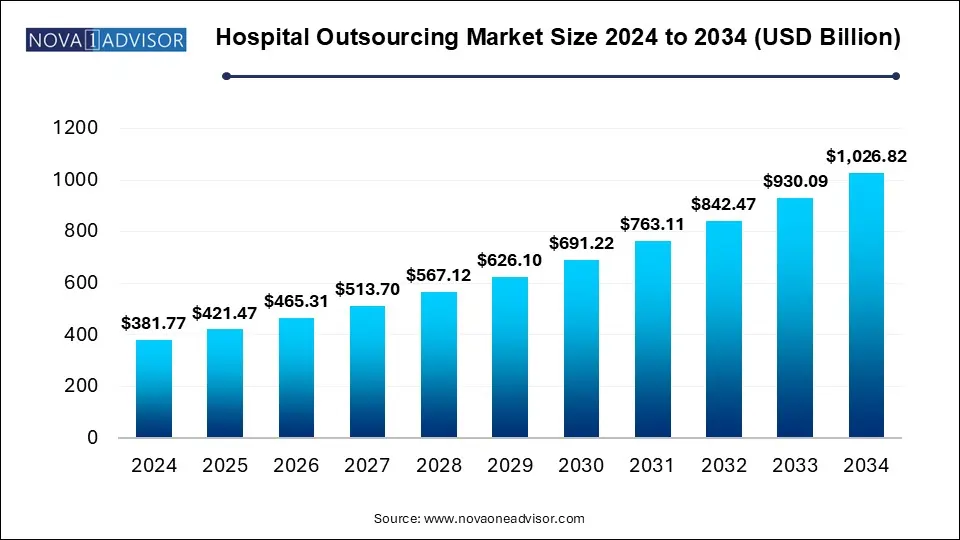

The hospital outsourcing market size was exhibited at USD 381.77 billion in 2024 and is projected to hit around USD 1026.82 billion by 2034, growing at a CAGR of 10.4% during the forecast period 2025 to 2034.

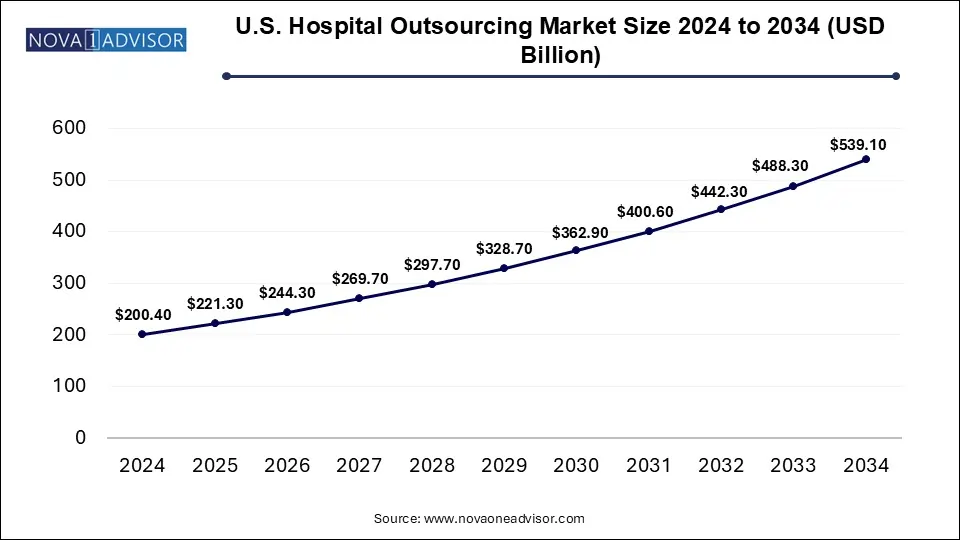

The U.S. hospital outsourcing market size was valued at USD 200.4 billion in 2024 and is expected to reach around USD 539.1 billion by 2034, growing at a CAGR of 9.41% from 2025 to 2034.

The North America hospital outsourcing market led the global industry in 2024, holding a 70.0% revenue share. Rising operational costs and regulatory challenges have driven healthcare facilities in the region to outsource non-core functions as a cost-effective strategy. The COVID-19 pandemic further accelerated the shift toward outsourced services, particularly in areas like billing and IT, while advancements in technology continue to improve service efficiency and operational performance.

U.S. Hospital Outsourcing Market Trends

In 2024, the U.S. hospital outsourcing market held the largest share in North America. Increasing regulatory complexities, including ICD-10 coding standards, are prompting hospitals to outsource specialized services to ensure compliance and efficiency. By outsourcing administrative tasks, hospitals can focus on patient care and core operations. Additionally, the availability of well-established outsourcing firms in the U.S. offers access to advanced expertise and technology-driven solutions.

Europe Hospital Outsourcing Market Trends

The Europe hospital outsourcing market accounted for a significant share in 2024, driven by regulatory complexities and a growing demand for high-quality healthcare. Hospitals are increasingly outsourcing IT, billing, and administrative functions to optimize resource management and operational efficiency. The region’s aging population is further contributing to the rising need for outsourced healthcare services, helping providers manage patient loads while ensuring quality care delivery.

The UK hospital outsourcing market is projected to witness substantial growth over the forecast period. The National Health Service (NHS) faces funding constraints and resource allocation issues, prompting a greater reliance on outsourcing to improve cost efficiency and service delivery. Additionally, technological advancements and evolving regulatory requirements have increased the demand for specialized expertise, making outsourcing a strategic solution for hospitals.

Asia Pacific Hospital Outsourcing Market Trends

The Asia Pacific hospital outsourcing market is anticipated to experience the fastest CAGR of 12.9% over the forecast period. Government policies promoting privatization and outsourcing are fueling demand for external service providers. The rising prevalence of chronic diseases and an aging population have created a need for efficient resource management, leading hospitals to explore specialized outsourcing solutions. Additionally, the adoption of advanced technologies is further improving operational efficiency and patient care outcomes in the region.

In 2024, Japan led the Asia Pacific hospital outsourcing market, driven by the country’s aging population, which has significantly increased demand for healthcare services. To improve operational efficiency, hospitals in Japan are increasingly outsourcing administrative, IT, and support functions. Moreover, stringent regulatory changes have made compliance a top priority, pushing hospitals to partner with specialized outsourcing firms. This strategic shift enables hospitals to focus on high-quality patient care while effectively addressing operational challenges.

The hospital outsourcing market has seen significant growth in recent years, driven by the need for cost reduction, operational efficiency, and improved patient care. Healthcare providers are increasingly turning to outsourcing solutions for non-core activities, allowing them to focus on their primary responsibility patient care.

The hospital outsourcing market is growing rapidly due to the increasing need for cost reduction, operational efficiency, and improved patient care. Healthcare facilities are outsourcing non-core services such as medical billing, IT management, facility maintenance, and supply chain operations to specialized providers. This allows hospitals to focus on their primary function—delivering quality healthcare—while reducing administrative and financial burdens. Additionally, the rising prevalence of chronic diseases and an aging population has led to higher hospital admissions, increasing the demand for efficient service management. Regulatory compliance, data security concerns, and the adoption of advanced technologies like artificial intelligence and cloud computing further drive market growth. By leveraging outsourcing solutions, hospitals can enhance service accuracy, streamline operations, and achieve better financial sustainability, making outsourcing a crucial strategy for the modern healthcare industry.

| Report Coverage | Details |

| Market Size in 2025 | USD 421.47 Billion |

| Market Size by 2034 | USD 1026.82 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 10.4% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Service, Type, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Allscripts; Cerner Corporation; The Allure Group; Integrated Medical Transport; Sodexo; Aramark Corporation; LogistiCare Solutions, LLC (ModivCare); Flatworld Solutions Inc.; Abbott; ABM INDUSTRIES INCORPORATED |

In 2024, clinical services held the largest market share of 22.0%. The growing complexity of healthcare delivery and the demand for specialized expertise have led hospitals to outsource clinical functions, allowing them to focus on core patient care activities. Additionally, the aging population and rising chronic disease burden are driving the need for expanded clinical services, which outsourcing helps address effectively. The complexity of ICD-10 coding highlights this trend, as hospitals seek accurate billing and regulatory compliance by partnering with specialized coding firms, thereby enhancing operational efficiency.

The transportation services segment is anticipated to experience significant growth over the forecast period. The increasing emphasis on patient-centric care necessitates efficient logistics for patient transfers, medical supplies, and equipment. Furthermore, the expansion of telehealth and home healthcare services has heightened the need for reliable transportation solutions. Regulatory mandates and cost-control measures are encouraging hospitals to outsource transportation services to specialized providers, improving operational efficiency and resource management.

In 2024, private hospitals led the market, accounting for a 73.0% share. Facing budget constraints, these hospitals have increasingly turned to outsourcing as a cost-effective strategy to maintain high-quality services. By outsourcing non-core operations such as billing and IT, private hospitals can enhance patient care while reducing operational expenses. Additionally, growing regulatory complexities have made outsourcing an attractive solution for improving service delivery and operational flexibility.

The public hospitals segment is expected to grow rapidly over the forecast period. These hospitals face financial limitations while striving to provide high-quality, cost-effective care. Outsourcing essential but non-core functions like billing, IT, and facility management allows them to prioritize patient care. Moreover, the rising patient load and increasing regulatory requirements are prompting public hospitals to collaborate with external partners to ensure compliance and efficient service delivery.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Hospital Outsourcing Market

By Service

By Type

By Regional