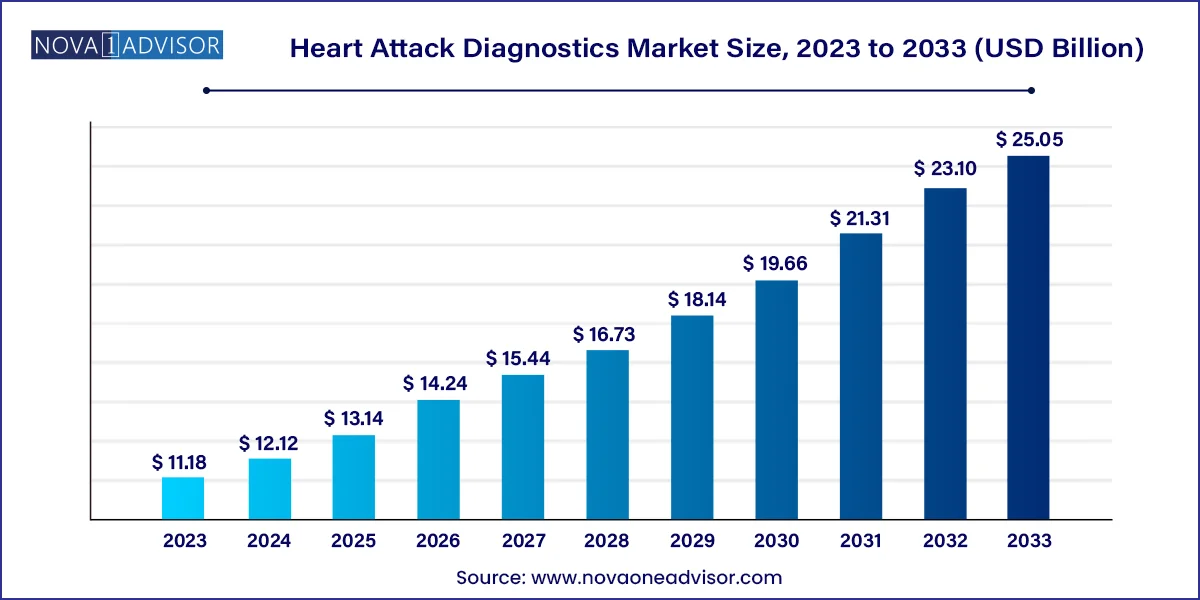

The global heart attack diagnostics market size was valued at USD 11.18 billion in 2023 and is anticipated to reach around USD 25.05 billion by 2033, growing at a CAGR of 8.4% from 2024 to 2033.

The Unhealthy lifestyle choices, such as poor dietary habits, tobacco smoking, high body mass index, sedentary lifestyles, and the prevalence of chronic diseases such as diabetes and hypertension, are the primary risk factors contributing to the development of heart attacks in individuals.

The occurrence of a heart attack, or myocardial infarction, arises when specific regions of the heart muscle experience a lack of oxygen supply. This situation occurs due to the obstruction of blood flow to the heart muscle.

The COVID-19 pandemic adversely affected diagnosis and treatment of non-communicable diseases. The pandemic caused widespread disruptions in healthcare systems worldwide. Fear of contracting COVID-19 led many people to avoid seeking medical attention for potential medical attack symptoms.

According to the World Heart Report, cardiovascular diseases continue to affect more than 500 million people across the globe. Alarmingly, these diseases claimed the lives of 20.5 million individuals in 2021, accounting for nearly a third of all deaths worldwide. This represents a substantial increase compared to the estimated 121 million deaths attributed to cardiovascular diseases (CVDs). It impacts the heart and blood vessels, and their occurrence can be attributed to a combination of socio-economic, metabolic, behavioral, and environmental risk factors. These risk factors encompass high blood pressure, an unhealthy diet, elevated cholesterol levels, diabetes, air pollution, obesity, tobacco usage, kidney disease, physical inactivity, excessive alcohol consumption, and stress.

| Report Attribute | Details |

| Market Size in 2024 | USD 12.12 Billion |

| Market Size by 2033 | USD 25.05 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 8.4% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Test, end use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | GE Healthcare; Hitachi Corporation; Koninklijke Philips NV; Midmark Corporation; F Hoffmann-La Roche Ltd; Schiller AG; Siemens Healthineers; Toshiba Corporation; Welch Allyn Inc; Astrazenca PLC |

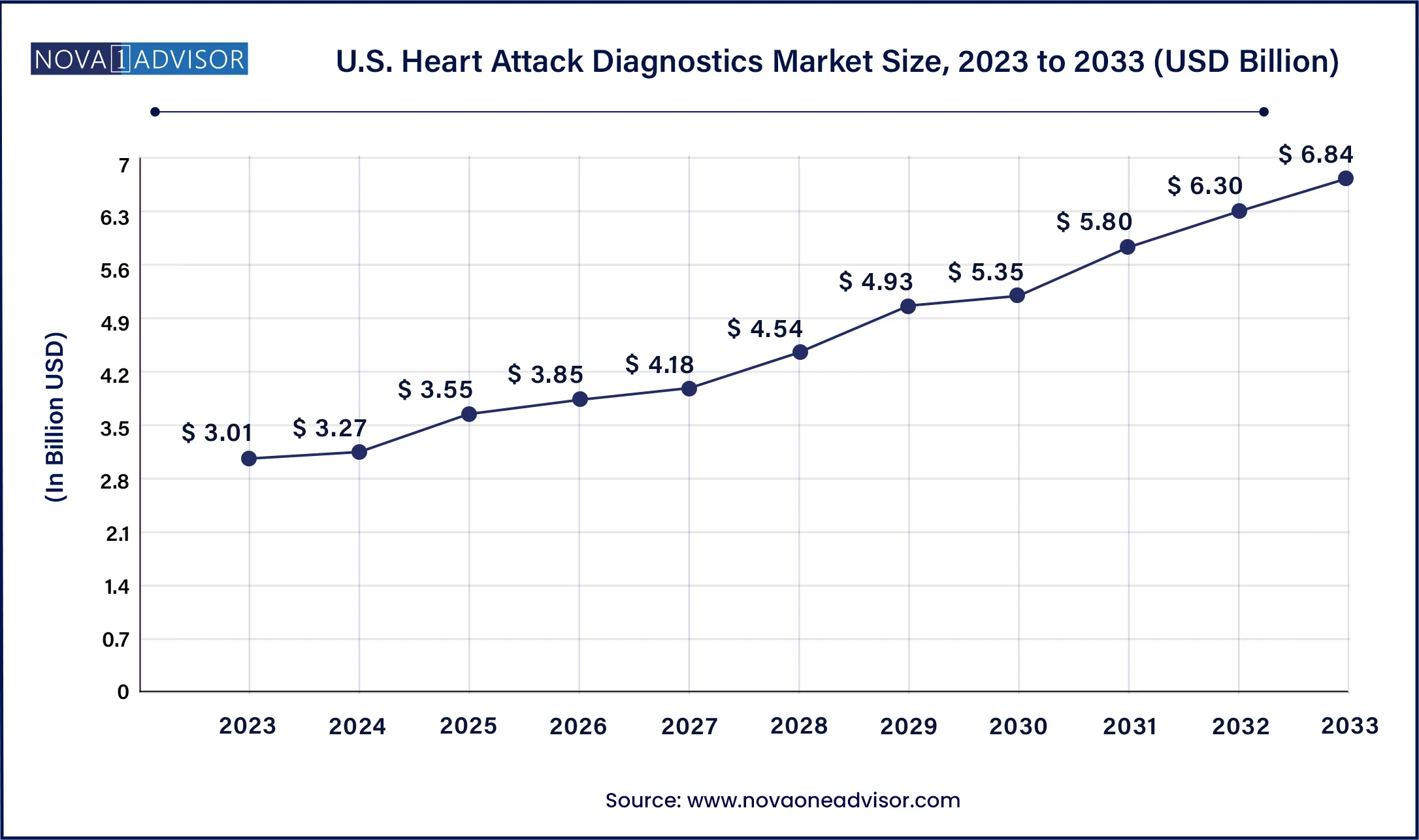

The U.S. heart attack diagnostics Market is valued at USD 3.01 Billion in 2023 and is projected to reach a value of USD 6.84 Billion by 2033 at a CAGR (Compound Annual Growth Rate) of 8.6% between 2024 and 2033.

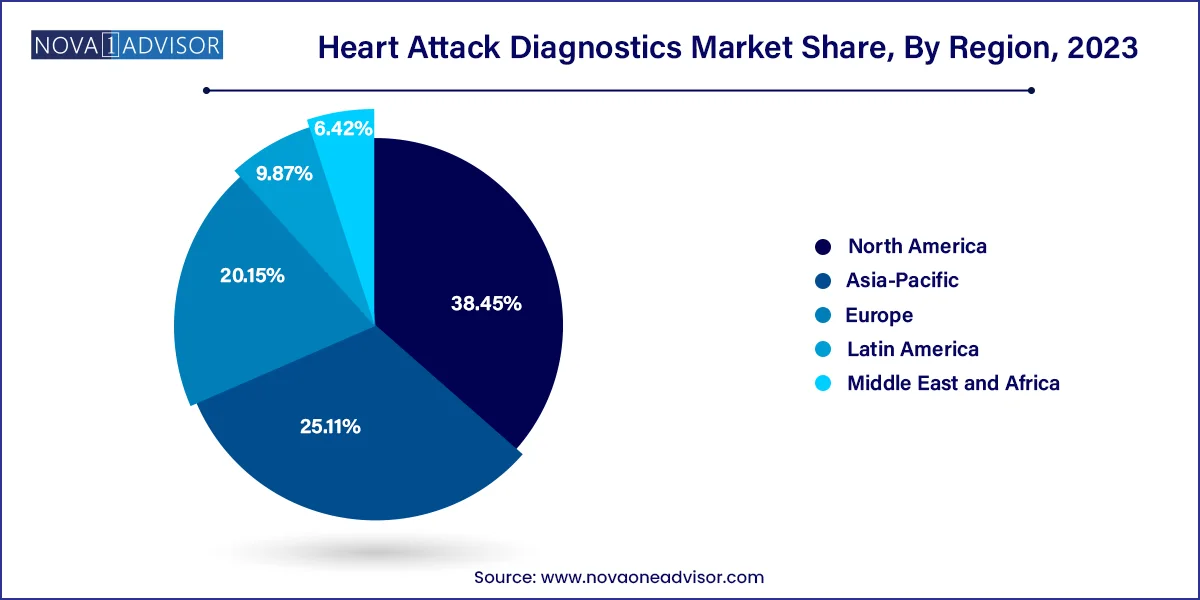

North America emerged as the largest global heart attack diagnostics market, with a 38.45% share in 2023 pertaining to the rise of cardiovascular cases in Canada and the U.S. Other factors that play a key role in market development include advanced healthcare infrastructure and increased investments in innovation.

U.S. Heart Attack Diagnostics Market Trends

The U.S. heart attack diagnostics market is expected to witness a significant growth of CAGR 8.2% during the forecast period. Recent research conducted by the U.S. Centers for Disease Control (CDC) indicates that every 40 seconds, a person in the U.S. undergoes a heart attack, making it the most expensive medical treatment in American healthcare facilities. The American Heart Association forecasts that around 45% of the U.S. population will be impacted by heart diseases by 2035, largely due to factors such as obesity, smoking, and sedentary lifestyles, all of which can increase the risk of heart attacks and other cardiovascular complications.

Europe Heart Attack Diagnostics Market Trends

The Europe heart attack diagnostics market, with a valuation of 3.1 billion, is expected to witness a growth rate of 7.4% during the forecast period from 2024 to 2030. The increase in patients with coronary artery disease and peripheral artery diseases has contributed to this growth. The European Union reported on March 21, 2022, that cardiovascular attacks were a leading cause of death in the EU. Additionally, advancements in technology are incorporating portability features into testing devices, which is driving market revenue growth.

The heart attack diagnostics market in UK is projected to witness steady growth rate in forecast period owing to an ageing and growing population and improved survival rates. Furthermore, the country’s development in research and technology is pushing the market.

Germany heat attack diagnostics market is expected to experience growth in the coming years. Germany is one of the top countries in terms of mortality rates from heart attacks. Cardiovascular diseases are the leading cause of death in the Germany. In addition, they are associated with significant health consequences for the individual and result in high medical costs for society.

Asia Pacific Heart Attack Diagnostics Market Trends

The heart attack diagnostics market in Asia Pacific is projected to witness a steady CAGR of 10.0% during the forecast period. Few regions experience a heavy burden of heart diseases, due to a large patient population in countries such as India and China.

The China heart attack diagnostics market is expected to witness a strong growth rate during the forecast period, 2024-2033. A recent report from Biospectrum reveals that China has a staggering population of around 290 million individuals affected by cardiovascular disease (CVD). CVD, encompassing stroke and ischemic heart disease (including heart attacks), stands as the primary cause of mortality in China, responsible for nearly two-fifths of all deaths. Notably, ischemic heart disease is rapidly emerging as the leading cause of premature death in the country.

In 2023, the blood tests segment emerged as the market leader, capturing the largest revenue share of 54.19%. One of the key factors driving the demand for blood tests in heart attack diagnostics is Troponin T, a protein found in heart muscle. Health care professionals utilize high-sensitivity troponin T tests to diagnose heart attacks and assess the risk of heart disease. Interestingly, even individuals without symptoms can have an increased level of troponin T, indicating a higher risk of heart disease. Other contributing factors include elevated cholesterol levels, the growing consumption of alcohol and tobacco, and the prevalence of unhealthy lifestyles among people.

The electrocardiogram segment is anticipated to exhibit a CAGR of 7.2% from 2024 to 2033, owing to factors such as the growing elderly population, unhealthy lifestyles, and the increase in tobacco and alcohol use. Additionally, the progress in technology and the heightened emphasis on healthcare in emerging nations such as India and China could create additional investment and research prospects, potentially impacting the worldwide ECG market.

The Troponin segment dominated the blood tests market and accounted for a share of 62.5% in 2023. Troponin T, a protein present in the heart muscle, is crucial in diagnosing heart attacks through a high-sensitivity troponin T test. This test is usually conducted when there are suspicions of heart muscle damage or during critical medical situations like heart attacks. Factors that can contribute to increased troponin levels include rapid heartbeat, high blood pressure in the lungs, and blockages in lung arteries due to blood clots, fat, or tumor cells.

The CK-MB (creatine kinase-myoglobin binding) segment in the blood tests category is expected to grow rapidly at a CAGR of 9.6% over the forecast period. The CK-MB test is utilized to determine the level of creatine kinase in the bloodstream. This specific enzyme is predominantly found in the heart, with minor amounts also present in the skeletal muscles.

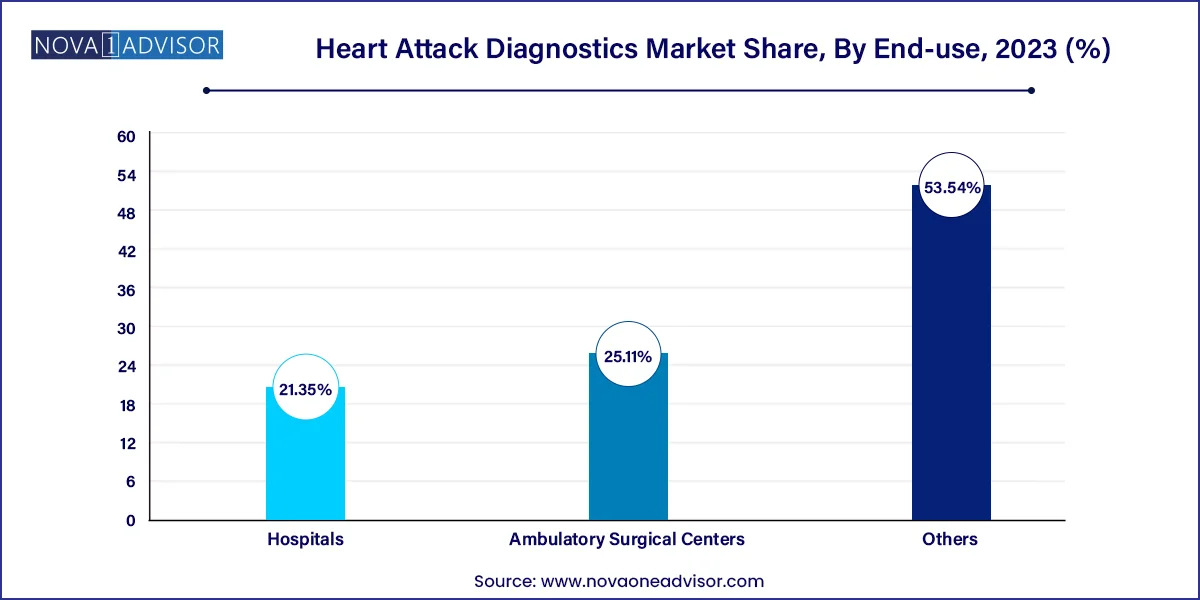

The hospital segment accounted for a share of 21.35% in 2023 primarily attributed to the extensive surgical procedures carried out in hospital settings and the widespread penetration of hospitals globally. Each year, over 290,000 adults in the U.S. experience in-hospital cardiac arrests.

The ambulatory segment is expected to grow at a CAGR of 10.6% during forecast period. There is an increasing emphasis on expediting and enhancing the convenience of diagnosis, especially for non-critical cases. Moreover, the progress in medical technology is driving the creation of portable and user-friendly diagnostic tools.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Heart Attack Diagnostics market.

By Test

By End-use

By Region