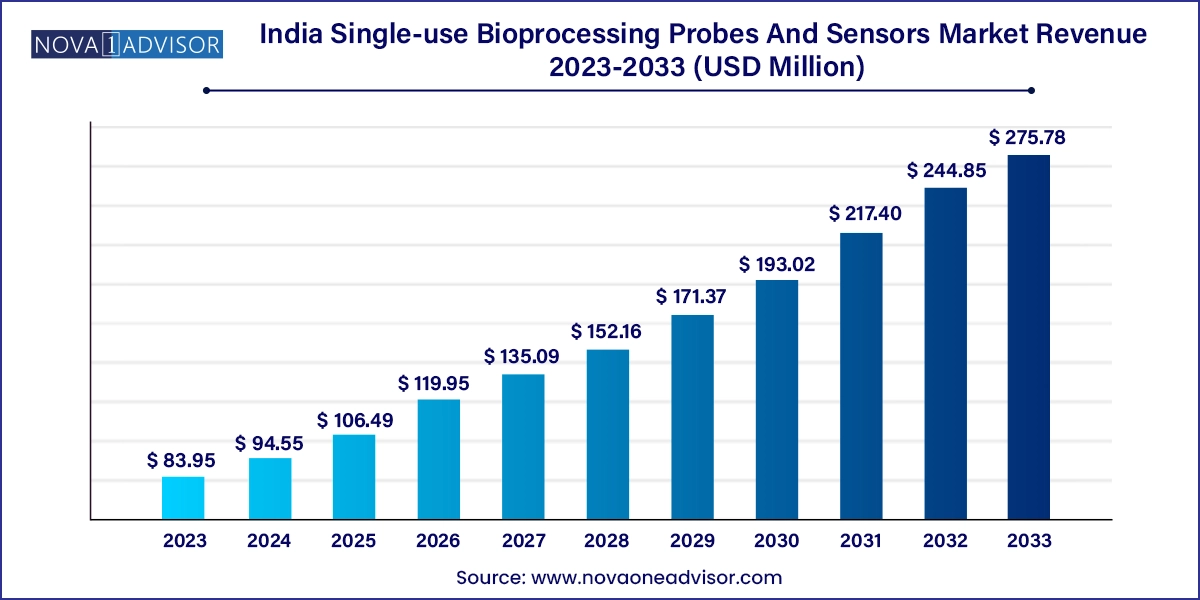

The India single-use bioprocessing probes and sensors market size was exhibited at USD 83.95 million in 2023 and is projected to hit around USD 275.78 million by 2033, growing at a CAGR of 12.63% during the forecast period 2024 to 2033.

The India single-use bioprocessing probes and sensors market is gaining significant traction as the country evolves into a global hub for biopharmaceutical innovation, manufacturing, and contract research. As biotechnology firms in India increasingly adopt single-use technologies (SUTs) to improve process efficiency, reduce contamination risks, and accelerate time-to-market, the role of disposable probes and sensors has become indispensable in both upstream and downstream bioprocessing applications.

These sensors, embedded within single-use bioreactors and filtration systems, are designed to monitor critical process parameters such as pH, dissolved oxygen, pressure, temperature, and flow without requiring in-line sterilization or recalibration. With a growing ecosystem of biopharmaceutical and vaccine manufacturing in India—especially post-COVID-19—the demand for sterile, compliant, and scalable bioprocessing solutions has increased dramatically.

Furthermore, India's rising prominence in contract research and manufacturing services (CRAMS), coupled with regulatory reforms encouraging domestic biosimilar production, has bolstered market expansion. As pharmaceutical and biologics companies pursue leaner manufacturing footprints and seek to eliminate cross-contamination risks in multiproduct facilities, single-use sensors are fast becoming the default in both greenfield and brownfield projects. Government initiatives like "Make in India" and investment in bio-clusters are further accelerating this transition toward disposable bioprocessing tools, making India a high-growth market for sensor manufacturers.

Accelerated Adoption of Biologics and Biosimilars Manufacturing: Rising demand for cost-effective biologics is driving the need for flexible, scalable, and sterile production systems using single-use sensors.

Miniaturization and Multi-parameter Sensing: Compact, integrated sensors that measure multiple process parameters (e.g., pH, DO, and temperature) in real time are gaining popularity.

Indigenous Manufacturing Initiatives: Indian biotech firms are partnering with local sensor developers to reduce dependence on imports and enhance supply chain resilience.

Smart Sensors with IoT Integration: Advanced digital sensors capable of wireless data transmission, cloud integration, and real-time analytics are being explored for remote monitoring.

Growing Focus on GMP Compliance and Regulatory Readiness: With increasing exports, companies are investing in sensors that support 21 CFR Part 11 and other international validation standards.

Increased Penetration of CMOs/CROs Using Single-use Platforms: These entities are accelerating market demand due to their preference for modular, single-use-compatible sensor systems.

Academic-Industry Collaborations for Custom Sensor Development: Research institutions in India are working with startups to develop cost-effective probes customized for local manufacturing needs.

| Report Coverage | Details |

| Market Size in 2024 | USD 94.55 Million |

| Market Size by 2033 | USD 275.78 Million |

| Growth Rate From 2024 to 2033 | CAGR of 12.63% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Workflow, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Thermo Fisher Scientific; Sartorius AG; PreSens; Precision Sensing GmbH; Hamilton Company; Mettler-Toledo India Private Limited; PARKER HANNIFIN CORP; Danaher; Saint-Gobain |

A primary growth driver of the Indian single-use bioprocessing probes and sensors market is the rapid expansion of the biopharmaceutical manufacturing landscape, fueled by increasing investments, government policy support, and a strategic push toward self-reliance. India has become a key player in global biosimilars production and vaccine manufacturing. Companies like Biocon Biologics, Dr. Reddy’s Laboratories, Serum Institute of India, and Zydus Lifesciences are heavily investing in biologics infrastructure, which depends significantly on modular, scalable, and sterile production systems.

Single-use probes and sensors are integral to these systems, enabling real-time process control and efficient batch tracking. These tools eliminate the need for cleaning validation between batches, reduce downtime, and improve regulatory compliance. The growing emphasis on speed-to-market, especially for biosimilars and cell-based therapies, underscores the relevance of flexible sensor solutions that integrate seamlessly with single-use bioreactors, mixers, and filtration units. As India's biologics output continues to rise, so does the strategic importance of accurate and disposable sensing technology.

Despite strong growth prospects, the Indian market faces a significant restraint in the form of high costs and limited domestic production capabilities for advanced single-use sensors. Most high-performance pH, oxygen, and conductivity sensors used in Indian facilities are imported from North American or European suppliers. Import duties, supply chain delays, and currency fluctuations make these devices expensive and at times unreliable in terms of availability.

Furthermore, the lack of standardization across sensor formats and integration systems creates challenges for smaller biotech firms trying to adopt single-use platforms. Not all facilities are equipped to incorporate single-use sensors into existing infrastructure without extensive customization. The training and technical support required for proper implementation also act as barriers, especially for academic labs and small-scale contract manufacturers with limited budgets. While the long-term return on investment is clear, the initial setup costs continue to be a constraint for many mid-sized Indian firms.

A transformative opportunity lies in the development and scaling of indigenous sensor manufacturing in India, aligned with the broader "Atmanirbhar Bharat" (self-reliant India) mission. With increased funding for biotechnology R&D through programs like BIRAC and DBT, Indian startups and academic institutions are now collaborating to design low-cost, high-accuracy sensors tailored for single-use systems. These sensors are optimized for the Indian market, addressing affordability, climatic tolerance, and compatibility with locally manufactured bioprocessing equipment.

For instance, a partnership between IIT Delhi and a local medtech startup has recently resulted in a cost-efficient fiber optic oxygen probe with in-line calibration capability. Such innovations promise to reduce costs, improve accessibility, and create export-ready solutions for emerging markets. The rise of bio-clusters in Bengaluru, Hyderabad, and Pune further accelerates this opportunity by fostering startup ecosystems focused on diagnostics, analytics, and process monitoring. If scaled effectively, local sensor production could significantly shift the import-heavy dynamics of the current market.

pH sensors dominated the India single-use bioprocessing probes and sensors market in 2023, owing to their central role in maintaining cell viability, metabolic activity, and enzyme stability across upstream and downstream workflows. In biologics production, pH must be continuously monitored to prevent culture shock and ensure optimal yield. Single-use pH sensors, integrated with bioreactor bags, allow sterile, in-situ measurement and reduce contamination risks associated with reusable probes. Their widespread adoption in vaccine manufacturing and monoclonal antibody production ensures their lead in the market.

Flow meters and sensors are expected to be the fastest-growing segment, driven by the increased complexity and automation of bioprocessing lines. As Indian facilities scale up continuous manufacturing and perfusion-based systems, precise control over flow rates becomes critical. Disposable flow sensors—often integrated with tubing and filtration modules—enable real-time tracking of fluid transfer across different bioreactor and purification stages. These sensors are especially valuable in multiproduct facilities where rapid changeovers require plug-and-play sensor formats. The rising adoption of continuous processing is expected to drive exponential demand for accurate, single-use flow measurement tools.

Upstream processing dominated the market, as this phase involves cultivation, fermentation, and cell line expansion—processes highly sensitive to pH, temperature, and dissolved oxygen levels. Single-use sensors for upstream applications, such as optical DO sensors and temperature probes, are essential for maintaining consistent process parameters. Manufacturers rely on these sensors for optimizing growth conditions, reducing batch variability, and ensuring scalability from pilot to commercial scale. With India’s growing cell culture-based production facilities, the reliance on upstream-specific disposable sensors continues to surge.

Downstream processing is anticipated to be the fastest-growing workflow segment, especially in the purification and fill-finish stages of biosimilar and vaccine production. Single-use conductivity and flow sensors play a crucial role in chromatography, filtration, and buffer preparation—steps that demand high accuracy and rapid changeover. As India strengthens its formulation and packaging infrastructure, the need for scalable, sterile, and disposable downstream sensors is growing. These sensors enable traceability, reduce cross-contamination, and support GMP compliance, making them critical for export-ready manufacturing environments.

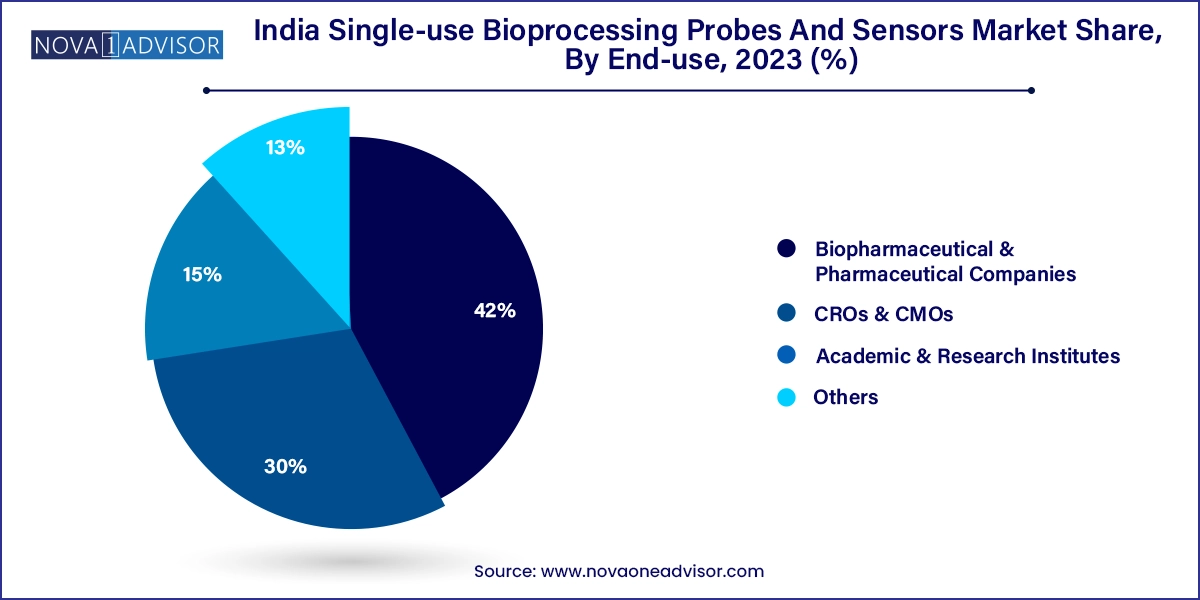

Biopharmaceutical and pharmaceutical companies accounted for the largest share of the Indian single-use bioprocessing probes and sensors market in 2024. These organizations lead in adopting single-use bioreactors, media bags, and integrated sensing technologies to support commercial-scale manufacturing. Major players like Biocon Biologics, Bharat Biotech, and Cipla Biotech are investing heavily in disposable systems to reduce turnaround times and increase batch productivity. The pressure to meet global regulatory standards and reduce risk of contamination in biologics production has made single-use sensors a standard feature in modern manufacturing suites.

CROs and CMOs represent the fastest-growing end-use segment, driven by their increasing role in outsourced manufacturing for both domestic and international biopharma firms. With India becoming a preferred location for clinical trial material production and early-phase biologics development, CROs and CMOs are rapidly scaling up their infrastructure. These firms are highly focused on flexibility and rapid changeovers, making single-use sensors ideal for their workflows. Additionally, global clients often demand the use of validated single-use systems, reinforcing the need for disposable sensor integration in these facilities.

India presents a unique landscape for the growth of the single-use bioprocessing probes and sensors market. On one hand, there’s a strong push for modernization and GMP compliance in pharmaceutical and biologics manufacturing, driven by both government incentives and global demand. On the other, cost sensitivity and a heavy reliance on imports pose operational and strategic challenges. The majority of demand stems from biotechnology clusters in cities like Hyderabad, Bengaluru, Pune, and Ahmedabad—regions that host leading pharma companies and a growing base of biotech startups.

Urban bio-incubators and national biotech parks are providing infrastructure support to innovators, enabling the development of India-specific single-use technologies. Furthermore, India's emergence as a global vaccine supplier has placed emphasis on upstream quality control—boosting demand for accurate, sterile, and real-time monitoring tools. While the current market is concentrated in Tier-1 and Tier-2 cities, expanding biologics R&D capabilities in Tier-3 cities and rural clinical hubs are expected to create new demand pockets in the years ahead.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the India single-use bioprocessing probes and sensors market

Type

Workflow

End-use