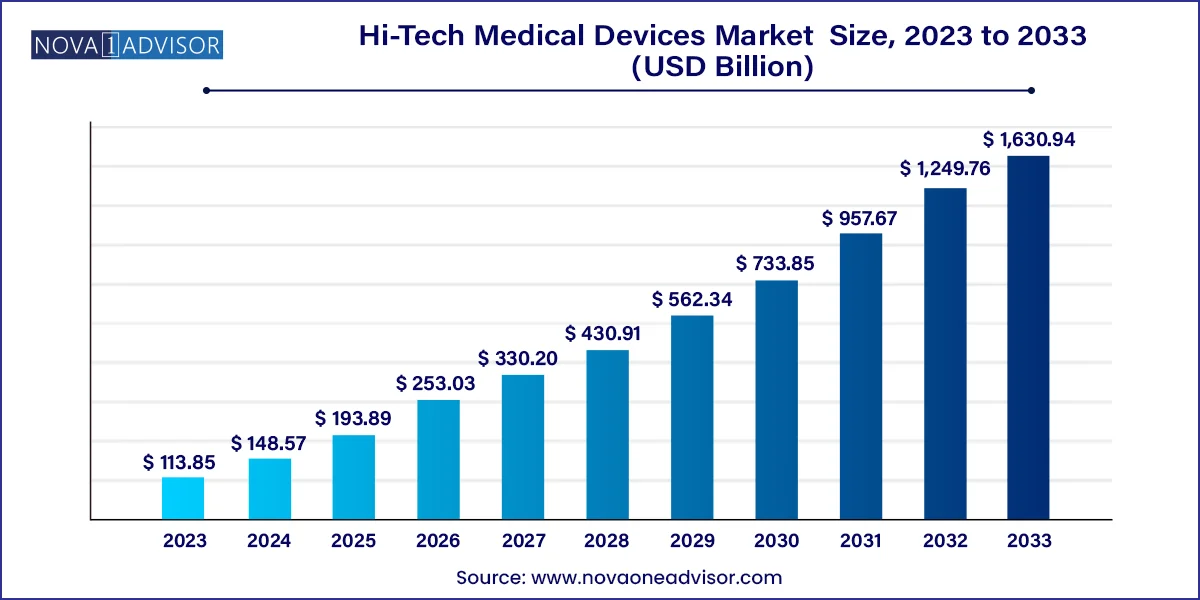

The global hi-tech medical devices market size was valued at USD 113.85 billion in 2023 and is anticipated to reach around USD 1,630.94 billion by 2033, growing at a CAGR of 30.5% from 2024 to 2033.

This market growth is attributable to the increasing prevalence of chronic diseases, cardiovascular disorders, diabetes, and respiratory conditions. High-technology medical devices provide effective monitoring and management of these critical diseases, leading to improved patient care.

In addition, new technologies such as Artificial Intelligence (AI) and IoT have paved the way to create smart and efficient medical devices. For instance, AI enables the detection of diseases based on accurate data analysis of medical images. In addition, the use of IoT devices helps patients exchange information with consultants with convenience while constantly monitoring the patient’s vital signs through wearable devices. These cost-effective devices provide targeted information, leading to better patient outcomes.

Moreover, the rising prevalence of patients with type 2 diabetes, cardiovascular diseases, respiratory illnesses, and chronic diseases has resulted in significant market expansion. These chronic conditions can be effectively managed by hi-tech medical solutions. For instance, the continuous glucose monitoring system assists diabetic patients with consistent monitoring of blood sugar levels and adjusting insulin doses. Some of the technologies used in heart treatments are enhanced implants, including implantable cardioverter-defibrillators that are used to prevent Spinocerebellar ataxia (SCA). In addition, smart gadgets allow patients to monitor their daily activities, workouts, nutrition, count, and more.

Furthermore, governments and private sectors have increasingly invested in healthcare facilities which has led to a significant boost in the use of hi-tech medical devices. Government support pmarketavorable reimbursement policies, and growing research and development efforts in the medical sector have contributed to the market growth.

| Report Attribute | Details |

| Market Size in 2024 | USD 148.57 Billion |

| Market Size by 2033 | USD 1,630.94 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 30.5% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, application, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Apple Inc.; Google Inc.; Xiaomi;Sony Corporation; Elevate Healthcare Inc.; Fitbit LLC; Garmin Ltd.; Honeywell International Inc.; Medtronic; OMRON Healthcare, Inc. |

Product Trends

Smartphones accounted for the dominant share of the market with 52.64% in 2023 and are expected to continue their lucrative growth over the forecast period. This growth can be credited to their expanding capabilities, including high-quality cameras for medical imaging and sensors for tracking health metrics. Moreover, smartphones offer compatibility with wearable devices which allows seamless integration into patient monitoring systems. Advanced sensors, HD cameras, and powerful processors in these devices allow remote patient monitoring with real-time data collection. The user-friendliness of these devices makes complex medical information more accessible to patients, promoting healthcare literacy and awareness. In addition, mobile health applications offer fitness tracking, disease management, and telemedicine services.

Fitness trackers are expected to register the fastest CAGR of 39.6% during the forecast period owing to their customizable operating systems and adaptable product designs that allow users to tailor their experience. Technological advancements, such as improved sensors and connectivity, enhance their utility for tracking physical activity and health metrics with sophisticated wearables. These devices help users track sleep patterns, stress levels, and blood oxygen saturation levels. Furthermore, affordability and user-friendly interfaces of fitness trackers have significantly driven adoption among patients. These devices play a crucial role in promoting wellness, enabling users to monitor their health proactively and make informed lifestyle choices.

Application Trends

Handheld medical devices have registered the largest market revenue share of 62.67% in 2023. This growth can be credited to the rising geriatric population and increasing prevalence of chronic diseases, such as cancer, diabetes, and cardiovascular diseases (CVDs). Patients have increasingly adopted these devices as portable diagnostic and monitoring tools. In addition, the need for minimally invasive procedures has encouraged the development of compact, handheld devices for diagnostics, imaging, and treatment. enhance the capabilities of these devices, improving accuracy and efficiency. Technological advancements including AI and machine learning have enhanced the capabilities of these devices with high-resolution imaging, improving the portability of early diagnosis.

Straps, clips, and bracelets are expected to grow exponentially at a CAGR of 34.6% during the forecast period. These devices offer appealing features such as portability and precision. Notably, internet-savvy patients have increasingly sought high-end devices that blend digital connectivity, comfort, and exclusivity. These wearable accessories have played a pivotal role in remote patient monitoring, sports and fitness tracking, and home healthcare with their non-invasive features. Their compatibility with smartphones and seamless integration into daily routines have significantly contributed to their popularity.

Regional Insights

North America hi-tech medical devices market dominated the market in 2023 owing to the rising expenditure on healthcare, growth in R&D, and technological advancements. Significant investments in medical research and technology have encouraged the usage of hi-tech medical equipment in the region. Moreover, the availability of numerous healthcare providers and medical facilities has led to the active implementation of innovative technologies in the work of healthcare systems.

U.S. Hi-Tech Medical Devices Market Trends

The U.S. hi-tech medical devices market dominated the North America with a share of 85.7% in 2023. The country has witnessed substantial growth in the elderly population, leading to an increased prevalence of age-related disorders. Chronic conditions such as diabetes, hypertension, and osteoarthritis. Furthermore, healthcare agencies have actively promoted diagnosis and treatment through awareness programs, leading to a large patient pool seeking treatment.

Europe Hi-Tech Medical Devices Market Trends

Europe hi-tech medical devices market held a lucrative share in 2023 pertaining to the aging population, which drove demand for advanced medical technologies to address age-related health issues and chronic diseases. The region's well-developed healthcare infrastructure and high healthcare investments have provided a strong foundation for the adoption of innovative medical devices. Additionally, digital health initiatives and the increasing adoption of telemedicine and remote patient monitoring solutions have further contributed to market growth.

Asia Pacific Hi-Tech Medical Devices Market Trends

Asia Pacific hi-tech medical devices market is anticipated to witness significant growth in the hi-tech medical devices market due to the rising prevalence of chronic diseases among the elderly population. Additionally, the increasing disposable incomes have encouraged considerable adoption of advanced medical technologies.

Japan hi-tech medical devices market is expected to grow rapidly in the coming years due to country’s robust advanced healthcare infrastructure and adoption of new technologies and country’s aging population is driving the market growth.

India hi-tech medical devices market held a substantial market share in 2023 owing to largest population base and increasing government initiatives in the healthcare facilities.

Some of the key companies in the hi-tech medical devices market include Apple Inc., Google Inc., Xiaomi, Garmin Ltd., Sony Corporation, and more. Organizations have focused on increasing customer base to gain a competitive edge in the industry. They have implemented several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

The following are the leading companies in the hi-tech medical devices market. These companies collectively hold the largest market share and dictate industry trends.

Hi-Tech Medical Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Hi-Tech Medical Devices market.

By Product

By Application

By Region

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Hi-Tech Medical Devices Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Market Size and Growth Prospects (USD Million)

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.2. Market Restraints Analysis

3.4. Hi-Tech Medical Devices Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

Chapter 4. Hi-Tech Medical Devices Market: Product Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Hi-Tech Medical Devices Market: Product Movement Analysis, 2024 & 2033 (USD Million)

4.3. Smart Phones

4.3.1. Smart Phones Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.4. Tablets

4.4.1. Tablets Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.5. Smart Watches

4.5.1. Smart Watches Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.6. Fitness Trackers

4.6.1. Fitness Trackers Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.7. Virtual Reality Sets

4.7.1. Virtual Reality Sets Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

4.8. Others

4.8.1. Others Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

Chapter 5. Hi-Tech Medical Devices Market: Application Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Hi-Tech Medical Devices Market: Application Movement Analysis, 2024 & 2033 (USD Million)

5.3. Handheld

5.3.1. Handheld Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

5.4. Headband

5.4.1. Headband Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

5.5. Strap, Clip, Bracelet

5.5.1. Strap, Clip, Bracelet Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

5.6. Shoe Sensors

5.6.1. Shoe Sensors Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

5.7. Others

5.7.1. Others Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

Chapter 6. Hi-Tech Medical Devices Market: Regional Estimates & Trend Analysis

6.1. Hi-Tech Medical Devices Market Share, By Region, 2024 & 2033 (USD Million)

6.2. North America

6.2.1. North America Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.2.2. U.S.

6.2.2.1. U.S. Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.2.3. Canada

6.2.3.1. Canada Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.2.4. Mexico

6.2.4.1. Mexico Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.3. Europe

6.3.1. Europe Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.3.2. UK

6.3.2.1. UK Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.3.3. Germany

6.3.3.1. Germany Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.3.4. France

6.3.4.1. France Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.3.5. Italy

6.3.5.1. Italy Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.3.6. Spain

6.3.6.1. Spain Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.3.7. Denmark

6.3.7.1. Denmark Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.3.8. Sweden

6.3.8.1. Sweden Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.3.9. Norway

6.3.9.1. Norway Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4. Asia Pacific

6.4.1. Asia Pacific Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4.2. China

6.4.2.1. China Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4.3. Japan

6.4.3.1. Japan Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4.4. India

6.4.4.1. India Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4.5. South Korea

6.4.5.1. South Korea Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4.6. Australia

6.4.6.1. Australia Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4.7. South Korea

6.4.7.1. South Korea Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.4.8. Thailand

6.4.8.1. Thailand Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.5. Latin America

6.5.1. Latin America Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.5.2. Brazil

6.5.2.1. Brazil Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.5.3. Argentina

6.5.3.1. Argentina Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.6. Middle East and Africa

6.6.1. Middle East and Africa Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.6.2. Saudi Arabia

6.6.2.1. Saudi Arabia Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.6.3. UAE

6.6.3.1. UAE Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.6.4. South Africa

6.6.4.1. South Africa Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

6.6.5. Kuwait

6.6.5.1. Kuwait Hi-Tech Medical Devices Market Estimates and Forecasts, 2021 - 2033 (USD Million)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis by Key Market Participants

7.2. Company Categorization

7.3. Company Heat Map Analysis

7.4. Company Profiles

7.4.1. Apple Inc.

7.4.1.1. Participant’s Overview

7.4.1.2. Financial Performance

7.4.1.3. Product Benchmarking

7.4.1.4. Recent Developments/ Strategic Initiatives

7.4.2. Google Inc.

7.4.2.1. Participant’s Overview

7.4.2.2. Financial Performance

7.4.2.3. Product Benchmarking

7.4.2.4. Recent Developments/ Strategic Initiatives

7.4.3. Xiaomi

7.4.3.1. Participant’s Overview

7.4.3.2. Financial Performance

7.4.3.3. Product Benchmarking

7.4.3.4. Recent Developments/ Strategic Initiatives

7.4.4. Sony Corporation

7.4.4.1. Participant’s Overview

7.4.4.2. Financial Performance

7.4.4.3. Product Benchmarking

7.4.4.4. Recent Developments/ Strategic Initiatives

7.4.5. Elevate Healthcare Inc.

7.4.5.1. Participant’s Overview

7.4.5.2. Financial Performance

7.4.5.3. Product Benchmarking

7.4.5.4. Recent Developments/ Strategic Initiatives

7.4.6. Fitbit LLC.

7.4.6.1. Participant’s Overview

7.4.6.2. Financial Performance

7.4.6.3. Product Benchmarking

7.4.6.4. Recent Developments/ Strategic Initiatives

7.4.7. Garmin Ltd.

7.4.7.1. Participant’s Overview

7.4.7.2. Financial Performance

7.4.7.3. Product Benchmarking

7.4.7.4. Recent Developments/ Strategic Initiatives

7.4.8. Honeywell International Inc.

7.4.8.1. Participant’s Overview

7.4.8.2. Financial Performance

7.4.8.3. Product Benchmarking

7.4.8.4. Recent Developments/ Strategic Initiatives

7.4.9. Medtronic

7.4.9.1. Participant’s Overview

7.4.9.2. Financial Performance

7.4.9.3. Product Benchmarking

7.4.9.4. Recent Developments/ Strategic Initiatives

7.4.10. OMRON Healthcare, Inc.

7.4.10.1. Participant’s Overview

7.4.10.2. Financial Performance

7.4.10.3. Product Benchmarking

7.4.10.4. Recent Developments/ Strategic Initiatives