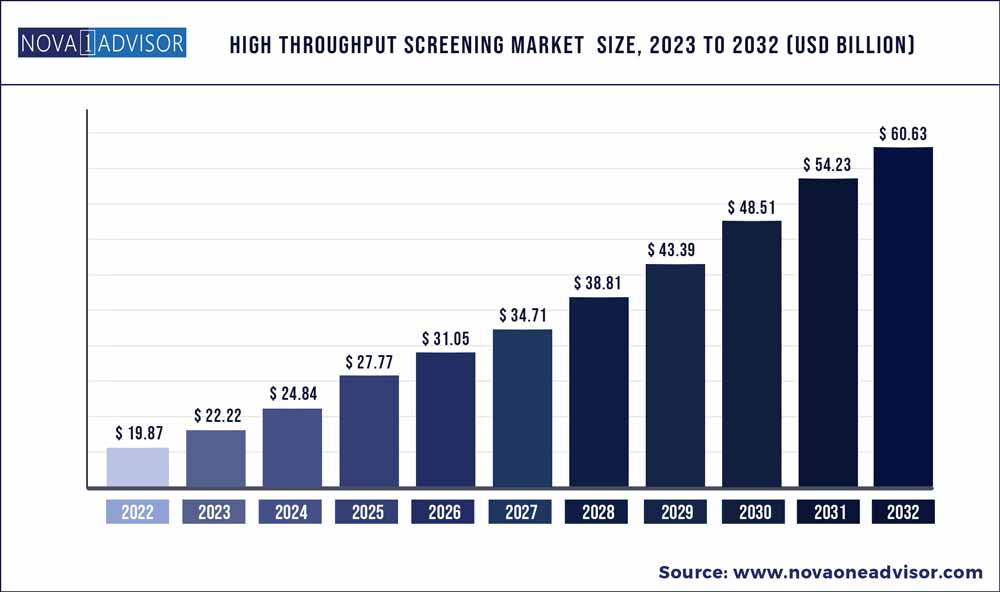

The global High-Throughput Screening market size accounted for USD 19.87 billion in 2022 and is estimated to achieve a market size of USD 60.63 billion by 2032 growing at a CAGR of 11.8% from 2023 to 2032.

Key Pointers:

Expanding applications of high throughput screening (HTS) in stem cell research is expected to offer significant opportunities for the overall market growth. High-throughput cell-based screening assays are routinely used in toxicology studies and stem cell research. Miniaturized cell-based assays with high-throughput capabilities can identify toxic compounds early in the process of drug discovery, thereby saving enormous financial resources. Many government research organizations utilize HTS for toxic compounds.

High-Throughput Screening Market Report Scope

|

Report Coverage |

Details |

|

Market Size in 2023 |

USD 22.22 Billion |

|

Market Size by 2032 |

USD 60.63 Billion |

|

Growth Rate from 2023 to 2032 |

CAGR of 11.8% |

|

Base year |

2022 |

|

Forecast period |

2023 to 2032 |

|

Segments covered |

By Product & Service, Application, Technology, End User & Region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Key companies profiled |

Thermo Fisher Scientific Inc. (US), Agilent Technologies, Inc. (US), Danaher Corporation (US), PerkinElmer, Inc. (US), Tecan Group Ltd. (Switzerland), AXXAM S.p.A. (Italy), Merck KGaA (Germany), Bio-Rad Laboratories, Inc. (US), Promega Corporation (US), Corning Incorporated (US), and Eurofins Scientific (Luxembourg). |

High Throughput Screening Market Dynamics

DRIVERS: Technological advancements in the HTS market

Continuous technological advancements and the introduction of new products in the market are major factors driving the growth of the global high throughput screening market. Various HTS providers are increasingly focusing on developing new products that are technologically advanced, faster, and easy to use. Next-generation liquid handling technologies, such as automated positive displacement pipetting systems, enable scientists to cover both lower volume ranges and a wider variety of liquid types ranging from highly viscous to highly volatile, which helps them cover a wide variety of applications, where once manual pipetting was used. Advancements in genomics & proteomics research have also helped in the target identification process. The integration of genomics and proteomics help understand disease mechanisms, thereby leading to improved and speedier drug discovery strategies.

RESTRAINTS: The capital-intensive nature of HTS instruments

HTS involves a number of steps such as target selection & characterization, reagent preparation, assay development, compound screening, and hit validation in secondary assays. The time and cost involved in each process vary according to the complexity of the target and assay. The process of reagent & assay development for primary and secondary makes it more expensive. Academic research laboratories find it difficult to afford such instruments, as they have restricted budgets. On the other hand, pharmaceutical companies require many such systems, and hence their capital costs increase significantly. Moreover, the maintenance costs and several other indirect expenses increase the total ownership cost of these instruments. Therefore, the high cost hinders the wide adoption of HTS instruments in both clinical & research applications.

Opportunities: Emerging markets

Emerging countries such as India, China, and Brazil offer huge growth opportunities for market players with their diversified healthcare markets, low labour & raw materials costs, rising life science & research activities, government support, the rapid growth of CROs, and the pharmaceutical industry, and technological integration & advancements. Governments of emerging countries have also spent significantly on encouraging research in the life sciences industry.

Moreover, the increasing interest of pharmaceutical companies in drug discovery outsourcing due to the ever-increasing demand for better drugs, drying drug pipelines, and rising R&D costs is further fueling the growth of HTS in emerging markets. Brazil, China, and India have many CROs that offer drug discovery services to serve pharmaceutical & biotechnology companies.

CHALLENGES: The dearth of skilled professionals

HTS instruments such as flow cytometers, liquid handling systems, and multimode readers are relatively complex technologies and require expertise to be handled effectively. However, there is a significant shortage of skilled personnel. The Coalition of State Bioscience Institutes surveyed 354 life sciences hiring managers and human resources professionals in 2020. It was revealed that multiple companies cited significant individual challenges in finding the right candidates for C-suite positions or positions in analytical R&D, bioinformatics, clinical development, clinical operations, IT & data analytics, project/program management, quality, regulatory, research, sales, and software engineering.

The HTS services segment is expected to grow at the fastest pace during the forecast period.

Based on product & service, the high-throughput screening market is segmented into consumables, instruments, services, and software. The HTS services segment is expected to grow at the fastest pace during the forecast period. Target assessment and assay evaluation, HTS assay development & testing, HTS target profiling assays, full-scale HTS screening, hit validation, and data analysis & storage are important high-throughput screening services offered by market players. Other services include training & support services for users in instrumentation, workstations, software usage for analysis, assay development, sample testing, preclinical & clinical services, and expert consultation.

The drug discovery segment will witness the highest growth during the forecast period.

Based on application, the high-throughput screening market is segmented into drug discovery, biochemical screening, life sciences research, and other applications (toxicology testing and food safety assessment). The drug discovery segment will witness the highest growth during the forecast period. HTS technologies are used to screen combinatorial chemistry, genomics, peptide, and protein libraries for the identification of hits. For a screening program to succeed, the choice of the assay is of prime importance. The different detection approaches used for HTS include cell-based cytotoxic assay; enzyme-linked immunosorbent assay (ELISA); antimicrobial, radiometric, and fluorescence-based assays; and affinity chromatography methodology.

North America was the largest regional market for high-throughput screening in 2022.

Geographically, the high-throughput screening market is segmented into North America, Europe, Asia Pacific, and Rest of the World. In 2022, North America accounted for the largest share of the high-throughput screening market, followed by Europe and the Asia Pacific. The North America region has shown strong commercialization of pharmaceutical & biotechnology research. The generic manufacturers need HTS platforms for hit identification and target validation in drug discovery & development.

Some of the prominent players in the High-Throughput Screening Market include:

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global High-Throughput Screening market.

By Product & Service

By Technology

By Application

By End User

By Region