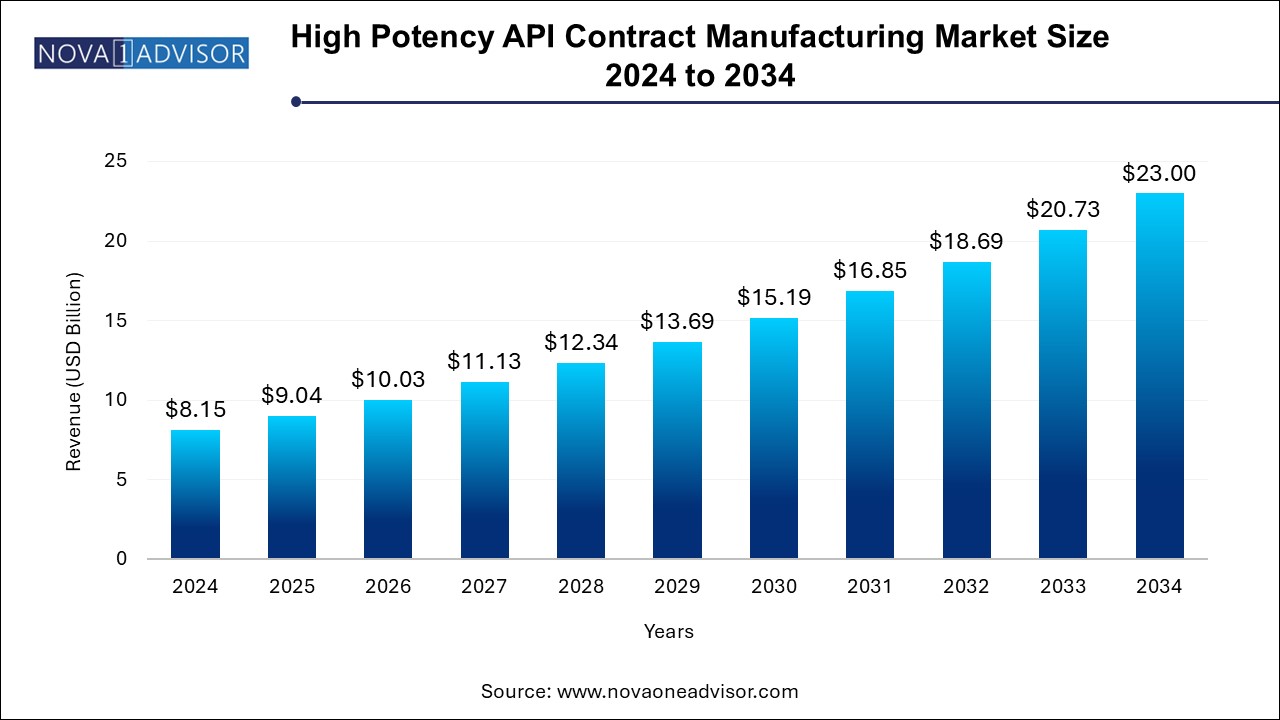

The high potency API contract manufacturing market size was exhibited at USD 8.15 billion in 2024 and is projected to hit around USD 23.00 billion by 2034, growing at a CAGR of 10.93% during the forecast period 2024 to 2034. Increasing demand for high-potency drugs, growing prevalence of cancer and hormonal disorders, and outsourcing trends in the pharmaceutical industry are key drivers for the high potency API contract manufacturing market.

The high potency Active Pharmaceutical Ingredient (API) contract manufacturing market is a rapidly growing sector driven by the increasing demand for specialized drugs, particularly for oncology and hormonal disorders. High potency APIs are used in drugs that have strong biological effects at very low doses, making them essential in treatments for cancers, hormonal imbalances, and other critical conditions. The market is largely fueled by the trend of outsourcing pharmaceutical manufacturing, with contract manufacturers offering specialized capabilities to produce high-potency drugs in compliance with strict regulatory standards. The rise of biologics, alongside the increasing demand for more effective treatments for diseases such as cancer, is further enhancing the growth of this market.

| Report Coverage | Details |

| Market Size in 2025 | USD 9.04 Billion |

| Market Size by 2034 | USD 23.00 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 10.93% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product, Application, Synthesis, Dosage Form, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | Piramal Pharma Solutions; Lonza, Catalent, Inc.; VxP Pharma, Inc.; Pfizer CentreOne, Gentec Pharmaceutical Group; AbbVie; Aurigene Pharmaceutical Services Ltd.; CordenPharma International; Curia Global, Inc. |

Driver: Rising Cancer Incidence Driving High Potency API Demand

The increasing global incidence of cancer is one of the primary drivers of the high potency API contract manufacturing market. High-potency APIs are used extensively in the development of cancer drugs, particularly in the treatment of solid tumors and blood cancers such as leukemia. As the global cancer burden continues to rise, pharmaceutical companies are focusing on more potent and targeted therapies that require the use of high-potency APIs. These specialized ingredients are crucial for creating effective drugs that can combat various types of cancer with minimal dosage, thus reducing side effects and enhancing patient outcomes. This rising demand for oncology treatments continues to drive the need for high-potency API manufacturing, particularly in contract manufacturing partnerships.

Restraint: Complex and Costly Manufacturing Process

A significant restraint for the high potency API contract manufacturing market is the complex and costly nature of producing these APIs. High-potency APIs require highly specialized manufacturing processes that involve stringent safety measures to prevent exposure to potent substances, which can be harmful to workers and the environment. These processes often require customized equipment, containment systems, and a highly controlled manufacturing environment. Additionally, the cost of maintaining such facilities, along with the need for skilled labor, adds to the overall cost of production. This makes it challenging for smaller pharmaceutical companies or contract manufacturers to enter or remain in the market, as the initial investment and operational costs are substantial.

Opportunity: Growing Demand for Biologic Drugs and Biosimilars

The increasing focus on biologic drugs and biosimilars presents a significant opportunity for the high-potency API contract manufacturing market. Biologics are complex, large-molecule drugs that are used to treat diseases such as cancer, autoimmune disorders, and hormonal imbalances. These drugs require high-potency APIs in their production, as they often involve potent active ingredients. The demand for biosimilars—biological products that are highly similar to an already approved reference product—is also expanding, as they offer more affordable alternatives to original biologic drugs. Contract manufacturers with expertise in biologics and biosimilars can leverage this opportunity to cater to the growing demand for these advanced therapies.

The innovative segment dominated the market with a share of 72.4% in 2024. Innovative high-potency APIs are essential in the development of new and cutting-edge treatments, particularly for oncology, hormonal disorders, and other critical conditions. Pharmaceutical companies are increasingly focusing on innovative therapies that require specialized manufacturing processes, creating a strong demand for high-potency APIs. These drugs often require more complex production methods and specialized facilities, driving the demand for contract manufacturers with expertise in handling potent substances. As the pharmaceutical industry continues to prioritize the development of innovative treatments, the demand for innovative high-potency APIs is expected to remain robust.

The generic high-potency API segment is experiencing rapid growth, driven by the increasing demand for cost-effective alternatives to branded medications. As patents for blockbuster drugs expire, generic versions of high-potency drugs are becoming more accessible, offering affordable treatment options for patients. This segment is particularly relevant for the treatment of chronic conditions like cancer, where ongoing therapies are required. Generic drug manufacturers are increasingly seeking contract manufacturers with specialized capabilities to produce high-potency APIs at scale. As the market for generics continues to expand, the demand for high-potency generic APIs is expected to grow significantly over the forecast period.

The oncology segment dominated the market in 2024 and is projected to witness significant growth during the forecast period. The increasing prevalence of cancer worldwide, combined with the development of new and more potent cancer therapies, is driving the demand for high-potency APIs. These APIs are essential in creating targeted cancer treatments, including chemotherapy and immunotherapy drugs. As the oncology drug market continues to grow, the need for high-potency APIs will remain high. Pharmaceutical companies are focusing on developing more potent therapies that require highly specialized manufacturing processes, which in turn drives the demand for contract manufacturers skilled in handling these ingredients.

The glaucoma segment is expected to experience significant growth in the coming years due to the high prevalence of the condition in both developed and emerging economies. The widespread nature of glaucoma, along with the fact that many individuals remain unaware of their condition, has led to increased research and clinical studies focused on this therapeutic area. This growing awareness and focus on glaucoma are driving the demand for high-potency active pharmaceutical ingredients (HPAPIs) to support the development of effective treatments. As the condition continues to gain attention, the need for specialized therapies is anticipated to rise.

Synthetic high-potency APIs dominate the synthesis outlook segment. Synthetic APIs are chemically manufactured and are more commonly used in the production of high-potency drugs. These APIs are typically more cost-effective and can be produced at larger scales, making them the preferred choice for many pharmaceutical companies. Synthetic APIs are essential in creating a wide range of treatments, including those for oncology and hormonal disorders. The dominance of synthetic APIs is expected to continue as they are the primary choice for many high-potency drug formulations, and the market for these drugs continues to expand.

The biotech synthesis segment is the fastest-growing in the high-potency API market. Biotech APIs are derived from living organisms and are used in the production of biologic drugs, which are becoming increasingly important in the treatment of diseases such as cancer, autoimmune disorders, and diabetes. Biotech-derived APIs often have more complex structures and require specialized manufacturing processes, making them a high-demand product. With the growing focus on biologic drugs and the increasing investment in biotechnology, this segment is expected to experience significant growth in the coming years.

The injectables segment dominated the market share of 51.% in 2024 owing to rapid delivery of HPAPI to the target location. They can be delivered as either subcutaneous (in the fat layer), intradermal (between the layer of the skin), or intramuscular (in the muscle). In addition, several developments by the market players is further contributing to the segment’s market growth. For instance, in March 2024, CordenPharma announced to expand its early clinical peptide manufacturing capabilities to launch an integrated offering that includes IND-targeted peptide APIs and injectable drug products. This integration allows for more efficient transitions from early-stage development to clinical trials, reducing timelines and accelerating the time to market for new therapies. Thus, constant developments by the market players in this segment would contribute to the high potency API contract manufacturing market growth.

The oral segment is projected to witness fastest growth in the coming years owing to reduced time and costs as well as decreasing cross-contamination. In addition, manufacturing oral solids helps in improving the safety of the operator by reducing the potential exposure and increasing fill speeds. Moreover, oral solids are much more patient-centric as these are a very convenient method of drug delivery, thus leading to greater demand for this dosage type. Hence, the aforementioned factors are anticipated to support the segment's growth.

North America high potency API contract manufacturing market dominated globally with a market share of 38.0% in 2024. The growth in the region is attributed to the fact that approximately 40% of new chemical entity manufacturing is outsourced to large contract manufacturers in developed regions, particularly North America. This region is a leader in contract development, especially for high potency drug engineering, resulting in a substantial volume of projects being directed to the U.S. Furthermore, the stringent regulatory requirements surrounding manufacturing and product quality are expected to create additional growth opportunities for contract manufacturing services, especially in the U.S., where compliance with these standards is critical for success.

U.S. High Potency API Contract Manufacturing Market Trends

The high potency API contract manufacturing market in the U.S. is projected to be driven by significant investments by pharmaceutical companies and growing research and development activities in the country. Moreover, increasing demand for oncology therapies is also contributing to the country’s market growth. As the prevalence of cancer continues to rise, pharmaceutical companies are focusing on developing targeted therapies that require high potency APIs. This trend is driving contract manufacturers to enhance their capabilities and invest in specialized processes to produce these potent compounds safely and efficiently.

Europe High Potency API Contract Manufacturing Market Trends

The high potency API contract manufacturing market in Europe is anticipated to witness lucrative growth over the projected period. The growth is due to the expansion of outsourcing activities among pharmaceutical companies. Several companies are entering into a partnership and collaboration agreement with contract manufacturers that offer expertise in high potency API production. By outsourcing, companies can reduce operational costs, enhance production flexibility, and access advanced manufacturing technologies. This trend is contributing to the growth of the contract manufacturing market across the region.

The high potency API contract manufacturing market in the UK is anticipated to experience considerable growth over the forecast period. The UK operates under a rigorous regulatory framework that oversees the manufacturing and quality of high potency APIs. Thus, with the more stringent regulation, contract manufacturers are required to invest in robust quality assurance and compliance systems. This trend not only increases the operational costs for manufacturers but also emphasizes the importance of partnering with outsourcing organizations that follows proper regulatory compliance and ensures that products meet the highest standards of safety and efficacy.

The high-potency API contract manufacturing market in Germany is expected to grow at a considerable rate over the forecast period. Technological advancements are significantly shaping the landscape of the market in the country. Innovations such as continuous manufacturing, single-use systems, and enhanced containment technologies are improving the efficiency and safety of high potency API production. These advancements have facilitated compliance with stringent regulatory standards and has enhanced the overall quality of the products.

Asia Pacific High Potency API Contract Manufacturing Market Trends

Asia Pacific high potency API contract manufacturing market is expected to grow at the fastest CAGR over the forecast period. The growth can be attributed to the increasing scope of opportunities, especially in Japan, China, and India. Factors, such as an improved regulatory framework, high scope for cost savings, increased risk management capabilities, and a robust drug pipeline, is expected to augment the region’s growth in the years to come. Furthermore, the availability of a skilled workforce at lower costs than in developed economies, such as the U.S., is anticipated to propel the regional market’s growth further.

The high potency API contract manufacturing market in China is projected to witness significant growth in the coming years owing to the increasing demand for biopharmaceuticals. Pharmaceutical companies in the country are increasing their focus on developing innovative therapies, particularly in oncology and chronic diseases. Thus, these factors are boosting the demand for high potency APIs. This trend is prompting contract manufacturers to enhance their production capabilities and invest in specialized technologies to meet the rising demand for complex biologics.

Japan high potency API contract manufacturing market is expected to witness lucrative growth over the forecast period. Regulatory compliance, technological advancements, strong R&D capabilities, skilled workforce, strategic location, and favorable government initiatives are expected to create lucrative growth opportunities. The Global Health Innovative Technology (GHIT) Fund represents Japan’s inaugural Public-Private Partnership (PPP) dedicated to advancing the R&D and commercialization of novel medical solutions, such as drugs & vaccines, to combat the prevalent diseases in developing nations. Thus, increasing investments and initiatives by government and market players are contributing to the country’s market growth.

The high potency API contract manufacturing market in India is poised to grow in the coming years. Low labor costs, improvements in healthcare infrastructure, and easy availability of technical expertise are expected to be some of the major factors propelling market growth over the forecast period. Moreover, the increase in government funding for research & development (R&D) to accelerate new product development is expected to make India one of the highly favored locations for establishing manufacturing services.

MEA High Potency API Contract Manufacturing Market Trends

The MEA high potency API contract manufacturing market is projected to grow at a lucrative rate over the forecast period. Growth in the region can be attributed to rising incidence of chronic diseases. Furthermore, improvements in government initiatives, regulations for the production of APIs, and changes in geopolitical developments are expected to propel the MEA market.

The high potency API contract manufacturing market in Saudi Arabia is projected to witness the fastest CAGR owing to the growing awareness about the benefits of effective pharmaceutical solutions and rising investments in R&D. The pharmaceutical industry in Saudi Arabia is expected to gain substantial benefits over the forecast period due to rising prevalence of diseases, presence of CMOs, and the growing number of clinical trials.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the high potency API contract manufacturing market

Product

Application

Synthesis

Dosage Form

Regional