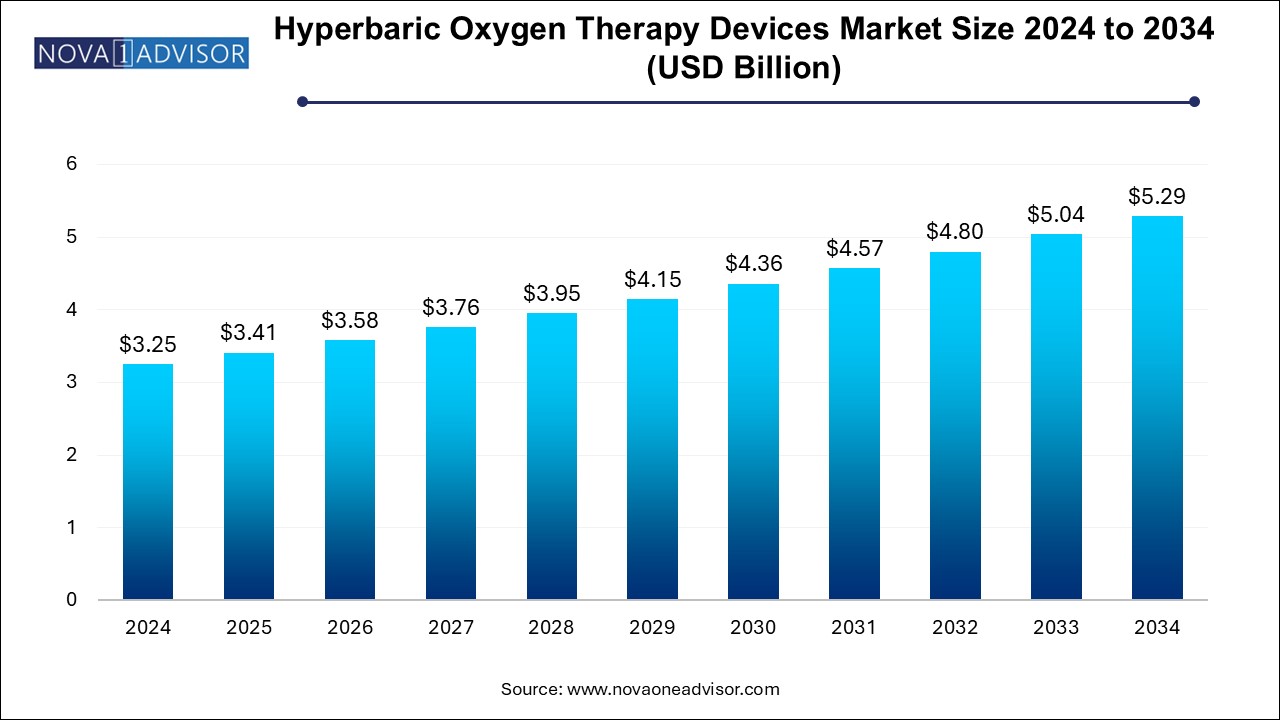

The hyperbaric oxygen therapy devices market size was exhibited at USD 3.25 billion in 2024 and is projected to hit around USD 5.29 billion by 2034, growing at a CAGR of 5.0% during the forecast period 2024 to 2034.

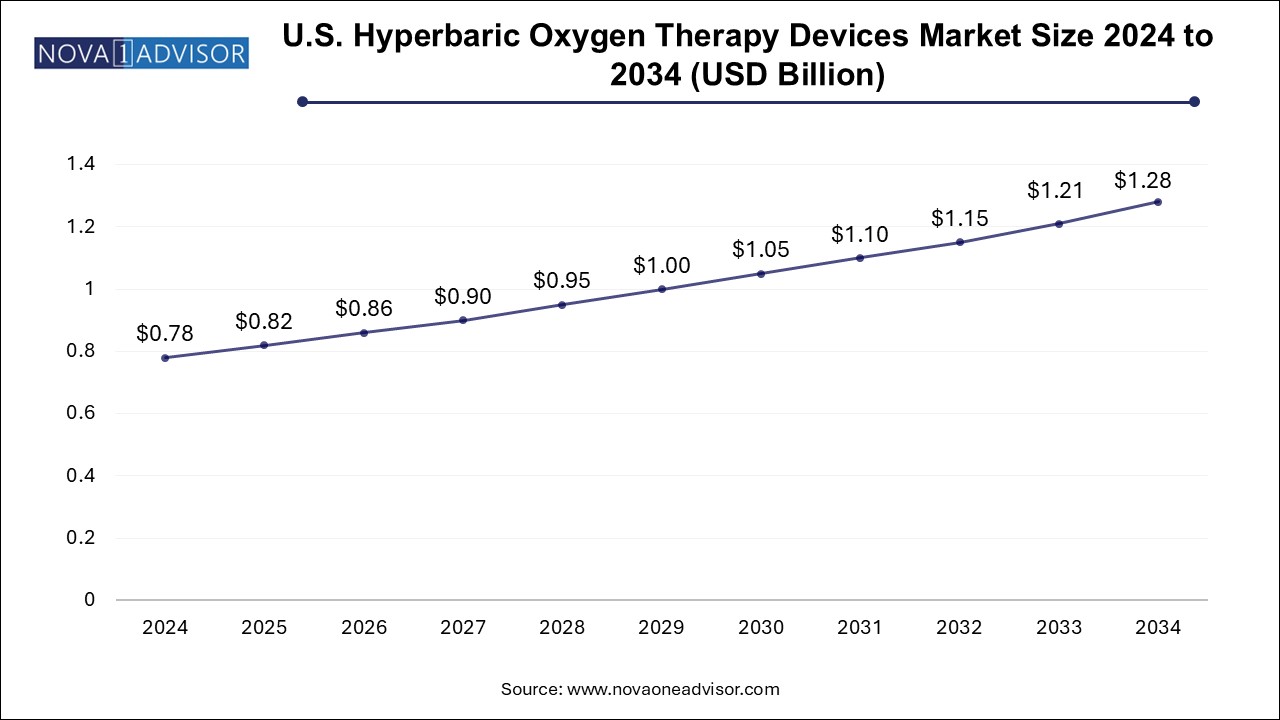

The U.S. hyperbaric oxygen therapy devices market size is evaluated at USD 0.78 billion in 2024 and is projected to be worth around USD 1.28 billion by 2034, growing at a CAGR of 4.6% from 2024 to 2034.

North America was the leading segment, accounting for the largest revenue share of 32.0% in 2024. This dominance can be attributed to several factors: a well-established healthcare infrastructure, high prevalence of chronic conditions like diabetes and obesity, and the presence of numerous wound care centers equipped with HBOT systems. Moreover, favorable reimbursement frameworks from Medicare and private insurers have made HBOT accessible to a wide patient base. The region also boasts some of the leading manufacturers and research institutions driving technological advancements and clinical adoption.

Asia Pacific is poised to be the fastest-growing regional market during the forecast period, driven by escalating healthcare investments, rising diabetic populations, and improving access to advanced medical technologies. Countries like China, India, and South Korea are witnessing rapid urbanization and increasing health awareness, resulting in greater demand for specialized wound care and emergency treatment options. Additionally, the growing participation of regional manufacturers and healthcare providers in deploying affordable HBOT systems tailored for local needs is accelerating market penetration. Government initiatives supporting medical tourism and infrastructural upgrades further enhance the region’s growth prospects.

The global Hyperbaric Oxygen Therapy (HBOT) Devices Market is experiencing a significant transformation, driven by a blend of rising clinical applications, increasing awareness about advanced wound care, and evolving healthcare infrastructure. Hyperbaric oxygen therapy is a well-established modality that involves the inhalation of pure oxygen in a pressurized environment, facilitating enhanced oxygen delivery to tissues. Traditionally associated with treating decompression sickness in divers, HBOT is now widely recognized for its benefits in managing chronic wounds, carbon monoxide poisoning, gas embolism, and certain infections.

The increased global burden of diabetic foot ulcers and radiation injuries—conditions that benefit significantly from hyperbaric oxygen therapy—is bolstering the adoption of HBOT devices. According to the International Diabetes Federation, over 537 million adults were living with diabetes globally in 2021, and the number is expected to rise to 643 million by 2030. With chronic wounds being a major complication of diabetes, the demand for HBOT as a supplementary treatment is accelerating in hospitals and outpatient clinics alike.

The technological evolution of hyperbaric systems—particularly the shift towards portable and user-friendly models—has made the therapy more accessible and scalable. With growing clinical evidence supporting HBOT's efficacy, insurance reimbursement support in some regions, and rising demand for non-invasive treatment alternatives, the market is anticipated to expand considerably in the coming decade.

Technological innovation in HBOT devices: Emergence of compact, portable, and electronically controlled systems with improved patient safety features and automation.

Rising adoption of HBOT for off-label applications: Increasing interest in using hyperbaric oxygen therapy for neurological conditions such as stroke recovery, autism spectrum disorders, and traumatic brain injuries.

Integration of HBOT in multi-disciplinary wound care centers: Specialized clinics are incorporating HBOT into routine care plans for pressure ulcers, diabetic wounds, and radiation injuries.

Expansion of HBOT services in developing regions: Emerging economies, especially in Asia Pacific and Latin America, are witnessing rapid development in advanced wound care infrastructure, including HBOT chambers.

Growing emphasis on personalized medicine: Tailored HBOT regimens based on patient-specific diagnostics and genetic profiling are gaining attention in research pipelines.

| Report Coverage | Details |

| Market Size in 2025 | USD 3.41 Billion |

| Market Size by 2034 | USD 5.29 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 5.0% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Fink Engineering; ETC Hyperbaric Chambers (Environmental Tectonics Corporation); HAUX-LIFE-SUPPORT; Gulf Coast Hyperbarics, Inc.; HEARMEC; IHC Hytech B.V. (Royal IHC); Hyperbaric SAC; Sechrist Industries, Inc.; OxyHeal International; SOS Group Global Ltd |

One of the most potent drivers of the HBOT devices market is the surge in chronic wounds globally, especially due to diabetes and vascular diseases. Chronic wounds such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers impose a significant economic and clinical burden. HBOT has proven efficacy in enhancing neovascularization, reducing inflammation, and promoting granulation tissue formation—critical components in wound healing. With healthcare systems aiming to reduce amputation rates and hospital stays, HBOT has become an attractive adjunct therapy. In countries like the U.S., clinical guidelines increasingly recommend HBOT for diabetic ulcers unresponsive to conventional therapies, further stimulating demand for installations in hospitals and specialized wound clinics.

Despite the clinical efficacy of HBOT, the high initial investment and maintenance cost of hyperbaric chambers remains a significant barrier to widespread adoption. Monoplace and multiplace chambers require considerable space, specialized training, and rigorous safety compliance due to the risk of oxygen toxicity and fire hazards. The installation of these systems can cost anywhere from $100,000 to over $1 million depending on size and features. Additionally, in regions with limited insurance reimbursement or public healthcare coverage, the per-session cost becomes prohibitive for patients. This has led to underutilization of the technology in resource-constrained settings, especially in low- and middle-income countries.

An emerging opportunity for the HBOT devices market lies in the growing application of hyperbaric therapy in neurological rehabilitation. Recent clinical studies have indicated positive outcomes from HBOT in managing traumatic brain injuries (TBI), stroke aftermath, and neuroinflammation, although these uses are still under investigation in many countries. For instance, research funded by the U.S. Department of Defense is evaluating HBOT’s role in helping veterans recover from PTSD and brain trauma. As evidence mounts and regulatory bodies consider expanding the list of approved indications, this could unlock a substantial new market segment for HBOT equipment manufacturers and therapy providers.

Monoplace HBOT devices dominate the market owing to their cost-effectiveness, compact footprint, and ease of use in outpatient settings. These single-patient chambers are particularly popular in standalone wound care centers and small hospitals. Their design allows for a controlled, individualized oxygen delivery system that requires minimal staffing. The ability to scale deployment across smaller facilities without massive infrastructure investment makes monoplace systems a preferred choice in both developed and developing countries.

In contrast, multiplace chambers are emerging as the fastest-growing segment, particularly in tertiary care hospitals and trauma centers. These chambers can accommodate multiple patients simultaneously, making them suitable for large-scale emergencies like carbon monoxide poisoning events or diving accidents involving multiple victims. Additionally, multiplace systems allow medical personnel to be inside the chamber with patients, enabling real-time intervention in critical cases. Although expensive, hospitals in high-income countries and military settings are increasingly investing in these advanced systems.

Wound healing applications constitute the largest segment of the HBOT market, largely due to the rising global incidence of diabetic foot ulcers, post-surgical wounds, and radiation-induced tissue damage. Clinics specializing in chronic wound care have integrated HBOT into routine treatment protocols, supported by mounting evidence and, in many cases, insurance reimbursement. The therapy not only speeds up recovery but significantly reduces complications like infection and amputation, making it a mainstay in wound management programs.

On the other hand, infection treatment and gas embolism segments are gaining traction as the fastest growing applications. Hyperbaric oxygen's ability to inhibit anaerobic bacterial growth and enhance leukocyte function makes it highly effective in treating severe infections such as necrotizing fasciitis and osteomyelitis. Likewise, HBOT is the gold-standard intervention for air embolisms, especially in surgical or diving-related mishaps. With increased awareness and emergency preparedness, more facilities are investing in HBOT as a frontline solution for these critical conditions.

December 2024: Environmental Tectonics Corporation (ETC) announced the expansion of its HBOT product line with a new advanced monoplace system designed for remote clinic usage. The device integrates AI-assisted pressure monitoring and oxygen dosing protocols for enhanced safety and treatment customization.

October 2024: Sechrist Industries introduced an upgraded multiplace chamber system featuring automated environmental controls and modular seating, aimed at large hospital networks and military applications.

August 2024: Perry Baromedical Corporation received FDA clearance for a new portable HBOT device suitable for home-based oxygen therapy trials under clinical supervision, signaling a shift towards decentralizing access to hyperbaric care.

June 2024: Haux-Life-Support GmbH partnered with an Indian hospital chain to deliver 20 multiplace chambers across major cities in India as part of a multi-year infrastructure development project.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the hyperbaric oxygen therapy devices market

By Product

By Application

By Regional