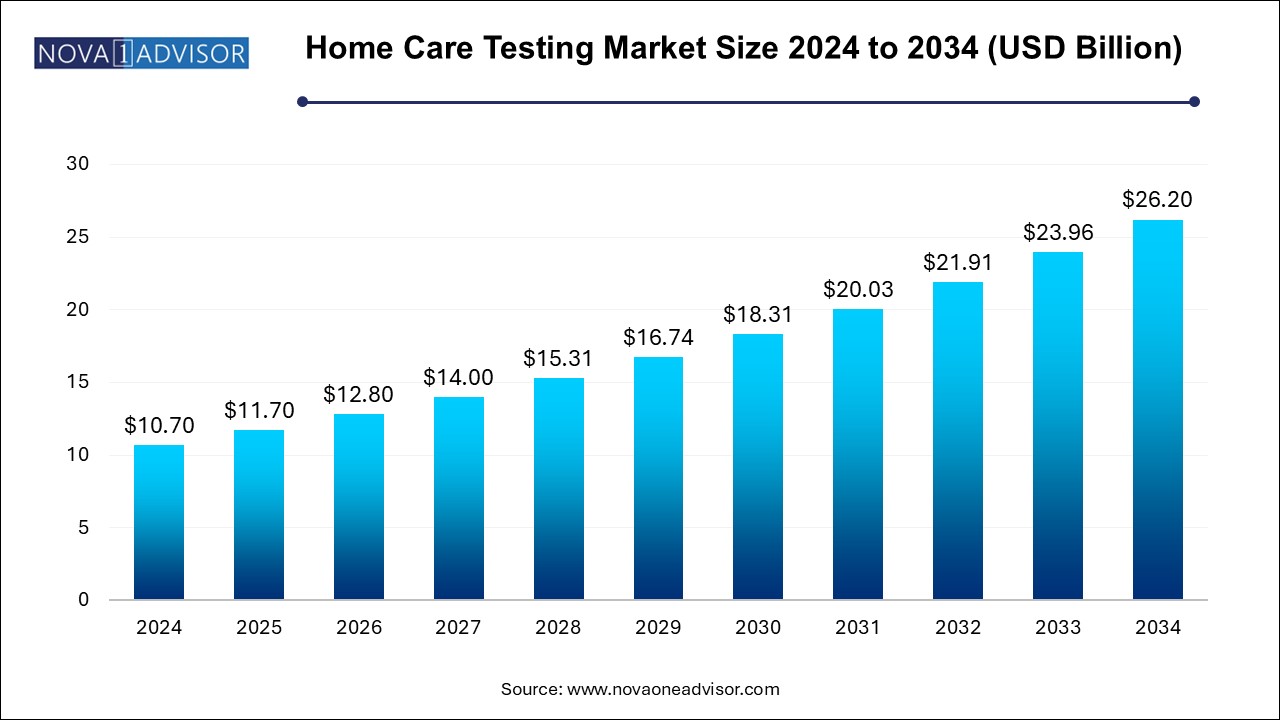

The home care testing market size was exhibited at USD 10.70 billion in 2024 and is projected to hit around USD 26.20 billion by 2034, growing at a CAGR of 9.37% during the forecast period 2024 to 2034.

The home care testing market is experiencing remarkable growth as healthcare delivery increasingly shifts from institutional settings to the home environment. Empowered by digital health tools, telemedicine, and rising patient demand for autonomy, home care testing encompasses diagnostic kits and monitoring devices that allow individuals to assess various health indicators independently. These tests cover a broad range of conditions—from chronic disease monitoring (e.g., diabetes and cholesterol) to acute infections (e.g., HIV, urinary tract infections), and wellness screening such as pregnancy or fertility tests.

As the population ages and chronic diseases become more prevalent, the appeal of self-administered, rapid, and cost-effective diagnostics is growing exponentially. In parallel, innovations in biotechnology, miniaturized sensors, and AI-powered digital interfaces are making home tests more accurate, affordable, and user-friendly than ever before. This paradigm is increasingly valuable for managing diseases in aging populations, reducing clinical burden, and facilitating timely interventions through remote care pathways.

The COVID-19 pandemic served as a pivotal moment for this market, dramatically increasing public awareness and acceptance of home testing solutions. Millions became familiar with self-administered antigen tests and the convenience they offer. This normalization has opened the door for other categories—such as glucose monitoring, sexually transmitted infections (STIs), and fertility diagnostics—to flourish.

Government support for decentralized healthcare, technological advancement in point-of-care testing (POCT), and consumer demand for privacy and convenience continue to shape the future of the home care testing market. From urban centers to rural regions, home testing offers the promise of personalized, proactive healthcare across demographic and socioeconomic boundaries.

Increasing consumer preference for privacy and convenience in diagnostic testing, especially for reproductive and infectious disease categories.

Rising adoption of digital health platforms and mobile apps that integrate with test kits for real-time interpretation and record-keeping.

Proliferation of chronic disease test kits, especially glucose and cholesterol monitoring systems, driven by lifestyle-related conditions.

Expansion of online pharmacies and e-commerce as dominant distribution channels for diagnostic test kits.

Technological innovation in test accuracy, including lateral flow assays, biosensors, and AI-powered diagnostic analytics.

Surging demand for pediatric-friendly and pain-free testing tools, particularly in urban family households.

Development of multi-panel test kits for simultaneous screening of various markers (e.g., glucose, ketones, and proteins).

Integration of telehealth support services with home care test results to enable seamless physician consultation.

Improved accessibility in rural and underserved areas, reducing diagnostic gaps through affordable, direct-to-consumer test kits.

| Report Coverage | Details |

| Market Size in 2025 | USD 11.70 Billion |

| Market Size by 2034 | USD 26.20 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 9.37% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Age, Sample, Test Type, Distribution Channel, Product, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | Abbott; BD; Quidel Corporation; BioSure; F. Hoffmann-La Roche Ltd.; Nova Biomedical; Siemens Healthcare GmbH; ACON Laboratories; Inc.; OraSure Technologies, Inc.; Chembio Diagnostics, Inc. |

A major driver propelling the home care testing market is the increasing prevalence of chronic illnesses, particularly diabetes, cardiovascular disorders, and renal conditions, coupled with the growing geriatric population. Managing these chronic diseases requires regular monitoring, which imposes logistical and financial challenges when dependent on clinical settings.

Home care testing bridges this gap by enabling routine and real-time disease management from the comfort of home. For instance, self-administered blood glucose meters and cholesterol tests empower patients to make timely lifestyle and medication adjustments. For elderly individuals or those with mobility constraints, these tools significantly reduce dependence on hospitals or diagnostic labs. This shift also aligns with the broader healthcare trend of decentralization and cost containment, making home diagnostics an integral part of future-ready care ecosystems.

Despite its growing popularity, the home care testing market faces a notable restraint in the form of accuracy variability and the risk of user error. Unlike professional laboratory testing, which follows controlled protocols, home diagnostics depend heavily on patient compliance and understanding.

Inaccurate readings—whether due to improper handling, expired reagents, incorrect sample collection, or lack of calibration—can lead to false reassurance or unnecessary anxiety. This is particularly concerning for critical conditions like HIV, where false negatives can delay treatment, or for glucose monitoring, where false highs or lows may influence medication dosing.

While technological improvements and smartphone guidance interfaces are helping mitigate these risks, concerns over result reliability and proper interpretation remain a barrier, especially among older, low-literacy, or technologically underserved populations.

A compelling opportunity lies in the integration of home care test kits with digital health platforms, mobile apps, and AI analytics. Smart diagnostics are increasingly capable of capturing, storing, and interpreting test results in real time, facilitating proactive interventions and remote consultations.

For example, glucose meters now transmit readings to mobile apps that visualize trends, suggest dietary changes, or alert caregivers to abnormal levels. AI-powered platforms can assist in interpreting multi-parameter test panels and recommending next steps. This convergence of diagnostic hardware with software is driving a new era of intelligent, personalized healthcare at home.

Startups and established medtech players alike are investing in cloud-connected testing solutions that enable longitudinal health tracking, integrate with electronic health records (EHRs), and even sync with wearable devices. This not only elevates user experience but also builds value for providers, insurers, and public health programs.

The adult population dominates the home care testing market, as adults aged 25–64 represent the largest user base for routine wellness, chronic disease monitoring, and reproductive health testing. This group is highly engaged in managing their health proactively, often utilizing home-based diagnostics to screen for conditions such as diabetes, cholesterol, and STIs. Pregnancy and fertility test kits are also widely used among this demographic, contributing significantly to sales across urban and suburban regions.

Geriatric users represent the fastest growing segment, driven by their high burden of chronic illnesses and limited mobility. Older adults frequently require glucose monitoring, cardiovascular health checks, and kidney function surveillance. Home testing reduces their dependency on hospitals, enhances autonomy, and supports aging-in-place models. Innovations such as easy-to-handle devices, voice-guided instructions, and real-time alerts are being tailored specifically for elderly populations.

Blood samples account for the largest share of the home care testing market, especially for chronic disease tests involving glucose, triglycerides, and cholesterol. Finger-prick kits have become highly standardized and widely accepted, offering fast results with high accuracy. Blood-based HIV and infectious disease rapid tests also contribute to the popularity of this sample type due to its reliability in detecting antibodies and analytes.

Saliva-based testing is the fastest growing sample segment, driven by its non-invasive nature, ease of collection, and increasing application in hormone testing, genetic screening, and infectious disease detection (e.g., COVID-19, STIs). Saliva tests eliminate the discomfort and biohazard concerns associated with blood draws, making them ideal for pediatric and geriatric users. Innovation in lateral flow devices and microfluidics is expanding the range of analytes detectable through saliva, making this segment highly attractive for future diagnostics.

Diabetes and glucose test kits dominate the home care testing market, owing to the global epidemic of type 2 diabetes. These kits are essential for millions of individuals managing insulin regimens or dietary interventions. Continuous innovation in glucose monitoring—such as Bluetooth-enabled glucometers, lancet-free sampling, and app integration—has sustained dominance in this category.

Infectious disease test kits are the fastest growing category, especially after the COVID-19 pandemic normalized at-home testing for respiratory viruses. At-home HIV, hepatitis, and UTI test kits are gaining popularity due to increased awareness, privacy benefits, and the need for early diagnosis. Additionally, rising demand for self-screening tools for conditions like syphilis, chlamydia, and HPV is creating new market opportunities across sexual health diagnostics.

Retail pharmacies remain the dominant distribution channel, offering convenient, trusted access to diagnostic kits for walk-in customers. Pharmacies serve as critical hubs for both over-the-counter sales and pharmacist-guided test education. Products like glucose strips, pregnancy kits, and cholesterol test cards are prominently displayed and promoted at retail counters.

Online pharmacies and e-commerce platforms are the fastest growing channels, driven by the convenience of home delivery, discreet purchasing, and subscription-based refill services. Online platforms also facilitate detailed product comparisons, user reviews, and personalized recommendations. Companies are increasingly launching DTC (direct-to-consumer) brands, offering bundled kits and access to remote lab partnerships.

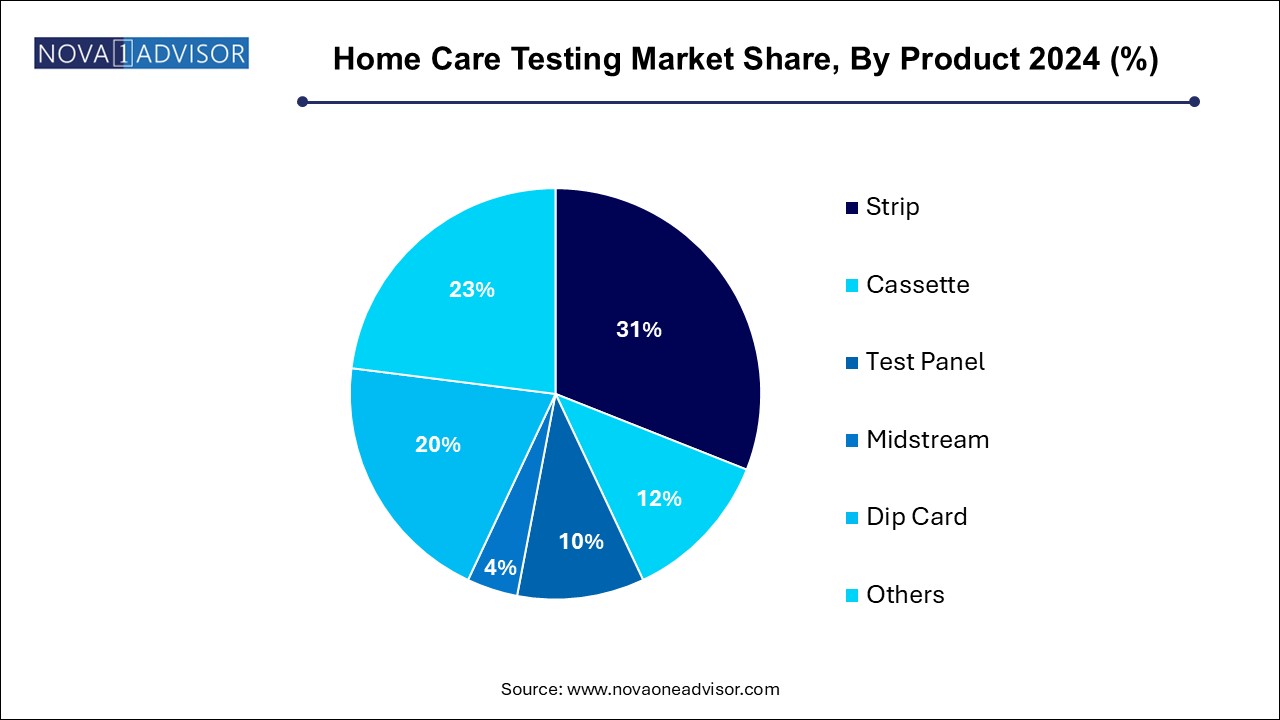

The strip segment led the market with the largest revenue share of 31.0% in 2024. These strips are inexpensive, easy to use, and compatible with handheld analyzers or visual comparison charts. Their long shelf life and ease of bulk distribution make them a staple in the chronic disease segment.

Test panels are the fastest growing product category, especially for comprehensive screening applications. Multi-marker panels are used in hormone tests, infectious disease kits, and drug screening. The rise of multiplexed, lab-quality panels for home use—offering detection of multiple conditions from a single sample—reflects user demand for convenience and holistic health insights.

North America leads the home care testing market, driven by high healthcare awareness, robust retail pharmacy networks, and early adoption of self-care technologies. The United States, in particular, has seen widespread use of at-home test kits across all age groups. Reimbursement support for chronic disease monitoring, such as Medicare coverage of diabetes supplies, further strengthens the market.

The region also benefits from a strong regulatory framework (e.g., FDA EUA pathways), enabling rapid introduction of new tests. Companies like Abbott, Roche, and Quidel are headquartered or heavily invested in North America, supporting innovation and distribution.

Asia Pacific is the fastest growing region, supported by rising chronic disease prevalence, increasing disposable income, and expanding healthcare infrastructure. Countries like India and China are experiencing a surge in diabetes, hypertension, and kidney-related disorders—conditions that necessitate ongoing monitoring.

Cultural shifts and increased internet penetration are making self-care diagnostics more acceptable across Asia. E-commerce growth, mobile-first digital health platforms, and local manufacturing capabilities are accelerating access to affordable, home-use kits. Government health campaigns and NGO support in rural areas are also promoting early detection and health literacy.

February 2025 – Abbott launched a Bluetooth-enabled glucose monitoring system designed specifically for the home care market, integrated with real-time alerts via mobile apps.

December 2024 – LetsGetChecked announced expansion into Asia Pacific with a localized product suite targeting infectious disease and fertility diagnostics through home kits.

September 2024 – OraSure Technologies received FDA clearance for its next-gen HIV self-test kit with extended shelf life and improved sensitivity.

August 2024 – Everlywell partnered with CVS Health to distribute multi-panel test kits across 1,000 retail pharmacy outlets in the U.S.

June 2024 – DrTrust India launched a pediatric-friendly UTI and glucose home testing range, featuring cartoon-themed interfaces and mobile app integration for children and caregivers.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the home care testing market

Age

Sample

Test Type

Distribution Channel

Product

Regional