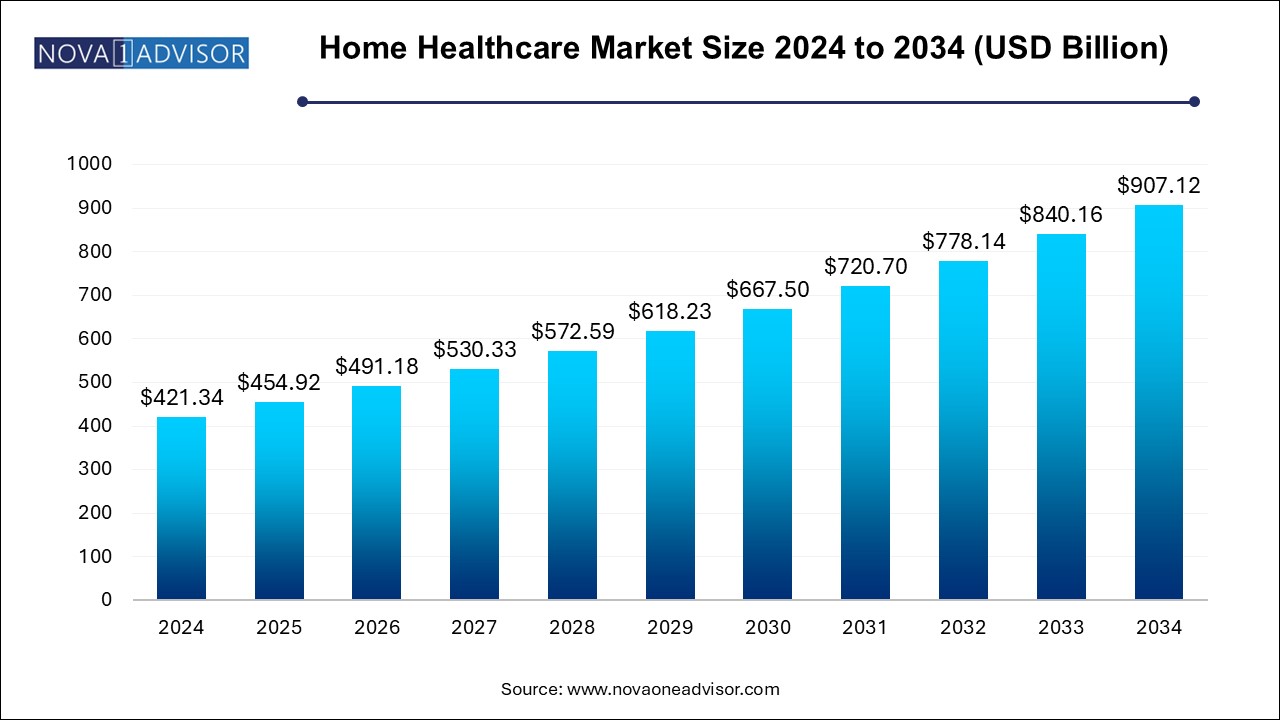

The home healthcare market size was exhibited at USD 421.34 billion in 2024 and is projected to hit around USD 907.12 billion by 2034, growing at a CAGR of 7.97% during the forecast period 2025 to 2034.

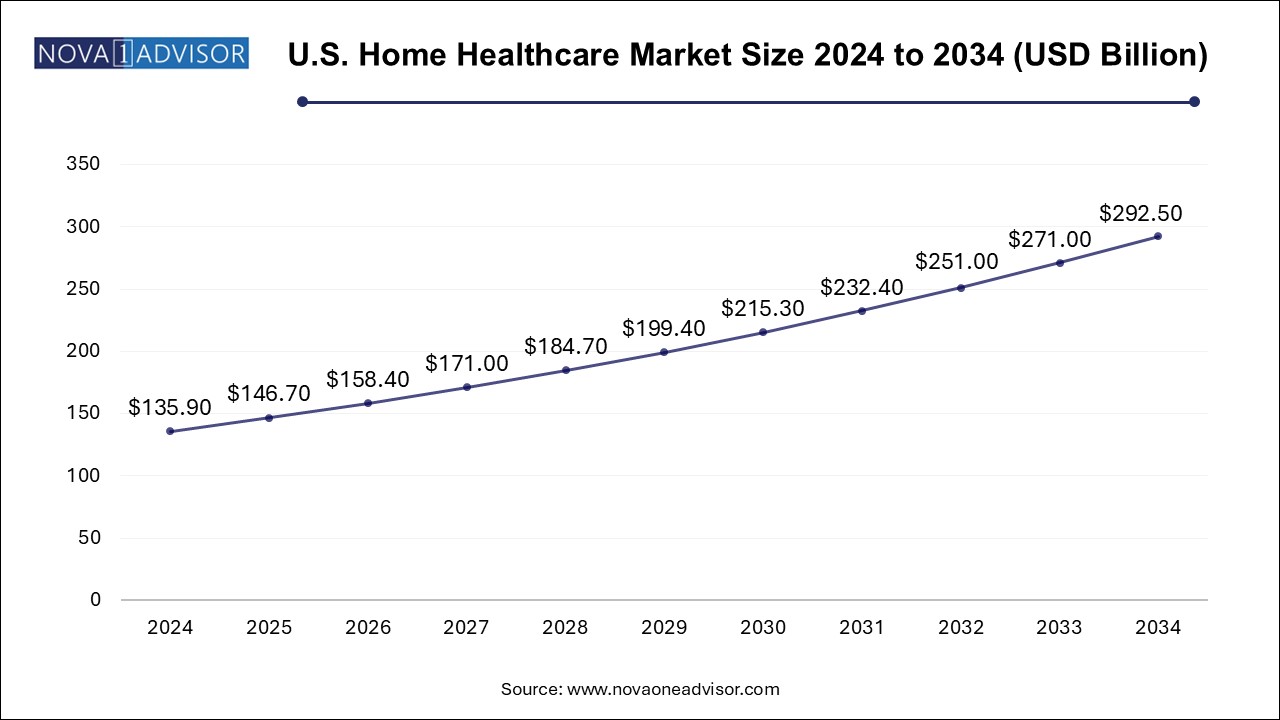

The U.S. home healthcare market size is evaluated at USD 135.9 billion in 2024 and is projected to be worth around USD 292.5 billion by 2034, growing at a CAGR of 7.21% from 2025 to 2034.

North America, particularly the United States, holds the largest market share due to advanced healthcare infrastructure, high adoption of digital technologies, favorable reimbursement frameworks, and strong presence of leading home health providers. The U.S. Medicare and Medicaid programs cover many aspects of home healthcare, from post-acute nursing to hospice services. Furthermore, growing public awareness, increased chronic disease burden, and a shift toward value-based care have created a mature and supportive ecosystem for home-based models.

Major hospital networks are also establishing in-house or partnered home care programs to reduce inpatient loads and ensure continuum of care. The presence of established players such as LHC Group, Amedisys, and Kindred at Home, along with emerging tech-enabled startups, has diversified the market landscape.

Asia Pacific is the fastest-growing region in the home healthcare market, driven by its large population base, rising geriatric demographic, increasing incidence of chronic diseases, and ongoing healthcare system transformation. Countries like Japan, China, India, and South Korea are investing in healthcare infrastructure and policy reforms that support decentralization of care and community-based service delivery.

Japan, with one of the oldest populations globally, has led the adoption of home-based care models, including robotic caregiving and digital health platforms. In India and China, government initiatives to improve rural healthcare access and chronic disease control are prompting investment in mobile care units and home-based diagnostics. Local companies are also entering partnerships with insurance and tech firms to scale cost-effective, scalable models for population health.

The home healthcare market has rapidly emerged as one of the most transformative and essential components of global healthcare infrastructure. Driven by rising healthcare costs, the growing burden of chronic diseases, and a shift toward patient-centric care, home healthcare refers to medical and supportive services provided in a patient’s residence. These services range from post-acute care and palliative care to long-term monitoring and disease management. The market includes diagnostic, therapeutic, and assistive devices, as well as skilled and unskilled care services delivered by professionals or caregivers.

Home healthcare has gained traction due to its ability to reduce hospital readmissions, improve patient satisfaction, and support aging-in-place preferences among the elderly population. Technological innovations such as remote patient monitoring, wearable devices, and telehealth platforms are enabling more accurate diagnostics, real-time data sharing, and proactive disease management from the comfort of one’s home. In parallel, rising incidences of cardiovascular diseases, diabetes, respiratory ailments, and neurological disorders are increasing the demand for home-based care solutions.

Post-pandemic, the market witnessed a sharp inflection as health systems looked for cost-effective and scalable alternatives to facility-based care. Moreover, policy support in the form of reimbursement for at-home treatments, growing caregiver workforce, and investment in digital health tools have further accelerated market adoption. With aging demographics and rising demand for personalized, accessible, and affordable care, the home healthcare market is poised for robust and sustained growth through 2034.

Rising Demand for Chronic Disease Management at Home (especially Diabetes, Heart Failure, COPD)

Integration of Telehealth and Remote Monitoring in Home Care Workflows

Growing Popularity of Subscription-Based Home Health Plans

Emergence of AI-Enabled Home Diagnostic Devices

Expansion of Skilled Home Nursing and Rehabilitation Services

Miniaturization and Portability of Therapeutic and Diagnostic Devices

High Adoption of Home Dialysis, IV Infusion, and Insulin Pump Therapies

Increase in Palliative and Hospice Care Utilization Amid Aging Population

Enhanced Reimbursement Frameworks for At-Home Services in Developed Markets

Strategic Partnerships Between Home Health Providers and Tech Firms

| Report Coverage | Details |

| Market Size in 2025 | USD 454.92 Billion |

| Market Size by 2034 | USD 907.12 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 7.97% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Component, Indication, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | B. Braun Melsungen AG; Abbott; Sunrise Medical; 3M Healthcare; Baxter International Inc.; Medtronic PLC; Cardinal Health Inc; F. Hoffmann-La Roche AG; Air Liquide; Amedisys, Inc; NxStage Medical, Inc. (Fresenius Medical Care); Arkray, Inc.; Becton, Dickinson and Company; Omron Healthcare, Inc; Drive DeVilbiss Healthcare; GE Healthcare; Medline Industries, Inc; Koninklijke Philips N.V; Johnson & Johnson Services, Inc.; Linde Healthcare; Acelity (3M); Vygon; Teleflex, Inc; Moog Inc.; Intersurgical Ltd.; Fresenius Kabi AG; GF Health Products, Inc. |

A key driver of the home healthcare market is the increasing aging population coupled with a growing burden of chronic conditions. As per the United Nations, by 2050, more than 2.1 billion people will be aged 60 or above, representing over 20% of the global population. Elderly individuals are disproportionately affected by chronic illnesses such as heart disease, diabetes, respiratory disorders, arthritis, and neurodegenerative diseases—all of which require continuous management, rehabilitation, and monitoring.

Home healthcare allows patients with mobility limitations or complex conditions to receive timely care in familiar environments, improving outcomes and reducing caregiver burden. Studies show that elderly patients receiving home-based post-acute care recover faster and are less likely to experience complications compared to those in institutional care. The convenience and psychological benefits of remaining at home, combined with healthcare system cost savings, are making home-based services the preferred approach for long-term and post-hospitalization care.

Despite its growth potential, the home healthcare market faces a significant constraint in the form of workforce shortages and caregiver fatigue. The demand for skilled nurses, therapists, and home aides far exceeds supply, especially in rural and underserved areas. In many countries, the home healthcare workforce is aging, underpaid, and faces high turnover rates due to emotional and physical exhaustion.

Moreover, family members who serve as informal caregivers often lack adequate training or support. These workforce gaps can compromise care quality, increase medical errors, and delay treatment adherence, particularly for patients with complex needs such as ventilator dependence or terminal illnesses. Addressing this restraint requires investment in caregiver training, better working conditions, flexible scheduling models, and policy support for workforce expansion.

A key opportunity in this market lies in the integration of smart diagnostics and remote monitoring devices into home care ecosystems. The emergence of compact, user-friendly devices capable of tracking vitals, medication adherence, glucose levels, blood pressure, sleep patterns, and ECG signals is revolutionizing how care is delivered outside clinical settings. Combined with AI-based analytics and cloud platforms, these devices provide clinicians with real-time insights and enable early interventions.

Wearables, portable ECG monitors, connected insulin pumps, and smart pill dispensers are enabling patients with chronic conditions to self-manage their health with confidence. Telemonitoring tools not only reduce unnecessary hospital visits but also improve clinical workflow efficiency and resource allocation. As healthcare systems adopt value-based models, these solutions will play a critical role in achieving population health management goals while keeping costs under control.

The services segment dominated the market and held the largest revenue share of 85.0% in 2024. the services segment—particularly skilled home healthcare services—is growing at the fastest rate. Services such as nursing care, primary physician consultations, physical therapy, occupational therapy, nutritional support, and palliative care are essential for recovery post-hospital discharge, especially for surgeries, stroke, or cancer treatments. These services are also crucial for managing functional decline and chronic conditions among elderly patients.

Unskilled home healthcare services, which include support with activities of daily living (ADLs), housekeeping, and companionship, are expanding alongside demographic aging and solo-living trends. As payers and providers focus on reducing readmissions, the demand for coordinated care transitions and continuous at-home support is driving investment in service delivery platforms, caregiver training programs, and digital scheduling/coordination tools.

Cardiovascular disorders and hypertension represent the dominant indication segment, driven by the sheer volume of patients requiring continuous monitoring, medication adherence support, and post-procedure rehabilitation. Patients recovering from heart attacks, angioplasty, bypass surgery, or arrhythmias benefit from nurse-supervised care, home ECG monitoring, and physical activity regulation at home. The chronic nature of cardiovascular diseases makes them ideal for ongoing at-home support to avoid complications and emergency admissions.

Meanwhile, diabetes and kidney disorders are among the fastest-growing indications due to increasing prevalence and rising demand for self-managed therapies. Diabetic patients require blood sugar monitoring, foot care, and insulin administration—all of which are now facilitated through at-home programs. Similarly, patients with end-stage kidney disease increasingly opt for home dialysis (peritoneal or hemodialysis) as an alternative to center-based services, driven by convenience, infection control, and clinical outcomes.

March 2025: Amedisys Inc. expanded its palliative care division by partnering with tech firm Aidlink to integrate remote monitoring into its home nursing services for cardiac and oncology patients.

February 2025: Philips Healthcare launched a new suite of wearable biosensors and connected devices tailored for at-home chronic disease monitoring in Europe and North America.

January 2025: LHC Group, a leading U.S. home health provider, announced a strategic merger with a regional hospice care provider, aiming to build an integrated post-acute home care continuum.

December 2024: Bayada Home Health Care piloted an AI-powered care coordination platform to optimize caregiver assignments and monitor patient compliance with therapy regimens.

November 2024: Fresenius Medical Care launched a portable home dialysis machine in select Asia Pacific markets, aiming to improve adoption in low-resource settings.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the home healthcare market

By Component

By Indication

By Regional