalent providing process development and cGMP manufacturing services.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the healthcare patent filing outsourcing market

Domain

Service

Origin

Regional