The global high potency active pharmaceutical ingredients market size was exhibited at USD 27.19 billion in 2023 and is projected to hit around USD 62.39 billion by 2033, growing at a CAGR of 8.66% during the forecast period 2024 to 2033.

.webp)

Key Takeaways:

High Potency Active Pharmaceutical Ingredients Market Overview

The high potency active pharmaceutical ingredients (HPAPI) are more effective than conventional APIs at considerably lower dosage levels, but their handling issues are unique due to their potency. One significant reason anticipated to propel the market for highly potent active pharmaceutical ingredients is the increased incidence of cancer (HPAPIs). The WHO estimates that cancer is the second leading cause of mortality, accounting for nearly 9.6 million deaths in 2019, with tobacco use accounting for 22% of those deaths. The entire burden of the disease has been attributed, according to the CDC, to risk factors including lifestyle modifications like smoking, obesity, drinking alcohol, and exposure to UV radiation from the sun or tanning beds. Furthermore, it is predicted that the cost of cancer treatment will rise to USD 174 billion by the end of 2022, which will likely drive market expansion.

High Potency Active Pharmaceutical Ingredients Market Report Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 27.96 Billion |

| Market Size by 2033 | USD 50.55 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.8% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Manufacturer Type, Drug Type, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | BASF SE; CordenPharma; Dr. Reddy’s Laboratories Ltd.; CARBOGEN AMCIS AG; Pfizer, Inc.; Sun Pharmaceutical Industries, Ltd.; Teva Pharmaceutical Industries Ltd.; Albany Molecular Research, Inc.; Sanofi; Merck & Co., Inc.; Novartis AG; F. Hoffmann-La Roche Ltd; Bristol-Myers Squibb Company; Boehringer Ingelheim International GmbH; Lonza; Cipla Inc. |

High potency active pharmaceutical ingredients (HPAPI) market is witnessing growth due to the factors such as thegrowing applications of HPAPI, increasing prevalence of cancer, and growth of targeted therapies.Rise in the incidence of cancer has resulted in increase in R&D pertaining to anticancer drugs, which is expected to boost the growth of the HPAPI market over the forecast period.

The growing number of COVID-19 cases adversely affects the production of drugs as well as the manufacturing of HPAPI. Rising incidence of infection among workers led to the closure of manufacturing plants for safety purposes. Thus, high incidence and government-imposed lockdowns hampered growth of the high potency APIs market during the pandemic. For instance, in March 2020, Jubilant Pharmova Limited closed the API production plant due to the spread of coronavirus infection at production site. This shutdown affected HPAPIs, which were under development.

The HPAPI market is experiencing a surge in demand for products with the rise in the adoption of cancer therapeutics. Cancer is considered one of the prominent health hazards due to the increasing number of people being affected by the disease. According to WHO, cancer accounted for 10 million deaths in 2020which equals nearly one in six deaths, making it the leading cause of death worldwide. The research initiatives and the presence of health awareness campaigns are expected to fuel the global HPAPI market growth.

Moreover, market players are focusing on developing novel drugs to meet the growing demand for the production of active ingredients. For instance, in July 2023, for its site in Mourenx, the Novasep-PharmaZell Group invested USD 7.3 million as part of a bigger initiative backed by the "France Relance Plan” to increase API and HPAI production capacity. The production of active pharmaceutical ingredients (APIs), notably the extremely potent medicines (HPAPIs) used to treat cancer, will continue to be in high demand, which will support the expansion of the Mourenx site.

The HPAPI market requires complex material with large investments for production and establishment of manufacturing unit. Companies are investing to expand their manufacturing units to increase the production capacity to address the increased market demand. For instance, in April 2023, Cambrex announced the completion of a USD 50 million expansion and the opening of new high potency capabilities in the U.S.

For addressing unmet medical needs, companies are collaborating to develop novel High Potency Active Pharmaceutical Ingredients (HPAPIs). This allows firms to use their resources to aid the development of products and enhance their supply chain. For instance, in January 2023, Lonza, BioGeneration Ventures (BGV), and Forbion announced the extension of their collaboration to include the development & production of small molecules (biologics). Lonza will provide customized services to BGV and Forbion’s large molecule biologic portfolio.

High Potency Active Pharmaceutical Ingredients Market Dynamics

Key Market Drivers

Rising demand for drugs

The market is expanding as a result of a number of factors, including rising medication demand (particularly for oncology and antibody-drug conjugates). New predictions from the International Agency for Research on Cancer (IARC) for GLOBOCAN 2020 indicate that there will be 10.3 million cancer deaths and 19.3 million new cases of cancer worldwide in 2020. According to this recent study, more than 50 million people will receive a cancer diagnosis in the next five years.

The usage of very potent APIs in a variety of pharmacological therapies also contributes to the market's expansion. For instance, novel treatments for several malignancies, including lung, thyroid, and breast cancers, were approved by the US Center for Drug Evaluation and Research (CDER) in 2020. Both small and large API molecules were used in these treatments. The main ingredients in these medications are high-potency APIs. The market will expand in tandem with the increase in cancer cases to offer treatments for the condition. Similarly, 60,000 Americans are estimated to receive a Parkinson's disease diagnosis each year, according to a Parkinson's Foundation article released in July 2020. In recent years, precision medicine has received a lot of attention.

Increasing clinical trials

Targeted therapies are expanding as a result of hospitals and healthcare organizations collaborating closely with pharmaceutical firms to perform clinical trials. For instance, the Human Epidermal Growth Factor Receptor 2 (HER-2) protein, which is abundant in cancer cells, is being targeted for the treatment of breast cancer. Because the protein is overexpressed in breast and stomach cancer cells, HER-2 receptor antagonists such as trastuzumab are employed. Additionally, scientists are working to create a variety of specialized products, such as Janus kinase (JAK) 3 inhibitors, selective S1P receptor modulators, inhibitors of human interleukin, and inhibitors of dihydroorotate dehydrogenase.

Key Market Challenges

Barriers to entry - While many companies have not sought to buy existing businesses or add HPAPI capacity to their infrastructure, those with current HPAPI capabilities are actively growing their facilities. With regard to entrance obstacles, regulatory constraints, large investments, and knowledge related to APIs & HPAPI development, several manufacturers across different geographies and degrees of experience are making a sizable number of investments in HPAPI capabilities.

Need for appropriate process designs - The majority of HPAPI and ADC medication payloads require just modest clinical and commercial production volumes. However, it is difficult to produce gram-scale GMP APIs and payloads. It is undoubtedly difficult to maintain containment control when employing flexible and compact equipment, especially glass equipment, and each process and unit operation calls for a different strategy. In order to make sure that the process scales up to the facility's capabilities and equipment, it is crucial to retain proper process designs at the developmental stage.

Key Market Opportunities

Opportunities for CMOs and CDMOs are expanding

Comprehensive planning, the use of risk management and assessment tools, and a system to decide which compounds are suitable for manufacturing in each facility are all necessary for a comprehensive HPAPI manufacturing plant. The manufacturing of such substances exposes both the environment and people to dangers and risks.

A growing number of strong substances require pharmaceutical producers to have the ability to produce, store and transport them safely. This demonstrates that putting into practice a successful HPAPI manufacturing strategy involves a sizable time and financial commitment. Because many of these businesses have the appropriate machinery, many sponsor companies choose to turn to CMOs and CDMOs for assistance with the research, production, and distribution of HPAPIs and their formed medicinal products.

Segments Insights:

Product Insights

The synthetic segment accounted for the largest revenue share 70.5% in the HPAPI market in 2023. The growth of this segment is due to the higher effectiveness in treatment offered by synthetic HPAPI for a wide range of diseases at very small dosages. Moreover, with the expiry of patents associated with synthetic molecules, there is an increasing entry of generics into the market. The FDA carried out the generic drug program to ensure the availability of high-quality and cost-effective drugs in the U.S. amid COVID-19. It reduces the total healthcare cost and decreases the financial burden on patients by promoting generic products. In 2020, FDA approved 948 ANDA applications, including 72 first generic drugs.

Biotech segment is expected to show the fastest growth during the forecast period. The growth of the segment is owing to technological advancements in this segment and the high level of efficacy of these ingredients. Biotech HPAPIs are mostly peptides and other forms of enzymes. Moreover, the growth of the biotech segment can also be attributed to high investments in the biotechnology and biopharmaceutical sectors. This allows the innovation of new molecules that aid in the treatment of diseases, such as cancer. The cost of production of biotechnological products is high, as it requires highly specialized units and trained personnel, which increases the inclination of pharmaceutical companies toward third-party manufacturers. Outsourcing of HPAPIs has resulted in an increase in the bargaining power of suppliers.

Manufacturer Type Insights

In-house segment held the largest market share 71%in the HPAPI market in 2023. The dominance of the segment is due to the initiatives taken by key players for the development of products suggests that they are highly focused on in-house manufacturing over outsourcing. In August 2021, Cipla, Inc. introduced an “API re-imagination” program for expanding its own manufacturing capabilities using recent government incentives, such as production subsidies.

Outsourced segment is expected to show the fastest growth over the forecast period. The growth of is attributed to the rapidly increasing adoption of outsourcing in the high potency APIs market. Outsourced manufacturing reduces the risk, resource commitment, and product complexity of the company. Moreover, developing countries are a cost-effective measure for outsourcing, because they have a lower cost of manufacturing which allows companies to gain higher profits which further is expected to boost the demand of the market. In June 2023, Wuxi STA announced the expansion of its HPAPI facility in China, which allows it to cater to CDMO customers that are looking for a complex manufacturing setup.

Drug Type Insights

Innovative drugs accounted for the largest revenue share 71.6% in the HPAPI market owing to the growing focus on personalized and precision medicines, such as Antibody-Drug Conjugates (ADCs), the creation of innovative HPAPIs to treat certain patient diseases, making innovation in this field a market driver for the growth of the market. In May 2021, Zydus Cadila launched the first biosimilar antibody-drug conjugate trastuzumab emtansine under the brand name Ujvira.

Generic medicine segment is expected to grow at the fastest growth rate. The growth of the segment is due to the critical role generics serve in allowing access to life-saving medicines and the U.S. FDA continues to prioritize it as a public health priority for saving healthcare funding. As of November 2021, there are already over 10,000 FDA-approved generic medications on the market, with generics filling nine out of ten prescriptions in the U.S.

Application Insights

oncology segment dominated the market with the largest market share 75% in 2023 and is expected to be the fastest-growing segment. This can be attributed to the increasing prevalence of cancer worldwide. For instance, according to GLOBOCAN 2020, an estimated 19.3 million new cancer cases and almost 10.0 million cancer deaths occurred in 2020. In addition, breast and lung cancers were observed as the most common cancer worldwide. Due to the rise in the incidence of cancer, key market players are expanding their manufacturing capabilities to meet unmet needs. In June 2023, Merck announced the expansion of its U.S. Verona-based HPAPI facility two-fold to meet the increasing demand for cancer treatment components.

Furthermore, the hormonal segment is expected to witness lucrative growth in the forecast period. The growth of the segment is attributed to the increasing prevalence of the geriatric population along with increasing awareness of hormonal therapy. Some of the major hormone-dependent problems in women are Alzheimer’s disease, osteoporosis, coronary atherosclerosis, and urinary incontinence. Rising prevalence of hormonal disease is further anticipated to drive growth.

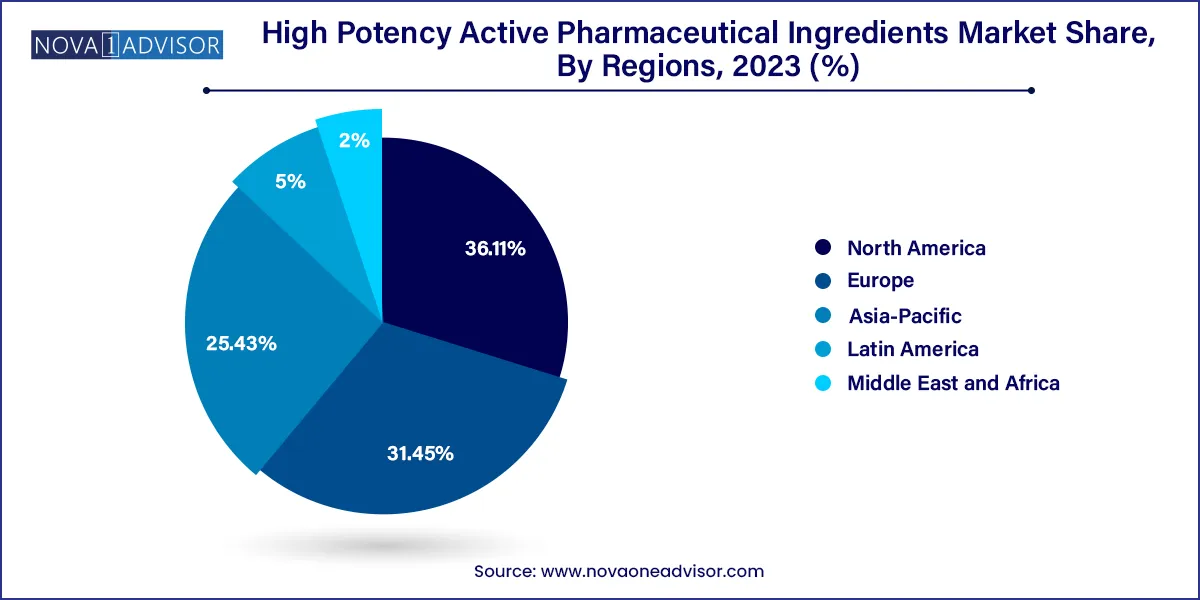

Regional Insights

North America dominated the high potency active pharmaceutical ingredients market with a share 36.12% in 2023. The dominance of the region is due to the increase in prevalence of cancer, developed infrastructure and the presence of key market players operating in the market. For instance, in 2021, the estimated numbers of new cancer cases were 1.9 million and the number of deaths were around 608,570 in the United States. The region is anticipated to grow as a result of rising regulatory support and the increasing incidences of chronic diseases with an increasing demand for fast acting and high-efficacy drugs.

The Asia Pacific is estimated to show the fastest growth over the forecast period. The growth of the region is attributed to the presence of emerging economies in the region. Presence of India and China which are major suppliers of HPAPI across different regions further makes it a source of reliance for manufacturers. Moreover, the region offers API and HPAPI at a lower cost which further boosts the market growth. Furthermore, the advent of generics and improvement in healthcare facilities further facilitate growth.

Some of the prominent players in the High potency active pharmaceutical ingredients market include:

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global high potency active pharmaceutical ingredients market.

Product

Manufacturer Type

Drug Type

Application

By Region