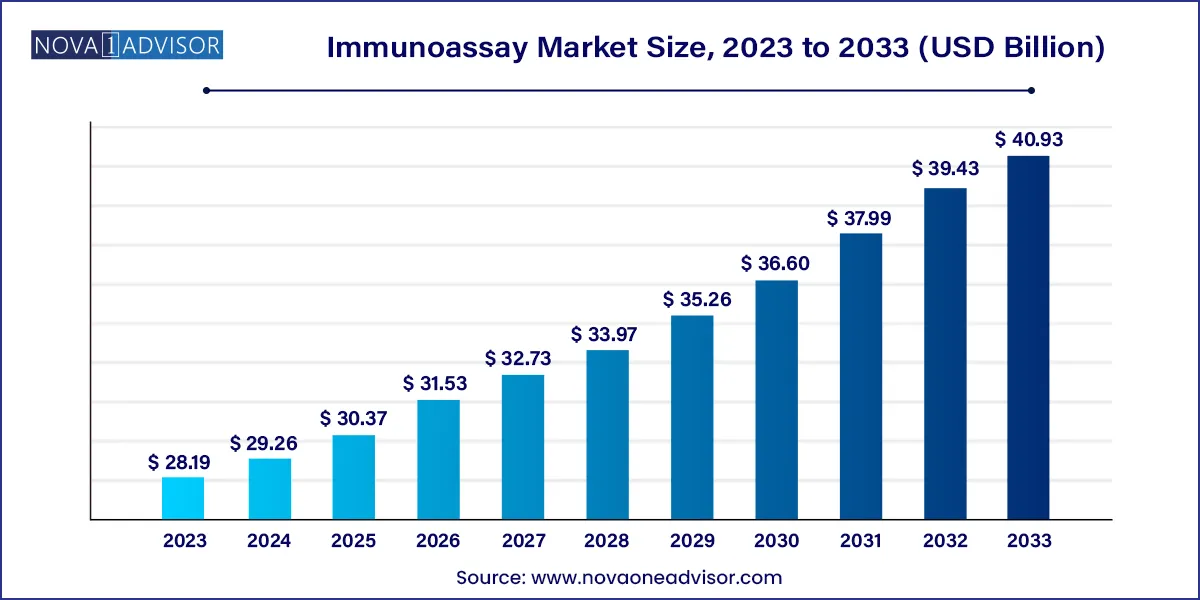

The global Immunoassay market size was valued at USD 28.19 billion in 2023 and is projected to surpass around USD 40.93 billion by 2033, registering a CAGR of 3.80% over the forecast period of 2024 to 2033.

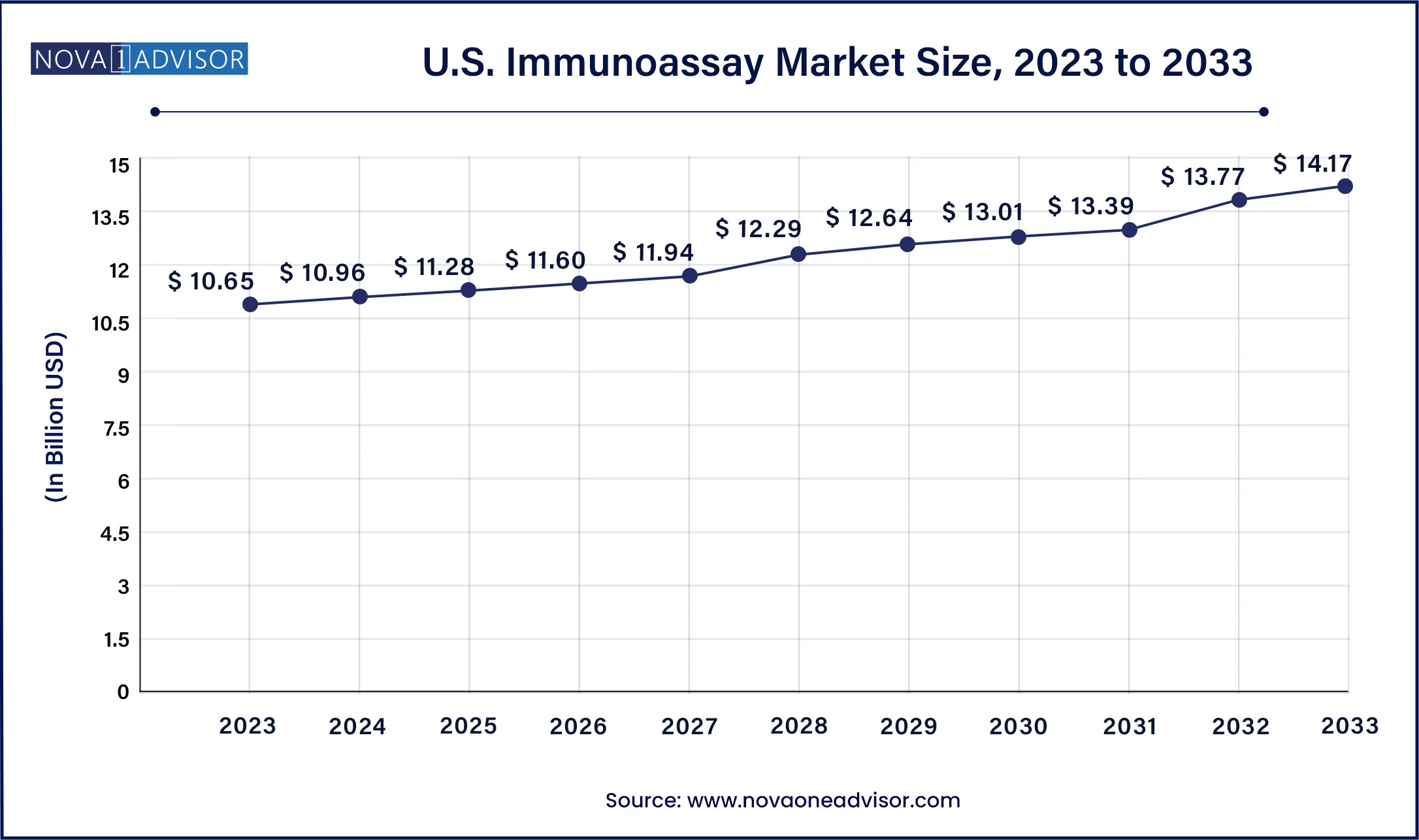

The U.S. Immunoassay market size was valued at USD 10.65 billion in 2023 and is anticipated to reach around USD 14.17 billion by 2033, growing at a CAGR of 2.90% from 2024 to 2033.

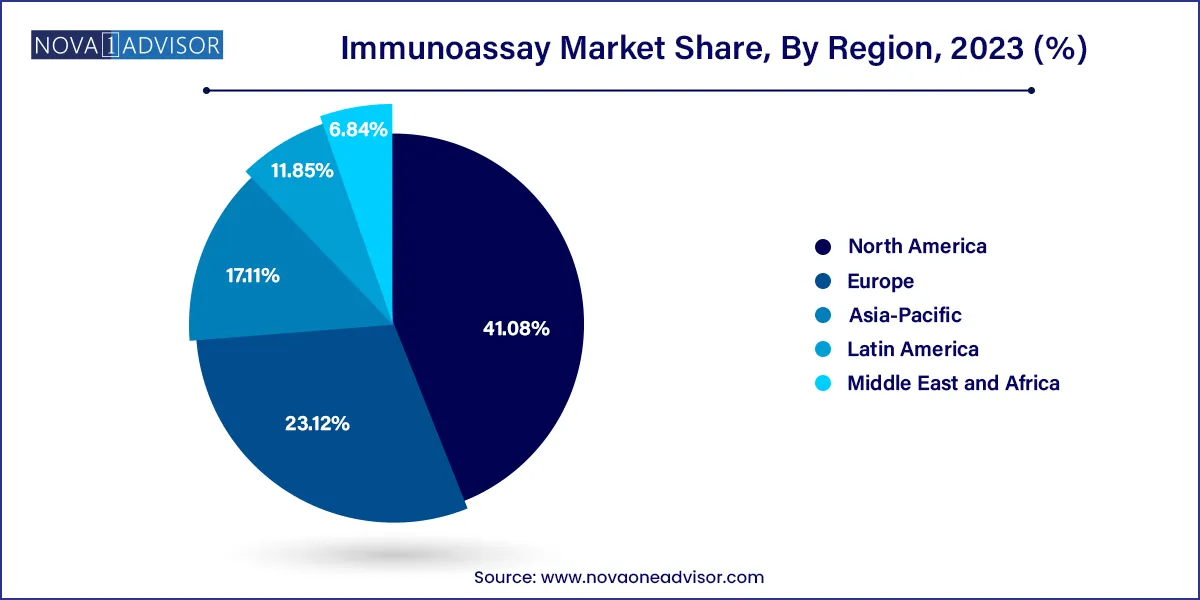

North America, led by the U.S., dominates the global immunoassay market, holding the largest share due to advanced healthcare infrastructure, strong regulatory oversight, and high diagnostic testing rates. The presence of major manufacturers like Abbott, Bio-Rad, and Thermo Fisher Scientific, combined with broad access to healthcare services, ensures consistent adoption of immunoassay platforms.

Government funding, rapid regulatory approvals, and insurance coverage for diagnostic tests further enhance market maturity. The U.S. also leads in research activity, with academic centers and CROs heavily using immunoassays in clinical trials. The widespread prevalence of chronic diseases and an aging population requiring regular biomarker monitoring sustains long-term demand.

Asia-Pacific is the Fastest Growing Region

Asia-Pacific is the fastest growing region, driven by expanding diagnostic infrastructure, government initiatives to combat infectious diseases, and increasing awareness about preventive care. Countries like China and India are investing heavily in public health labs and healthcare digitization, boosting immunoassay adoption in both urban and rural areas.

Rising healthcare expenditures, increasing prevalence of diabetes and cancer, and a growing middle-class population contribute to demand. Additionally, regional manufacturing capabilities are improving, with local players offering cost-effective kits for regional markets. Collaborations with global companies are accelerating product approvals and technology transfer, further catalyzing market growth.

The global immunoassay market represents a cornerstone of modern diagnostic and research applications, playing a crucial role in detecting and quantifying biomolecules for a wide range of purposes. Immunoassays leverage the specificity of antibodies to identify and measure antigens such as proteins, hormones, viruses, or drugs in biological specimens. These techniques are widely utilized across clinical diagnostics, pharmaceutical development, food safety, and environmental testing.

With the growing global emphasis on precision medicine, infectious disease management, cancer diagnostics, and therapeutic drug monitoring, the demand for robust, accurate, and scalable immunoassay platforms has surged. Technologies ranging from enzyme-linked immunosorbent assays (ELISAs) to high-throughput chemiluminescence immunoassays (CLIA) and fluorescence immunoassays (FIA) are being adopted for their speed, sensitivity, and cost-effectiveness.

The market has witnessed a post-COVID rebound and expansion, spurred by rising investments in diagnostic infrastructure, increased R&D in oncology and autoimmune disorders, and the growing burden of chronic diseases globally. Key players such as Abbott Laboratories, Roche Diagnostics, Bio-Rad Laboratories, and Siemens Healthineers are consistently launching innovations to improve throughput, automation, and multi-analyte capabilities.

According to current industry estimates, the global immunoassay market is expected to grow at a CAGR of over 6% through 2030, reaching a projected market value of more than USD 50 billion. This growth trajectory is propelled by technology convergence, rising healthcare expenditure, and heightened demand for real-time diagnostic data.

Shift Toward Fully Automated and High-Throughput Systems: Labs are investing in instruments that streamline immunoassay workflows, reducing manual errors and increasing reproducibility.

Integration of AI and Predictive Analytics in Immunoassay Platforms: Software-enhanced systems can now flag abnormal patterns, track trends, and improve interpretation speed.

Rising Popularity of Point-of-Care (POC) and Rapid Testing Kits: Demand for lateral flow assays and handheld immunoassay devices is increasing in primary care and rural settings.

Multiplexing Capabilities in Immunoassay Kits: New kits can detect multiple biomarkers in a single test, enhancing clinical decision-making.

Increased Use in Therapeutic Drug Monitoring (TDM) and Companion Diagnostics: Personalized medicine is driving the adoption of immunoassays for drug efficacy and safety evaluation.

Growth of Saliva and Non-Invasive Sampling Methods: Saliva-based immunoassays are gaining ground due to ease of use, especially in pediatrics and at-home testing.

Regulatory Harmonization and Expansion of Global Testing Infrastructure: Regulatory clarity from FDA, EMA, and WHO is accelerating market entry and adoption.

Expansion into Emerging Markets: Asia-Pacific and Latin America are witnessing growing immunoassay adoption due to rising investments in diagnostic labs and healthcare access.

| Report Attribute | Details |

| Market Size in 2024 | USD 29.26 Billion |

| Market Size by 2033 | USD 40.93 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 3.80% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, specimen, technology, application, end-use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Siemens Healthineers; bioMérieux SA; Abbott Laboratories; Danaher Corporation (Beckman Coulter); Quidel Corporation; Ortho Clinical Diagnostics; Sysmex Corporation; Bio-Rad Laboratories, Inc.; Becton, Dickinson, and Company; F. Hoffmann-La Roche AG; Thermo Fisher Scientific, Inc. |

Reagents and kits dominate the immunoassay market, accounting for the largest revenue share due to their recurring demand, wide applicability, and central role in diagnostic workflows. ELISA reagents and rapid test kits are particularly widespread, with applications in infectious disease testing, hormone analysis, and therapeutic drug monitoring. Reagents represent a recurring revenue stream for manufacturers, and advancements in multiplexing and assay sensitivity continue to drive innovation.

Software and services are the fastest-growing product category, driven by the digitization of laboratory workflows and demand for integration with Laboratory Information Management Systems (LIMS). These tools enhance assay traceability, ensure compliance with regulatory standards, and improve result turnaround. As labs seek to optimize operations and reduce errors, software-driven assay management and remote diagnostic platforms are witnessing rapid adoption.

Enzyme immunoassays (EIA), including ELISAs, continue to dominate the market due to their affordability, reliability, and widespread use across applications. ELISAs have long been the standard for detecting antigens and antibodies in research and clinical settings. Their simplicity and adaptability to various analytes keep them indispensable for infectious disease testing and autoimmune profiling.

Chemiluminescence immunoassays (CLIA) are the fastest-growing technology, driven by their superior sensitivity, dynamic range, and automation compatibility. CLIA platforms allow for high-throughput screening in clinical labs and are increasingly used in cancer biomarker detection, cardiac assays, and hormone testing. Companies like Roche and Abbott have introduced fully automated CLIA systems that deliver rapid results and integrate seamlessly into centralized lab infrastructures.

Infectious disease testing dominates the immunoassay application spectrum, as it has traditionally been the core use case—spanning diseases like HIV, hepatitis, dengue, COVID-19, and influenza. The recent pandemic underscored the importance of rapid, scalable immunoassay diagnostics, leading to mass adoption globally. Public health agencies, travel regulations, and occupational testing protocols continue to drive volume in this segment.

Oncology is the fastest-growing application area, propelled by the emergence of tumor biomarker panels and companion diagnostics. Immunoassays enable early detection and monitoring of cancer markers such as PSA, CEA, CA-125, and HER2/neu. As immunotherapy and personalized oncology evolve, the need for immunoassay-based drug response monitoring and minimal residual disease tracking will further boost this segment.

Blood remains the dominant specimen type, with serum and plasma offering high biomarker concentration and established protocols for immunoassay testing. Most immunoassays, including hormone and antibody detection, are validated for blood samples, ensuring robust and standardized performance. Hospitals, clinical labs, and biopharma research heavily rely on venous blood-based assays for reliable diagnostics.

Saliva is the fastest growing sample type, particularly in rapid diagnostics and at-home testing. Saliva collection is non-invasive, simple, and stress-free making it ideal for pediatric, geriatric, and point-of-care applications. The success of saliva-based COVID-19 antibody tests has encouraged manufacturers to expand development into other domains such as hormone monitoring (e.g., cortisol, testosterone), drug abuse testing, and fertility diagnostics.

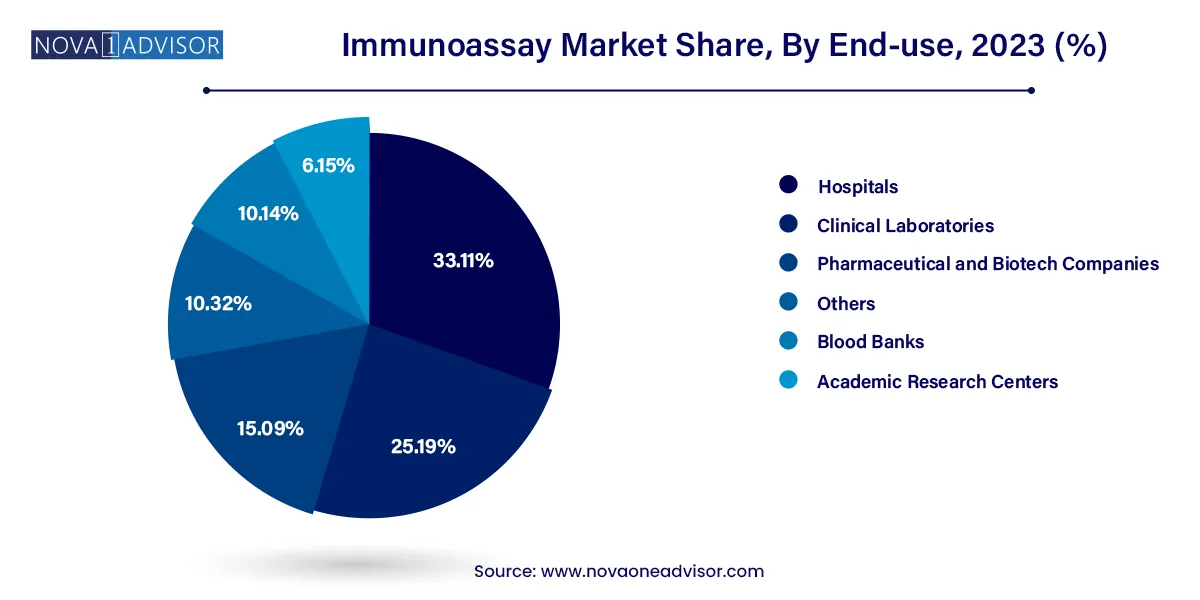

Hospitals are the largest end-users, supported by their central role in patient diagnostics and acute care. Immunoassays are integral to emergency diagnostics, in-patient screening, and surgical monitoring. Hospital-based labs often deploy fully automated systems and handle high test volumes, ensuring consistent demand for reagents and instruments.

Pharmaceutical and biotech companies represent the fastest-growing end-user segment, driven by increased demand for immunoassays in drug development, vaccine trials, and biomarker discovery. These companies utilize ELISA, CLIA, and multiplex assays for pharmacokinetic analysis, immunogenicity testing, and preclinical biomarker validation. As biopharma R&D intensifies globally, this segment is expected to grow exponentially.

March 2024 – Abbott Laboratories launched its next-generation CLIA-based immunoassay platform, offering faster throughput and enhanced AI-based result interpretation for hospital labs.

February 2024 – Bio-Rad Laboratories announced the release of an expanded immunoassay product line, including an automated ELISA workstation targeting oncology and autoimmune markers.

January 2024 – Siemens Healthineers secured FDA approval for its new high-sensitivity cardiac troponin immunoassay, enhancing early diagnosis of acute coronary syndromes.

December 2023 – Thermo Fisher Scientific acquired a mid-size European immunoassay firm to strengthen its specialty diagnostics division and expand its biomarker detection portfolio.

November 2023 – Roche Diagnostics partnered with multiple global health NGOs to distribute low-cost infectious disease immunoassay kits in Southeast Asia and Sub-Saharan Africa.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Immunoassay market.

By Product

By Specimen

By Technology

By Application

By End-use

By Region