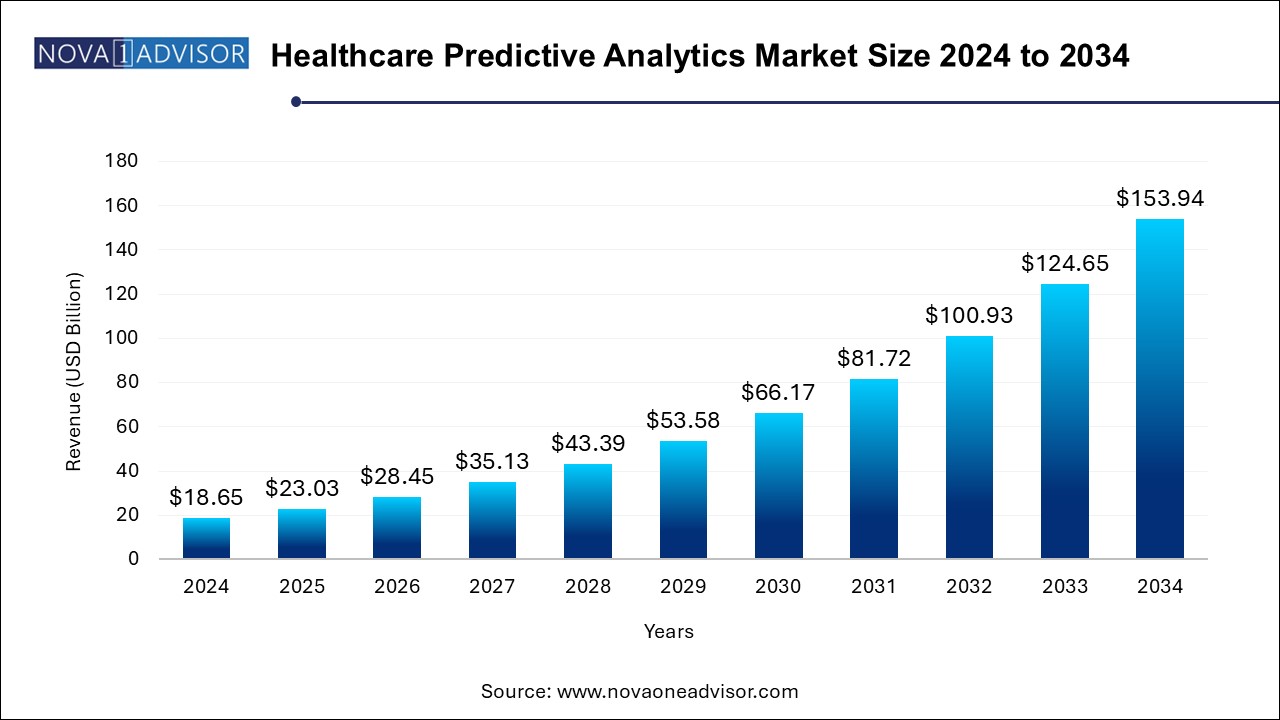

The healthcare predictive analytics market size was exhibited at USD 18.65 billion in 2024 and is projected to hit around USD 153.94 billion by 2034, growing at a CAGR of 23.5% during the forecast period 2024 to 2034.

The Healthcare Predictive Analytics Market is witnessing exponential growth, driven by the convergence of artificial intelligence (AI), big data, and the pressing need for efficient and personalized healthcare delivery. Predictive analytics in healthcare refers to the use of historical data, machine learning algorithms, and statistical techniques to forecast patient outcomes, optimize operations, and improve financial performance. From reducing hospital readmissions to predicting disease outbreaks and streamlining clinical workflows, predictive analytics is transforming the decision-making processes across healthcare systems.

With an ever-expanding pool of healthcare data comprising electronic health records (EHRs), genomics, clinical trial data, and patient-generated health data there is a rising imperative to extract actionable insights. Predictive analytics helps healthcare organizations move from reactive to proactive care models, which is especially valuable in managing chronic diseases such as diabetes, hypertension, and heart conditions. For example, Mount Sinai Health System in New York has leveraged predictive models to anticipate patient deterioration in intensive care units, thus enabling timely interventions and improving survival rates.

Moreover, healthcare providers are turning to analytics to solve long-standing challenges like emergency department overcrowding, operational inefficiencies, and rising treatment costs. By identifying patient risk factors in advance, institutions can allocate resources more effectively, minimize delays, and reduce costs without compromising care quality. The COVID-19 pandemic further accelerated the adoption of predictive tools, as health systems worldwide faced unprecedented challenges in resource allocation, patient triage, and supply chain management.

The market is positioned for robust expansion due to the increasing digitization of healthcare, rising pressure on healthcare systems to cut costs, and the growing demand for value-based care. While the benefits are vast, the market is not without its challenges—chief among them being data privacy concerns, regulatory barriers, and the lack of standardization in data infrastructure.

Integration of AI and Machine Learning with Predictive Models: Healthcare analytics platforms are increasingly powered by sophisticated AI algorithms that continuously learn and evolve with new datasets.

Shift Toward Value-Based and Personalized Care: Predictive analytics is being used to tailor treatments based on individual patient profiles and risk scores.

Increased Focus on Population Health Management: Healthcare providers and payers are using analytics to manage chronic diseases and monitor community health metrics.

Expansion of Cloud-Based Predictive Analytics Platforms: Cloud adoption enables scalable, real-time analytics and easier data sharing across systems.

Rise in Use of Predictive Tools for Financial Optimization: Institutions are using analytics to detect billing anomalies, forecast revenue, and prevent fraud.

Predictive Staffing and Workforce Optimization: Advanced forecasting tools are helping hospitals schedule staff efficiently to reduce burnout and overtime costs.

Integration with Wearable and Remote Patient Monitoring Devices: Real-time data from wearables is increasingly being used to predict adverse events and enable remote interventions.

| Report Coverage | Details |

| Market Size in 2025 | USD 18.65 Billion |

| Market Size by 2034 | USD 153.94 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 23.5% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | IBM; Verisk Analytics, Inc.; McKesson Corp.; SAS; Oracle;Allscripts (now Veradigm); Optum, Inc.; MedeAnalytics, Inc.; INFRAGISTICS; Cloudera; Health Catalyst; IQVIA Inc; Inovalon; OSP; ClosedLoop |

The most powerful driver shaping the healthcare predictive analytics market is the escalating need to reduce healthcare costs while improving efficiency and care quality. Healthcare systems globally are burdened with increasing patient loads, staff shortages, and resource constraints. Predictive analytics offers a compelling solution by enabling healthcare organizations to optimize clinical and operational decisions based on predictive insights.

For instance, predictive tools help hospitals forecast patient admissions, anticipate peak emergency room demand, and streamline discharge processes to minimize unnecessary readmissions. This has a direct impact on operating margins and helps avoid penalties related to inefficiencies. Similarly, predictive financial analytics is allowing providers to anticipate billing errors, prevent fraud, and optimize reimbursement cycles. In an industry where every percentage point in savings can translate to millions in recovered costs, predictive analytics has become not just a luxury but a necessity.

A major restraint hindering the growth of the healthcare predictive analytics market is the complexity of ensuring data privacy, security, and interoperability across disparate systems. Healthcare organizations manage vast volumes of sensitive patient data, protected under regulations like HIPAA (U.S.) and GDPR (Europe). Any breach or misuse can lead to significant legal and reputational repercussions.

Additionally, the lack of standardized data formats and siloed information systems makes it difficult to integrate and harmonize datasets from multiple sources such as EHRs, lab systems, and payer databases into a unified analytical framework. This fragmentation results in incomplete insights, algorithm bias, and operational bottlenecks. Without robust data governance frameworks and interoperable IT infrastructure, the true potential of predictive analytics remains largely untapped in many settings.

One of the most promising opportunities for predictive analytics lies in its application to remote patient monitoring and preventive care, especially post-COVID. With the widespread adoption of telehealth and wearable technologies, healthcare systems now have access to continuous, real-time patient data outside clinical settings.

Predictive analytics can leverage this data to flag early warning signs of health deterioration, enabling timely intervention and reducing hospital admissions. For example, chronic disease patients can be monitored for heart rate anomalies or glucose level trends through wearable sensors. When integrated with predictive models, such systems can notify healthcare providers in advance, preventing emergency events. This shift from episodic to continuous care not only improves outcomes but also reduces treatment costs significantly. The ongoing expansion of digital health ecosystems offers fertile ground for scalable predictive solutions.

Clinical Applications Dominate the Healthcare Predictive Analytics Market. Clinical predictive analytics is the most widely adopted application due to its direct impact on patient outcomes and care quality. Tools under this category include clinical outcome analysis, patient care enhancement, and quality benchmarking. Hospitals utilize these models to predict complications, identify patients at risk of sepsis or stroke, and benchmark performance against national standards. For instance, Kaiser Permanente uses predictive tools to identify high-risk patients for early intervention, thus improving care outcomes and reducing readmissions.

However, Population Health is the Fastest-Growing Application Area, owing to the rising emphasis on proactive and preventive healthcare. Population health analytics focuses on risk stratification, therapy management, and patient engagement across communities. As value-based reimbursement models become more prevalent, healthcare organizations are investing in tools that allow them to monitor chronic disease populations, track medication adherence, and personalize outreach programs. Government initiatives in preventive health and chronic disease monitoring are expected to further boost this segment’s growth.

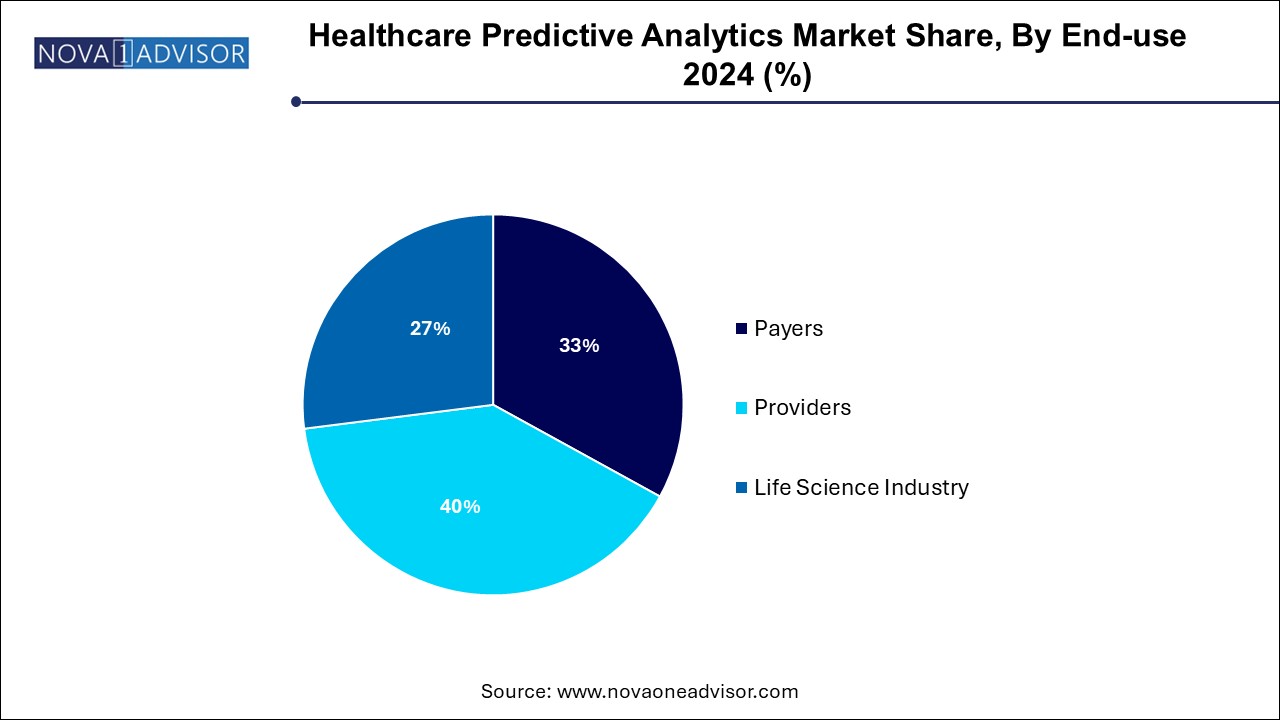

Providers Are the Largest End-Users of Predictive Analytics. Hospitals, clinics, and other healthcare delivery organizations use predictive tools to enhance clinical outcomes, optimize operations, and reduce costs. The high volume of patient data generated in these settings provides a rich foundation for analytics. Institutions like Mayo Clinic and Johns Hopkins Medicine are pioneers in integrating predictive analytics into their EHR systems for risk scoring and treatment planning.

However, Payers Are Emerging as the Fastest-Growing End-Use Segment. Insurance companies and government agencies are increasingly using predictive tools to assess population risk, detect fraud, and personalize insurance plans. Predictive models are instrumental in calculating premiums, projecting claim volumes, and designing value-based payment systems. As healthcare economics become more data-driven, payer interest in advanced analytics will continue to surge.

North America, particularly the United States, commands the largest share in the global market. This dominance stems from several factors: a highly digitized healthcare infrastructure, early adoption of AI-driven technologies, robust regulatory frameworks, and significant investments from both government and private sectors. Initiatives like the HITECH Act and Medicare’s Accountable Care Organizations (ACOs) have created a conducive environment for predictive technologies. Leading U.S. providers such as Kaiser Permanente and the Mayo Clinic are investing heavily in predictive models to enhance care coordination and operational efficiency.

Moreover, the region boasts a vibrant ecosystem of health tech startups, academic institutions, and established analytics firms like IBM Watson Health, SAS, and Optum. The integration of predictive analytics with EHRs and cloud computing platforms is rapidly transforming patient care across hospitals, clinics, and home health settings.

Asia Pacific is experiencing rapid adoption of healthcare predictive analytics, driven by rising healthcare expenditures, government digitization initiatives, and increasing awareness about population health management. Countries like India, China, and South Korea are making significant strides in telehealth and digital health infrastructure, which serve as a backbone for predictive technologies.

For instance, India’s Ayushman Bharat digital health mission aims to establish an integrated digital health ecosystem, creating new opportunities for predictive analytics in managing population health and insurance schemes. Similarly, China is investing heavily in AI-enabled healthcare analytics through state-backed initiatives and partnerships with tech giants like Tencent and Alibaba Health. As the region moves toward universal healthcare coverage and outcome-based models, predictive analytics will play a central role in optimizing resources and personalizing care.

March 2025 – Optum launched a new AI-driven predictive analytics suite tailored for value-based care models, focusing on chronic disease management and hospital readmission prevention.

February 2025 – IBM Watson Health collaborated with Mayo Clinic to enhance its clinical decision support tools using predictive analytics and natural language processing.

November 2024 – Cerner Corporation (Oracle Health) introduced an upgraded predictive analytics module integrated into its EHR, enabling real-time patient risk scoring across inpatient settings.

August 2024 – SAS Analytics announced the launch of a cloud-based fraud detection platform for healthcare payers, using advanced predictive modeling to identify false claims.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the healthcare predictive analytics market

Application

End-use

Regional