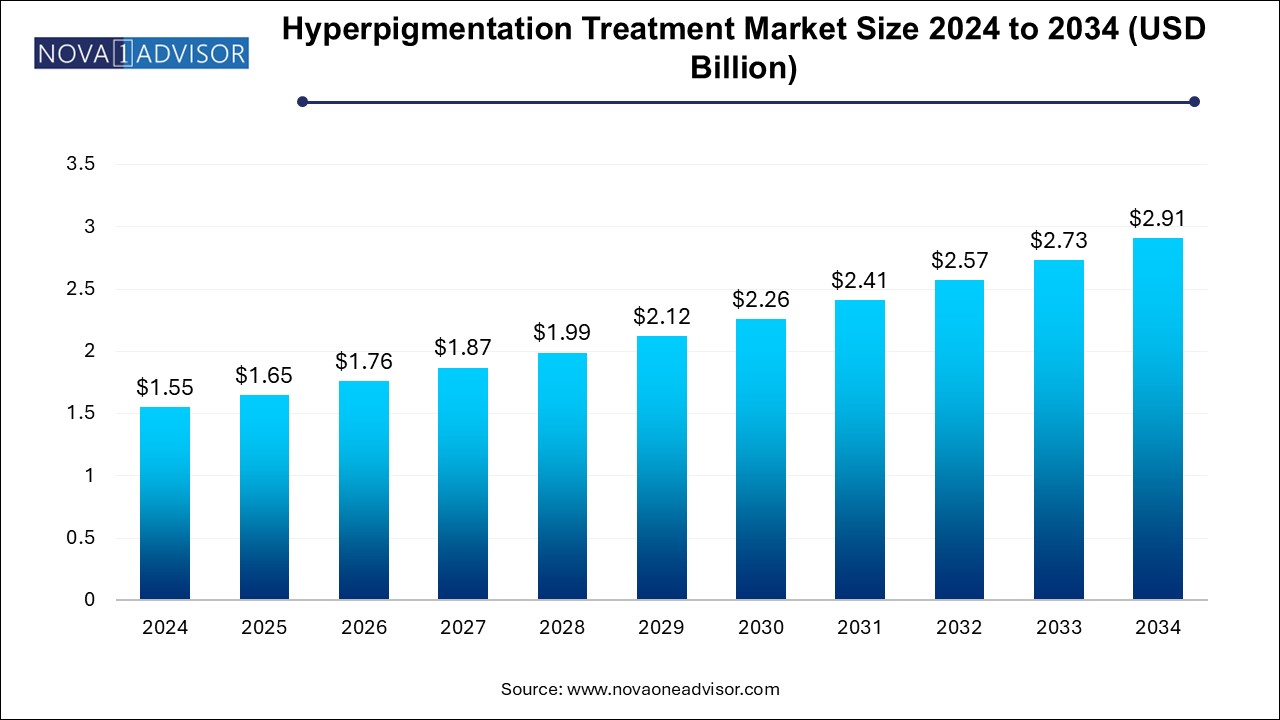

The hyperpigmentation treatment market size was exhibited at USD 1.55 billion in 2024 and is projected to hit around USD 2.91 billion by 2034, growing at a CAGR of 6.5% during the forecast period 2025 to 2034.

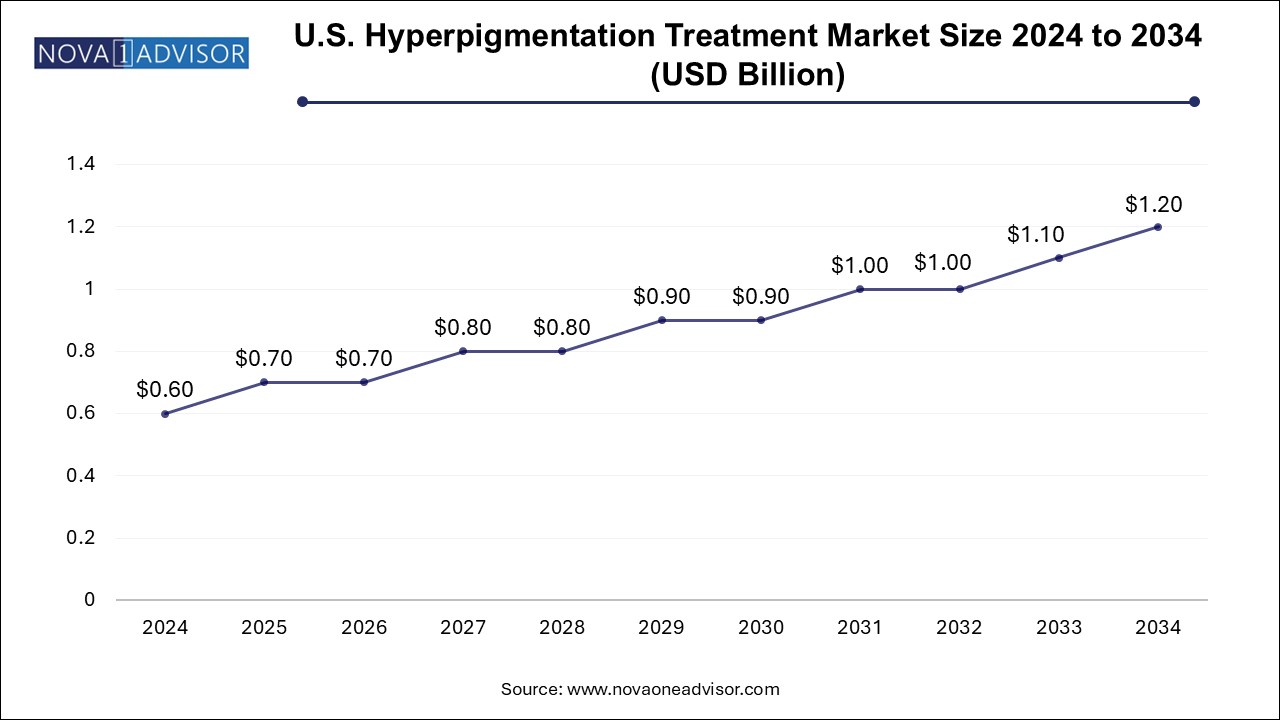

The U.S. hyperpigmentation treatment market size is evaluated at USD 0.6 billion in 2024 and is projected to be worth around USD 1.2 billion by 2034, growing at a CAGR of 6.5% from 2025 to 2034.

North America holds the largest share of the hyperpigmentation treatment market, attributed to the presence of advanced healthcare infrastructure, high awareness of dermatological conditions, and a large base of dermatology clinics and aesthetic centers. The U.S., in particular, is home to leading skincare brands and laser technology manufacturers, making it a hub for innovation and early adoption. The increasing demand for cosmetic procedures among all age groups, coupled with growing insurance support for dermatological consultations, contributes to market dominance. Additionally, high consumer spending power and widespread use of tele-dermatology platforms further drive regional growth.

Asia Pacific is the fastest-growing region in the hyperpigmentation treatment market, driven by rising disposable incomes, increasing beauty consciousness, and a high prevalence of melasma and PIH due to sun exposure and genetic factors. Countries like China, India, South Korea, and Japan are seeing a surge in dermatology clinics and aesthetic centers. South Korea, in particular, is a leader in cosmetic dermatology and exports advanced skincare technologies globally. Government initiatives promoting local manufacturing of skincare devices and the booming medical tourism industry further enhance the region's growth prospects.

The hyperpigmentation treatment market has witnessed significant growth over the past decade due to increasing awareness of skin health, rising demand for aesthetic treatments, and the growing prevalence of skin disorders caused by aging, hormonal fluctuations, and sun exposure. Hyperpigmentation, a condition characterized by the darkening of skin due to excess melanin production, affects millions worldwide, making it a prominent concern in dermatology and cosmetic medicine.

The market is driven by advancements in dermatological technologies, an increase in the number of skin care clinics, and growing consumer inclination toward non-invasive aesthetic procedures. With the rising influence of social media and beauty standards, consumers are increasingly seeking treatments to correct uneven skin tone, age spots, melasma, and post-inflammatory hyperpigmentation (PIH). The market is also expanding due to the development of new formulations, particularly those targeted at darker skin tones, which are more prone to pigmentation disorders.

Globally, the hyperpigmentation treatment market is highly fragmented with the presence of several multinational corporations and emerging dermatological brands. These companies are continuously investing in research and development to improve the efficacy, safety, and accessibility of their treatment offerings. As a result, innovative solutions such as laser-based therapies, chemical peels, and combination treatments are becoming widely available, contributing to robust market growth.

Increasing popularity of energy-based devices such as lasers and Intense Pulsed Light (IPL) for treating pigmentation.

Growing preference for minimally invasive and non-invasive aesthetic treatments.

Rising demand for personalized skincare solutions tailored to different Fitzpatrick skin types.

Increasing use of combination therapies (e.g., microneedling with topical agents) for improved results.

Expansion of tele-dermatology and digital skincare consultations post-pandemic.

Product innovation with the inclusion of natural and botanical ingredients in depigmenting agents.

Emergence of AI and machine learning in skin analysis and treatment planning.

Rising medical tourism in emerging economies for affordable hyperpigmentation treatments.

Growth in male consumer base for skincare and aesthetic treatments.

Strategic collaborations between dermatology clinics and beauty brands for expanded service offerings.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.65 Billion |

| Market Size by 2034 | USD 2.91 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 6.5% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Indication, Treatment, Skin Tone, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | BD; U-CyTech; Cellular Technology Limited; Mabtech; Abcam Limited; Autoimmun Diagnostika GmbH; Lophius Biosciences GmbH; Bio-Connect B.V.; Oxford Immunotec; Bio-Techne Corporation |

Market Driver: Rise in Aesthetic Consciousness Across Age Groups

A significant driver for the hyperpigmentation treatment market is the increasing aesthetic consciousness among individuals across various age groups. The millennial and Gen Z populations, in particular, are more inclined to seek out preventive and corrective dermatological treatments due to their active presence on social media platforms where appearance is often scrutinized. Simultaneously, older adults are showing increased interest in anti-aging treatments that target age spots and sun damage. The democratization of beauty standards, combined with the accessibility of cosmetic procedures, has created a fertile ground for hyperpigmentation treatments to thrive. Dermatology clinics and aesthetic centers are now offering flexible pricing, financing options, and customized packages, making treatments more accessible to a broader demographic.

Market Restraint: High Cost and Limited Insurance Coverage

Despite the growing popularity of hyperpigmentation treatments, one of the major restraints hampering market growth is the high cost associated with these procedures. Energy-based therapies, including laser and IPL treatments, often require multiple sessions and may not be affordable for all patients. Moreover, most aesthetic and cosmetic treatments are considered elective by health insurance providers, meaning they are not covered under standard policies. This limits access for middle- and lower-income individuals who may suffer from severe hyperpigmentation but cannot afford the necessary treatments. The lack of regulatory standardization in aesthetic practices across different regions also affects the pricing and quality of care.

Market Opportunity: Innovation in Treatment Modalities for Darker Skin Tones

An emerging opportunity in the hyperpigmentation treatment market lies in developing safe and effective treatment modalities for darker skin tones. Fitzpatrick skin types IV to VI are more prone to pigmentation issues and paradoxically more vulnerable to complications such as hypopigmentation or burns from conventional laser therapies. This gap in safe treatment options presents a significant growth avenue for companies to innovate in device settings, topical formulations, and post-treatment care protocols tailored for melanin-rich skin. Companies investing in inclusive research and culturally competent dermatological solutions are likely to gain a competitive edge, particularly in regions like Africa, Latin America, and Southeast Asia.

By Indication: Melasma Dominated the Market; PIH Emerging as Fastest-Growing Segment

Melasma emerged as the dominant segment in the hyperpigmentation treatment market due to its high prevalence among women, especially those undergoing hormonal changes such as pregnancy or using oral contraceptives. Melasma affects deeper layers of the skin, often requiring prolonged and combination treatments involving chemical peels, laser therapy, and depigmenting agents. The psychological impact of melasma, particularly on facial areas, drives individuals to seek timely intervention, further fueling market demand.

Conversely, post-inflammatory hyperpigmentation (PIH) is the fastest-growing indication segment, especially among younger populations and individuals with acne-prone skin. PIH frequently occurs following inflammation or injury, such as acne, eczema, or dermatological procedures. As awareness increases regarding early treatment of PIH to prevent permanent marks, demand for targeted topical and laser treatments is rising, especially in Asia Pacific and Latin American regions where PIH is highly prevalent.

By Treatment: Energy-Based Therapy Dominated; Microneedling Fastest-Growing

Energy-based therapy dominated the market due to its proven efficacy, rapid results, and advancements in devices like Q-switched lasers and IPL. Dermatologists prefer these modalities for their ability to target melanin precisely with minimal damage to surrounding tissues. Additionally, patients favor laser and light-based therapies for their relatively non-invasive nature and reduced downtime.

Microneedling has emerged as the fastest-growing treatment segment due to its versatility and effectiveness in treating hyperpigmentation across various skin tones. The minimally invasive procedure promotes collagen production while allowing deeper penetration of depigmenting agents. It is also favored for its lower risk of post-treatment complications in darker skin types. Combined with topical serums and PRP, microneedling is gaining popularity among younger demographics and those seeking affordable alternatives to laser therapies.

By Skin Tone: Fitzpatrick Skin Type III & IV Dominated; Type V & VI Fastest-Growing

Fitzpatrick skin type III & IV dominated the market due to the large population base in regions like Asia and the Middle East, where these skin types are most common. These individuals are more prone to hyperpigmentation due to genetic and environmental factors such as UV exposure. Treatment protocols for these skin types often include a balanced mix of topical agents, laser therapy, and sun protection.

Meanwhile, Fitzpatrick skin type V & VI is the fastest-growing segment, driven by increasing demand for pigmentation treatments in African, Caribbean, and South Asian populations. Historically underrepresented in dermatological research, these skin types are now receiving more attention, leading to safer and more effective treatment strategies. Companies developing devices with customized laser settings and specialized formulations for darker skin tones are expanding their market presence.

By End-use: Dermatology Clinics Dominated; Aesthetic Centers Fastest-Growing

Dermatology clinics have been the dominant end-use segment due to the presence of certified dermatologists, access to advanced treatment devices, and the ability to provide medically supervised care. These clinics are often the first choice for patients seeking treatment for severe pigmentation disorders, especially those requiring a combination of topical and procedural interventions.

Aesthetic centers are the fastest-growing end-use segment, driven by the increasing consumer interest in beauty and skincare treatments that do not require medical supervision. These centers offer a wide range of cosmetic treatments, including chemical peels and non-ablative laser sessions, often at more affordable rates. Their growth is further supported by partnerships with skincare brands and the expansion of services in urban and suburban areas.

In January 2025, Lumenis announced the launch of its new Splendor X Pro laser device, designed for safe and effective treatment of pigmentation issues in darker skin tones, expanding its portfolio of energy-based devices.

Candela Corporation, in March 2024, partnered with a chain of dermatology clinics in the U.S. to offer bundled treatment plans using their Nordlys IPL system, making pigmentation treatments more accessible.

In October 2024, Sisram Medical Ltd., the parent company of Alma Lasers, launched the Harmony XL Pro ClearLift Plus with enhanced settings for melanin-rich skin, targeting the APAC and MEA regions.

The Ordinary (DECIEM) expanded its range of topical pigmentation solutions in July 2024, introducing new niacinamide and alpha arbutin formulations targeting PIH and melasma.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the hyperpigmentation treatment market

By Indication

By Treatment

By Skin Tone

By End-use

By Regional