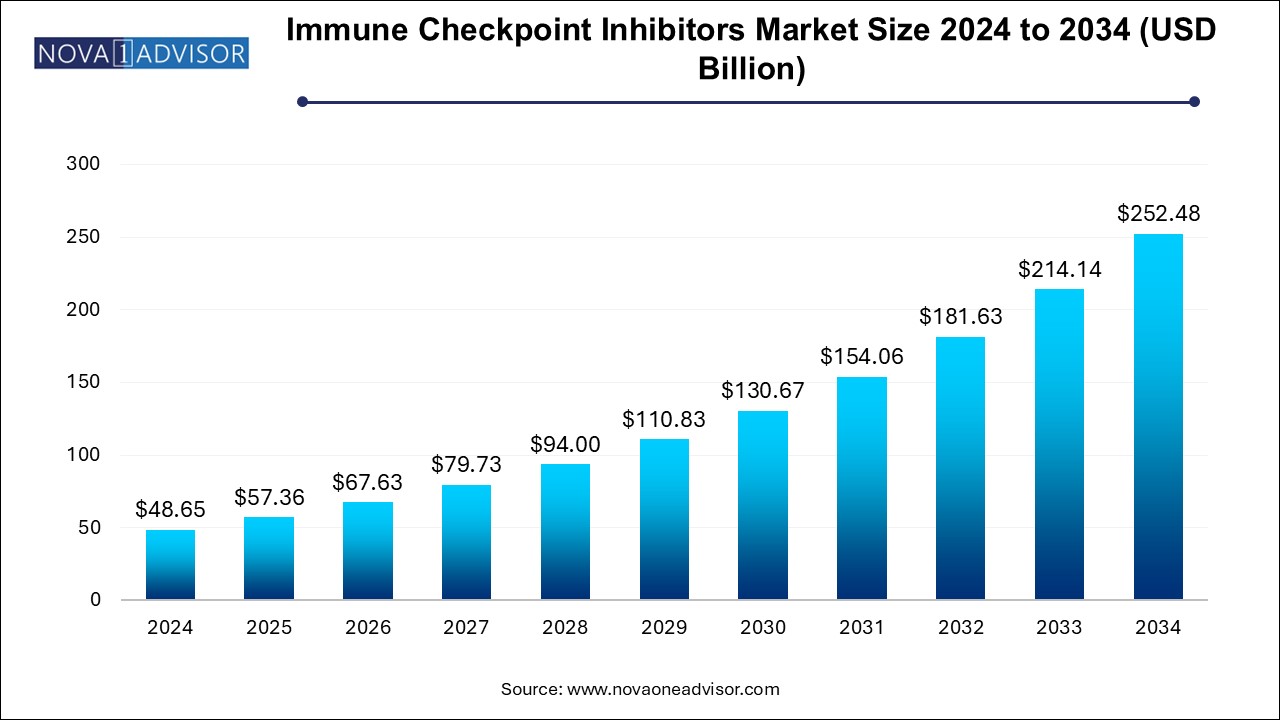

The immune checkpoint inhibitors market size was exhibited at USD 48.65 billion in 2024 and is projected to hit around USD 252.48 billion by 2034, growing at a CAGR of 17.9% during the forecast period 2024 to 2034.

The Immune Checkpoint Inhibitors (ICI) Market has emerged as one of the most transformative segments in oncology, revolutionizing cancer treatment by offering targeted immunotherapies that modulate the body’s immune response. Immune checkpoint inhibitors act by blocking proteins such as PD-1, PD-L1, and CTLA-4 molecules that tumors exploit to evade immune detection. By disarming these molecular brakes, ICIs enable T-cells to recognize and attack cancer cells effectively.

The market has rapidly expanded over the past decade, led by groundbreaking therapies like nivolumab (Opdivo) and pembrolizumab (Keytruda). Originally approved for melanoma, these drugs now have applications across numerous malignancies, including non-small cell lung cancer (NSCLC), bladder cancer, Hodgkin lymphoma, and even certain gastrointestinal and head & neck cancers. ICIs are increasingly being used in both monotherapy and combination regimens, often with chemotherapy, targeted drugs, or other immunotherapies.

As cancer becomes the second leading cause of death globally, with rising incidence rates in both developed and emerging markets, the demand for advanced, durable, and less toxic treatment options has intensified. Checkpoint inhibitors offer not just survival benefits but often extended remissions, redefining the expectations for late-stage cancer therapy. The continued exploration of novel checkpoint targets, expanding clinical trials, and supportive regulatory pathways suggest a robust pipeline and strong commercial prospects.

Expansion into Early-Stage Cancer Therapy: Use of ICIs in neoadjuvant (pre-surgery) and adjuvant (post-surgery) settings is growing, especially in NSCLC and melanoma.

Combination Therapy Development: ICIs are being combined with other ICIs, chemotherapy, tyrosine kinase inhibitors (TKIs), or radiotherapy to enhance response rates.

Personalized Immunotherapy through Biomarkers: PD-L1 expression, TMB (tumor mutational burden), and MSI-H (microsatellite instability-high) status are increasingly used to select eligible patients.

Emerging Checkpoint Targets: Beyond PD-1/PD-L1 and CTLA-4, targets like LAG-3, TIM-3, and TIGIT are gaining research momentum.

Real-World Evidence (RWE) Integration: Data from electronic health records and registries are being used to assess ICI effectiveness outside clinical trials.

Rise of Subcutaneous Delivery: To improve convenience and reduce infusion burden, drug makers are exploring subcutaneous ICI formulations.

Approval in Non-Oncologic Indications: Preclinical and early-stage trials are exploring use in diseases like HIV, sepsis, and autoimmune disorders.

Artificial Intelligence in Drug Development: AI is being employed to identify patient cohorts, predict adverse events, and optimize dosing schedules.

| Report Coverage | Details |

| Market Size in 2025 | USD 57.36 Billion |

| Market Size by 2034 | USD 252.48 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 17.9% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Type, Application, Distribution Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Sanofi; F. Hoffmann-La Roche Ltd.; Merck & Co.; Bristol-Myers Squibb Company; Eli Lilly and Company; Regeneron Pharmaceuticals Inc.; AstraZeneca PLC; Shanghai Jhunsi Biosciences Ltd; Immutep Ltd; BeiGene Ltd/ GlaxoSmithKline PLC |

One of the strongest drivers of the immune checkpoint inhibitors market is the rising incidence and mortality associated with cancer worldwide. According to the World Health Organization (WHO), there were approximately 19.3 million new cancer cases and 10 million deaths in 2022. Traditional chemotherapy and radiation approaches often fall short in advanced stages or cause significant systemic toxicity. ICIs offer an alternative with a more targeted mechanism of action, often producing durable responses in patients who have failed standard lines of treatment.

For example, in non-small cell lung cancer (NSCLC), the five-year survival rate has historically been below 10% for stage IV patients. The introduction of pembrolizumab as a first-line therapy, either alone or in combination, has doubled survival rates in some subsets. Similarly, in metastatic melanoma, once considered one of the deadliest cancers, drugs like ipilimumab and nivolumab have drastically improved survival outcomes. These breakthroughs continue to drive oncologists and researchers to explore immune checkpoint inhibition as a mainstream pillar of cancer therapy.

Despite the clinical promise of ICIs, one of the biggest restraints limiting broader market penetration is their exceptionally high cost. A single course of treatment can run into the hundreds of thousands of dollars per patient annually. For instance, annual therapy with nivolumab or pembrolizumab may cost anywhere from $100,000 to $150,000, depending on dosage and duration. Even with partial reimbursement or insurance, out-of-pocket expenses can be prohibitive for many patients.

Moreover, the financial burden extends to national healthcare systems and payers, prompting some governments and insurers to adopt restrictive reimbursement policies or require biomarker testing before approval. This raises accessibility issues in middle- and low-income countries and even within underserved populations in developed economies. As more checkpoint inhibitors enter the market, the challenge of balancing innovation with affordability becomes increasingly pressing.

While immune checkpoint inhibitors have revolutionized cancer care, they also present an emerging opportunity beyond oncology. Researchers are actively exploring the role of checkpoint blockade in autoimmune diseases, infectious diseases, and chronic inflammatory conditions. For instance, trials are underway to assess the use of checkpoint modulation in HIV, where T-cell exhaustion plays a role in viral persistence. There is also growing interest in leveraging these agents to reset immune tolerance in autoimmune diseases like Type 1 diabetes and multiple sclerosis.

Pharmaceutical companies and academic institutions are partnering to investigate how modulating checkpoint pathways can induce immune homeostasis or enhance pathogen clearance. While still early-stage, this could potentially expand the market by billions of dollars and unlock entirely new therapeutic verticals. Regulatory agencies like the FDA and EMA have also expressed interest in supporting such novel indications, offering expedited designations for breakthrough applications of known checkpoint inhibitors.

PD-1 inhibitors dominate the immune checkpoint inhibitors market, accounting for the largest market share due to their broad application spectrum, favorable safety profile, and robust clinical data. Drugs like pembrolizumab (Merck) and nivolumab (Bristol Myers Squibb) have set benchmarks for first-line and subsequent therapy in NSCLC, melanoma, and RCC. Their approvals cover over 20 cancer types combined, and they are central to most combination regimens, often used as a backbone therapy in immuno-oncology. Their success is also attributable to better tolerance and more manageable immune-related adverse effects compared to CTLA-4 inhibitors.

PD-L1 inhibitors are the fastest-growing segment, with drugs like atezolizumab (Roche), durvalumab (AstraZeneca), and avelumab (Pfizer/Merck KGaA) gaining expanded approvals. PD-L1 drugs are increasingly preferred in specific settings such as triple-negative breast cancer (TNBC) and urothelial carcinoma, and are being studied for their differential efficacy and toxicity profiles. PD-L1 inhibitors also hold potential for combination with targeted therapies like PARP inhibitors and are projected to gain market share over the next five years.

Lung cancer dominates the market by application, especially non-small cell lung cancer (NSCLC), which is the most common and deadliest form globally. ICIs have become frontline therapies in advanced NSCLC, especially for patients with high PD-L1 expression. The KEYNOTE trials (e.g., KEYNOTE-024, -042, -189) have played a pivotal role in establishing pembrolizumab as a preferred agent, both as monotherapy and in combination with chemotherapy. The CheckMate series of trials has also validated nivolumab's effectiveness in similar settings. Additionally, ICIs are making inroads in small-cell lung cancer, which traditionally had limited treatment options.

Bladder cancer is the fastest-growing application, driven by recent approvals for ICIs in both first-line and maintenance settings. Avelumab received breakthrough designation and approval for maintenance therapy post-chemotherapy in metastatic urothelial carcinoma. Trials like JAVELIN Bladder 100 have reshaped treatment algorithms. ICIs are now being used in BCG-unresponsive non-muscle invasive bladder cancer and are under evaluation for use in combination with intravesical therapies. As diagnostics improve, more patients are being screened for eligibility, further accelerating market growth.

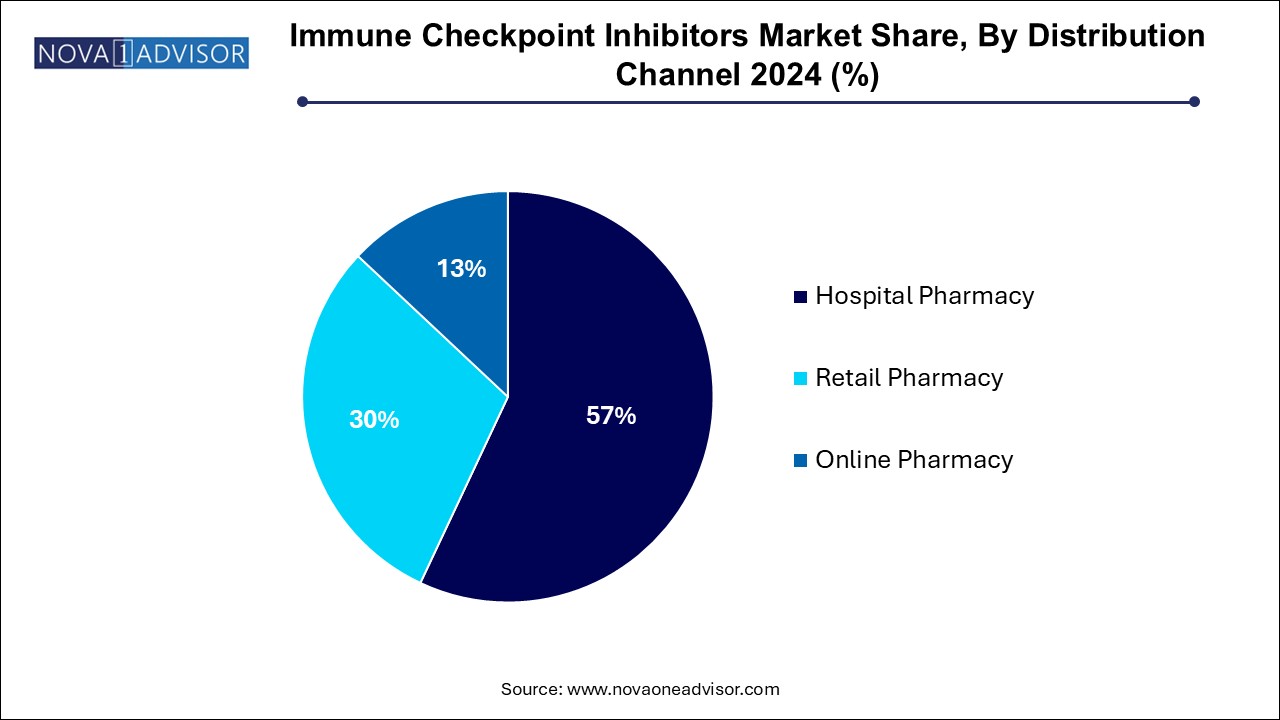

Hospital pharmacies dominate the distribution channel segment, as ICIs are typically administered through intravenous infusions in clinical settings that can manage potential adverse events like immune-related toxicities. These pharmacies also coordinate with oncologists, ensuring adherence to treatment regimens and storage protocols. Due to the complex logistics and high cost, ICIs remain centralized in specialty centers and oncology hospitals, where they are often reimbursed under bundled payment schemes.

Online pharmacies are the fastest-growing channel, although still at a nascent stage in many regions. As patient awareness grows and oral/subcutaneous ICIs are developed, online models for cancer drug distribution are gaining traction. In countries like the U.S. and Germany, oncology-focused digital platforms are emerging to provide at-home delivery of maintenance doses under remote monitoring. This trend is expected to grow significantly with further regulatory support and insurance model integration.

North America dominates the global immune checkpoint inhibitors market, driven by early adoption, robust R&D infrastructure, and favorable reimbursement policies. The U.S. FDA has been at the forefront of approving ICIs under accelerated pathways, often setting global standards. Leading pharmaceutical companies like Merck, BMS, and Pfizer have launched multiple ICIs in this region, supported by comprehensive biomarker testing infrastructure and a high incidence of cancer. The presence of National Cancer Institute (NCI)-designated centers ensures rapid uptake of novel therapies, while Medicare coverage supports access across demographics.

Asia-Pacific is the fastest-growing region, fueled by rising cancer incidence, increased healthcare investments, and growing participation in clinical trials. Countries like China, India, and Japan are witnessing a boom in domestic ICI development, particularly by companies such as Junshi Biosciences, Innovent, and BeiGene. Regulatory agencies in Asia are also fast-tracking oncology approvals, supported by national cancer programs and expanded insurance coverage. Furthermore, the cost-effectiveness of regionally developed ICIs is enabling greater accessibility across socioeconomic strata.

April 2025 – AstraZeneca reported positive phase III data for durvalumab in combination with chemotherapy in early-stage NSCLC, paving the way for adjuvant therapy approval.

February 2025 – Merck & Co. received FDA approval for Keytruda as a first-line treatment in metastatic gastric cancer, based on the success of the KEYNOTE-859 trial.

December 2024 – BMS launched its dual checkpoint combination nivolumab + relatlimab (Opdualag) in multiple European countries, targeting melanoma and expanding its footprint.

November 2024 – Roche received expanded approval for atezolizumab in combination with bevacizumab and chemotherapy for unresectable hepatocellular carcinoma.

September 2024 – BeiGene submitted a BLA (Biologics License Application) for tislelizumab, a PD-1 inhibitor, in the U.S., marking its entry into the Western immuno-oncology market.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the immune checkpoint inhibitors market

By Type

By Application

By Distribution Channel

By Regional