The human growth hormone market size was exhibited at USD 7.65 billion in 2024 and is projected to hit around USD 24.62 billion by 2034, growing at a CAGR of 12.4% during the forecast period 2025 to 2034.

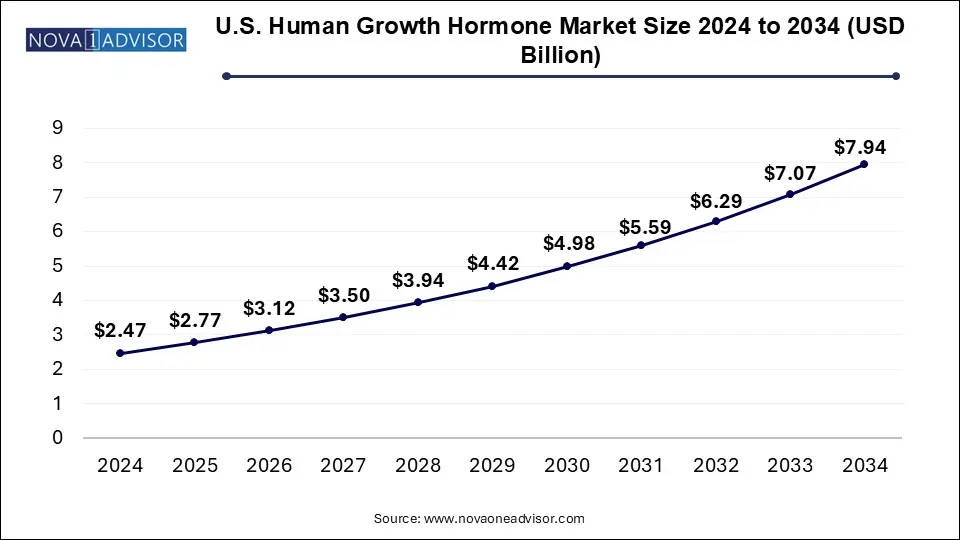

The U.S. human growth hormone market size was valued at USD 2.47 billion in 2024 and is expected to reach around USD 7.94 billion by 2034, growing at a CAGR of 11.19% from 2025 to 2034.

In 2024, North America dominated the human growth hormone market, capturing a 43.0% revenue share. This growth was driven by increasing healthcare awareness, substantial government initiatives, and favorable reimbursement policies. Additionally, rising R&D activities, sufficient research funding, and the presence of organizations promoting awareness and treatment accessibility have contributed to the region’s expansion. The strong market presence of major players such as Pfizer Inc., Lilly, and others further supports North America's significant revenue share.

Europe holds the second-largest market share, primarily fueled by the rising prevalence of growth hormone deficiencies, the availability of synthetic growth hormones, and extensive research and development efforts. The increasing incidence of growth hormone deficiency in Europe is linked to factors such as stress, poor sleep quality, and low glucose levels. For instance, in 2024, the European Medicines Agency reported that approximately 4.7 out of every 10,000 individuals in the European Union were affected by growth hormone deficiency. Within Europe, Germany leads in market share, while France is experiencing the most rapid growth in the region.

The Asia-Pacific region is expected to witness a significant growth rate during the forecast period, driven by the high prevalence of rare genetic disorders, unmet medical needs, and a growing demand for advanced therapeutics. Additionally, the region benefits from increasing investments by key industry players, drawn by APAC’s thriving pharmaceutical sector, which is anticipated to support its market expansion.

| Report Coverage | Details |

| Market Size in 2025 | USD 8.6 Billion |

| Market Size by 2034 | USD 24.62 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 12.4% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Application, Distribution Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Novo Nordisk A/S; Pfizer, Inc; Eli Lilly and Company; Sandoz International GmbH (Novartis AG); Merck KGaA; Genentech, Inc (Roche); Ferring Pharmaceuticals; Teva Pharmaceutical Industries, Ltd; Ipsen. |

The market is categorized by product type into long-acting and others. In 2024, the "others" segment held the largest share, accounting for 96.0% of the total market size. This segment is expected to maintain steady growth throughout the forecast period. It includes short-acting and intermediate-acting growth hormones.

The segment is anticipated to gain significant traction due to the rising incidence of hormone insufficiency and the availability of various products, such as Genotropin (Pfizer Inc.), Humatrope (Eli Lilly & Co.), Saizen (Merck & Co. Inc.), and Norditropin (Novo Nordisk A/S). Additionally, recent product launches and the widespread adoption of short-acting formulations, due to their lower risk of side effects, are key factors contributing to the segment's expansion.

The long-acting segment is projected to witness the fastest growth rate during the forecast period. Its advantages, including reduced administration frequency, improved patient compliance, and greater convenience, are driving demand. Furthermore, a strong investigational pipeline and new product introductions are fueling market growth. For instance, in January 2024, Ascendis Pharma A/S received European Commission (EC) approval for the marketing authorization of SKYTROFA, a treatment for growth failure in children and adolescents aged 3 to 18 years.

The growth hormone deficiency segment dominated the human growth hormone market in 2024 and is expected to experience the highest growth rate throughout the forecast period. Increased awareness regarding early diagnosis and treatment, along with efforts by biopharmaceutical companies to develop innovative therapies, are accelerating the segment's adoption. For example, in May 2024, Novo Nordisk announced that the Committee for Medicinal Products for Human Use of the European Medicines Agency issued a positive opinion recommending the use of once-weekly Sogroya (somapacitan) for treating growth hormone deficiency in children aged three years and above, as well as adolescents with developmental failure. This advancement underscores the potential of Sogroya as a replacement therapy for endogenous growth hormone in these patient groups.

The Turner syndrome segment holds a significant market share due to the high prevalence of the condition, growing research in rare genetic disorders, and various initiatives from public and private organizations to increase awareness. Groups such as the Turner Syndrome Foundation, Turner Syndrome Society of the United States, and Turner Syndrome Support Society play a crucial role in promoting awareness and encouraging early diagnosis.

The hospital pharmacy segment led the human growth hormone market in 2024, capturing the largest revenue share. Factors such as the rising prevalence of growth hormone disorders, frequent hospital visits, and favorable reimbursement policies have driven the adoption of this segment. Moreover, patients increasingly prefer recombinant and artificial human growth hormone (HGH), which is readily available in hospital pharmacies, further boosting the segment’s growth.

The online pharmacy segment is expected to witness rapid expansion in the coming years. This growth is attributed to the strong presence of online pharmacies in key regions such as North America and Europe, increased patient awareness, and the growing popularity of e-commerce and telehealth services. The convenience, flexibility, and attractive discounts on medications offered by online pharmacies further contribute to their rising revenue.

Additionally, the retail pharmacy segment ranked second in terms of revenue, largely due to the presence of major pharmacy chains such as Walgreens, Walmart, CVS Caremark, and others. These retail pharmacies ensure easy access to a wide range of medications and healthcare products, playing a significant role in the segment’s market growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the human growth hormone market

By Product

By Application

By Distribution Channel

By Regional