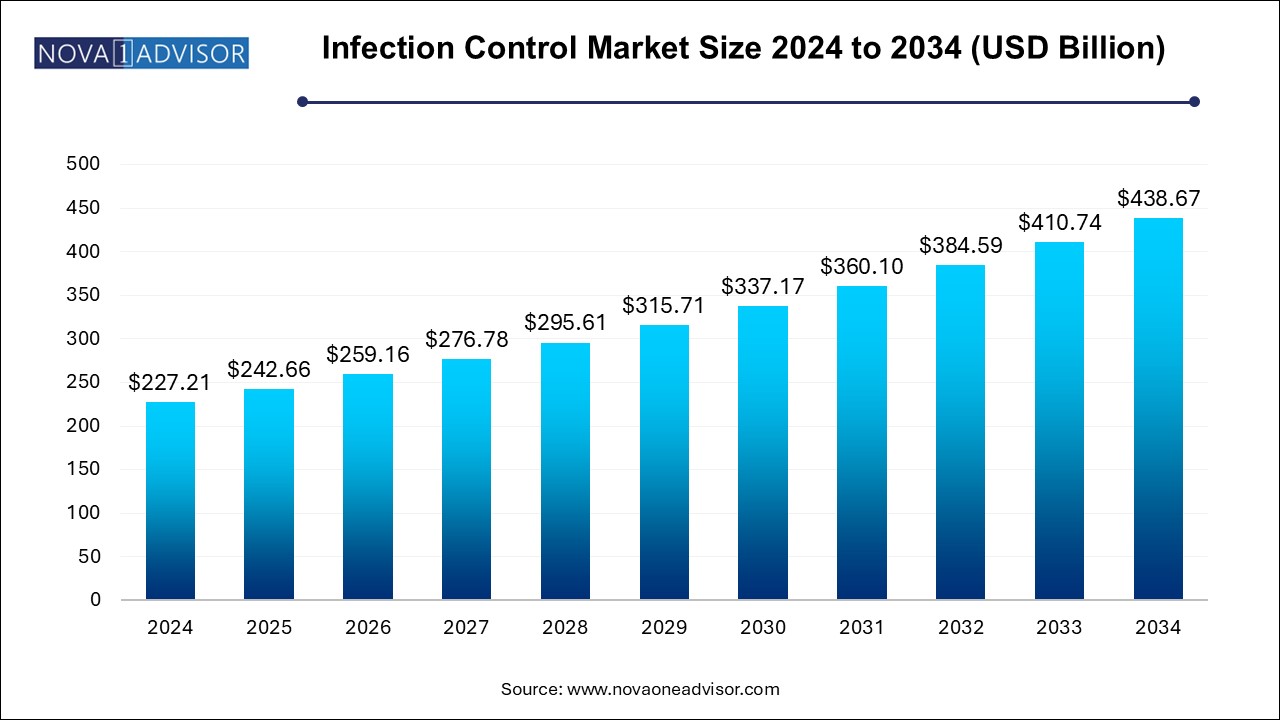

The infection control market size was exhibited at USD 227.21 billion in 2024 and is projected to hit around USD 438.67 billion by 2034, growing at a CAGR of 6.8% during the forecast period 2024 to 2034.

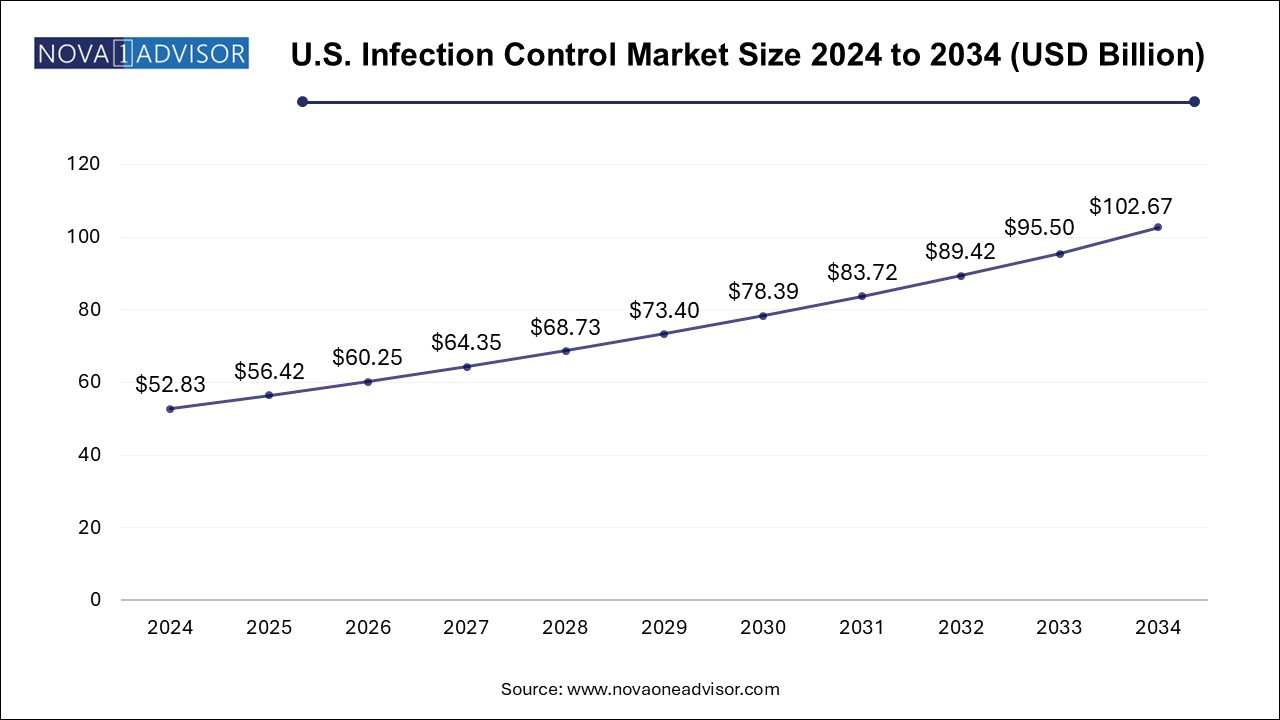

The U.S. infection control market size is evaluated at USD 52.83 billion in 2024 and is projected to be worth around USD 102.67 billion by 2034, growing at a CAGR of 6.22% from 2024 to 2034.

North America dominated the infection control market and accounted for the largest revenue share of over 31.0% in 2024. The substantial share captured by this region is due to a good number of strategic collaborations by key companies in the market to widen their infection control capabilities and product portfolio. In addition, increasing efforts by the established companies to widen their presence across this region is responsible for the dominant share captured by North America. For instance, In January 2017, Advanced Sterilization Products launched the STERRAD 100NX System with ALLClear in the U.S. and is planning to expand its footprint into regions such as Europe, Africa, and the Middle East. In 2020, Advance Sterilization Products got 510(k) clearance from the U.S. Food and Drug Administration (FDA) for a 15-minute time result for the STERRAD VELOCITY® Biological Indicator, which is a device used in the STERRAD System. It offers the fastest way to provide instrument sterilization for healthcare professionals.

Asia Pacific is expected to expand at the fastest CAGR of 8.3% over the forecast period from 2024 to 2034, owing to the growing number of outsourcing organizations, growing expenditure on healthcare, and evolving healthcare standards and infrastructure unprecedently across this region. Government organizations are focusing more on improving infection control standards as it is also one of the important factors contributing to the growth of the Asia Pacific region. The increasing trend of outsourcing by established market players in developed economies to companies in the Asia Pacific region also serves as a key growth impelling factor for the market. For instance, the Asia Pacific Society of Infection Control (APSIC) is a voluntary organization working to establish collaborative partnerships to facilitate quality improvement and conduct infection control research to promote cost-efficient practices throughout the Asia Pacific region.

| Report Coverage | Details |

| Market Size in 2025 | USD 242.66 Billion |

| Market Size by 2034 | USD 438.67 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 6.8% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Type, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | 3M; Belimed AG; O&M Halyard or its affiliates.; Getinge Group; ASP; MATACHANA; Sterigenics U.S., LLC – A Sotera Health company; MMM Group; Cantel Medical Corp.; STERIS Corporation; Midmark Corporation.; Medivators Inc.; W&H |

Based on the type, the global infection control market is segmented into equipment, services, and consumables. The consumables segment dominated the market for infection control and accounted for the largest revenue share in 2024. The dominant share captured by consumables is predicted to be a consequence of consistent usage and the short life cycle of these products. Consumables are being extensively incorporated in disinfection, sterilization, and other control procedures and are indispensable parts of the procedures mentioned above, accounting for a larger share. Under consumables, personal protective equipment held a substantial share as of 2024.

Further, the equipment segment is classified as disinfectors and sterilization equipment. Again disinfectors are further segmented into washers, flushes, and endoscope reprocessors. The sterilization equipment is segmented into heat sterilization equipment, low-temperature sterilization equipment, radiation sterilization equipment, filtration sterilization equipment, and liquid sterilization equipment. Also, consumables are segmented into infectious waste disposal, disinfectants, sterilization consumables, personal protective equipment, and others.

Various healthcare organizations are advocating and promoting awareness about the benefits of personal protective equipment, which is anticipated to be responsible for a significant share. For instance, W&H company is working on a hygiene portfolio and added the LEXA PLUS CLASS B sterilizer, a new technologically advanced device for easier reprocessing and infection prevention for dental practice workflow.

Based on type, the services segment is expected to grow at the fastest CAGR during the forecast period. This fastest growth is attributed to the high inclination of market players to reduce overall healthcare expenditure and the utilization of benefits involved. It primarily includes cost advantages, increased efficiency of services, enhanced productivity, and a significantly higher focus on the core areas of development, which are critical to a company’s overall profit and growth. The organizations also strive to promote the adoption through issuing guidelines and recommendations for selection, risk assessment, rational usage, removal, and considerations to reduce the risk of transmission of respiratory pathogens to healthcare workers and other medical staff within a healthcare facility. Further, services are segmented into contract sterilization and infectious waste disposal. The contract sterilization segment is again classified into ethylene oxide sterilization, e-beam sterilization, gamma sterilization, and others.

Based on end use, the global infection control market is segmented into medical device companies, hospitals, pharmaceutical companies, clinical laboratories, and others. The hospital segment dominated the market for infection control and accounted for the largest revenue share of around 41.0% in 2024 and is also expected to grow at the fastest CAGR of 7.4% over the forecast period from 2024 to 2034. The considerable share is majorly a result of the high probability of getting infected on hospital premises by transmitting blood-borne or respiratory pathogens. Hospital-acquired infections require rigorous control as it is one of the major challenges faced by the market. This has urged public health organizations and hospitals to adopt highly effective control systems. Also, as per research published in NCBI, 40% to 60% of hospital infections were estimated to be at surgical sites.

One of the major concerns is the high probability of infection from pathogens such as drug-resistant, blood-borne, and others in the operating room, because of which the need of the market is growing. For instance, frequent usage of urinary catheters poses a high probability of UTIs and may result in catheter-associated (CA)-UTIs. According to data published by the National Center for Biotechnology Information (NCBI), UTIs account for 25% of all bacterial infections. As per the data published in the National Nosocomial Infection Surveillance (NNIS) system report, the most frequently occurring HAI are associated with CA-bacteriuria and catheterization globally, accounting for 40% of HAIs in the U.S. annually. These factors are expected to widen the future growth prospects of the market.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the infection control market

By Type

By End-use

By Regional