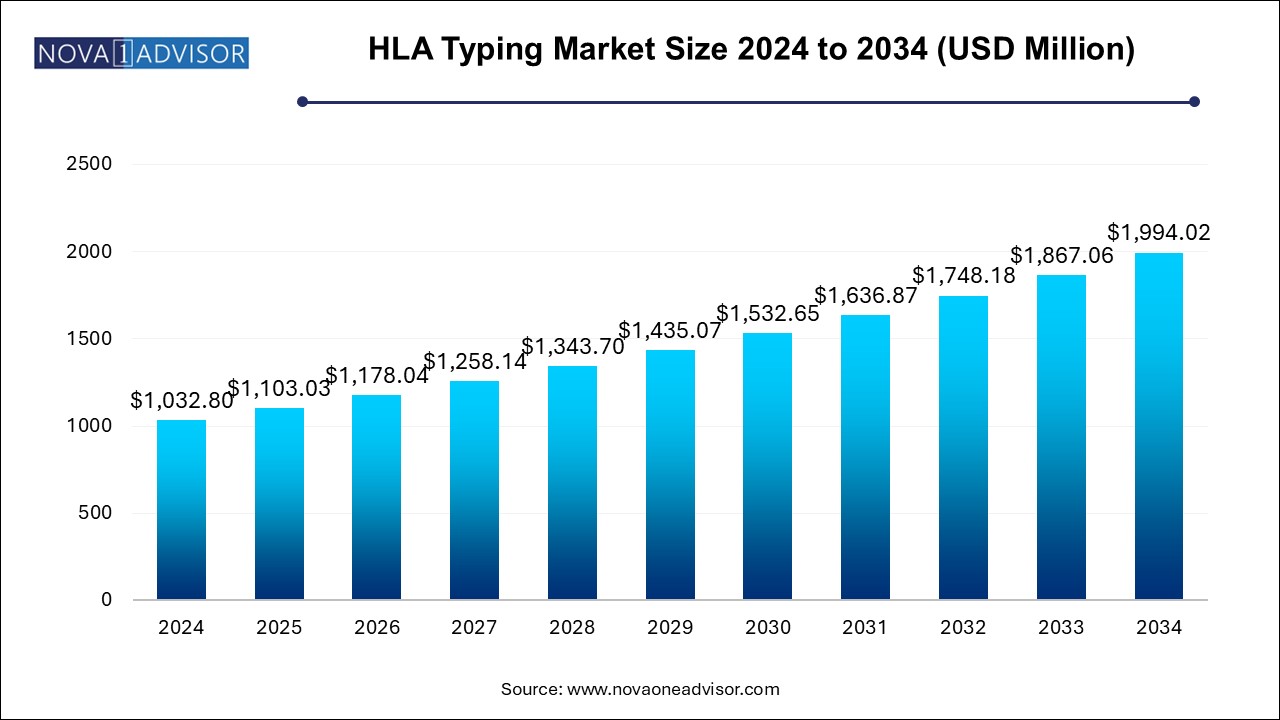

The HLA typing market size was exhibited at USD 1,032.80 million in 2024 and is projected to hit around USD 1,994.02 million by 2034, growing at a CAGR of 6.8% during the forecast period 2024 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 1,103.03 Million |

| Market Size by 2034 | USD 1,994.02 Million |

| Growth Rate From 2024 to 2034 | CAGR of 6.8% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product, Application, Technique, End-user, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Thermo Fisher Scientific Inc.; Bio-Rad Laboratories Inc.; Qiagen N.V.; Omixon Inc.; GenDx; Illumina Inc.; TBG Diagnostics Limited; Dickinson and Company; Takara Bio Inc.; F. Hoffman-La Roche Limited; Pacific Biosciences |

The increasing demand for organ transplantation, along with extensive use of human leukocyte antigen (HLA) testing in pharmacogenetics is expected to be the key growth determinant of the market. HLA matching is considered to be a commonly used test for determining the compatibility of tissue transplantation. Every donor is compelled to undergo this test, including organs from a deceased, relatives, or others. Hence, a good match lowers the probability of complications after the transplant.

Over a span of time, the number of transplantations has increased. According to the Organ Procurement and Transplantation Network, around 41,354 organ transplantations have been performed alone in the U.S. in 2021, which is a 5.9% increase from 2020. The most common transplants in 2021 were kidney with 24,669 transplants, liver with 9,236 transplants, and heart with 3,817. However, deceased due to lack of organ donors is the loss of a potential number of human leukocyte antigen testing. In 2021, approximately 17 individuals per day lost their lives due to the organ shortage and 105,800 people are on the U.S. transplant waiting list.

Similarly, the adoption of HLA testing in numerous applications expands the scope of the test and its demand. For instance, in February 2024, NEC Oncolmmunity AS, a biotech company, announced the publication of its research describing a method to test new alleles of human leukocyte antigen and characterize the tumors’ HLA, which can assist in personalized cancer immunotherapy. The approach conducted human leukocyte antigen testing through the data of NGS. The company collaborated with Ultimovacs ASA in the research to verify the approach from the blood of various donors through deep target sequencing of human leukocyte antigen. The verification was a success with 100% of HLA typing.

Integration of HLA typing in the area of personalized immunotherapy is expected to be an important breakthrough. It is likely to assist the professionals in HLA testing by filling gaps in the human leukocyte antigen libraries at the global level and assist in identifying the human leukocyte antigen variants in disease. Along with that, further innovation in this area can enhance the HLA typing accuracy for organ transplants and vaccine design.

Similarly, increasing strategic initiatives by companies in the human leukocyte antigen matching market are anticipated to accelerate the innovation in the product offering and increase the regional footprint. For instance, in November 2024, Werfen SA announced to initiate the buying out process of Immuncor Inc. for USD 2 billion. The acquirer company believes Immuncor Inc. is a well complementary to the existing product portfolio in transplants or transfusion. Immmuncor's offering includes human leukocyte antigen testing software that provides rapid analysis of gene sequencing. Post-acquisition, Werfen is expected to surpass USD 2.25 (EUR 2.2) billion in revenue, with 7 technology centers and around 7,000 employees in total. This strategy is expected to assist Werfen to create a direct presence in over 30 countries and 100 territories via distributors.

The reagents and consumables in human leukocyte antigen typing is considered to be revenue generating segment with the largest market share of 54.2% in 2024 and fastest growth rate between 2024 to 2034. The HLA reagents and consumables are also complementary products in a range of diagnostic test kits, including HLA typing, that are used to enhance the accuracy and speed of diagnoses. According to the 2021 annual report of Thermo Fisher Scientific Inc., the key users of reagents are from healthcare, clinical and pharmaceutical industry.

The exponential growth of the segment is likely to attract players from similar or related markets, which enable them to establish synergy amongst the resources and maximize the profit. For instance, in August 2024, Eurobio Scientific announced the acquisition of Genome Diagnostics BV (GenDx), a key player in the HLA typing market with a strong presence in the U.S. and Europe. GenDx develops and commercializes a comprehensive solution for HLA typing, including reagents for conducting HLA typing through sequencing, supporting software, and training modules.

The diagnosis is anticipated to be the fastest-growing segment of HLA typing with a 6.8% CAGR during the forecast period. It can be used to diagnose diseases such as rheumatoid arthritis, narcolepsy, and Behcet’s disease which paves the way to accelerate the market for HLA matching. Recently in May 2024, Mylab Discovery Solutions announced to launch a detection kit, DiscoverSeries HLAB*27 for diagnosing Ankylosing spondylitis. The requirement for molecular diagnostic tests has surged due to their promising results.

Similarly, in March 2024, NeoGenomics Laboratories announced receiving U.S.FDA for using HLA typing for companion diagnostics. The company believes that the demand for HLA typing, and applicable companion diagnostic assays are expected to grow for multiple therapeutics. Hence, there is a noticeable demand for human leukocyte antigen typing which pushes the market. However, molecular tests and gene sequencing tests are expensive which restrains the adoption and market growth of human leukocyte antigen matching to an extent.

The molecular assay segment dominated the market and accounted for the largest revenue share of 53.0% in 2024. Molecular techniques such as massively parallel sequencing or probe-based hybridization methods are the most performed technique in HLA typing. Molecular typing can be conducted through various genetic approaches including PCR followed by massively parallel sequencing. The use of technique differs according to the donors and organs to be transplanted. For instance, for deceased donors, molecular typing class I and II HLA loci are performed; while for hematopoietic stem cell transplantation, high-resolution molecular class typing I HLA loci is recommended.

The HLA matching market is witnessing the increasing adoption of next-generation sequencing in human leukocyte antigen typing, resulting in the growing demand for sequencing-based molecular assays. For instance, in June 2024, a team of researchers developed a high-resolution assay for HLA typing through RNA sequencing that can offer accurate HLA allele-specific transcript expression and HLA genotyping in 7 to 8 hours. Hence, the sequencing-based molecular assay is proven to reduce the time and cost to get high-resolution HLA typing.

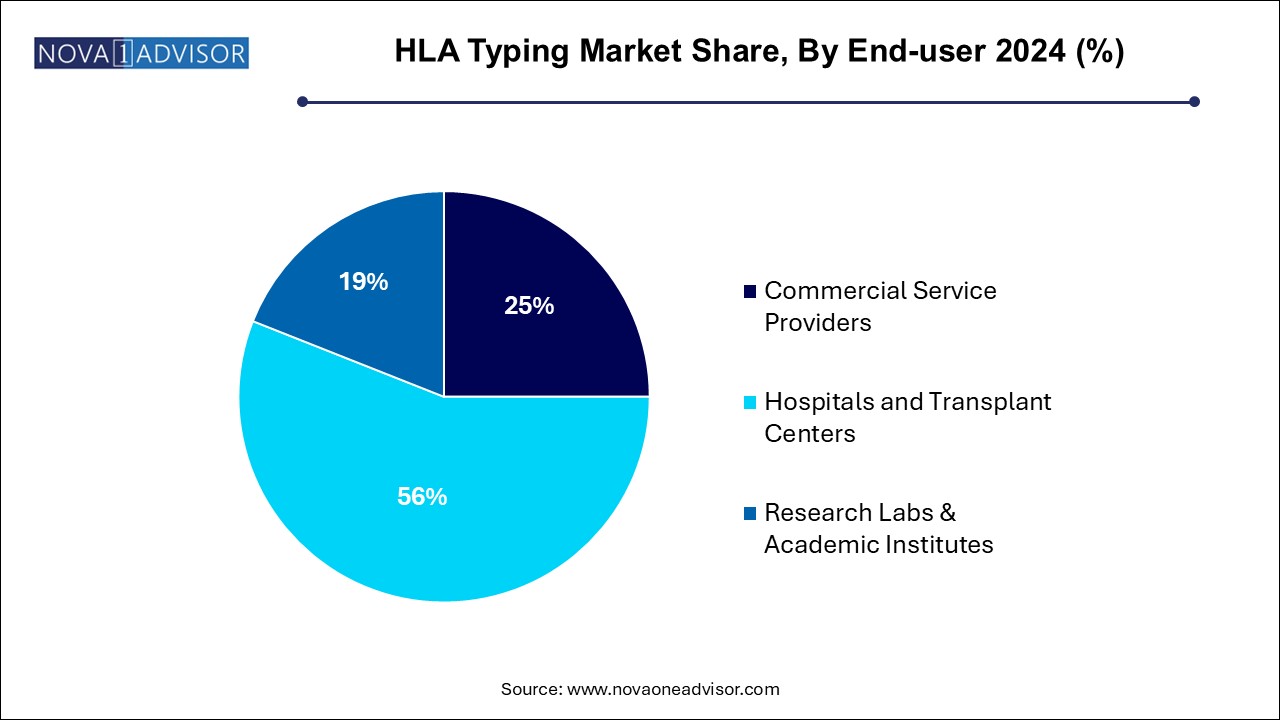

The hospitals and transplant centers segment dominated the market and accounted for the largest revenue share of 56.0% in 2024.In the U.S., there are approximately 147 hospitals and transplant centers for liver transplants. From January 2021 to December 2021, around 181 candidates received the transplant from a deceased donor and 1 from a living donor in Houston Methodist Hospital. Similarly, in Stanford Health Care and VCU Health System Authority, VCUMC, 103 and 164 transplants were performed in the same time frame, respectively. Hence, the increasing number of transplantations in hospitals and transplant centers accelerates the demand for HLA typing.

Furthermore, the increasing services by research labs & academic institutes of HLA typing are anticipated to have a significant impact on the valuation of the market. For instance, the University of Rochester Medical Center Rochester offers comprehensive services in antibody testing, HLA typing, and cross-matching at various levels of resolutions that can be customized according to the client's requirements. Thus, the demand for service providers for sensitivity testing of drugs, transplantation programs, and eligibility screening for the vaccine is increasing among these end-users.

North America is observed to have dominance in the HLA typing market with a share of 46.94% in 2024. The foremost determinant of the largest market share is the existence of well-established academic institutions and research centers in the region coupled with the rising genetic disorders. Hence, there are advanced healthcare and research facilities available. Moreover, the government and companies are focused on the advancements in organ transplant.

Asia Pacific is estimated to witness the fastest growth in the human leukocyte antigen matching market owing to the enhanced infrastructure of the health care facilities, well-designed reimbursement policies, and improving growth of economic factors, resulting in a positive impact on the market. Along with the increasing availability of skilled professionals and transplant hospitals, laboratories with advanced technologies will boost the market.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the HLA typing market

By Product

By Application

By Technique

By End-user

By Regional

Chapter 1 Research Methodology

1.1 Country Wise Market: Base Estimates

1.2 Global Market: CAGR Calculation

1.3 Region-Based Segment Share Calculation

1.4 Research Scope & Assumptions

1.5 List of Data Sources

1.5.1 Data for primary interviews, by sources

1.5.2 Data for primary interviews, by region

Chapter 2 Executive Summary

2.1 Market Snapshot

Chapter 3 HLA typing Market Variables, Trends & Scope

3.1 Market Segmentation & Scope

3.2 Market Driver Analysis

3.2.1 Increasing number of organs transplants

3.2.2 Technology advancement in testing techniques

3.2.3 Adoption of HLA testing in Pharmacogenetic

3.3 Market Restraint Analysis

3.3.1 Stringent Regulatory Framework

3.4 HLA typing - SWOT Analysis, By Factor (political & legal, economic, and technological)

3.5 Industry Analysis - Porter’s

3.6 HLA Typing Market: Market Position Analysis, 2022

3.7 COVID-19 Impact Analysis

Chapter 4 HLA Typing Market: Product Estimates & Trend Analysis

4.1 HLA Typing Market: Product Movement Analysis

4.2 Instruments

4.2.1 Instruments market

4.3 Reagents & consumables

4.3.1 Reagents & consumables market

4.4 Software & Services

4.4.1 Software & services market

Chapter 5 HLA Typing Market: Application Estimates & Trend Analysis

5.1 HLA Typing Market: Application Movement Analysis

5.2 Diagnosis

5.2.1 Diagnosis market

5.3 Research

5.3.1 Research market

Chapter 6 HLA Typing Market: Technique Estimates & Trend Analysis

6.1 HLA Typing Market: Technique Movement Analysis

6.2 Molecular Assay

6.2.1 Molecular assay market

6.3 Sequenced-based Molecular Assay

6.3.1 Sequenced-based molecular assay market

6.4 Non-Molecular Assay

6.4.1 Non-molecular assay Market

Chapter 7 HLA Typing Market: End-user Estimates & Trend Analysis

7.1 HLA Typing Market: End-user Movement Analysis

7.2 Commercial Service Providers

7.2.1 Commercial service providers market

7.3 Hospitals and Transplant Centers

7.3.1 Hospitals and transplant centers market

7.4 Research Labs & Academic Institutes

7.4.1 Research labs & academic institutes market

Chapter 8 HLA typing Market: Regional Estimates & Trend Analysis, by Product, Application, Technique, End-use

8.1 HLA typing Market Share By Region, 2024 & 2034

8.2 North America

8.2.1 SWOT Analysis

8.2.1.1 North America HLA typing market, by product

8.2.1.2 North America HLA typing market, by application

8.2.1.3 North America HLA typing market, by End-user

8.2.1.4 North America HLA typing market, by technique

8.2.2 U.S.

8.2.2.1 Key Country Dynamics

8.2.2.2 Target Disease Prevalence

8.2.2.3 Competitive Scenario

8.2.2.4 Regulatory Framework

8.2.2.5 Reimbursement Scenario

8.2.2.6 U.S. HLA typing market, by product

8.2.2.7 U.S. HLA typing market, by application

8.2.2.8 U.S. HLA typing market, by End-user

8.2.2.9 U.S. HLA typing market, by technique

8.2.3 Canada

8.2.3.1 Key Country Dynamics

8.2.3.2 Target Disease Prevalence

8.2.3.3 Competitive Scenario

8.2.3.4 Regulatory Framework

8.2.3.5 Reimbursement Scenario

8.2.3.6 Canada HLA typing market, by product

8.2.3.7 Canada HLA typing market, by application

8.2.3.8 Canada HLA typing market, by End-user

8.2.3.9 Canada HLA typing market, by technique

8.3 Europe

8.3.1 SWOT Analysis

8.3.1.1 Europe HLA typing market, by product

8.3.1.2 Europe HLA typing market, by application

8.3.1.3 Europe HLA typing market, by End-user

8.3.1.4 Europe HLA typing market, by technique

8.3.2 Germany

8.3.2.1 Key Country Dynamics

8.3.2.2 Target Disease Prevalence

8.3.2.3 Competitive Scenario

8.3.2.4 Regulatory Framework

8.3.2.5 Reimbursement Scenario

8.3.2.6 Germany HLA typing market, by product

8.3.2.7 Germany HLA typing market, by application

8.3.2.8 Germany HLA typing market, by End-user

8.3.2.9 Germany HLA typing market, by technique

8.3.3 UK

8.3.3.1 Key Country Dynamics

8.3.3.2 Target Disease Prevalence

8.3.3.3 Competitive Scenario

8.3.3.4 Regulatory Framework

8.3.3.5 Reimbursement Scenario

8.3.3.6 UK HLA typing market, by product

8.3.3.7 UK HLA typing market, by application

8.3.3.8 UK HLA typing market, by End-user

8.3.3.9 UK HLA typing market, by technique

8.3.4 France

8.3.4.1 Key Country Dynamics

8.3.4.2 Target Disease Prevalence

8.3.4.3 Competitive Scenario

8.3.4.4 Regulatory Framework

8.3.4.5 Reimbursement Scenario

8.3.4.6 France HLA typing market, by product

8.3.4.7 France HLA typing market, by application

8.3.4.8 France HLA typing market, by End-user

8.3.4.9 France HLA typing market, by technique

8.3.5 Italy

8.3.5.1 Key Country Dynamics

8.3.5.2 Target Disease Prevalence

8.3.5.3 Competitive Scenario

8.3.5.4 Regulatory Framework

8.3.5.5 Reimbursement Scenario

8.3.5.6 Italy HLA typing market, by product

8.3.5.7 Italy HLA typing market, by application

8.3.5.8 Italy HLA typing market, by End-user

8.3.5.9 Italy HLA typing market, by technique

8.3.6 Spain

8.3.6.1 Key Country Dynamics

8.3.6.2 Target Disease Prevalence

8.3.6.3 Competitive Scenario

8.3.6.4 Regulatory Framework

8.3.6.5 Reimbursement Scenario

8.3.6.6 Spain HLA typing market, by product

8.3.6.7 Spain HLA typing market, by application

8.3.6.8 Spain HLA typing market, by End-user

8.3.6.9 Spain HLA typing market, by technique

8.3.7 Denmark

8.3.7.1 Key Country Dynamics

8.3.7.2 Target Disease Prevalence

8.3.7.3 Competitive Scenario

8.3.7.4 Regulatory Framework

8.3.7.5 Reimbursement Scenario

8.3.7.6 Denmark HLA typing market, by product

8.3.7.7 Denmark HLA typing market, by application

8.3.7.8 Denmark HLA typing market, by End-user

8.3.7.9 Denmark HLA typing market, by technique

8.3.8 Sweden

8.3.8.1 Key Country Dynamics

8.3.8.2 Target Disease Prevalence

8.3.8.3 Competitive Scenario

8.3.8.4 Regulatory Framework

8.3.8.5 Reimbursement Scenario

8.3.8.6 Sweden HLA typing market, by product

8.3.8.7 Sweden HLA typing market, by application

8.3.8.8 Sweden HLA typing market, by End-user

8.3.8.9 Sweden HLA typing market, by technique

8.3.9 Norway

8.3.9.1 Key Country Dynamics

8.3.9.2 Target Disease Prevalence

8.3.9.3 Competitive Scenario

8.3.9.4 Regulatory Framework

8.3.9.5 Reimbursement Scenario

8.3.9.6 Norway HLA typing market, by product

8.3.9.7 Norway HLA typing market, by application

8.3.9.8 Norway HLA typing market, by End-user

8.3.9.9 Norway HLA typing market, by technique

8.4 Asia Pacific

8.4.1 SWOT Analysis

8.4.1.1 Asia Pacific HLA typing market, by product

8.4.1.2 Asia Pacific HLA typing market, by application

8.4.1.3 Asia Pacific HLA typing market, by End-user

8.4.1.4 Asia Pacific HLA typing market, by technique

8.4.2 Japan

8.4.2.1 Key Country Dynamics

8.4.2.2 Target Disease Prevalence

8.4.2.3 Competitive Scenario

8.4.2.4 Regulatory Framework

8.4.2.5 Reimbursement Scenario

8.4.2.6 Japan HLA typing market, by product

8.4.2.7 Japan HLA typing market, by application

8.4.2.8 Japan HLA typing market, by End-user

8.4.2.9 Japan HLA typing market, by technique

8.4.3 China

8.4.3.1 Key Country Dynamics

8.4.3.2 Target Disease Prevalence

8.4.3.3 Competitive Scenario

8.4.3.4 Regulatory Framework

8.4.3.5 Reimbursement Scenario

8.4.3.6 China HLA typing market, by product

8.4.3.7 China HLA typing market, by application

8.4.3.8 China HLA typing market, by End-user

8.4.3.9 China HLA typing market, by technique

8.4.4 India

8.4.4.1 Key Country Dynamics

8.4.4.2 Target Disease Prevalence

8.4.4.3 Competitive Scenario

8.4.4.4 Regulatory Framework

8.4.4.5 Reimbursement Scenario

8.4.4.6 India HLA typing market, by product

8.4.4.7 India HLA typing market, by application

8.4.4.8 India HLA typing market, by End-user

8.4.4.9 India HLA typing market, by technique

8.4.5 South Korea

8.4.5.1 Key Country Dynamics

8.4.5.2 Target Disease Prevalence

8.4.5.3 Competitive Scenario

8.4.5.4 Regulatory Framework

8.4.5.5 Reimbursement Scenario

8.4.5.6 South Korea HLA typing market, by product

8.4.5.7 South Korea HLA typing market, by application

8.4.5.8 South Korea HLA typing market, by End-user

8.4.5.9 South Korea HLA typing market, by technique

8.4.6 Australia

8.3.9.1 Key Country Dynamics

8.4.6.2 Target Disease Prevalence

8.4.6.3 Competitive Scenario

8.4.6.4 Regulatory Framework

8.4.6.5 Reimbursement Scenario

8.4.6.6 Australia HLA typing market, by product

8.4.6.7 Australia HLA typing market, by application

8.4.6.8 Australia HLA typing market, by End-user

8.4.6.9 Australia HLA typing market, by technique

8.4.7 Thailand

8.4.7.1 Key Country Dynamics

8.4.7.2 Target Disease Prevalence

8.4.7.3 Competitive Scenario

8.4.7.4 Regulatory Framework

8.4.7.5 Reimbursement Scenario

8.4.7.6 Thailand HLA typing market, by product

8.4.7.7 Thailand HLA typing market, by application

8.4.7.8 Thailand HLA typing market, by End-user

8.4.7.9 Thailand HLA typing market, by technique

8.5 Latin America

8.5.1 SWOT Analysis

8.5.1.1 Latin America HLA typing market, by product

8.5.1.2 Latin America HLA typing market, by application

8.5.1.3 Latin America HLA typing market, by End-user

8.5.1.4 Latin America HLA typing market, by technique

8.5.2 Brazil

8.5.2.1 Key Country Dynamics

8.5.2.2 Target Disease Prevalence

8.5.2.3 Competitive Scenario

8.5.2.4 Regulatory Framework

8.5.2.5 Reimbursement Scenario

8.5.2.6 Brazil HLA typing market, by product

8.5.2.7 Brazil HLA typing market, by application

8.5.2.8 Brazil HLA typing market, by End-user

8.5.2.9 Brazil HLA typing market, by technique

8.5.3 Mexico

8.5.3.1 Key Country Dynamics

8.5.3.2 Target Disease Prevalence

8.5.3.3 Competitive Scenario

8.5.3.4 Regulatory Framework

8.5.3.5 Reimbursement Scenario

8.5.3.6 Mexico HLA typing market, by product

8.5.3.7 Mexico HLA typing market, by application

8.5.3.8 Mexico HLA typing market, by End-user

8.5.3.9 Mexico HLA typing market, by technique

8.5.4 Argentina

8.5.4.1 Key Country Dynamics

8.5.4.2 Target Disease Prevalence

8.5.4.3 Competitive Scenario

8.5.4.4 Regulatory Framework

8.5.4.5 Reimbursement Scenario

8.5.4.6 Argentina HLA typing market, by product

8.5.4.7 Argentina HLA typing market, by application

8.5.4.8 Argentina HLA typing market, by End-user

8.5.4.9 Argentina HLA typing market, by technique

8.6 MEA

8.6.1 SWOT Analysis

8.6.1.1 MEA HLA typing market, by product

8.6.1.2 MEA HLA typing market, by application

8.6.1.3 MEA HLA typing market, by End-user

8.6.1.4 MEA HLA typing market, by technique

8.6.2 South Africa

8.6.4.1 Key Country Dynamics

8.6.2.2 Target Disease Prevalence

8.6.2.3 Competitive Scenario

8.6.2.4 Regulatory Framework

8.6.2.5 Reimbursement Scenario

8.6.2.6 Argentina HLA typing market, by product

8.6.2.7 Argentina HLA typing market, by application

8.6.2.8 Argentina HLA typing market, by End-user

8.6.2.9 Argentina HLA typing market, by technique

8.6.3 Saudi Arabia

8.6.3.1 Key Country Dynamics

8.6.3.2 Target Disease Prevalence

8.6.3.3 Competitive Scenario

8.6.3.4 Regulatory Framework

8.6.3.5 Reimbursement Scenario

8.6.3.6 Saudi Arabia HLA typing market, by product

8.6.3.7 Saudi Arabia HLA typing market, by application

8.6.3.8 Saudi Arabia HLA typing market, by End-user

8.6.3.9 Saudi Arabia HLA typing market, by technique

8.6.4 UAE

8.6.4.1 Key Country Dynamics

8.6.4.2 Target Disease Prevalence

8.6.4.3 Competitive Scenario

8.6.4.4 Regulatory Framework

8.6.4.5 Reimbursement Scenario

8.6.4.6 UAE HLA typing market, by product

8.6.4.7 UAE HLA typing market, by application

8.6.4.8 UAE HLA typing market, by End-user

8.6.4.9 UAE HLA typing market, by technique

8.6.5 Kuwait

8.6.5.1 Key Country Dynamics

8.6.5.2 Target Disease Prevalence

8.6.5.3 Competitive Scenario

8.6.5.4 Regulatory Framework

8.6.5.5 Reimbursement Scenario

8.6.5.6 Kuwait HLA typing market, by product

8.6.5.7 Kuwait HLA typing market, by application

8.6.5.8 Kuwait HLA typing market, by End-user

8.6.5.9 Kuwait HLA typing market, by technique

Chapter 9 Competitive Landscape

9.1 Participant’s overview

9.2 Financial performance

9.3 Participant categorization

9.3.1 Market leaders

9.3.1.1 HLA typing market share analysis, 2022

9.3.1.2 Company profiles

9.3.1.2.1 Thermo Fisher Scientific Inc.

9.3.1.2.2 Bio-Rad Laboratories Inc.

9.3.1.2.3 Qiagen N.V.

9.3.1.2.4 Omixon Inc.

9.3.1.2.5 GenDx

9.3.1.2.6 Illumina Inc.

9.3.1.2.7 TBG Diagnostics Limited

9.3.1.2.8 Dickinson and Company

9.3.1.2.9 Takara Bio Inc.

9.3.1.2.10 F. Hoffman-La Roche Limited

9.3.1.2.11 Pacific Biosciences

9.3.2 Strategy mapping

9.3.2.1 Expansion

9.3.2.2 Acquisition

9.3.2.3 Collaborations

9.3.2.4 Product/service launch

9.3.2.5 Partnerships

9.3.2.6 Others