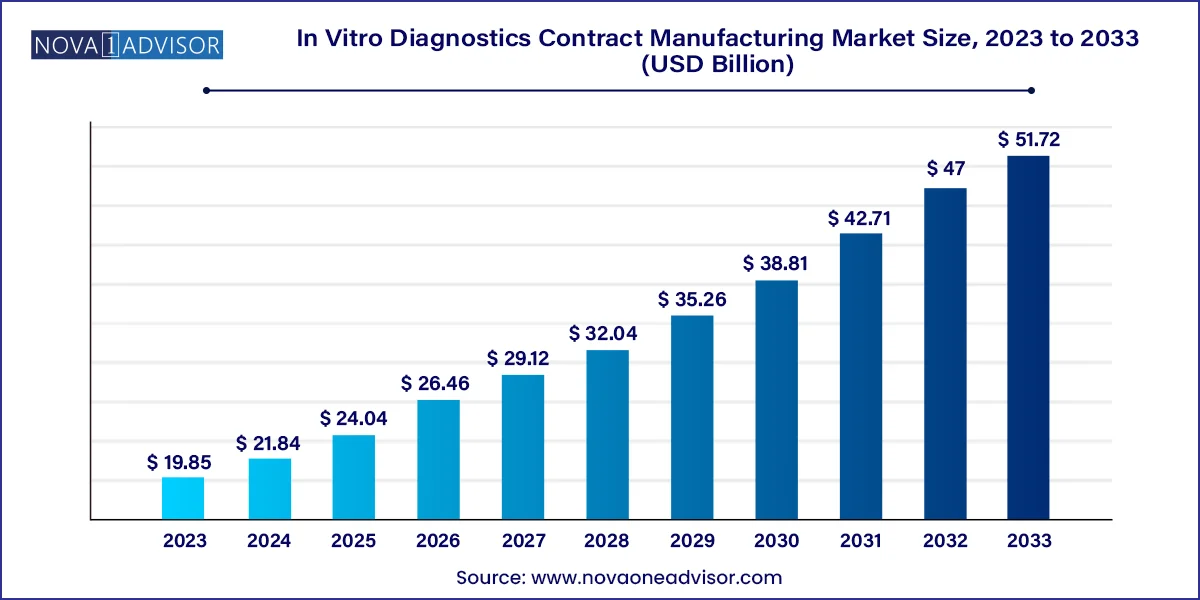

The global in vitro diagnostics contract manufacturing market size was valued at USD 19.85 billion in 2023 and is anticipated to reach around USD 51.72 billion by 2033, growing at a CAGR of 10.05% from 2024 to 2033.

The In Vitro Diagnostics (IVD) contract manufacturing market is gaining considerable traction as companies increasingly seek to streamline operations, reduce costs, and accelerate the time-to-market for diagnostic products. IVD contract manufacturing involves outsourcing various stages of product development and production—including assay development, reagent manufacturing, instrument fabrication, and packaging—to third-party manufacturers with specialized expertise. This practice allows original equipment manufacturers (OEMs) to focus on innovation, regulatory approvals, and commercialization while leveraging the infrastructure and experience of contract manufacturing organizations (CMOs).

The demand for IVD contract manufacturing has escalated in response to the growing prevalence of chronic diseases, the global burden of infectious diseases, and heightened awareness of early diagnosis and preventive healthcare. The COVID-19 pandemic underscored the critical role of scalable diagnostic production capabilities, prompting diagnostic developers to collaborate extensively with CMOs to meet surging demand for PCR kits, rapid antigen tests, and serology assays. This event acted as a catalyst, reshaping industry perspectives around outsourcing as a strategic necessity rather than an operational option.

IVD contract manufacturing spans a broad spectrum of diagnostic technologies, including immunoassays, molecular diagnostics, hematology, microbiology, and clinical chemistry. The rise of personalized medicine, home testing kits, and point-of-care diagnostics has further expanded the market scope. Moreover, the increasing adoption of companion diagnostics and regulatory requirements around quality assurance have led companies to partner with CMOs that offer validated processes, ISO-certified facilities, and GMP compliance.

Start-ups and mid-sized diagnostic developers, in particular, rely heavily on contract manufacturing to overcome capital constraints and achieve faster product launches. Simultaneously, larger players are outsourcing to manage fluctuations in demand, optimize supply chains, and focus resources on R&D and market expansion. As the diagnostic industry continues to evolve in response to technological innovations and global health priorities, the IVD contract manufacturing market is poised for robust, long-term growth.

Strategic Outsourcing by Diagnostic Startups and Mid-sized Firms: Increasing dependence on contract manufacturing for assay development, pilot production, and regulatory submissions.

Rise of Integrated Manufacturing Services: Growing demand for end-to-end solutions including design, prototyping, testing, regulatory compliance, and large-scale production under a single partner.

Surge in Molecular Diagnostics Post-COVID: Contract manufacturers are investing in capabilities for nucleic acid extraction, PCR assay production, and RNA/DNA stabilization due to ongoing demand.

Miniaturization and Portability in Instruments: CMOs are engineering compact diagnostic instruments for home testing and decentralized settings.

AI-Integrated IVD Software Solutions: Software-as-a-Service (SaaS) offerings are increasingly bundled with diagnostic hardware, requiring specialized software development outsourcing.

Regulatory Harmonization: Increasing emphasis on regulatory readiness and global quality certifications (e.g., FDA QSR, ISO 13485) among CMOs to support multi-regional launches.

Expansion of Personalized and Companion Diagnostics: Demand for highly specialized assay production services that support targeted therapies is growing.

Biotech-Contract Manufacturer Partnerships: Academic labs and research institutions are partnering with CMOs to commercialize lab-developed tests (LDTs) under new FDA regulations.

| Report Attribute | Details |

| Market Size in 2024 | USD 21.84 Billion |

| Market Size by 2033 | USD 51.72 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 10.05% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, service, technology, end use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Jabil Inc.; Sanmina Corporation; TE Connectivity; Celestica Inc.; Savyon Diagnostics; West Pharmaceutical Services, Inc.; Thermo Fisher Scientific; KMC Systems; Cenogenics Corporation; Novo Biomedical; Cone Bioproducts; Invetech; AVIOQ Inc.; Meridian Bioscience Inc.; Nemera |

A primary driver propelling the IVD contract manufacturing market is the global demand for rapid, scalable, and reliable production of diagnostic tools in response to both endemic and emerging diseases. The COVID-19 pandemic fundamentally altered how diagnostic companies operate, demonstrating the urgent need for flexible manufacturing ecosystems that can quickly adapt to surges in demand. This paradigm shift reinforced the importance of outsourcing partnerships with CMOs that possess the agility to scale operations without compromising quality or compliance.

Moreover, with the growth of personalized medicine and decentralized testing, diagnostic firms must manage a broader, more diverse product portfolio. Scaling such operations internally often leads to inefficiencies, production bottlenecks, and regulatory delays. Contract manufacturers provide a strategic solution, enabling access to GMP-compliant facilities, validated processes, and global logistics networks. These advantages reduce time-to-market, mitigate risks, and allow diagnostic innovators to focus on core competencies like product development, market analysis, and commercialization. This outsourcing model is increasingly vital in an industry where agility, innovation, and speed are competitive differentiators.

Despite its numerous advantages, IVD contract manufacturing is not without its limitations. A major restraint hampering broader market adoption is the issue of intellectual property (IP) protection and quality control. Diagnostic companies, especially those developing novel assays or proprietary instrument platforms, are often wary of sharing sensitive technical specifications, formulations, or software algorithms with third-party manufacturers. The risk of IP theft, reverse engineering, or contract disputes can be significant, particularly when outsourcing to international partners with varying legal frameworks.

Quality control is another critical concern. Any inconsistency in reagent purity, assay performance, or instrument calibration can severely compromise diagnostic accuracy, leading to reputational damage and regulatory penalties. While leading CMOs implement rigorous quality assurance protocols, smaller or newer entrants may struggle to meet stringent FDA or CE mark standards. These concerns necessitate extensive due diligence, robust contractual safeguards, and ongoing audits—factors that can delay outsourcing decisions and inflate operational costs for diagnostic firms.

The global shift toward point-of-care (POC) and home-based diagnostics presents a promising growth opportunity for the IVD contract manufacturing market. Rising consumer interest in real-time health monitoring, combined with the decentralization of care models, has driven demand for compact, user-friendly diagnostic solutions. These devices, whether for glucose monitoring, infectious disease screening, or fertility tracking, require high-precision manufacturing to ensure accuracy, safety, and ease of use.

Contract manufacturers equipped with capabilities in miniaturized hardware development, sensor integration, reagent lyophilization, and mobile app interfacing are well-positioned to capture this market. Furthermore, with regulatory agencies increasingly approving home-based diagnostic kits, the opportunity to manufacture and scale such products has grown exponentially. Companies that can offer turnkey services—including design, regulatory support, packaging, and fulfillment—will gain a competitive edge. This opportunity is particularly ripe in markets where aging populations, remote healthcare access, and digital literacy are converging to redefine how and where diagnostics are delivered.

Based on product, the market includes instruments, reagents & consumables, software & services. In 2023, the reagents & consumables segment accounted for the largest revenue share of 69.74%. Accounting for the largest share of revenue in the IVD contract manufacturing market. These materials are essential for running diagnostic tests, including buffers, enzymes, detection reagents, and assay cartridges. Given the repetitive nature of diagnostic testing, particularly in clinical laboratories and hospitals, the demand for high-quality, cost-effective consumables is constant. CMOs specializing in reagent manufacturing play a critical role in scaling production volumes, maintaining batch-to-batch consistency, and ensuring regulatory compliance. With diagnostics increasingly used in screening and monitoring chronic conditions like diabetes, cardiovascular diseases, and infections, this segment continues to generate steady revenue streams.

Software & Services is the fastest-growing product sub-segment, driven by the increasing integration of digital platforms in IVD devices. Modern diagnostics often rely on AI algorithms, cloud-based data analytics, and automated workflows to interpret results. As diagnostic companies embed software capabilities into their instruments, demand for contract software development and cybersecurity services is growing. CMOs offering embedded systems engineering, user interface design, and compliance with standards such as IEC 62304 are increasingly favored. This trend is particularly strong in molecular diagnostics and POC platforms that require real-time data transfer and remote monitoring capabilities.

Manufacturing Services dominate the service segment, supported by high demand for large-scale production of diagnostic instruments, reagents, and test kits. These services include everything from component sourcing and cleanroom assembly to packaging and labeling. OEMs increasingly rely on CMOs for volume production under GMP conditions, especially when launching new product lines or responding to rapid surges in test demand. Leading CMOs offer flexible manufacturing lines, automated systems, and supply chain integration, reducing lead times and operational costs for diagnostic firms.

Assay Development Services are the fastest-growing, owing to the rising complexity of diagnostic assays and the need for rapid validation of new targets. This includes services such as biomarker identification, test optimization, stability testing, and clinical validation support. With the proliferation of companion diagnostics and personalized medicine, OEMs are outsourcing assay design and performance characterization to specialized CMOs with immunology, molecular biology, or proteomics expertise. These services are especially valuable in oncology and infectious disease diagnostics where rapid assay customization is essential for therapeutic alignment.

Immunoassays lead the technology segment, largely due to their widespread use in diagnostics ranging from hormone detection to infectious disease screening. CMOs are contracted to produce ELISA plates, lateral flow devices, chemiluminescent reagents, and antibody coatings. The simplicity, versatility, and cost-effectiveness of immunoassays make them a staple in clinical labs, blood banks, and even at-home testing environments. Contract manufacturers with robust antibody production and conjugation capabilities dominate this space.

Molecular Diagnostics is the fastest-growing technology segment, propelled by the need for precise, high-sensitivity testing. CMOs are investing heavily in infrastructure to support PCR reagent production, nucleic acid extraction, and isothermal amplification methods. The COVID-19 pandemic served as a major accelerator, and even post-pandemic, molecular diagnostics continue to expand into oncology, genetic testing, and infectious disease surveillance. This segment’s growth is also driven by regulatory support and patient preference for high-accuracy results.

End-use Insights

Medical Device Companies dominate the end-use segment, given their role as primary developers and marketers of diagnostic technologies. These companies contract CMOs for production scalability, global distribution, and compliance assurance. As large firms continue to consolidate their operations and focus on innovation, they increasingly outsource back-end operations like reagent filling, device assembly, and packaging to reduce overheads and meet regulatory timelines.

Academic & Research Institutions are the fastest-growing segment, especially those developing laboratory-developed tests (LDTs) or early-stage prototypes. These entities often lack the infrastructure to scale production or navigate regulatory pathways independently. CMOs serve as valuable partners in translating bench-level discoveries into commercially viable diagnostic products. Funding initiatives from organizations like the NIH, Horizon Europe, and private research foundations are fueling this trend by supporting public-private partnerships.

North America holds the largest share of the global IVD contract manufacturing market, driven by the presence of advanced healthcare systems, well-established IVD companies, and strong regulatory frameworks. The United States is a global hub for diagnostic innovation, hosting key players such as Thermo Fisher Scientific, Abbott, and Danaher. These companies regularly partner with contract manufacturers to optimize production, particularly during periods of product scaling or pandemic response. Additionally, North America benefits from an innovation-friendly regulatory environment, where the FDA’s streamlined pathways for diagnostics encourage timely product approvals. Investments in personalized medicine and digital health further elevate the region's dominance.

U.S. In Vitro Diagnostics Contract Manufacturing Market Trends

The in vitro diagnostics contract manufacturing market in the U.S. accounts for the largest share of the North American region owing to established market players, increasing demand for molecular diagnostics, growing focus on the accuracy and efficiency of IVD, rising geriatric population, and increasing prevalence of chronic diseases. The U.S. has increased the number of market players offering IVD contract manufacturing to various end users to improve efficiency, accuracy, and throughput, further driving the market growth.

Asia-Pacific is witnessing the fastest growth due to expanding healthcare infrastructure, rising awareness of early disease detection, and cost-efficient manufacturing ecosystems. Countries like China, India, and South Korea are investing heavily in biotechnology and med-tech capabilities, supported by government-backed healthcare reforms. Domestic CMOs are rapidly scaling up to serve both local and international clients. For example, India’s “Make in India” initiative and China's push for self-sufficiency in diagnostics have attracted global companies to partner with local manufacturers. Additionally, the growing middle-class population and prevalence of infectious diseases further boost the need for scalable diagnostic manufacturing in the region.

The following are the leading companies in the in-vitro-diagnostics-contract-manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

March 2024: Thermo Fisher Scientific expanded its contract manufacturing services by opening a new bioproduction facility in Massachusetts, capable of large-scale production of molecular diagnostics reagents.

February 2024: Bio-Rad Laboratories entered into a strategic alliance with an Asia-based CMO to support the global distribution of its PCR-based infectious disease kits.

January 2024: Invetech announced the launch of a new turnkey assay development platform tailored to support rapid prototyping and scale-up for molecular diagnostics clients.

November 2023: Meridian Bioscience partnered with a contract manufacturer in India to produce rapid antigen testing kits for respiratory viruses, expanding its footprint in emerging markets.

September 2023: QIAGEN revealed its investment in enhancing global supply chain resilience by outsourcing its diagnostic cartridge manufacturing to partners in Europe and Southeast Asia.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the In Vitro Diagnostics Contract Manufacturing market.

By Product

By Service

By Technology

By End Use

By Region