The global immuno-oncology clinical trials market size was exhibited at USD 8.30 billion in 2023 and is projected to hit around USD 35.37 billion by 2033, growing at a CAGR of 15.6% during the forecast period 2024 to 2033.

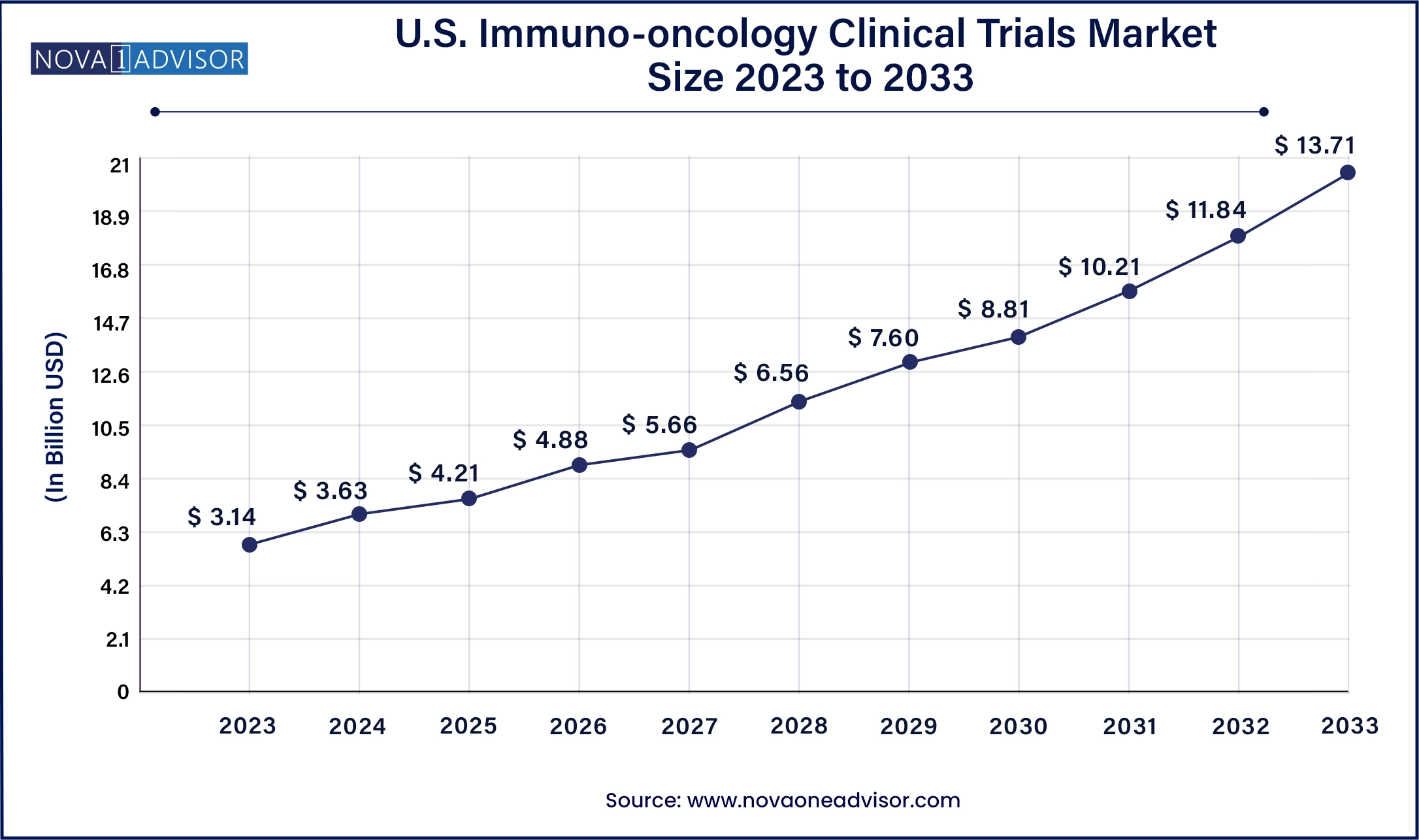

The U.S. Immuno-oncology Clinical Trials market size was valued at USD 3.14 billion in 2023 and is anticipated to reach around USD 13.71 billion by 2033, growing at a CAGR of 15.9% from 2024 to 2033.

North America dominates the immuno-oncology clinical trials market, fueled by a robust pharmaceutical R&D ecosystem, advanced healthcare infrastructure, and proactive regulatory support. The U.S. accounts for the majority of global I-O trials, with the FDA playing a key role in fostering innovation through mechanisms like Breakthrough Therapy Designation and Accelerated Approval. Leading academic institutions like MD Anderson, Memorial Sloan Kettering, and Dana-Farber Cancer Institute frequently serve as trial hubs for early and late-phase studies. The region also benefits from widespread adoption of digital health technologies, supporting remote monitoring and electronic data capture in trials.

Asia-Pacific is the fastest-growing region, driven by rising cancer incidence, increasing clinical research investments, and improved regulatory frameworks. Countries like China, Japan, South Korea, and India are expanding their participation in global trials. China, in particular, has seen an explosion in domestic biotech innovation, supported by regulatory reforms from the NMPA to expedite new drug development. Japan's emphasis on geriatric oncology, combined with government funding and public-private partnerships, is making it a key destination for immunotherapy trials. Furthermore, the region offers diverse genetic pools, helping to validate the global applicability of immuno-oncology treatments.

The Immuno-oncology (I-O) Clinical Trials Market represents one of the most dynamic and rapidly advancing sectors within the broader clinical research and oncology landscapes. As the understanding of cancer immunology deepens, the paradigm of treatment has shifted dramatically from cytotoxic chemotherapies toward immune-mediated therapies that harness the body's own defense mechanisms. Clinical trials are at the forefront of this evolution, validating the safety and efficacy of checkpoint inhibitors, CAR-T cell therapies, cancer vaccines, and novel immuno-modulators.

Fueling this transformation is the global rise in cancer incidence, combined with the limitations of traditional treatments and the promise of durable responses seen in certain immunotherapies. Regulatory bodies have responded with adaptive trial frameworks and expedited pathways to encourage innovation. The surge in precision medicine and biomarker-driven patient stratification has made I-O trials more targeted, efficient, and personalized. Major pharmaceutical companies, biotech startups, and academic research centers are collaborating globally to drive forward immuno-oncology innovations.

| Report Coverage | Details |

| Market Size in 2024 | USD 9.59 Billion |

| Market Size by 2033 | USD 35.37 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 15.6% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Phase, Design, Indication, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | ICON Plc; IQVIA Holdings; Covance; BioNTech; IO Biotech Medical; Medpace; Novartis; Exscientia; Syneous Health; AstraZeneca |

Rising Demand for Targeted and Durable Cancer Treatments

Immuno-oncology offers a transformative potential: the ability to produce long-lasting remission in cancers previously deemed incurable. Traditional chemotherapies and radiation often offer only temporary relief and carry significant toxicity profiles. Immunotherapies such as PD-1/PD-L1 and CTLA-4 inhibitors have demonstrated durable responses across multiple cancer types, including melanoma, lung cancer, and renal cell carcinoma. This shift in therapeutic goals from tumor shrinkage to durable immune activation has created a robust demand for I-O clinical trials. The surge in FDA breakthrough therapy designations and accelerated approvals for immunotherapies is a testament to the growing market traction.

Complexity and High Costs of Trial Execution

Despite their promise, I-O clinical trials are notoriously complex and expensive. The biological variability of immune responses, coupled with the need for specialized diagnostics and long-term follow-up, leads to extended timelines and inflated costs. Moreover, patient recruitment remains a significant bottleneck due to eligibility restrictions based on biomarkers or prior treatment history. In multicenter trials, variability in assay performance and sample collection protocols further adds to the complexity. These challenges are exacerbated in lower-income regions with limited infrastructure for immunological assessments. As a result, small biotech firms may struggle to compete without significant partnerships or funding.

Application of Immuno-oncology in Early-Stage and Rare Cancers

While much of the immuno-oncology success has focused on advanced and refractory cancers, a growing opportunity lies in expanding these trials to early-stage and rare cancer types. Neoadjuvant and adjuvant immunotherapy trials are showing promise in shrinking tumors pre-surgery and preventing recurrence post-surgery. For example, studies on the use of nivolumab in early-stage non-small cell lung cancer have demonstrated strong pathological responses. Similarly, immunotherapies are being explored in rare malignancies like Merkel cell carcinoma, uveal melanoma, and mesothelioma. This expansion not only opens up new patient pools but also addresses significant unmet medical needs, driving trial volume and market growth.

Phase II trials currently dominate the I-O clinical trials market. This stage, where efficacy and safety are assessed in defined patient groups, is critical for proof-of-concept studies in immuno-oncology. With many therapies moving from exploratory research to targeted application, Phase II trials offer the best balance between exploratory data and clinical relevance. The growing trend of using Phase II data to secure conditional approvals—particularly in the U.S. and Europe—has also contributed to the expansion of this segment.

Phase I trials, however, are growing the fastest. This surge is being driven by an influx of new I-O agents entering the pipeline, including checkpoint inhibitors, TCR therapies, and oncolytic viruses. These early-stage trials are not only assessing safety and dose escalation but increasingly incorporating biomarker analysis and preliminary efficacy endpoints. For instance, several biotech firms are now using expansion cohorts within Phase I studies to accelerate development while minimizing cost and time to market.

Interventional trials dominate the I-O clinical trials landscape due to their central role in evaluating therapeutic efficacy and safety. These trials often involve randomization, controlled conditions, and sophisticated endpoints, particularly when assessing combination therapies. As the gold standard for clinical validation, interventional studies receive the bulk of sponsor funding and regulatory oversight. Most pivotal studies leading to FDA approvals fall within this category.

Expanded access trials are growing rapidly, reflecting the increasing demand for investigational treatments outside formal trial structures. As patients become more informed and demand access to breakthrough therapies, pharmaceutical companies are offering expanded access pathways for life-threatening cancers with limited alternatives. While these studies are not statistically powered like interventional trials, they provide critical real-world safety and compassionate use data, often influencing further trial design and regulatory considerations.

Solid tumors represent the largest segment in immuno-oncology clinical trials. This is due to the high prevalence of solid cancers like lung, breast, colorectal, and prostate cancers, which account for a significant proportion of global cancer cases. Trials investigating PD-1/PD-L1 and CTLA-4 inhibitors in these indications have been at the forefront of the I-O revolution. Combination studies with chemotherapy, radiotherapy, and targeted agents in solid tumors also account for a significant share of ongoing trials.

Hematological cancers are the fastest-growing segment. The advent of CAR-T cell therapies has revolutionized treatment for leukemia, lymphoma, and multiple myeloma. These trials are increasingly focusing on improving durability, reducing relapse, and managing toxicities like cytokine release syndrome. Moreover, bispecific antibodies and engineered T-cell receptors are entering early-phase trials, pushing innovation in blood cancer immunotherapy. The precision with which blood cancers can be genetically characterized also aligns well with the personalized approach of immuno-oncology.

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global immuno-oncology clinical trials market.

Phase

Design

Indication

By Region