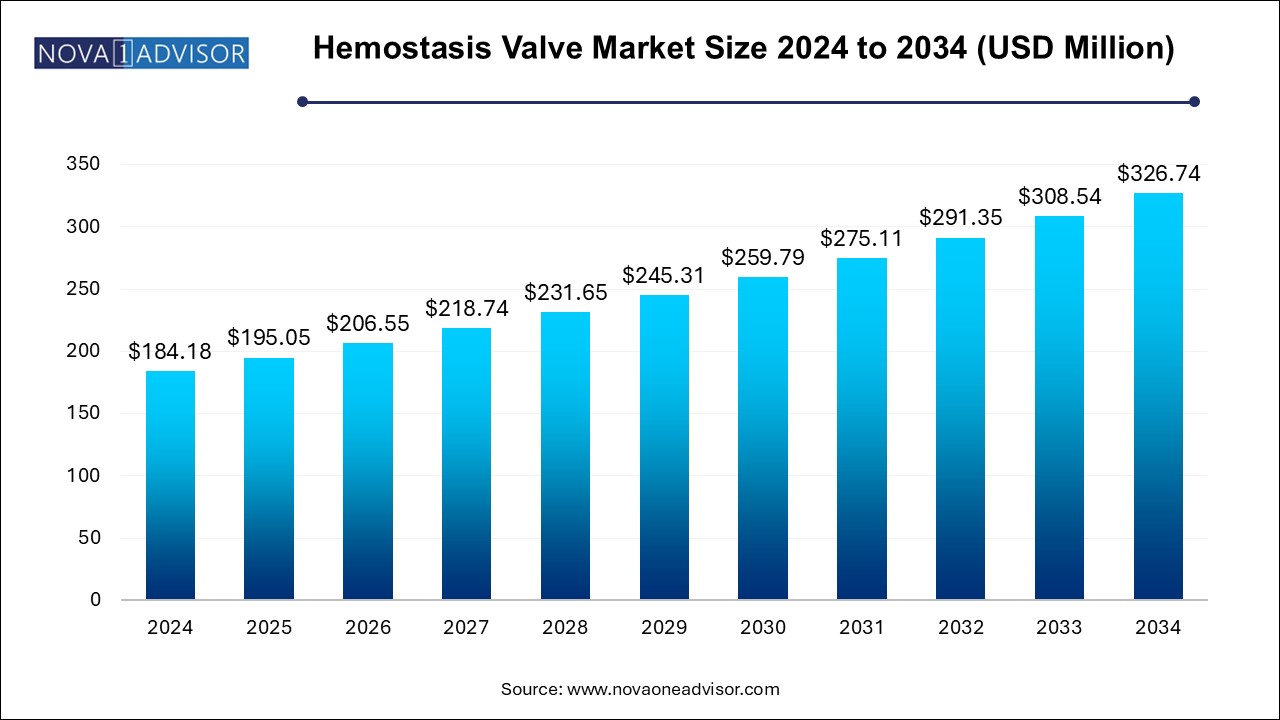

The hemostasis valve market size was exhibited at USD 184.18 million in 2024 and is projected to hit around USD 326.74 million by 2034, growing at a CAGR of 5.9% during the forecast period 2025 to 2034.

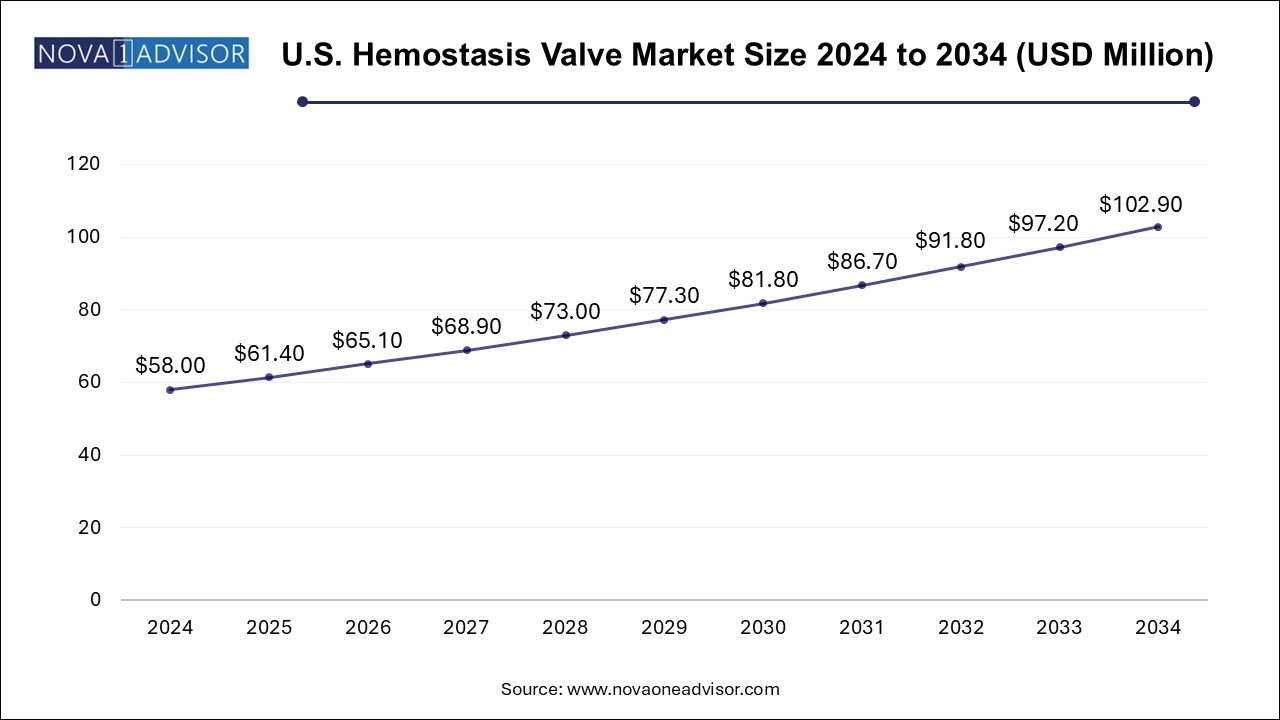

The U.S. hemostasis valve market size is evaluated at USD 58.0 million in 2024 and is projected to be worth around USD 102.9 million by 2034, growing at a CAGR of 5.35% from 2025 to 2034.

North America dominated the global hemostasis valve market, owing to its well-established healthcare infrastructure, high adoption of advanced medical technologies, and growing geriatric population. The U.S., in particular, leads in both the number of interventional cardiology procedures and the presence of leading market players. Favorable reimbursement scenarios and a strong focus on quality healthcare continue to drive growth. Furthermore, North America has a strong base of clinical research and innovation, with frequent product launches and FDA approvals enhancing its market position. The presence of key companies like Boston Scientific, Teleflex Incorporated, and Merit Medical Systems further strengthens the regional dominance.

Asia Pacific is projected to be the fastest growing region over the forecast period. The region is witnessing rapid urbanization, rising healthcare investments, and increasing awareness about cardiovascular health. Countries like China and India are experiencing a surge in catheter-based procedures due to the high burden of lifestyle-related diseases. In addition, government initiatives aimed at improving healthcare access, along with private investments in hospitals and surgical centers, are contributing to market expansion. Local manufacturing and strategic collaborations with global players are also aiding in offering affordable solutions, making the Asia Pacific region a hotspot for future growth in the hemostasis valve market.

The global hemostasis valve market has been witnessing notable growth over the past decade, driven by the increasing prevalence of cardiovascular diseases, rising interventional procedures, and advancements in minimally invasive surgeries. Hemostasis valves, often used during catheter-based procedures, are crucial in maintaining a bloodless field while allowing the insertion of interventional devices. These valves are extensively used in diagnostic and therapeutic procedures such as angiography and angioplasty, where vascular access and control are essential.

Healthcare systems worldwide are emphasizing on improving patient outcomes through technologically advanced medical devices. Hemostasis valves offer both safety and efficiency, reducing the chances of air embolism and excessive blood loss during surgeries. The growing aging population, which is more susceptible to vascular diseases, further contributes to the market demand. Moreover, the rise in outpatient procedures and increasing preference for ambulatory surgical centers is also catalyzing market growth.

The market is diversified with several types of valves—ranging from Y-connectors to one-handed valves—tailored to specific procedural needs. With increasing healthcare expenditure, especially in emerging economies, and rapid growth in the number of cardiac procedures, the global hemostasis valve market is poised for sustained growth. The market also sees consistent innovation and product development among leading players, focused on improving user ergonomics and clinical outcomes.

Major Trends in the Market

| Report Coverage | Details |

| Market Size in 2025 | USD 195.05 Million |

| Market Size by 2034 | USD 326.74 Million |

| Growth Rate From 2025 to 2034 | CAGR of 5.9% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type, Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Boston Scientific Corporation; Teleflex Incorporated; Merit Medical Systems; B. Braun Melsungen AG; TERUMO CORPORATION; Abbott; Argon Medical Devices; Freudenberg Medical; SCW Medicath Ltd; Lepu Medical Technology(Beijing)Co.,Ltd.; Nipro; DeRoyal Industries, Inc.; Antmed Corporation; Beijing Demax Medical Technology Co |

Market Driver: Increasing Prevalence of Cardiovascular Diseases

One of the most significant drivers of the hemostasis valve market is the global rise in cardiovascular diseases (CVDs). According to the World Health Organization (WHO), CVDs remain the leading cause of death globally, claiming an estimated 17.9 million lives annually. The rising prevalence of conditions such as coronary artery disease, myocardial infarction, and peripheral artery disease has led to a surge in interventional procedures like angiography and angioplasty. These procedures require precision, speed, and safety—making hemostasis valves indispensable. The need to maintain a sealed access site while introducing catheters or guidewires is effectively addressed by these valves, making them a critical tool in modern cardiovascular interventions.

Market Restraint: Stringent Regulatory Approval Processes

While the market presents lucrative opportunities, one of the key restraints is the stringent regulatory frameworks governing medical devices. Regulatory authorities such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) impose rigorous requirements to ensure the safety and efficacy of hemostasis valves. Manufacturers must undergo lengthy and expensive clinical trials before obtaining approvals. Additionally, post-market surveillance and reporting obligations can deter new entrants. These stringent processes, although essential for patient safety, often delay product launches and innovation cycles, especially for smaller or newer companies attempting to penetrate the market.

Market Opportunity: Growing Demand in Emerging Economies

Emerging markets such as India, China, Brazil, and countries in Southeast Asia present a significant growth opportunity for the hemostasis valve market. These regions are witnessing rapid advancements in healthcare infrastructure, increased government healthcare spending, and rising awareness about cardiovascular diseases. The growing middle-class population and improved access to healthcare services are leading to a higher number of diagnostic and therapeutic procedures, particularly in cardiology. Moreover, several global manufacturers are focusing on strategic partnerships, local manufacturing, and cost-effective product variants tailored for these regions. This localization strategy is enabling companies to tap into the unmet needs and expand their presence in high-growth territories.

Hemostasis Valve Y-Connectors dominated the market due to their widespread adoption in catheterization laboratories and interventional cardiology procedures. These valves offer multiple access ports and secure locking mechanisms, which facilitate the insertion of multiple devices while maintaining hemostasis. Their versatility, reliability, and availability in various sizes make them a staple in hospitals and surgical centers globally. As cardiac and peripheral vascular interventions continue to grow, Y-connectors remain the preferred choice for clinicians looking for high functionality and cost-effectiveness.

On the other hand, One-Handed Hemostasis Valves are the fastest growing segment. These valves offer enhanced ergonomics, especially in high-pressure, time-sensitive procedures where ease of handling is critical. Their design allows single-hand operation, freeing the other hand for catheter manipulation or other tasks. This feature is especially valuable in complex procedures involving limited personnel or when device exchange needs to be rapid and secure. The demand is fueled further by technological innovations that reduce operator fatigue and procedural time, making them increasingly popular in both developed and emerging healthcare settings

Angioplasty held the largest market share within the application segment, given the increasing number of patients undergoing percutaneous coronary interventions (PCI). Hemostasis valves are critical during these procedures to prevent blood loss while multiple catheter exchanges are performed. With the continuous rise in cardiovascular risk factors such as diabetes, hypertension, and obesity, angioplasty procedures are becoming more common worldwide. Additionally, the demand for drug-eluting and bioresorbable stents further increases the procedural complexity, thereby driving the need for effective hemostasis solutions.

Angiography is expected to be the fastest growing application segment. This growth is fueled by rising diagnostic rates and improved access to advanced imaging technologies in developing nations. As early diagnosis of cardiovascular conditions becomes a global health priority, angiographic procedures are seeing increased utilization. These diagnostic procedures often precede therapeutic interventions, requiring hemostasis valves to maintain vascular access and prevent bleeding. Moreover, as outpatient diagnostic centers and imaging facilities grow in number, the demand for easy-to-use and portable hemostasis valves is expected to rise.

Hospitals emerged as the dominant end-user segment due to their large volume of complex procedures and availability of specialized medical personnel and equipment. Most interventional procedures that use hemostasis valves, such as angioplasty and diagnostic catheterization, are performed in hospital settings. Hospitals often have dedicated cardiac catheterization labs (cath labs), further cementing their dominance in this market. Additionally, the presence of multi-disciplinary teams and higher budgets allow hospitals to invest in premium and technologically advanced valve systems.

Ambulatory Surgical Centers (ASCs) represent the fastest growing segment in the end-use category. The rising trend of outpatient procedures, especially in the U.S. and parts of Europe, is fueling the shift toward ASCs. These centers offer cost-effective and efficient alternatives to traditional hospital settings, often preferred by both patients and providers. With shorter wait times, lower infection risks, and faster patient turnover, ASCs are increasingly performing minimally invasive cardiovascular procedures. This evolution has led to a parallel demand for portable, disposable, and easy-to-use hemostasis valves optimized for such environments.

In November 2023, Teleflex Incorporated announced the expansion of its Arrow portfolio with an advanced hemostasis valve designed for enhanced sealing performance and reduced blood loss during high-pressure interventions.

Boston Scientific in January 2024 revealed the initiation of clinical trials for a next-generation hemostasis valve system integrated with pressure sensors for real-time monitoring, signaling a move toward smart catheter accessories.

In March 2024, Merit Medical Systems acquired a majority stake in a European catheter accessories manufacturer, strengthening its product offerings and geographical footprint in the hemostasis valve space.

In February 2024, B. Braun Melsungen AG announced a partnership with a Japanese medical device distributor to expand the availability of their hemostasis valve products in East Asia.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the hemostasis valve market

By Type

By Application

By End-use

By Regional