The industrial microbiology market size was estimated at USD 13.01 billion in 2024 and is projected to surpass around USD 25.84 billion by 2034, expanding at a CAGR of 7.1% during the forecast period from 2025 to 2034. The growing requirement for microbial testing and quality assurance in multiple industries is expected to fuel the growth of the industrial microbiology market during the forecast period.

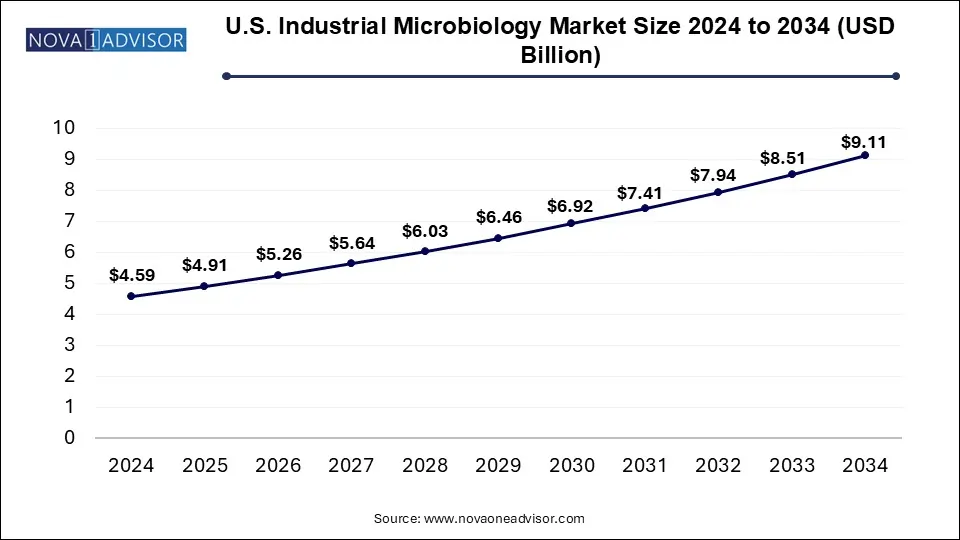

The U.S. industrial microbiology market size was valued at USD 4.59 billion in 2024 and is expected to surpass around USD 9.11 billion by 2034, growing at a CAGR of 6.43% from 2025 to 2034.

North America is expected to dominate the industrial microbiology market in 2024. The foremost determinant of the largest market share is due to the existence of well-established companies from industries such as pharmaceutical and biotechnology, rising technological innovations, rapid expansion of the food and beverages industry, rising R&D expenditure, and growing demand for fermented and nutraceutical products.

Several existing players are undertaking strategic initiatives to expand the industrial testing capabilities in multiple applications. For instance, a U.S. and UK-based CRO, Perfectus Biomed Group, was acquired by NAMSA in October 2023. This acquisition aims at improving the personalized services of microbiology and developing a global presence through 20 locations offering lab services across the U.S., Europe, and Asia.

Additionally, the increasing strategic initiatives by companies in the market are anticipated to accelerate innovation in product offerings, thus increasing the regional footprint. For instance, in November 2023, ADM announced its expansion in North America by opening a microbiology lab at the manufacturing site in Decatur, IL. The expansion doubles the company’s microbiology lab footprint and significantly increases the testing capabilities for industrial food processing. Furthermore, the facility is expected to offer testing services to 26 manufacturing sites of the company.

Asia Pacific is estimated to witness the fastest growth in the market. The growth of the region is attributed to the enhanced infrastructure of the healthcare facilities, increased emphasis on food safety and cleanliness, rapid expansion of biotechnology and pharmaceutical industries and improving growth of economic factors. For instance, in June 2023, Merck India announced the establishment of a Microbiology Application Training Lab (MAT Lab) in Bangalore, for academic and industrial purposes. The Lab encourages biopharma and pharma players to collaborate with Merck to develop capabilities in the analysis of microbial. Such factors have propelled the growth of the industrial microbiology market in the region.

Industrial microbiology is a popular branch of applied microbiology in which microorganisms such as bacteria, algae, and fungi are widely used in industrial processes. For instance, to produce high-value products such as drugs, chemicals, and fuels. This field of science has the remarkable potential to replace plastics with biodegradable ones, fossil fuels with biofuels, and polluting chemical processes with biocompatible alternatives. The increasing demand for nutraceuticals and other fermented products is expected to propel the market’s growth in the coming years. Industrial microbiology techniques are extensively utilized in the production of excipients, including microbial enzymes, polysaccharides, and fermentation products, which are frequently used in several industrial applications.

Additionally, increasing drug exports and imports have compelled manufacturers to follow the pharmacopeia that is accepted by regions. Considering that sterility testing is a significant part of pharmacopeia, increasing exports and imports is likely to impact the demand for sterility testing. Other than the Japanese Pharmacopeia, the European Pharmacopeia, and the United States Pharmacopeia, the British Pharmacopeia is highly accepted by 54 commonwealth countries. While India and China have different pharmacopeia.

| Report Coverage | Details |

| Market Size in 2025 | USD 13.94 Billion |

| Market Size by 2034 | USD 25.84 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 7.1% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Test, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | bioMerieux SA; Thermo Fisher Scientific Inc.; Bio-Rad Laboratories Inc.; Becton Dickinson and Company; 3M Company; Danaher Corporation; Eppendorf AG; Merck KGaA; and Sartorius AG |

Opportunity

Stringent regulatory frameworks

The presence of strict regulatory frameworks is expected to provide the industrial microbiology market with lucrative growth opportunities during the coming years. With increasing attention to quality standards for products, numerous industries have initiated the use of microbiological testing techniques. Stringent regulatory frameworks of the government associated with anti-microbial food additives and policies supporting the usage of sterility testing have significantly increased the demand for industrial microbiology, especially within the food & beverage industry. Thus, stringent testing requirements by regulatory bodies to ensure the integrity and quality control of the product are anticipated to boost the expansion of the industrial microbiology market in the coming years.

Restraint

High R&D cost

The high research and development cost is anticipated to hamper the market's growth. The lump sum amount of investment is required for research and development activities, which often restricts the entry of potential players, particularly in middle- and lower-income countries. In addition, the conflicts regarding the usage of genetically modified organisms in food sources may restrict the expansion of the global industrial microbiology market.

The reaction consumables in industrial microbiology are revenue-generating segments in 2024. The industrial microbiology testing consumables are not applicable for substitution and require regular operations to ensure the safety and quality of products. During COVID-19, the segment witnessed unprecedented demand, further disrupting the supply chain. Hence, various regions encouraged the players to increase the domestic production of consumables to reduce the reliance on imports. Increasing production of consumables in the emerging market is anticipated to accelerate the competitiveness of the segment in industrial microbiology testing.

The exponential growth of the equipment and system segment is likely to attract players from similar or related markets, which will enable them to maintain synergy amongst the resources and maximize profits. For instance, in November 2023, IDEXX announced the acquisition of Tecta-PDS, Canada Canada-based company that integrated automation and water microbiology testing. The acquisition is expected to give IDEXX access to automated instruments. Hence, increasing adoption of industrial microbiology testing in multiple applications is expected to result in a rise in demand for equipment and instruments.

The increasing importance of sterility testing in biopharmaceutical manufacturing is anticipated to support the growth of industrial microbiology. According to the India Pharmacopeia, British Pharmacopeia, and United States Pharmacopeia, the sterility test is employed on medical products, drugs, and preparations to ensure sterility and comply with the regulations. Along with that, each component and raw material employed for manufacturing a drug is required to pass the sterility test. Hence, the volume of drug manufacturing is directly proportional to the use of sterility testing in pharma and biopharma applications.

Microbial limit testing is witnessing increasing adoption in industrial microbiology for raw materials testing. The International Organization for Standardization (ISO) has also issued guidelines for the use of microbiological limits testing in the nutraceutical and cosmetic industries. Hence, increasing scrutiny of quality and efficacy within the cosmetics industry, along with rising monitoring by regulatory bodies, is expected to support the growth of the market.

The pharmaceutical biotechnology segment is one of the key revenue generators of the industrial microbiology market in 2024. In the pharmaceutical & biotechnology industries, quality is to be maintained throughout the manufacturing process. These standards are maintained via different methods, one such method is the environmental monitoring process which determines the quality and sterility of the controlled production environment. For instance, in November 2023, SAE announced that the 11th Annual Conference on Pharmaceutical Microbiology is to be held in January 2023 to explore the automated process, regulations, and technologies in microbiology. The conference also highlights the integration of sequencing technology with microbiology. Hence, innovation by the players is anticipated to boost the market.

On the other hand, the food & beverage industry is estimated to have significant growth during the forecasted period. Since the end-users heavily rely on industrial microbiology testing techniques to eliminate any possible pathogens and toxins in the products and protect the customer from ingestion of microbes. It is mandatory for the players in the food and beverage field to underpass the products for safety tests.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Industrial Microbiology Market

By Product

By Test

By End-use

By Regional