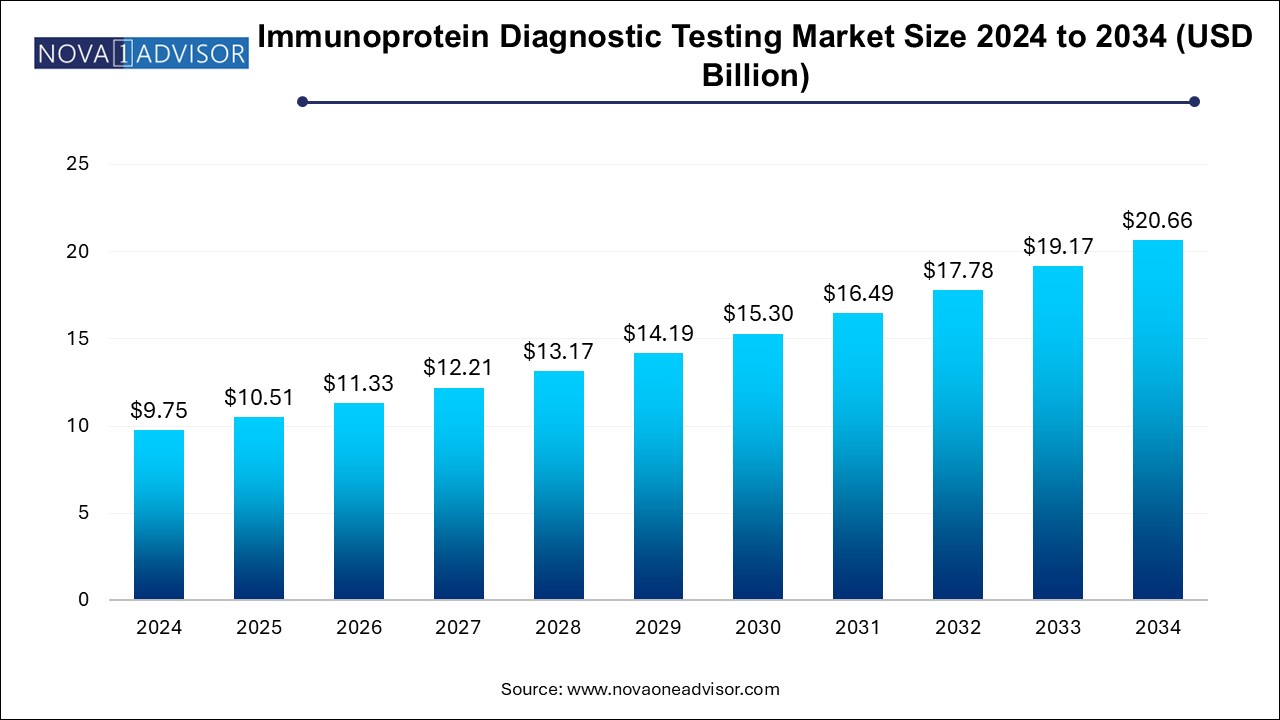

The immunoprotein diagnostic testing market size was exhibited at USD 9.75 billion in 2024 and is projected to hit around USD 20.66 billion by 2034, growing at a CAGR of 7.8% during the forecast period 2025 to 2034.

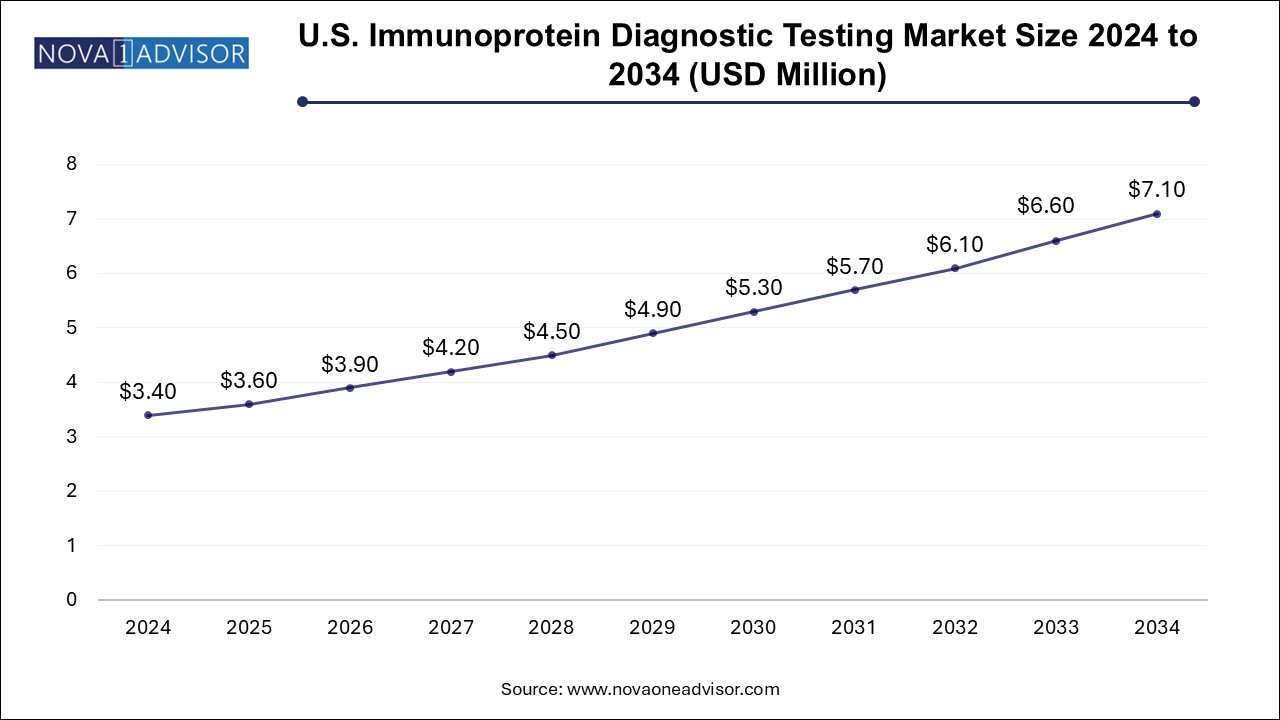

The U.S. immunoprotein diagnostic testing market size is evaluated at USD 3.4 billion in 2024 and is projected to be worth around USD 7.1 billion by 2034, growing at a CAGR of 6.92% from 2025 to 2034.

North America, particularly the United States, currently holds the largest share in the immunoprotein diagnostic testing market. This dominance is driven by advanced healthcare infrastructure, high diagnostic awareness, and robust government support for precision medicine. Moreover, the presence of major diagnostic companies, high adoption of automation in clinical labs, and a strong reimbursement framework contribute significantly to regional market growth.

The U.S. healthcare ecosystem also actively integrates immunoprotein testing into routine screenings for chronic and infectious diseases. According to the Centers for Disease Control and Prevention (CDC), routine CRP testing and immunoglobulin profiling have become standard practices in several medical centers for disease monitoring and risk assessment.

Asia Pacific is poised to register the highest growth rate during the forecast period, fueled by improving healthcare infrastructure, rising chronic disease burden, and government-led initiatives for accessible diagnostics. Countries such as China, India, and South Korea are witnessing a surge in diagnostic laboratory establishments and increasing investment from both public and private sectors.

The market is further driven by local manufacturers developing affordable diagnostic kits tailored to regional disease burdens. The growing adoption of point-of-care testing in rural areas, along with urban healthcare modernization, is rapidly closing the diagnostic gap between developed and emerging regions.

The Immunoprotein Diagnostic Testing Market is gaining substantial traction globally due to the increasing burden of chronic diseases, rising awareness regarding early disease diagnosis, and technological advancements in diagnostic platforms. Immunoproteins—such as immunoglobulins, haptoglobins, and C-reactive proteins—play a crucial role in immune responses and are extensively used as biomarkers in disease diagnostics. The market comprises a wide array of diagnostic tools designed to measure these proteins in biological samples, thereby assisting in the early and accurate detection of various pathological conditions including autoimmune diseases, infections, cancers, endocrine disorders, and allergic reactions.

In recent years, the surge in chronic disease incidence, especially among the aging population, has led to a marked increase in immunoprotein testing demand. Furthermore, diagnostic precision has become paramount in modern healthcare, with clinicians seeking highly specific, sensitive, and rapid diagnostic modalities—needs aptly addressed by immunoprotein assays. In addition to hospitals and diagnostic laboratories, the growing integration of these tests in point-of-care (POC) settings and research institutes further bolsters the market’s momentum.

From a technological standpoint, innovation in diagnostic platforms—such as chemiluminescence and immunofluorescence assays—has significantly improved the throughput and accuracy of immunoprotein testing. Combined with rising government and private sector investments in healthcare infrastructure, especially in emerging economies, the immunoprotein diagnostics landscape is projected to expand robustly through 2034.

Integration of AI and Machine Learning in Diagnostic Platforms: The incorporation of artificial intelligence (AI) in immunoprotein diagnostics is enabling predictive analytics and pattern recognition, improving result interpretation and clinical decision-making.

Rise in Home-Based Diagnostic Kits: With the COVID-19 pandemic transforming consumer behavior, there has been a surge in home-based immunoprotein diagnostic kits for monitoring chronic and autoimmune diseases.

Expansion in Biomarker Discovery: Continuous efforts in research are facilitating the discovery of novel immunoprotein biomarkers, enhancing diagnostic accuracy for early-stage diseases like pancreatic cancer and rheumatoid arthritis.

Consolidation of Diagnostic Laboratories: Mergers and acquisitions among diagnostic labs are streamlining resources and expanding access to advanced immunoprotein testing technologies across urban and semi-urban geographies.

Technological Advancements in Immunoassays: Innovations such as multiplex immunoassays and high-throughput platforms are enabling simultaneous detection of multiple biomarkers, thus saving time and reducing cost.

Increased Focus on Companion Diagnostics: Immunoprotein tests are increasingly being used alongside targeted therapies in oncology, particularly in selecting suitable candidates for immunotherapy.

Rising Demand in Emerging Markets: Countries in Asia Pacific and Latin America are witnessing surging demand due to improved healthcare awareness and government investments in diagnostics.

| Report Coverage | Details |

| Market Size in 2025 | USD 10.51 Billion |

| Market Size by 2034 | USD 20.66 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 7.8% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Test, Application, Technology, End-use, Distribution Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Agilent Technologies, Inc.; Danaher Corporation; Thermo Fisher Scientific Inc.; PerkinElmer Inc.; Bio-Rad Laboratories, Inc.; Aurora Biomed Inc.; Tecan Trading AG; Promega Corporation; Charles River Laboratories; Creative Biolabs. |

One of the primary drivers of the immunoprotein diagnostic testing market is the increasing prevalence of autoimmune and chronic diseases. Conditions like rheumatoid arthritis, multiple sclerosis, systemic lupus erythematosus (SLE), and type 1 diabetes are seeing a sharp rise globally. According to the National Institute of Environmental Health Sciences, autoimmune diseases affect more than 23 million Americans, and the global figure is considerably higher. Early detection is vital in managing such diseases effectively, and immunoprotein diagnostics serve as indispensable tools due to their ability to detect aberrant immune responses even before clinical symptoms become evident.

These tests measure specific immunoglobulins or inflammatory proteins such as CRP, which are elevated in autoimmune flare-ups or infections. The precision offered by these diagnostics not only improves disease prognosis but also reduces healthcare costs associated with delayed treatments. Their growing relevance in monitoring disease progression and treatment efficacy further amplifies market demand.

Despite its growth potential, the market is restrained by the high cost associated with advanced diagnostic technologies, particularly in resource-limited settings. Platforms such as chemiluminescence and immunofluorescence require sophisticated instruments and skilled professionals, making them cost-prohibitive for small clinics and public health laboratories. In regions where healthcare reimbursement is limited or insurance coverage is inadequate, patients often opt for less precise but more affordable diagnostic alternatives.

Additionally, the continuous upgrades and maintenance required for cutting-edge diagnostic equipment add to operational expenses for healthcare providers. This cost barrier becomes more pronounced in low- and middle-income countries, thereby hindering widespread adoption and market penetration.

The growing emphasis on personalized medicine presents a lucrative opportunity for the immunoprotein diagnostic testing market. Personalized healthcare involves tailoring treatment based on individual patient profiles, often relying on specific biomarkers to determine the most effective therapeutic route. Immunoprotein diagnostics provide a rich source of these biomarkers, especially in cancer and autoimmune disease management.

For instance, immunoglobulin profiling can guide immunotherapy decisions in oncology, while CRP levels are instrumental in evaluating inflammatory responses in personalized treatment plans. As healthcare shifts from one-size-fits-all approaches to customized interventions, immunoprotein diagnostics are expected to play a pivotal role in diagnostics-led patient stratification and monitoring.

The Immunoglobulin diagnostic tests accounted for the largest market share in 2024, driven by their broad applicability in diagnosing autoimmune diseases, infectious disorders, and immunodeficiencies. Immunoglobulin G (IgG), IgA, IgM, and IgE assessments are routine components of diagnostic panels worldwide. These tests are vital in detecting conditions ranging from common allergies to complex immune responses in HIV/AIDS and leukemia. Furthermore, the increasing incidence of antibody-mediated disorders has heightened the need for specific immunoglobulin assays, cementing their dominance in the global market.

On the other hand, C-reactive protein (CRP) diagnostic tests are anticipated to witness the fastest growth during the forecast period. The demand for CRP testing is expanding rapidly due to its effectiveness in detecting infections and monitoring inflammation in chronic diseases like rheumatoid arthritis and cardiovascular disorders. Its use in routine health check-ups and emergency settings, especially for patients with symptoms of bacterial infections or sepsis, has been growing exponentially.

The infectious disease testing segment accounted for the largest revenue share of the market of 25.0% in 2024. Autoimmune disorders often require regular monitoring, and immunoproteins serve as crucial markers in these evaluations. The growing prevalence of conditions such as lupus, celiac disease, and thyroid disorders has propelled the demand for reliable diagnostic tests. This segment is also supported by ongoing research initiatives that aim to develop novel biomarkers to detect autoimmunity at early stages.

The oncology testing segment is likely to grow at a CAGR of 8.2% over the forecast period. With cancer cases rising globally and the increasing use of immunotherapy, there is a growing need for biomarker-based diagnostics that can provide real-time disease insights. Immunoprotein markers are instrumental in tumor profiling, predicting treatment response, and detecting minimal residual disease. Integration of immunoprotein assays with next-generation sequencing (NGS) and liquid biopsy platforms is further enhancing the growth prospects of this segment.

The enzyme-based immunoassay segment accounted for the largest revenue share of the market of 25.2% in 2024. attributed to their widespread clinical usage, affordability, and well-established protocols. ELISA (enzyme-linked immunosorbent assay) is a preferred method for detecting antibodies and antigens in diagnostics laboratories due to its high sensitivity, reproducibility, and ease of use. Additionally, the broad compatibility of EIA with various biomarkers across diseases ensures its continued adoption.

However, chemiluminescence assays are forecasted to be the fastest-growing due to their superior analytical sensitivity and capability for automation. This method allows for high-throughput testing and integration with modern diagnostic systems, reducing turnaround time. Hospitals and diagnostic chains are increasingly adopting these assays for critical testing scenarios, including cardiac and sepsis-related biomarkers, which is driving growth.

The retail sales segment accounted for the largest share of the market of 54.4% in 2024. Pharmacies and online platforms now offer immunoprotein diagnostic kits for home use, catering to consumers seeking convenient and private testing solutions for allergies, infections, or inflammatory conditions.

The direct tender segment is likely to grow at a CAGR of 8.2% over the forecast period. due to the institutional nature of diagnostic test procurement, especially in large hospitals, public health organizations, and government-funded laboratories. These tenders ensure bulk purchasing, cost savings, and standardized product quality. Suppliers benefit from predictable revenue streams and long-term contracts.

The hospitals and clinics segment accounted for the largest revenue share of the market of 45.0% in 2024. Hospitals and clinics remain the primary end-users of immunoprotein diagnostics, owing to their comprehensive service offerings, in-house laboratory facilities, and ability to handle complex cases. Their role is central in emergency care and long-term patient monitoring, particularly for chronic disease management. Advanced diagnostic infrastructure and skilled personnel further consolidate their position in the market.

Conversely, diagnostic laboratories are the fastest-growing segment. The trend of outsourcing diagnostic services to specialized labs has gained momentum, especially in cost-sensitive healthcare systems. These labs offer rapid turnaround, a wide array of tests, and scalable services, attracting both individual consumers and institutional clients.

March 2025: Roche Diagnostics launched a new high-sensitivity CRP test for early sepsis detection, aiming to reduce mortality through faster clinical decision-making.

February 2025: Thermo Fisher Scientific announced its expansion in Asia Pacific by opening a new immunodiagnostic manufacturing facility in Singapore to cater to growing regional demand.

January 2025: Siemens Healthineers introduced a chemiluminescence-based immunoglobulin assay series integrated with AI-enhanced interpretation software to streamline oncology diagnostics.

December 2024: Bio-Rad Laboratories collaborated with a leading cancer institute in Europe to develop multiplex immunoprotein panels for clinical research in personalized medicine.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the immunoprotein diagnostic testing market

By Test

By Application

By Technology

By Distribution Channel

By End-use

By Regional