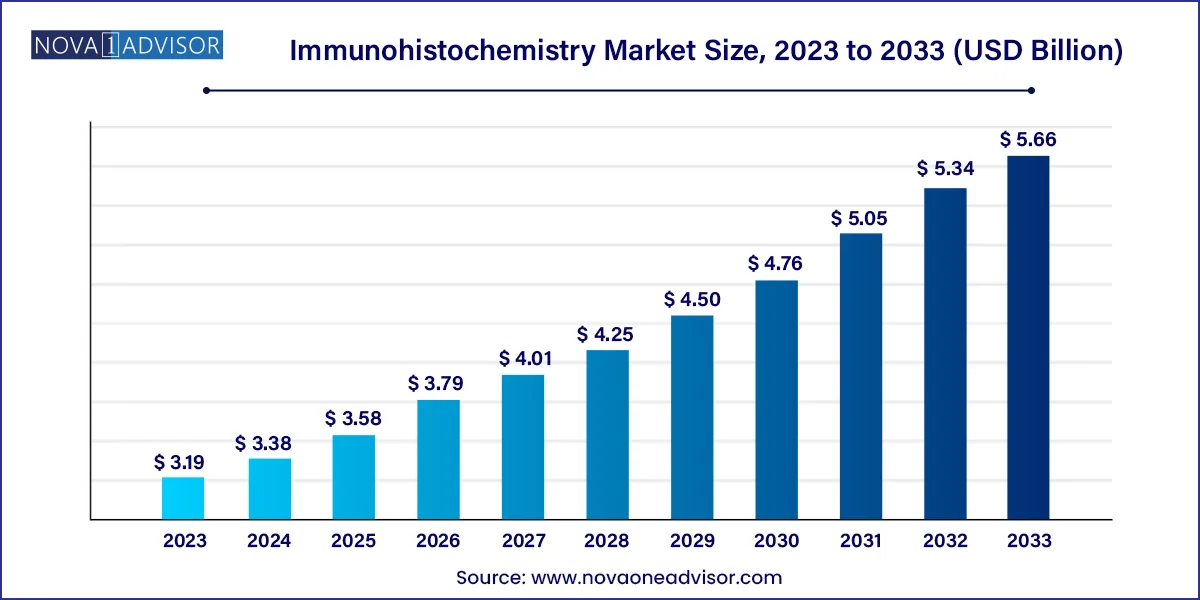

The global immunohistochemistry market size was valued at USD 3.19 billion in 2023 and is projected to surpass around USD 5.66 billion by 2033, registering a CAGR of 5.9% over the forecast period of 2024 to 2033.

The Immunohistochemistry (IHC) Market represents one of the most vital pillars of diagnostic pathology and translational research. Immunohistochemistry is a method used to detect specific antigens in tissues by using labeled antibodies as diagnostic or research tools. IHC enables the visualization of protein expression within the histological architecture of tissues, thus offering both spatial and quantitative insights into disease pathology. It has become an indispensable technique in clinical diagnostics, drug development, and cancer biomarker discovery.

Traditionally grounded in oncology, the scope of IHC has expanded significantly. Today, it is utilized in the diagnosis of infectious diseases, cardiovascular disorders, autoimmune conditions, and neurological pathologies. With the rising global burden of chronic diseases, particularly cancer, the demand for IHC has surged. According to the World Health Organization, cancer accounts for nearly 10 million deaths annually, and IHC plays a central role in subtype classification, prognosis, and treatment guidance for several cancer types including breast, lung, colorectal, and prostate.

Furthermore, the advent of personalized medicine and targeted therapy has reinforced the relevance of IHC in guiding treatment decisions. Biomarkers like HER2, PD-L1, and ER/PR are routinely evaluated through IHC to determine therapeutic eligibility. Innovations in antibody development, digital pathology, and multiplex staining have greatly expanded IHC’s capabilities, making it more reproducible, scalable, and accessible than ever before.

The market is composed of a broad range of offerings, including antibodies (primary and secondary), reagents, kits, and advanced instruments such as tissue processors and slide scanners. It is supported by a growing ecosystem of hospitals, diagnostic laboratories, research institutes, and biotechnology firms. As the integration of automation, artificial intelligence, and molecular biology with histopathology deepens, the global IHC market is poised for steady and substantial growth.

Rise of Companion Diagnostics in Oncology: IHC is increasingly being used alongside targeted cancer therapies to assess biomarker expression.

Growth of Multiplex Immunohistochemistry: Multiplexing enables simultaneous detection of multiple antigens in a single tissue section, enhancing diagnostic accuracy.

Adoption of AI-based Digital Pathology Platforms: Automated image analysis using AI is revolutionizing IHC slide interpretation, reducing human error and turnaround time.

Increased Use in Infectious and Autoimmune Disease Diagnostics: Beyond cancer, IHC is being applied in tuberculosis, hepatitis, and lupus diagnosis.

Customization and Ready-to-use Kits: Pre-configured IHC kits for specific disease panels are simplifying workflows in laboratories.

Expansion of Outsourcing Services and CRO Adoption: Pharmaceutical companies are increasingly outsourcing IHC services for drug development and biomarker validation.

Regulatory Support for Diagnostic Biomarker Validation: Regulatory bodies like the FDA are recognizing IHC assays as critical tools in precision medicine pathways.

Integration with Molecular and Genomic Tools: Combining IHC with PCR, NGS, and FISH is enhancing the granularity of disease diagnosis and classification.

| Report Attribute | Details |

| Market Size in 2024 | USD 3.38 Billion |

| Market Size by 2033 | USD 5.66 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.9% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, application, end-use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Thermo Fisher Scientific Inc.; F. Hoffmann-La Roche Ltd.; Merck KGaA; Danaher Corporation; PerkinElmer, Inc.; Bio-Rad Laboratories, Inc.; Cell Signaling Technology, Inc.; Bio SB; Abcam plc.; Agilent Technologies, Inc. |

The most compelling driver of the IHC market is the alarming rise in global cancer incidence, combined with a healthcare shift toward early and precise diagnosis. According to GLOBOCAN 2022, global cancer cases are projected to rise by over 50% by 2040, increasing the demand for reliable diagnostic modalities that can accurately subtype tumors and inform therapeutic decisions.

IHC is crucial in this regard. In breast cancer, for example, the assessment of HER2, estrogen receptor (ER), and progesterone receptor (PR) status via IHC is fundamental in determining treatment options. Similarly, in non-small cell lung carcinoma (NSCLC), PD-L1 expression measured through IHC dictates eligibility for immunotherapy agents like pembrolizumab. These examples highlight how IHC directly influences patient survival, therapeutic selection, and healthcare cost-effectiveness. As such, the increasing investment in cancer diagnostics and precision medicine is a powerful engine propelling the global IHC market forward.

Despite its clinical value, the adoption of immunohistochemistry is hindered by the high cost of instruments, reagents, and lab setup, particularly in low-resource regions. Sophisticated IHC equipment—such as automated slide stainers, tissue processors, and digital scanners—can cost tens of thousands of dollars. Moreover, consistent use of high-quality antibodies and reagents adds to operational expenses.

Additionally, IHC requires skilled personnel for sample preparation, staining, and interpretation. In many countries, pathology services face staffing shortages, and training is insufficient to handle advanced IHC workflows. The cost barrier is especially acute in smaller diagnostic labs and rural hospitals, which often rely on centralized facilities or reference labs. Thus, while IHC holds transformative diagnostic potential, its reach is limited by economic and infrastructural challenges, particularly in developing nations.

One of the most exciting opportunities in the IHC market lies in the integration of digital pathology with artificial intelligence (AI) for enhanced slide interpretation, data management, and remote diagnosis. Traditionally, IHC interpretation has been a manual, subjective process, prone to variability between pathologists. Digital slide scanners now allow for whole slide imaging (WSI), which, when combined with AI algorithms, can deliver objective, reproducible, and quantitative assessments of biomarker expression.

Startups and established players alike are developing AI-based platforms that automate scoring of markers like HER2, Ki-67, and PD-L1, thereby reducing turnaround times and improving accuracy. For example, PathAI and Paige AI are working on models that analyze thousands of IHC slides in real time, supporting both diagnostics and research. These tools are particularly useful in telepathology settings, where expert pathologists may not be locally available. As regulatory approvals and clinical adoption grow, AI-enabled IHC promises to revolutionize how histopathology is practiced globally.

Antibodies dominated the product segment, owing to their central role in antigen detection and high frequency of use. Primary antibodies are designed to bind to specific target antigens within tissue sections, while secondary antibodies facilitate signal detection through enzyme or fluorophore tagging. Monoclonal antibodies, due to their specificity, are preferred for most diagnostic applications. The market demand is highest in cancer biomarker detection, where validated antibodies for HER2, p53, and EGFR are routinely deployed.

Reagents are the fastest-growing product segment, fueled by the increased demand for standardization, high-throughput processing, and quality control in labs. These include blocking sera, diluents, fixation reagents, and chromogenic substrates that ensure consistency and clarity in staining results. Companies are innovating reagent kits that minimize background staining, improve contrast, and allow multiplex applications. As labs shift toward automation and lean protocols, demand for specialized, ready-to-use reagents is surging globally.

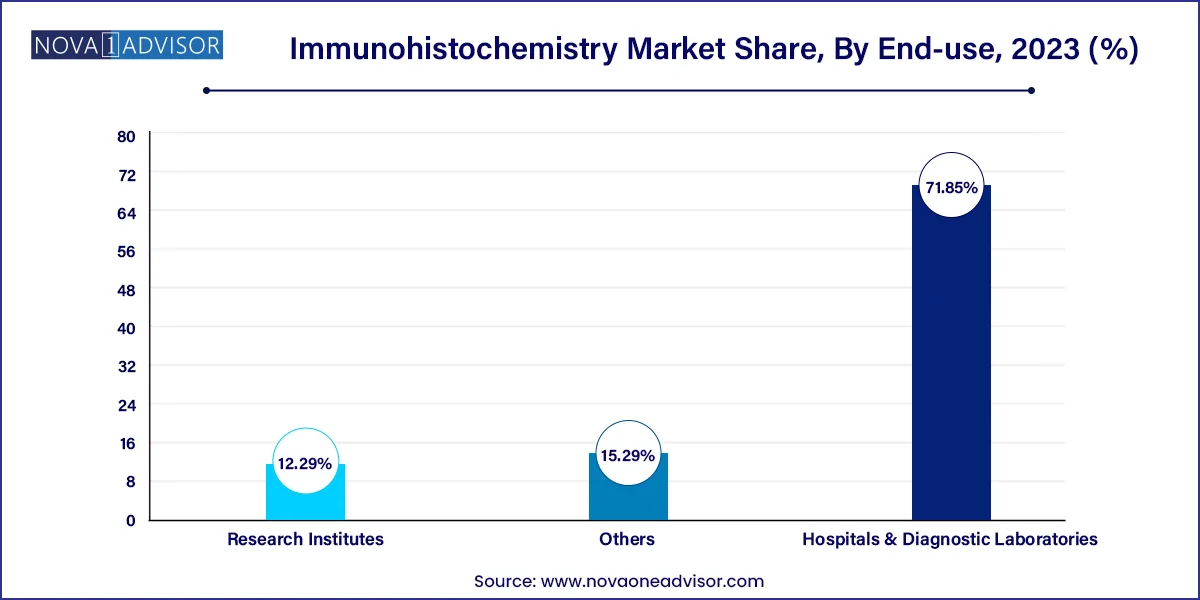

Hospitals and diagnostic laboratories dominate the end-use segment, reflecting the high volume of diagnostic IHC testing performed in these facilities. Most biopsies and surgical specimens are processed in hospital pathology labs, where IHC is standard practice for confirming clinical diagnoses. Diagnostic labs also cater to outpatient and second-opinion testing, making them crucial stakeholders in the IHC ecosystem. These institutions typically possess the infrastructure and expertise to handle high-throughput IHC testing with automation.

Research institutes are the fastest-growing end-users, driven by increasing government and private funding in biomedical research. IHC plays a critical role in histological studies, neuroscience research, and drug discovery. The use of advanced imaging and multiplexing technologies in these settings is driving adoption of new IHC reagents, platforms, and data analysis tools. Research institutes are also pivotal in validating novel biomarkers and establishing standardized protocols for clinical translation.

Diagnostics represent the largest application segment, with cancer diagnosis being the most dominant sub-application. IHC is used across virtually all major cancer types for subtype classification, prognostic assessment, and treatment planning. For instance, in melanoma, S100 and HMB-45 markers are used to confirm diagnosis, while in colorectal cancer, MMR protein expression helps determine eligibility for immunotherapy. Beyond oncology, IHC also plays a role in diagnosing hepatitis, lupus, and tuberculosis, expanding its diagnostic reach.

Research is the fastest-growing application segment, especially in academic institutions and pharmaceutical companies engaged in biomarker discovery and drug development. IHC is extensively used in preclinical studies to understand protein localization, disease pathways, and treatment response in animal models. The rise of multiplex IHC techniques is further enabling translational research to map cellular interactions in tumor microenvironments, aiding immunotherapy development.

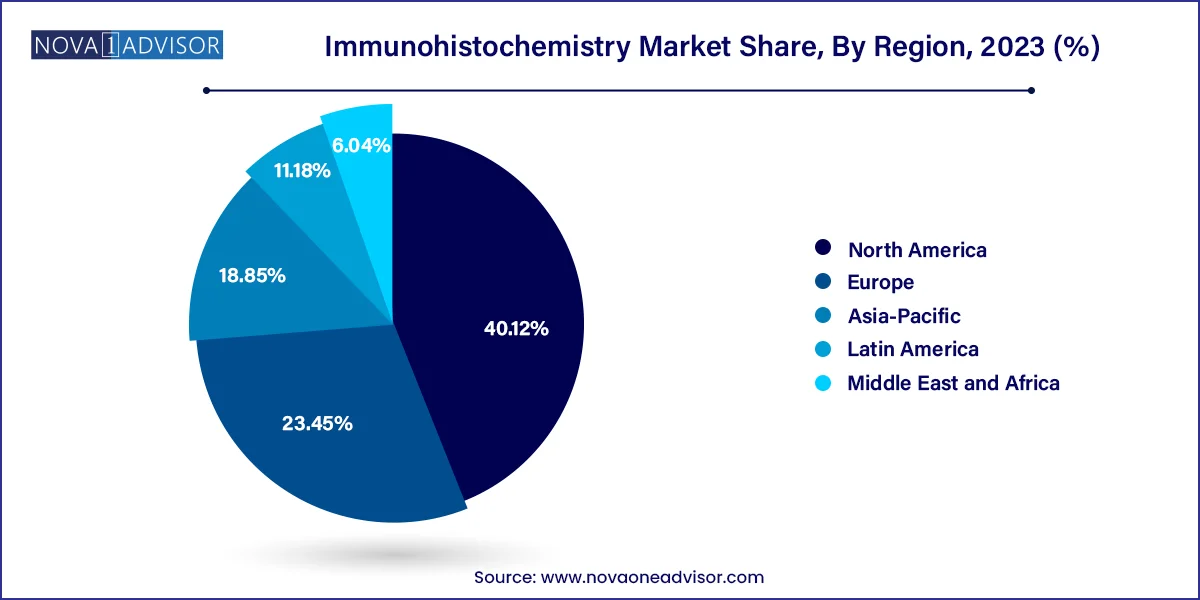

North America is the dominant region in the global IHC market, led by the United States, which boasts a sophisticated healthcare infrastructure, strong research ecosystem, and high prevalence of chronic diseases. Regulatory support for companion diagnostics, along with significant funding from NIH and other agencies, has accelerated IHC adoption in clinical and research settings. Leading players like Thermo Fisher Scientific, Danaher Corporation (Leica Biosystems), and Bio-Rad Laboratories are headquartered in the U.S., ensuring access to cutting-edge products and technologies.

Asia-Pacific is the fastest-growing region, driven by increasing cancer incidence, expanding healthcare infrastructure, and rising investment in molecular diagnostics. Countries such as China, India, and South Korea are investing in diagnostic laboratories and hospital networks, enhancing access to histopathology services. The growing biotech sector in the region, along with government initiatives in life sciences, is stimulating demand for IHC in both clinical and research domains. Local players are also entering the market, offering cost-effective reagents and instruments tailored to regional needs.

With the rising demand for IHC assays in cancer diagnostics, the key players are undertaking various strategic initiatives in the field of immunohistochemistry, including new product launches, mergers & acquisitions, and regional expansion, to meet the market needs.

For instance, in March 2023, Aptamer Group launched a new reagent solution, Optimer-Fc for use in automated immunohistochemistry workflows. The company expects this launch to open new avenues for emerging biomarkers in diagnostics and research. In addition, in January 2021, Abcam and Shuwen Biotech (Shuwen) entered into a strategic alliance for developing and commercializing companion diagnostics (CDx). Under the agreement, Abcam is providing recombinant rabbit monoclonal antibodies to Shuwen Biotech for further immunohistochemical verification. Some prominent players in the global immunohistochemistry market include:

March 2025: Leica Biosystems launched its next-generation Bond-Prime Advanced Staining System, featuring AI-assisted protocol optimization and faster staining cycles.

February 2025: Bio-Techne Corporation announced FDA clearance for its PD-L1 IHC 22C3 pharmDx companion diagnostic, to be used with a new checkpoint inhibitor therapy.

December 2024: Thermo Fisher Scientific released a line of multiplex-ready IHC antibody panels, enabling the simultaneous detection of up to five cancer markers in a single assay.

October 2024: Abcam plc partnered with Aiforia Technologies to integrate AI-powered analysis software with its digital pathology platforms.

August 2024: Roche Diagnostics expanded its VENTANA portfolio with an automated HER2 Dual ISH/IHC combo assay, simplifying HER2 testing in breast cancer patients.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Immunohistochemistry market.

By Product

By Application

By End-use

By Region