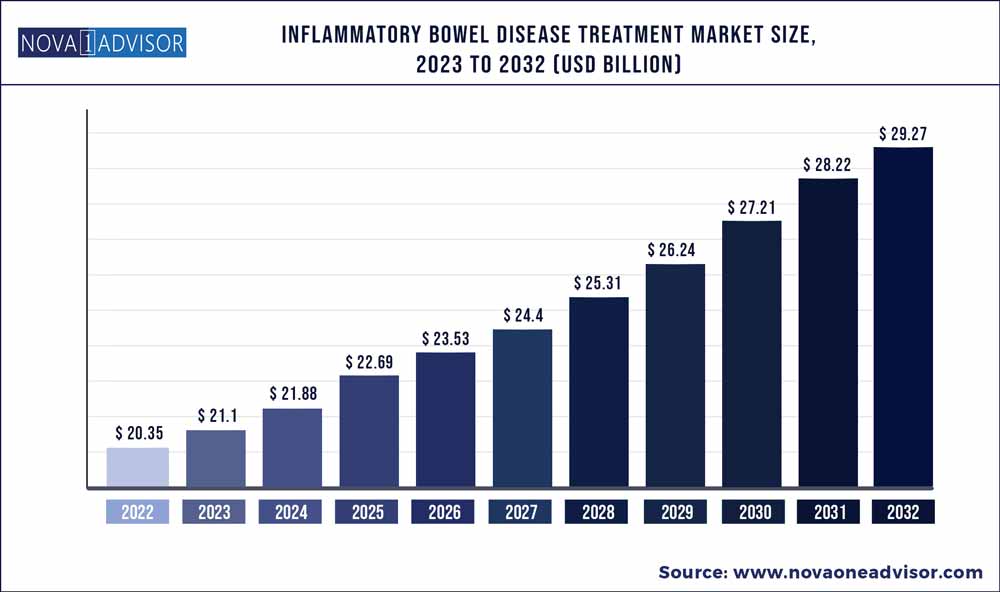

The global inflammatory bowel disease treatment market size was exhibited at USD 20.35 billion in 2022 and is projected to hit around USD 29.27 billion by 2032, growing at a CAGR of 3.7% during the forecast period 2023 to 2032.

Key Pointers:

Inflammatory Bowel Disease Treatment Market Report Scope

|

Report Coverage |

Details |

|

Market Size in 2023 |

USD 21.1 Billion |

|

Market Size by 2032 |

USD 29.27 Billion |

|

Growth Rate from 2023 to 2032 |

CAGR of 3.7% |

|

Base year |

2022 |

|

Forecast period |

2023 to 2032 |

|

Segments covered |

Type, Drug class, Distribution channel, Route of administration |

|

Regional scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

|

Key companies profiled |

AbbVie Inc; Takeda Pharmaceutical Company Limited; Pfizer Inc; Biogen; Novartis AG; Lilly; UCB S.A.; CELLTRION INC.; Merck & Co., Inc; Johnson & Johnson Services, Inc. |

The increasing prevalence of the disease, the surge in awareness about inflammatory bowel disease among people, and favorable regulatory scenarios are projected to drive the inflammatory bowel disease treatment market over the forecast period. For instance, in December 2022, Pfizer Inc. announced the U.S. FDA acceptance for review of an NDA for etrasimod for patients having severe ulcerative colitis. The favorable initiatives undertaken by regulatory authorities for treatment designations and approval of novel drugs for the management of inflammatory bowel disease are fueling market expansion.

The increasing collaboration of market players and non-profit organizations to counter various challenges in the development of novel therapeutics for IBD treatment is projected to propel market growth. For instance, in October 2022, Verily, a precision health company and the Crohn’s & Colitis Foundation expanded their strategic collaboration to accelerate research in ulcerative colitis and Crohn’s disease. In addition, the European Crohn’s and Colitis Organization has taken several favorable steps to improve the care of patients living with inflammatory bowel disease.

Recently approved novel drugs such as filgotinib, ozanimod, upadacitinib, and risankizumab for the treatment of inflammatory bowel disease are expected to support market growth in the coming years. Moreover, the regulatory authorities are encouraging manufacturers to develop novel therapeutic approaches for rare and life-threatening diseases. For instance, in December 2020, Thetis Pharmaceuticals received an orphan drug designation for TP-317 from the U.S. FDA for pediatric ulcerative colitis. Such favorable initiatives are expected to boost the R&D activities to develop novel therapeutic products for IBD.

Furthermore, the rising demand & approvals for biosimilars for the treatment of various inflammatory conditions is a high-impact rendering factor for the market. For instance, in December 2022, the U.S. FDA approved Idacio as an eighth adalimumab biosimilar in the U.S. The newly approved biosimilar is a citrate-free low-concentration preparation intended for the treatment of several inflammatory conditions, including CD in adults and children aged 6 years or older. In addition, in October 2021, the U.S. FDA approved Cyltezo for the management of moderate to severe CD and UC. Moreover, the increasing introduction of biosimilars is expected to boost the adoption of biological products for the treatment of IBD in developing economies.

Moreover, government bodies are taking efforts to promote the uptake of biosimilars with their safe use. For instance, in October 2022, the government of Saskatchewan launched a biosimilar initiative to help its residents to access high-quality therapeutics at a lesser cost. Similarly, provinces like Ontario and Quebec in Canada are also expanding biosimilar initiatives to promote the uptake of biosimilar candidates.

Inflammatory Bowel Disease Treatment Market Segmentation

| By Type | By Drug Class | By Route of Administration | By Distribution Channel |

|

|

|

|