The in vitro diagnostics market size was exhibited at USD 80.85 billion in 2024 and is projected to hit around USD 157.56 billion by 2034, growing at a CAGR of 6.9% during the forecast period 2024 to 2034.

-Market.jpg)

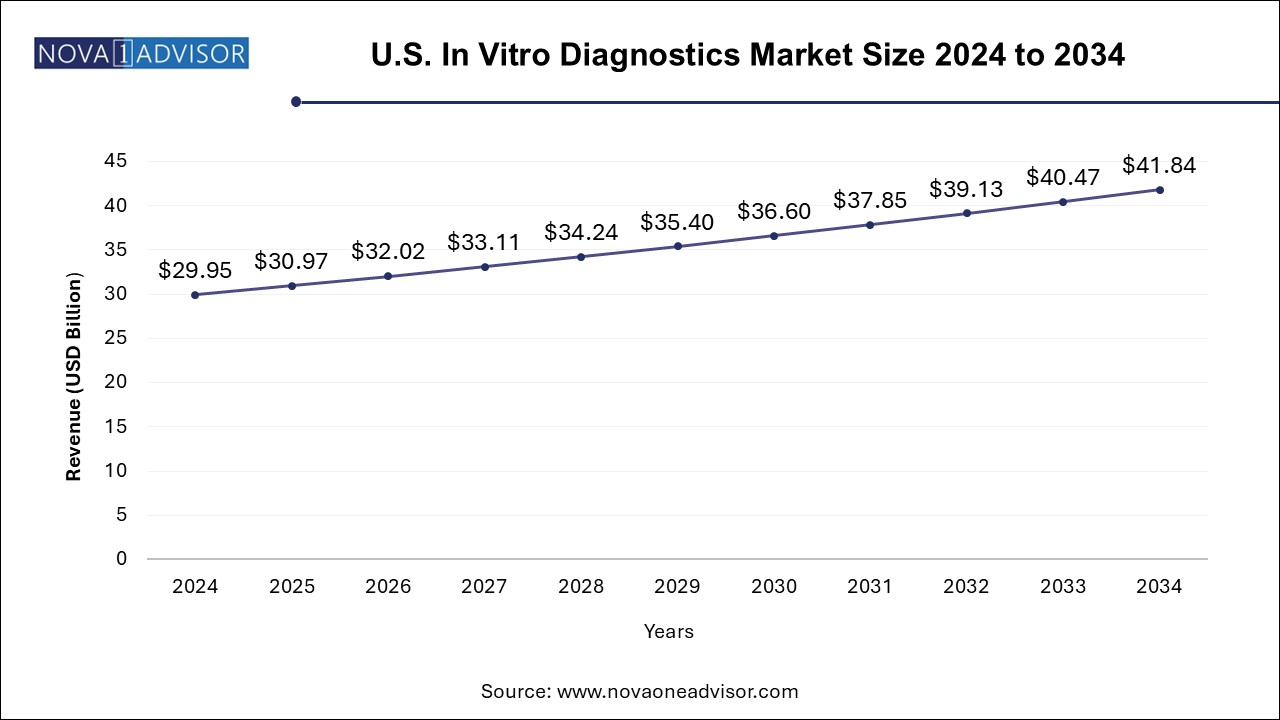

The U.S. In Vitro Diagnostics Market size was exhibited at USD 29.95 billion in 2024 and is projected to hit around USD 41.84 billion by 2034, growing at a CAGR of 3.4% during the forecast period 2024 to 2034.

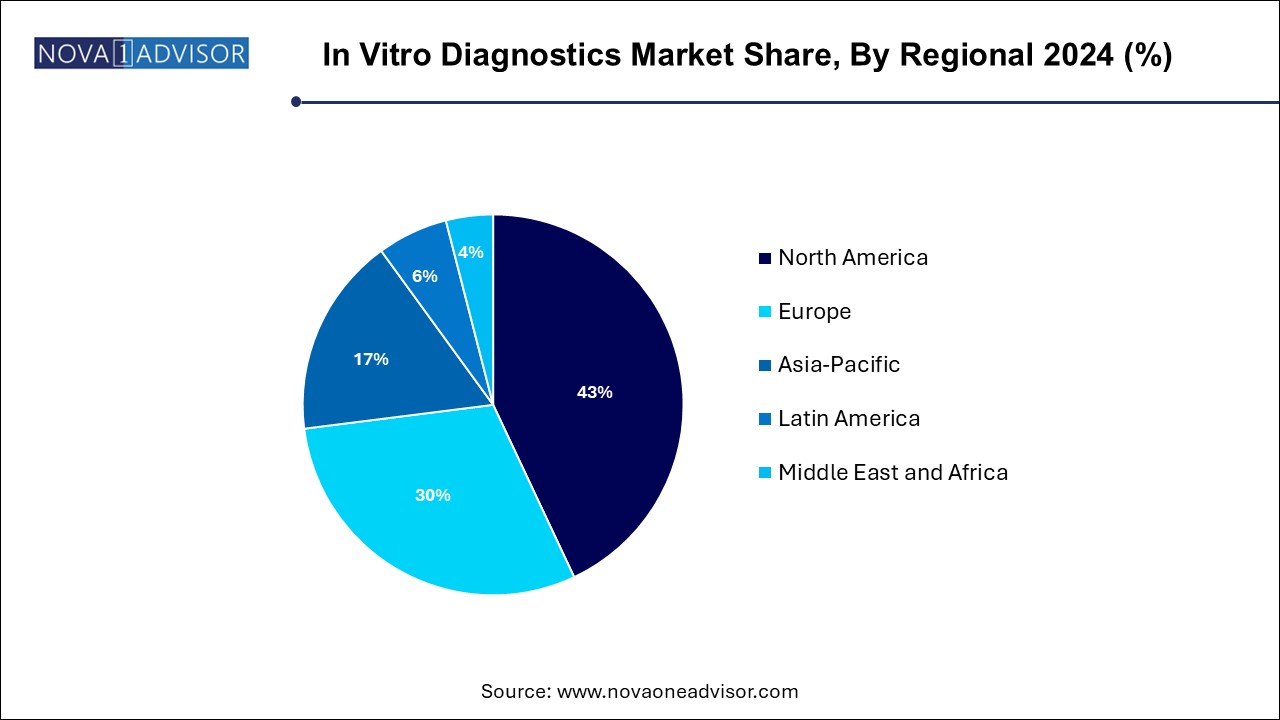

North America continues to lead the IVD market, primarily due to advanced healthcare systems, robust reimbursement policies, and strong presence of global diagnostics manufacturers. The U.S., in particular, has been at the forefront of molecular diagnostics innovation, with high adoption of companion diagnostics in oncology, extensive use of PoC tests, and leadership in regulatory science. Large-scale screening programs, chronic disease management models, and public-private research collaborations further boost IVD integration into routine care.

Asia Pacific is the fastest-growing IVD region, benefiting from rapidly modernizing healthcare infrastructure, rising disposable incomes, and increasing public awareness of early disease detection. Countries such as China, India, Japan, and South Korea are investing heavily in diagnostics, both through government initiatives and private-sector expansion. The pandemic significantly accelerated diagnostic capacity building, and the momentum continues through expanded lab networks, telehealth integration, and growth in PoC and home-based testing.

The In Vitro Diagnostics (IVD) market represents one of the most dynamic and foundational segments within the broader healthcare and life sciences industry. IVD refers to medical diagnostic tests performed outside the human body—typically in laboratories, clinics, or at the point-of-care—to detect diseases, conditions, or infections by analyzing samples such as blood, urine, tissues, or other body fluids. These tests form the backbone of disease diagnosis, treatment monitoring, and health management, especially in an era where precision and early intervention are prioritized.

With the ongoing evolution of healthcare systems worldwide, IVDs have grown from traditional laboratory-based techniques into advanced, digital-enabled platforms that support clinical decision-making. From blood glucose meters and pregnancy tests to advanced molecular diagnostics used in oncology and infectious disease detection, IVD tools continue to broaden their scope. The rapid developments in genomics, proteomics, bioinformatics, and microfluidics are further pushing IVD capabilities to deliver faster, more accurate, and increasingly personalized insights into patient health.

The COVID-19 pandemic served as a turning point for the IVD market, exposing gaps in global diagnostic capacity while simultaneously accelerating the adoption of rapid antigen and molecular testing on an unprecedented scale. Even post-pandemic, the heightened awareness around diagnostic preparedness, self-testing, and decentralized diagnostics remains a catalyst for sustained IVD adoption across all healthcare settings—from hospitals and labs to home-based care.

As of the current landscape, the IVD market is characterized by a mix of multinational diagnostics giants, regional players, and emerging startups developing disruptive technologies. Regulatory reforms, growing demand for minimally invasive diagnostics, increasing chronic disease prevalence, and global focus on value-based healthcare are all converging to shape the trajectory of the IVD market through 2034 and beyond.

Surge in Molecular Diagnostics: Post-COVID-19, there’s a growing shift toward high-accuracy molecular diagnostics for detecting infectious diseases and genetic disorders.

Rise of At-home and Point-of-Care (PoC) Testing: Demand is increasing for consumer-friendly, portable IVD tools that allow for self-testing, particularly in chronic disease management.

Digital Integration and AI Assistance: AI-enabled analysis, connected instruments, and integrated software solutions are enhancing the speed and accuracy of diagnostics.

Personalized Medicine and Companion Diagnostics: IVD tests tailored to genetic profiles are improving therapeutic decision-making, particularly in oncology.

Increased Role of IVD in Preventive Healthcare: Screening tests for conditions such as diabetes, cardiovascular diseases, and STDs are being adopted at a wider scale for preventive strategies.

Multiplex Assays and Syndromic Panels: These platforms allow simultaneous detection of multiple pathogens or biomarkers, enhancing clinical efficiency.

Lab Automation and Miniaturization: Automation of workflows and development of compact diagnostic systems are reducing manual errors and increasing throughput.

Emergence of Next-gen Biomarkers: Continuous research is expanding the panel of biomarkers for diseases like Alzheimer's, autoimmune disorders, and cancers.

| Report Coverage | Details |

| Market Size in 2025 | USD 86.43 Billion |

| Market Size by 2034 | USD 157.56 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 6.9% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Products, Technology, Application, End-use, Test Location, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Abbott; bioMérieux SA; QuidelOrtho Corporation; Siemens Healthineers AG; Bio-Rad Laboratories, Inc.; Qiagen; Sysmex Corporation; Charles River Laboratories; Quest Diagnostics Incorporated; Agilent Technologies, Inc.; Danaher Corporation; BD; F. Hoffmann-La Roche Ltd. |

Growing Burden of Chronic and Infectious Diseases Globally

A major driver for the IVD market is the rising prevalence of both chronic and infectious diseases worldwide. Chronic illnesses such as diabetes, cancer, cardiovascular diseases, and autoimmune disorders require continuous monitoring and early detection to improve patient outcomes and reduce healthcare costs. IVD tests play a vital role in screening, diagnosis, prognosis, and therapy response evaluation for these conditions.

Simultaneously, outbreaks of infectious diseases—from COVID-19 to emerging threats like monkeypox and antibiotic-resistant bacteria—have underscored the importance of rapid diagnostic tools. IVD platforms have been instrumental in pandemic response strategies, enabling large-scale testing, contact tracing, and health surveillance. With global health authorities now prioritizing disease prevention and real-time response systems, the demand for accurate, scalable IVD solutions is only expected to rise.

Stringent Regulatory Approvals and Variability Across Regions

One of the most significant challenges facing the IVD industry is navigating complex and often inconsistent regulatory environments across different regions. Diagnostic products must meet rigorous quality, safety, and clinical performance standards, which can vary greatly between countries. For instance, the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have different criteria for clinical evidence, labeling, and post-market surveillance, which can delay product launches and increase compliance costs.

Moreover, the implementation of the In Vitro Diagnostic Regulation (IVDR) in Europe has introduced more stringent clinical evidence requirements, posing challenges particularly for small and mid-sized companies. These evolving frameworks, while essential for ensuring patient safety, can slow innovation and increase barriers to market entry—especially in rapidly evolving subfields like molecular diagnostics and digital health-enabled IVDs.

Expansion of IVD in Emerging Markets and Decentralized Healthcare

One of the most promising opportunities for the IVD market lies in its expansion across emerging economies in Asia Pacific, Latin America, and Africa. These regions are witnessing a paradigm shift in healthcare delivery, marked by rising income levels, government investments in diagnostics infrastructure, and increasing public awareness of disease prevention and early diagnosis. As these regions build decentralized healthcare networks, IVD tools are becoming critical in enabling access to quality diagnostics in rural and underserved communities.

Furthermore, the increasing adoption of point-of-care and home-based testing in these regions supports healthcare delivery beyond traditional hospital settings. Mobile diagnostic vans, telehealth partnerships, and smartphone-integrated diagnostics are rapidly gaining traction, allowing providers to bring IVD solutions directly to patients. Companies that invest in cost-effective, rugged, and easy-to-use diagnostic platforms tailored for low-resource settings are well-positioned to capture this opportunity.

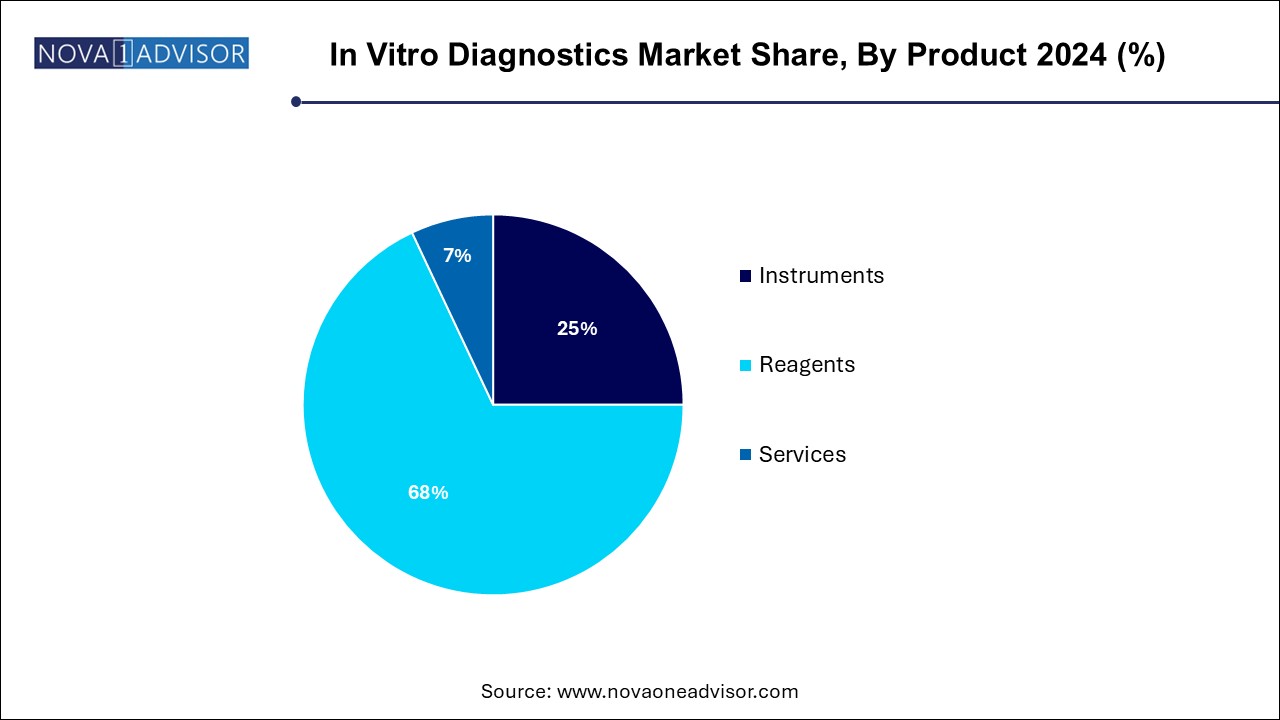

Reagents dominated the IVD product segment, as they are essential consumables required for every diagnostic test. Whether for immunoassays, molecular diagnostics, or hematology, reagents form the core of test execution and need regular replenishment. The recurring nature of reagent demand ensures consistent revenue generation for manufacturers. Additionally, innovations in reagent formulations—such as increased stability, specificity, and multiplexing capability—are enhancing test performance across clinical settings.

Services are the fastest-growing product segment, as laboratories and healthcare providers increasingly outsource diagnostic operations, data analytics, and instrument maintenance. The rise of lab-as-a-service models and bundled solutions—including installation, calibration, and remote monitoring—is reshaping vendor-customer relationships. This trend is particularly strong in developing markets and among small to mid-sized healthcare institutions that lack in-house technical capabilities.

Immunoassay technology dominates the IVD landscape, given its wide application in disease detection, hormone testing, infectious disease screening, and therapeutic monitoring. Immunoassays offer high sensitivity and specificity, and advancements in ELISA, CLIA, and RIA formats have enhanced throughput and reliability. Hospitals, diagnostic labs, and blood banks continue to rely heavily on immunoassays due to their clinical versatility and cost-effectiveness.

Molecular diagnostics is the fastest-growing technology segment, driven by rising demand for genetic testing, infectious disease detection (notably COVID-19), and precision oncology. The success of PCR-based tests during the pandemic has popularized molecular platforms, while next-generation sequencing (NGS) and isothermal amplification techniques are enabling faster, more comprehensive diagnostics. The segment also benefits from strong integration with AI tools for genetic variant analysis and disease prediction.

Hospitals remain the dominant end users of IVDs, particularly for high-throughput testing, complex assays, and acute diagnostics. The integration of advanced lab automation systems, real-time data access, and EHR connectivity positions hospitals as the epicenter of clinical diagnostics. Additionally, multidisciplinary teams in hospitals rely on IVD for surgical planning, intensive care, and disease monitoring.

Home-care settings are the fastest-growing end-use segment, reflecting the broader shift toward patient-centered care. The trend is supported by wearable devices, remote diagnostics, and mail-order test kits. As populations age and chronic disease prevalence rises, the need for continuous monitoring outside hospitals will make home-based IVD solutions increasingly indispensable.

Infectious diseases dominate IVD applications, as they remain a major cause of global morbidity and mortality. Tests for HIV, hepatitis, tuberculosis, and respiratory infections (including COVID-19) form a significant share of global IVD usage. The market continues to grow as new infectious diseases emerge, and variants of existing pathogens challenge existing diagnostic capabilities. Rapid, accurate detection is critical for containment and treatment.

Oncology is the fastest-growing application, with the rise of precision medicine and the increasing availability of companion diagnostics. Liquid biopsies, mutation detection assays, and tumor marker panels are driving demand for IVD in early cancer screening and personalized treatment planning. Clinical adoption is growing for cancers such as breast, lung, colorectal, and prostate, supported by reimbursement improvements and increased physician awareness.

Point-of-care testing is the largest and most established test location segment, owing to its convenience, speed, and ability to support decentralized diagnostics. Common tests include glucose monitoring, infectious disease rapid tests, and cardiac marker panels. Advances in miniaturized platforms and digital connectivity are enhancing the relevance of PoC testing in both hospital and home settings.

Home-care testing is the fastest-growing test location, driven by consumer demand for convenience, privacy, and cost-efficiency. At-home tests for blood glucose, fertility, cholesterol, and COVID-19 have seen widespread adoption. Companies are now expanding their offerings into cancer screening, infectious disease surveillance, and even genetic testing. Innovations in self-collection kits and digital health apps are enabling better adherence and result interpretation.

January 2025: Roche Diagnostics announced the global launch of a fully automated immunoassay analyzer with AI-enhanced workflow capabilities.

February 2025: Abbott received CE approval for its new COVID-19 and influenza multiplex PoC test, designed for use in urgent care and home-care settings.

March 2025: Thermo Fisher Scientific launched a next-gen NGS-based oncology panel integrated with a new cloud analytics platform.

April 2025: Siemens Healthineers expanded its Atellica portfolio with a high-throughput hematology analyzer for hospital networks in North America and Europe.

April 2025: Bio-Rad introduced an affordable qPCR platform targeting diagnostic startups and academic research labs in Asia Pacific.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the in vitro diagnostics market

Product

By Technology

By Application

By Test Location

By End-use

By Regional