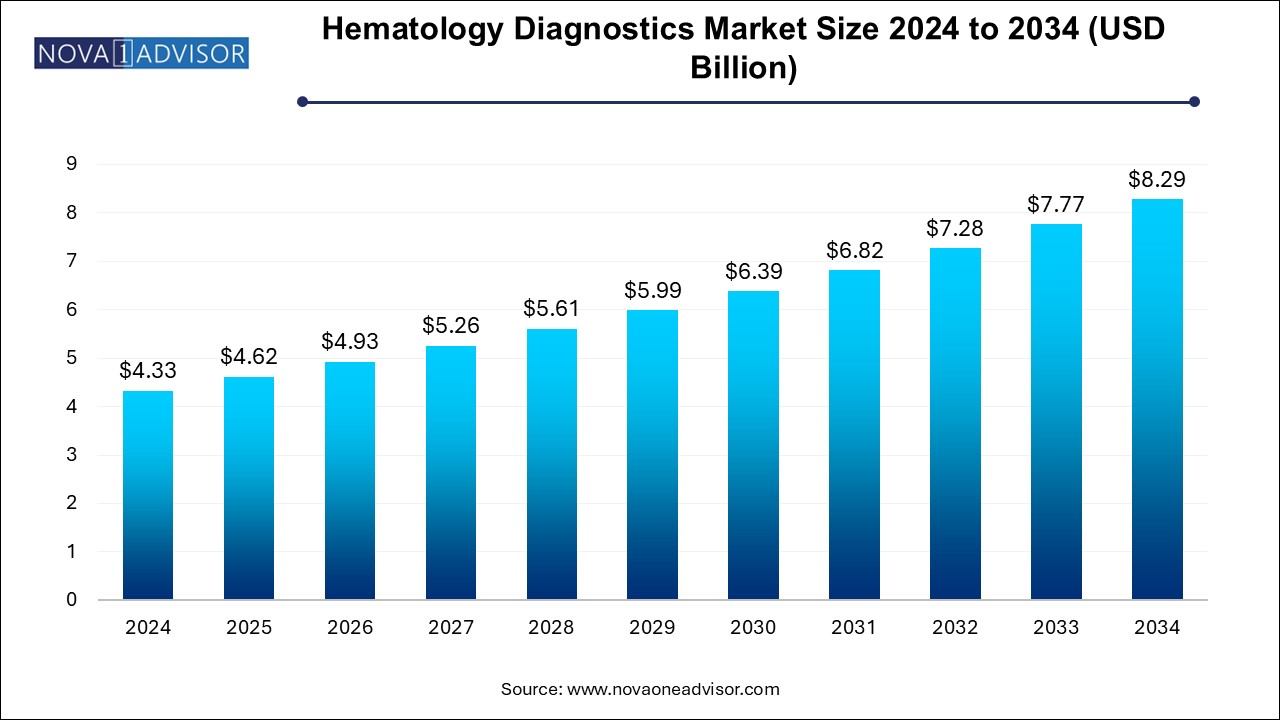

The hematology diagnostics market size was exhibited at USD 4.33 billion in 2024 and is projected to hit around USD 8.29 billion by 2034, growing at a CAGR of 6.7% during the forecast period 2025 to 2034.

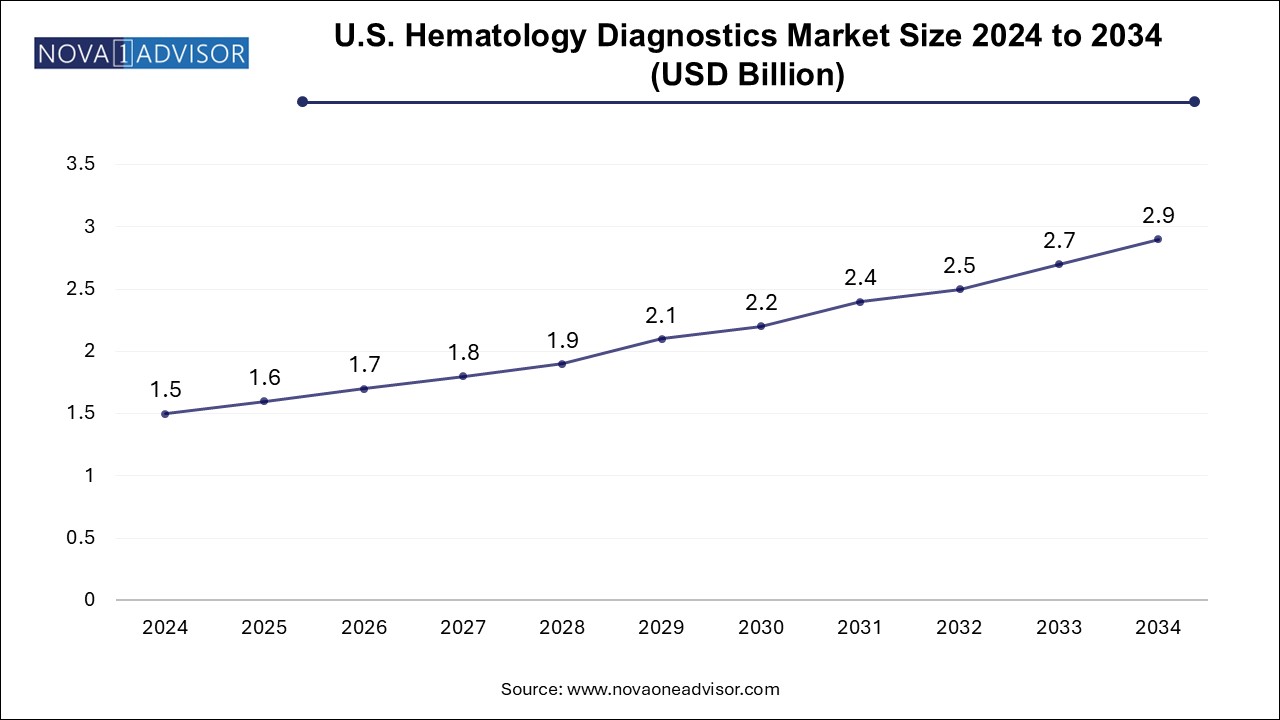

The U.S. hematology diagnostics market size is evaluated at USD 1.5 billion in 2024 and is projected to be worth around USD 2.9 billion by 2034, growing at a CAGR of 6.17% from 2025 to 2034.

North America hematology diagnostics market dominated the market and accounted for a 45.0 % share in 2024. owing to its advanced healthcare infrastructure, early adoption of new technologies, and high diagnostic awareness. The region has a well-established network of hospitals, clinical labs, and cancer centers, all equipped with advanced hematology analyzers and supported by robust reimbursement structures.

The U.S. also leads in hematology-based research and innovation, with companies and universities actively collaborating to develop next-generation diagnostic tools. The presence of major hematology equipment manufacturers such as Beckman Coulter, Sysmex America, and Abbott Diagnostics further strengthens the region's market leadership. Regulatory clarity and expedited approval pathways also support faster market entry for novel diagnostic systems.

Asia Pacific is projected to be the fastest-growing region, driven by a combination of increasing healthcare expenditure, large and aging populations, and rising incidence of blood disorders. Countries like China, India, and Japan are rapidly expanding their diagnostic infrastructure and adopting advanced hematology equipment in both urban and rural settings.

Government-led public health initiatives, combined with private sector investments, are improving access to diagnostic services, particularly in oncology and maternal care. Growing partnerships between local labs and international manufacturers are also facilitating technology transfer and price accessibility. As chronic diseases continue to rise in Asia Pacific, hematology diagnostics are expected to become a foundational tool in integrated care delivery.

The hematology diagnostics market plays a central role in the broader diagnostics industry, providing vital tools for the detection, monitoring, and management of blood-related disorders. Hematology focuses on the analysis of blood cells and coagulation pathways and is integral to the early detection of conditions such as anemia, infections, bleeding disorders, leukemia, lymphoma, and other hematologic malignancies.

The global healthcare community’s focus on precision diagnostics, rising incidence of hematologic conditions, expanding healthcare infrastructure in emerging economies, and the increasing importance of regular blood testing in routine medical assessments are fueling the growth of this market. The evolution of hematology analyzers—from traditional manual microscopes to fully automated, high-throughput, and AI-integrated platforms—has significantly improved diagnostic accuracy, turnaround times, and operational efficiency.

Further, the COVID-19 pandemic underscored the essential role of hematology testing in routine clinical care, driving demand for complete blood count (CBC) and inflammation markers such as neutrophil-to-lymphocyte ratios. As the world transitions toward preventive medicine and integrated care models, hematology diagnostics will remain a foundational pillar of disease surveillance, risk assessment, and therapeutic monitoring.

In addition, the market is experiencing a steady shift toward point-of-care (POC) hematology solutions, especially in low-resource and decentralized settings. Government health initiatives, increasing public health awareness, and funding for oncology and infectious disease screening are further contributing to the sustained demand for hematology diagnostics globally.

Integration of AI and Machine Learning in Hematology Analyzers: Enhancing cell morphology interpretation and reducing manual intervention.

Automation and High-throughput Testing: Fully automated systems are increasingly replacing manual and semi-automated testing platforms, especially in high-volume labs.

Shift Toward Reagent Rental Models: Hospitals and diagnostic chains are opting for cost-effective leasing models bundled with consumables.

Development of Multiparameter Analyzers: Advanced analyzers capable of providing comprehensive blood profiles and immune status in a single run.

Rising Demand for Point-of-Care Hematology Devices: Particularly in rural healthcare centers and emergency departments.

Growing Focus on Pediatric and Neonatal Hematology Diagnostics: Specialized solutions for early diagnosis of congenital blood disorders.

Increasing Use of Flow Cytometry in Hematologic Malignancies: For immunophenotyping, staging, and monitoring response to therapy.

Expanded Role in Personalized Oncology: Hematology diagnostics being utilized to guide chemotherapy dosing and monitor bone marrow suppression.

| Report Coverage | Details |

| Market Size in 2025 | USD 4.62 Billion |

| Market Size by 2034 | USD 8.29 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 6.7% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Test, End use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Abbott; Beckman Coulter, Inc.; Sysmex Corporation; Horiba; Bio-Rad Laboratories; Siemens Healthineers AG; F. Hoffmann-La Roche Ltd; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; NIHON KOHDEN CORPORATION; and EKF Diagnostics. |

A significant driver of the hematology diagnostics market is the increasing global burden of hematological diseases and chronic conditions that require regular blood monitoring. Disorders such as anemia, thalassemia, leukemia, hemophilia, and multiple myeloma are on the rise, fueled by aging populations, nutritional deficiencies, and increasing exposure to carcinogens and environmental toxins.

According to the Leukemia & Lymphoma Society, blood cancers account for nearly 10% of all new cancer cases in the United States each year. Moreover, chronic diseases such as kidney disease, diabetes, and cardiovascular disorders also necessitate frequent blood testing to monitor systemic impact and medication effectiveness.

Routine hematology tests such as CBC, hemoglobin levels, and platelet counts are essential for diagnosing these conditions and tailoring treatment strategies. This clinical indispensability is driving demand for hematology analyzers in both hospital and outpatient settings, with growing utilization in wellness programs and annual health checkups.

One of the primary restraints impacting the hematology diagnostics market is the high cost of procuring and maintaining advanced hematology analyzers, especially for smaller laboratories and facilities in low- and middle-income regions. Fully automated, multi-parameter analyzers require significant upfront capital, space, and trained personnel to operate efficiently.

Additionally, regular calibration, reagent management, and technical support can lead to high recurring costs. Although reagent rental agreements help ease financial burdens, the total cost of ownership for high-end systems remains a barrier to entry for smaller or standalone diagnostic providers.

Moreover, lack of standardization in test parameters, particularly in decentralized settings, may lead to inconsistent results and increased quality control efforts—adding another layer of complexity and cost. These factors can hinder widespread adoption, especially in underfunded public health labs and rural care centers.

The hematology diagnostics market is presented with a significant opportunity in the expanding role of hematology in precision oncology and personalized medicine. Hematological parameters such as absolute neutrophil count, platelet count, and hemoglobin levels are critical in managing cancer patients undergoing chemotherapy, radiation, or immunotherapy.

Moreover, advanced hematological techniques such as flow cytometry and molecular hematopathology are being increasingly employed in diagnosing, subtyping, and monitoring hematologic malignancies like lymphoma and leukemia. Immunophenotyping, cell sorting, and minimal residual disease detection have become indispensable tools in oncology labs.

As companion diagnostics become a mainstay in oncology treatment pathways, hematology analyzers that offer high sensitivity, multi-marker capability, and digital connectivity will be crucial. This shift toward personalized, data-driven care is opening new doors for device innovation, including AI-integrated hematology platforms capable of suggesting diagnostic interpretations and predictive insights.

The consumables segment dominated the market with a share of 66.0% in 2024 and is also expected to witness the fastest growth with a CAGR of 7.0% in the forecast period, especially reagents, stains, and accessories used in hematology tests. Consumables are indispensable for the daily operation of hematology analyzers, ensuring test consistency and accuracy. The recurring nature of consumable purchases makes this a high-margin and high-volume segment for manufacturers. As test volumes grow across hospitals and diagnostic labs, the demand for high-quality, standardized reagents continues to expand.

Moreover, manufacturers are now developing ready-to-use and auto-calibrating reagent packs to reduce downtime and simplify lab workflows. In the wake of the pandemic, there’s also growing demand for safer, contamination-resistant consumables with extended shelf life.

Instruments are expected to witness the considerable growth with in forecast period, led by a wide array of automated analyzers and flow cytometers. These instruments form the backbone of diagnostic workflows in hospitals, reference laboratories, and oncology centers. Automated analyzers streamline blood cell counting, hemoglobin estimation, and white blood cell differentials, significantly reducing human error and increasing throughput. Leading manufacturers continue to enhance their platforms by integrating digital imaging, AI-driven classification, and cloud-based data reporting.

Flow cytometers represent a niche yet rapidly growing segment within hematology instruments, particularly in cancer diagnostics and immunophenotyping. They offer deeper insights into cell morphology, DNA content, and immune markers, playing a pivotal role in precision diagnostics. These tools are increasingly being adopted in research and high-acuity clinical centers for more specialized use cases.

The blood count segment captured the largest revenue share at 45.0 % in 2024. primarily due to its use as a first-line screening tool across all age groups and medical specialties. Complete blood counts (CBCs) are ordered in virtually all healthcare scenarios, ranging from routine checkups and pre-surgical assessments to chronic disease management and infection diagnosis. Their ability to detect abnormalities in red and white blood cells and platelets makes CBCs indispensable in primary care and specialized medicine alike.

Platelet function segment is projected to grow at the fastest CAGR over the forecast period. driven by its emerging role in cardiovascular care, anticoagulation monitoring, and surgical planning. These tests are critical for patients on antiplatelet therapy and those undergoing high-risk procedures where bleeding control is vital. The rising prevalence of heart disease, diabetes, and stroke in aging populations is leading to broader clinical use of platelet aggregation studies and related diagnostics.

The hospital segment held the largest revenue share of 42.0% in 2024. This is accounting for the bulk of test volumes due to their comprehensive infrastructure, high patient turnover, and integration of emergency care, inpatient, and outpatient services. In tertiary care hospitals and academic centers, advanced hematology analyzers are used for real-time diagnostics, oncology monitoring, and intraoperative evaluations. Many hospitals are adopting fully automated analyzers that integrate with LIS (Laboratory Information Systems) for seamless result sharing and patient monitoring.

The diagnostics lab segment is expected to grow at the fastest CAGR of 7.0% over the forecast period. fueled by the outsourcing of non-urgent testing, expansion of lab networks, and rise in private health check-up packages. Chain diagnostic labs across urban and semi-urban regions are investing in compact, automated analyzers to boost efficiency and handle increasing volumes of CBCs, hemoglobin estimates, and reticulocyte counts. Their ability to scale and offer home collection services also contributes to their growth trajectory.

In March 2025, Beckman Coulter launched its DxH 900 hematology analyzer with enhanced AI capabilities for cell classification and anomaly flagging, improving efficiency in high-volume labs.

In January 2025, Sysmex Corporation expanded its hematology product portfolio in the U.S. with the FDA-cleared XN-Series platform designed for pediatric and geriatric diagnostics.

In November 2024, Abbott Diagnostics announced a partnership with a national reference laboratory network in Brazil to deploy its Alinity h-series hematology systems across Latin America.

In September 2024, Siemens Healthineers introduced an automated hematology module integrated with its Atellica solution, streamlining workflow for multidisciplinary diagnostics.

In June 2024, Mindray Biomedical released a compact hematology analyzer tailored for decentralized diagnostic labs and primary health centers in Asia and Africa.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the hematology diagnostics market

By Product

By Test

By End Use

By Regional