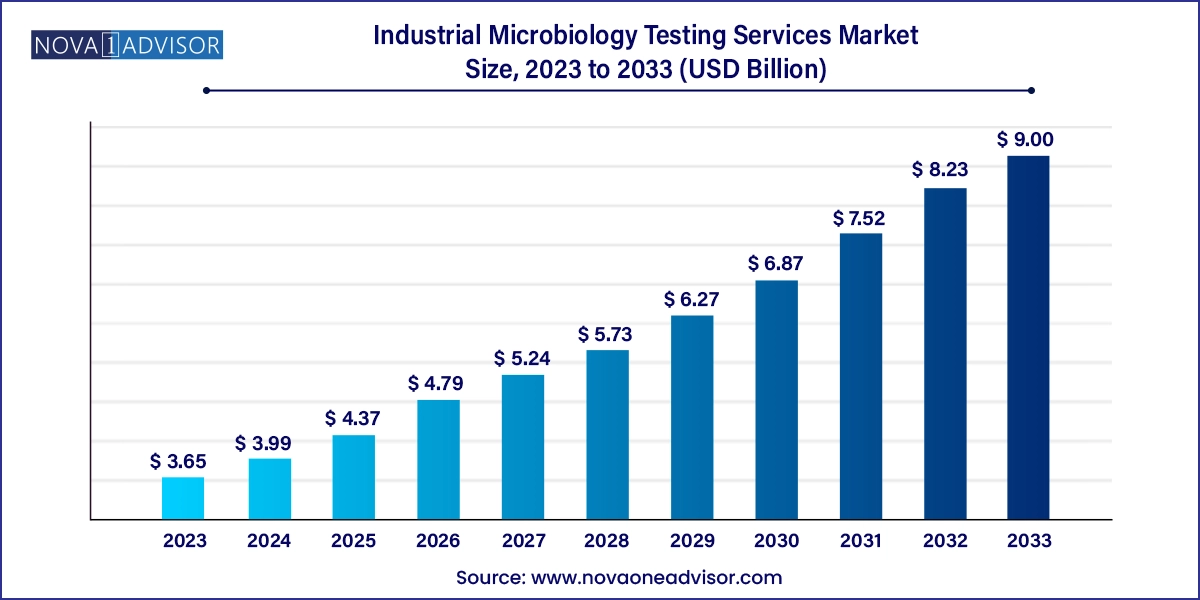

The industrial microbiology testing services market size was exhibited at USD 3.65 billion in 2023 and is projected to hit around USD 9.00 billion by 2033, growing at a CAGR of 9.45% during the forecast period 2024 to 2033.

The industrial microbiology testing services market has emerged as a vital pillar in ensuring safety, compliance, and quality control across diverse industries such as pharmaceuticals, food and beverages, cosmetics, agriculture, and environmental sectors. Industrial microbiology encompasses the detection, identification, quantification, and monitoring of microbial contaminants ranging from bacteria and fungi to viruses and spores in raw materials, finished products, manufacturing environments, and utilities.

Driven by increasing regulatory scrutiny, rising demand for safe and high-quality consumer products, and the globalization of supply chains, industrial microbiology testing services are becoming more specialized and essential. From sterility testing of injectables to microbial limits testing of food additives, these services ensure that industrial processes remain contamination-free and within safety thresholds. The advent of rapid microbial methods (RMM), automation, and genomic-based microbial identification technologies is also revolutionizing the service landscape, enhancing accuracy and reducing turnaround times.

Contract testing laboratories offering third-party microbiological services have seen rapid growth, especially among companies lacking in-house infrastructure or expertise. These labs provide a cost-effective solution, particularly for small and medium enterprises (SMEs), which face growing pressure to meet international quality standards. As consumer awareness and regulatory complexity intensify, the demand for end-to-end microbiological testing services is expected to accelerate.

Increasing adoption of rapid microbial detection technologies, such as PCR, flow cytometry, and MALDI-TOF

Growing outsourcing of microbiology testing by food, cosmetic, and pharmaceutical manufacturers

Integration of artificial intelligence (AI) in microbial data analytics and contamination risk prediction

Expansion of environmental microbiology testing to address climate resilience and biosafety

Rising demand for sterility testing in injectable and sterile pharmaceutical manufacturing

Emergence of microbiome testing for consumer and agricultural applications

Growth in demand for real-time monitoring of water and air systems in manufacturing plants

Consolidation of contract testing labs into larger, multinational service providers

| Report Coverage | Details |

| Market Size in 2024 | USD 3.99 Billion |

| Market Size by 2033 | USD 9.00 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 9.45% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Test type, end-use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

| Key Companies Profiled | Charles River Laboratories; Intertek Group Plc; Spectro Analytical Labs Pvt. Ltd.; Pacelabs; Biotech Testing Services; Merck KGaA; TÜV SÜD; Precise Analytics Lab; Eurofins Scientific; Biocare Research (India) Pvt. Ltd.; STERIS |

A central driver of the industrial microbiology testing services market is the escalating regulatory demand for product safety and environmental quality. Industries such as pharmaceuticals, food, cosmetics, and personal care must adhere to Good Manufacturing Practices (GMP), ISO standards, and national regulations that mandate microbial quality testing. For instance, the U.S. FDA, EMA, and USP require regular sterility, bioburden, and environmental monitoring for drug manufacturers.

In food and beverages, microbial testing ensures compliance with HACCP protocols and prevents product recalls due to contamination by pathogens like Salmonella, Listeria, or E. coli. Similarly, cosmetic manufacturers must meet ISO 17516 microbial limits. As regulatory agencies become more rigorous and global supply chains expand, the need for reliable, validated, and standardized microbial testing solutions intensifies, positioning industrial microbiology services as indispensable.

A key restraint facing the industrial microbiology testing services market is the cost and complexity involved in validating new testing methods, particularly rapid or automated technologies. Many regulatory agencies require extensive method validation, verification, and proficiency testing before novel methods can be adopted in routine quality control environments.

Moreover, small and medium-sized manufacturers may find it financially challenging to implement or outsource advanced testing systems, especially when operating in price-sensitive markets. Delays in test approval, lack of harmonized international standards, and skepticism regarding the equivalence of rapid methods to traditional culture-based techniques also hinder broader market penetration. For service providers, constant investments in infrastructure and staff training add to operating expenses.

An important growth opportunity lies in the rising demand for microbiological testing in cleanroom and biologic manufacturing environments, especially within the pharmaceutical and biotech sectors. With the global surge in sterile biologic drugs, cell and gene therapies, and injectable formulations, there is heightened emphasis on cleanroom monitoring, water system testing, and air quality assessment.

Microbial testing of cleanroom surfaces, personnel garments, HEPA filters, and purified water systems is critical for contamination prevention and regulatory compliance. Services offering end-to-end environmental monitoring, risk-based sampling plans, and data analytics to track microbial trends are in high demand. This opens up lucrative opportunities for microbiology testing labs to develop service models tailored to high-containment environments and advanced biologics production lines.

Sterility testing dominates the market, particularly in pharmaceutical, biotechnology, and medical device manufacturing. Ensuring the absence of viable microorganisms in parenteral and ophthalmic products is a critical safety requirement. Sterility testing methods such as membrane filtration and direct inoculation are standard procedures under USP <71> and other compendial guidelines. CDMOs and regulated manufacturers rely heavily on validated third-party labs to execute these tests under aseptic conditions.

Bio-burden and microbial limits testing are emerging as fast-growing segments, especially as biologics and advanced therapies become more common. Bio-burden testing is conducted during process validation, and microbial limits testing is used across multiple industries including cosmetics, dietary supplements, and nutraceuticals. The increasing demand for these tests, coupled with innovations like real-time PCR-based quantification, is boosting adoption rates.

Pharmaceutical and biotechnology sectors account for the largest share of the market, driven by stringent GMP regulations and the need for extensive environmental and product-related microbial testing. Biologic products, due to their sensitivity, demand specialized microbiology protocols including endotoxin detection, microbial ingress testing, and sterility assurance. Testing services also support investigational new drugs (INDs), post-market surveillance, and contamination investigations.

Food & beverage is the fastest-growing end-use segment, particularly due to heightened consumer awareness about food safety and the rising incidence of foodborne illness outbreaks. Manufacturers are increasingly outsourcing microbial testing for raw materials, process water, packaging lines, and final products. Testing for pathogens, spoilage organisms, and shelf-life stability is becoming a routine requirement, driving service uptake among both global conglomerates and regional producers.

North America dominates the global industrial microbiology testing services market, with the U.S. leading in terms of both service provider capacity and regulatory-driven demand. The presence of major pharmaceutical, biotechnology, and food processing industries, along with a mature regulatory ecosystem (FDA, USP, EPA), ensures a consistent demand for advanced microbiological testing. The region also hosts many globally accredited contract testing labs offering highly specialized services including viral clearance and endotoxin testing.

Asia Pacific is the fastest-growing region, fueled by the rapid expansion of pharmaceutical manufacturing, rising food export activities, and increasing investment in life sciences R&D. Countries like India, China, and South Korea are focusing on enhancing GMP compliance and international certifications, spurring demand for microbial quality assurance services. Moreover, domestic regulatory reforms and growing awareness about product hygiene and safety are further expanding the client base for contract microbiology labs.

February 2025: Eurofins Scientific announced the expansion of its microbial testing facility in North Carolina to cater to increased demand from biologics manufacturers.

January 2025: SGS launched a new rapid sterility testing service in Switzerland using advanced PCR and flow cytometry-based platforms.

November 2024: Charles River Laboratories partnered with a leading CDMO in Japan to offer integrated sterility and endotoxin testing for biologic products.

October 2024: Bureau Veritas launched environmental microbiology monitoring services for cleanrooms in Singapore, targeting regional vaccine and biologics production hubs.

August 2024: Intertek expanded its microbiology lab in the UK with new capabilities in water and air testing for cosmetic and personal care clients.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the industrial microbiology testing services market

Test Type

End-use